The cryptocurrency market experienced a significant downturn during October 17-23, 2025, with major digital assets facing substantial selling pressure. Bitcoin briefly fell below $107,000 before showing tentative signs of stabilization, while Ethereum struggled to maintain the $3,800 support level amid concerning developments from the Ethereum Foundation. The altcoin market faced even more severe challenges, with the total altcoin market capitalization declining by an additional 15% this month. Market sentiment remained firmly in "fear" territory, with the Fear & Greed Index registering a reading of 28. Massive token unlocks totaling hundreds of millions of dollars across 24 altcoins created additional selling pressure, while institutional interest showed mixed signals with record outflows from U.S. Bitcoin ETFs but continued accumulation by certain institutional players. Meanwhile, the Solana network's total value locked (TVL) has reached 60.78 million SOL, a nearly three-year high. Tesla (TSLA) continued to hold 11,509 BTC, valued at around $1.35 billion as of the end of the third quarter (valued somewhat less as of today). The U.S. government entered its fourth week of closure on Wednesday, exceeding its second-longest shutdown on record, and the crypto industry is lamenting the big-ticket items being affected.

Market Overview

BTC

: Bitcoin experienced volatile trading throughout the week, briefly falling below $107,000 before showing signs of stabilization. The flagship cryptocurrency faced significant resistance near the $110,000 level, unable to sustain upward momentum despite occasional rallies. The price action reflected ongoing uncertainty in the market, with traders closely monitoring key support and resistance levels for directional clues. On-chain data revealed that while Bitcoin's price declined, smaller retail holders increased their accumulation, suggesting a potential foundation for price stabilization. The technical structure for Bitcoin remained fragile, with the $100,000 level emerging as critical support. A break below this psychologically important level could trigger additional selling pressure and potentially push prices toward lower support zones. Conversely, reclaiming $110,000 as consistent support would be necessary to restore bullish momentum.

The week brought disappointing news on the ETF front, with U.S. Bitcoin ETFs experiencing substantial outflows. On October 16 alone, these products saw a record $530.9 million in net outflows, led by $132 million from Fidelity's FBTC and $29 million from BlackRock's IBIT. This outflow accelerated a broader trend that began in late September when Bitcoin ETFs lost $903 million, ending a six-week streak of inflows . The outflows reflected a macro-driven exodus from risk assets amid growing economic uncertainties.

ETH

: Ethereum faced significant selling pressure throughout the week, with its price struggling to maintain the $3,800 support level. The second-largest cryptocurrency briefly fell below this crucial threshold amid widespread market weakness and sector-specific concerns. Ethereum's price decline coincided with substantial profit-taking activity, with investors realizing over $700 million in profits during a 24-hour period. This profit-taking was largely triggered by the Ethereum Foundation's decision to transfer 160,000 ETH (worth approximately $650 million) to a new multisignature wallet. Ethereum's technical outlook deteriorated during the week, with cryptocurrency failing to overcome resistance at $4,100 and the 50-day exponential moving average (EMA). The repeated rejection at this key resistance level prompted additional selling, eventually pushing the price toward crucial support around $3,470, which aligns with the 200-day EMA . Technical indicators reflected the bearish momentum, with both the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) histogram remaining below neutral levels, "indicating persistent bearish dominance".

Altcoins: The altcoin market experienced pronounced weakness during the review period, with the total altcoin market capitalization declining by 15% in October alone . This significant contraction reflected a broad-based exodus from smaller-cap digital assets amid deteriorating risk appetite and concerns about the sustainability of recent gains. The decline was not merely a result of short-term volatility but reflected rising sell pressure and weakening demand from investors, creating a challenging environment for altcoin recovery. The altcoin market faced additional pressure from weakening stablecoin inflows, which signaled diminished potential buying power. CryptoQuant's Stablecoin CEX Flow data showed that while netflow remained positive, it had dropped sharply since mid-September and was approaching zero by October.

Market sentiment remained deeply pessimistic throughout the week, with the Fear & Greed Index registering a reading of 28, firmly in "fear" territory. This level represented a slight improvement from the "extreme fear" reading of 22 recorded on October 17, but still reflected widespread caution among market participants.

ETF: The week brought disappointing news on the ETF front, with U.S. Bitcoin ETFs experiencing substantial outflows. On October 16 alone, these products saw a record $530.9 million in net outflows, led by $132 million from Fidelity's FBTC and $29 million from BlackRock's IBIT . This outflow accelerated a broader trend that began in late September when Bitcoin ETFs lost $903 million, ending a six-week streak of inflows . The outflows reflected a macro-driven exodus from risk assets amid growing economic uncertainties.

Macro Data: Macroeconomic factors played a significant role in cryptocurrency market dynamics during the week. The Federal Reserve's monetary policy remained a focal point for investors, with the central bank's recent quarter-point rate cut in September 2025 and signals of two additional cuts by year-end projecting a terminal rate of 3.4%-3.6% for 2026 . This dovish pivot reflected a broader recalibration of global liquidity conditions, traditionally a supportive factor for risk assets including cryptocurrencies.

However, the market also faced macroeconomic headwinds, including escalating U.S.-China tensions and concerns about the Fed potentially maintaining a more hawkish stance than previously anticipated . These concerns contributed to a shift away from risk assets, with capital moving from crypto ETFs toward traditional safe havens like the U.S. Treasury bonds. During October, longer-duration Treasury ETFs such as the iShares 20+ Year Treasury Bond ETF (TLT) saw inflows of $2.2 billion, while S&P 500 ETFs SPY and VOO absorbed $13.3 billion in inflows , reflecting a broader reallocation away from digital assets.

Stablecoins: The overall market capitalization of

stablecoins is currently US$308.1 billion. The stablecoin ecosystem continued to demonstrate remarkable growth in both adoption and scale, even amid market volatility. Tether, the dominant stablecoin issuer, announced on October 21 that its USDT stablecoin had reached 500 million users for the first time, with total supply approaching $182 billion. CEO Paolo Ardoino described this milestone as "likely the biggest financial inclusion achievement in history," highlighting stablecoins' growing role in global finance, particularly in emerging markets where traditional banking remains limited.

Gas Fees: The GWEI base price is 0.15 GWEI, approximately $0.01 over a three-minute period.

Gas Heatmap. Source: Milk Road

Weekly Trending Sectors

During the week of October 17th to 23rd, the cryptocurrency market gradually recovered from its previous plunge and exhibited structural differentiation. The AI Crypto sector emerged as the brightest star, leading the market. Specific sectors, such as privacy coins, also saw renewed activity due to changes in the external environment.

AI Crypto: A New Narrative Leading the Market: The current market's most prominent highlight is the integration of AI and blockchain. The sector's rise is driven not only by short-term capital flows but also by solid underlying trends. Analysts point out that AI is transforming the cryptocurrency landscape through smarter analysis, such as fraud detection and transaction optimization. Projects like

Bittensor, whose value lies in creating a decentralized AI computing market, have over 70% of their tokens staked, demonstrating the community's long-term confidence.

CeFi and Specific Public Chains: Ecosystems Drive Value. The CeFi sector's rise was primarily driven by positive news from individual projects. For example,

Hyperliquid (HYPE) significantly boosted market confidence after its affiliates submitted fundraising documents, aiming to raise up to $1 billion. Binance's rise, on the other hand, is related to the continued expansion of the public chain ecosystem and the launch of new projects.

Privacy Coins: Revitalized Amid Regulatory Focus. As global regulatory frameworks gradually become clearer (e.g., the passage of the GENIUS and CLARITY Acts in the United States), discussions on financial privacy have intensified. This, in turn, has fueled demand for privacy-enhancing cryptocurrencies. This has led to renewed interest in established privacy coins such as Monero (XMR) and

Zcash (ZEC). Zcash, in particular, has seen a surge in the number of assets in its "shielded pool," reducing market liquidity and creating a positive impact on both supply and demand.

Layer 1 and Layer 2: Internal Rotation Driven by Technological Advancement. Although the L1 and L2 sectors performed weakly overall this week, internal divergence exists. Some projects, such as

Zcash (ZEC), experienced normal correction after a significant surge. Meanwhile, L2 projects such as Mantle (MNT) continued to rise, demonstrating that during market consolidation, investors are more inclined to favor projects with active technological development and ongoing ecosystem development.

Weekly Market Focus

Government Shutdown Threatens Crypto's Big Picture as It Stretches to Second-Longest

The U.S. government entered its fourth week of closure on Wednesday, exceeding its second-longest shutdown on record, and the crypto industry is lamenting the big-ticket items being affected, even if the closure of the federal agencies aren't yet causing direct pangs.

The closure of the government means the Senate is primarily focused on the task of re-opening it, largely shoving other policy pursuits aside. This period was meant to be the narrow window for crypto action in which the Senate had a shot at matching the House of Representatives' Digital Asset Market Clarity Act to regulate the U.S. crypto markets. That top goal of the industry has potentially missed its shot for 2025.

During the shutdown, federal agencies can only deploy employees they've deemed essential. It's not only stymied Congress' crypto work, but it also halted federal regulators from working on rules for crypto governance, including regulations for stablecoins and the online work at the U.S. Securities and Exchange Commission to hatch digital assets market proposals.

So far, the prediction markets are foreseeing a likelihood that this government shutdown exceeds the longest on record, which was during Trump's first term in the White House. The record is 35 days, which is still about two weeks away, but contracts on Polymarket and Kalshi are predicting the doors to open again in mid-November.

Crypto Exchange HTX Sued by UK for Unlawful Promotion of Assets

The UK Financial Conduct Authority has launched a civil case in the High Court targeting several entities tied to HTX. The HTX lawsuit accuses the crypto exchange of promoting digital asset services to UK users without proper authorization. This move signals a strong enforcement push by the FCA to maintain regulatory oversight over crypto promotions.

Regulators filed the HTX lawsuit on Tuesday, naming entities linked to the exchange formerly known as Huobi. According to the FCA, these companies promoted cryptoasset services in breach of the UK’s strict financial promotions regime. The FCA confirmed the legal action aims to stop unlawful activity and uphold market integrity. The HTX lawsuit does not name Justin Sun, an adviser to HTX, as a defendant in the filing. The FCA has previously warned consumers against using HTX’s services. HTX has not issued an official response to the court case or addressed the FCA’s accusations.

The regulatory body is enforcing stricter standards on crypto-related advertising and financial promotions. It has outlined that unregistered promotions can mislead the public and pose financial risks. Therefore, the FCA continues to take legal action against those who breach these rules

Hyperliquid Strategies Looks to Raise $1B to Fund HYPE Treasury Purchases

Hyperliquid Strategies, a new digital asset treasury company, has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission, signaling its intent to raise $1 billion for general purposes, including the accumulation of Hyperliquid's native token HYPE. Hyperliquid Strategy is a merger-in-progress involving Nasdaq-listed biotech firm Sonnet BioTherapeutics and a special purpose acquisition firm, Rorschach I LLC. The impending crypto treasury company will focus on the Hyperliquid ecosystem.

The company plans to issue up to 160 million shares of common stock, with Chardan Capital Markets acting as the financial advisor for this fundraising effort, according to a Wednesday filing. "In addition to its HYPE token accumulation strategy, to further enhance Pubco’s ability to generate income and seek to create value for Pubco’s shareholders, it aims to deploy its HYPE token holdings selectively, primarily through staking substantially all of its HYPE holdings, which Pubco expects will generate ongoing staking rewards," the company said in its filing.

Key Market Data Highlights

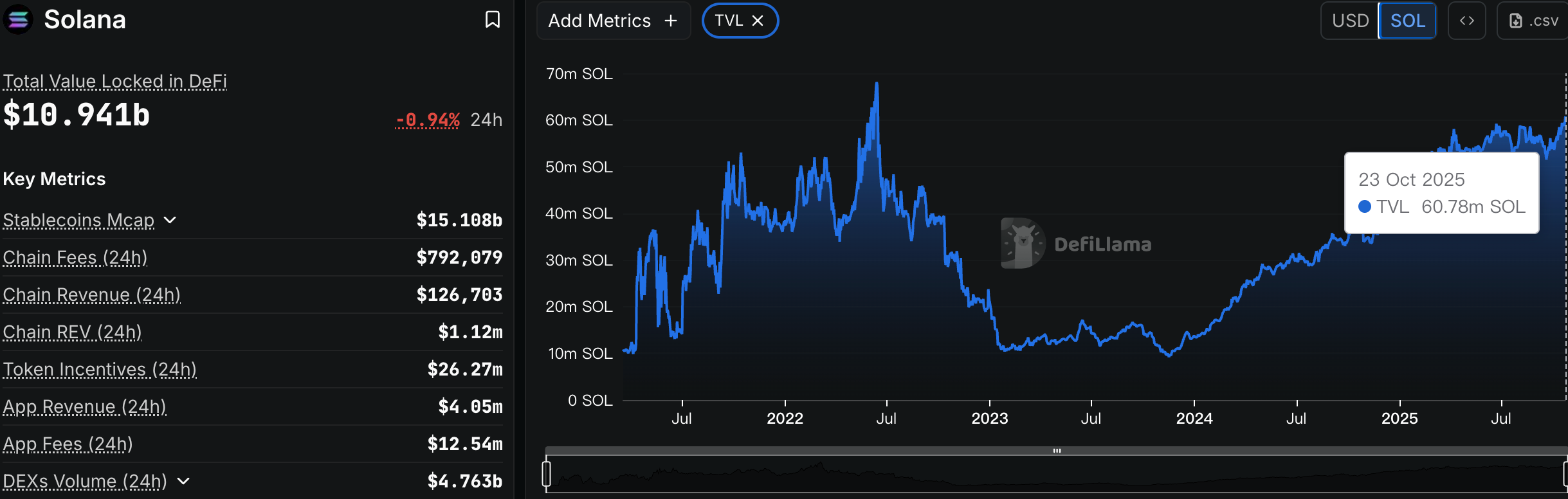

Solana's TVL Reaches New High Since Mid-2022

Solana TVL (by SOL). Source: DefiLlama

According to DefiLlama data, the Solana network's total value locked (TVL) has reached 60.78 million SOL, a nearly three-year high. This is the first time Solana has surpassed this level in SOL terms since mid-June 2022. Historical data shows that the Solana network's TVL peaked on June 13, 2022, reaching 68.13 million SOL. The current growth trend indicates that the Solana DeFi ecosystem is continuing to recover, with significant capital inflows.

Solana's TVL has reached a three-year high, signaling that the ecosystem has re-entered an expansion cycle after a long period of adjustment. With increasing activity in on-chain DEXs, stablecoins, and yield-generating protocols, investor confidence in Solana is gradually recovering. If the SOL price and TVL rise in tandem, Solana is expected to return to the mainstream public chain ranks in the next DeFi market cycle.

Bitcoin’s MVRV Ratio Hints at ‘Cyclical Bottom’ Forming Below $110K

Bitcoin’s Market Value to Realized Value (MVRV) ratio, an indicator that measures whether the asset is overvalued, recently slipped below its 365-day moving average, indicating that BTC could be at a local bottom, according to CryptoQuant analyst ShayanMarkets.

BTC MVRV ratio. Source: BITCOIN MAGAZINE PRO

The “MVRV ratio currently stands near 1.9, slightly below its 365-day moving average,” the analyst said in a QuickTake analysis on Monday, adding: “Historically, each time the ratio dropped below the 365 SMA, it has marked a buying opportunity and a local bottom signal.” The previous times this happened were in mid-2021, June 2022 and early 2024, preceding 135%, 100% and 196% rallies in BTC price, respectively.

This consistent pattern suggests that Bitcoin is once again “entering an undervalued phase, where long-term holders typically begin accumulating,” the analyst wrote. With an 1 8% BTC price drop to $103,530 on Friday from $126,000 all-time high , the MVRV declined, “reflecting reduced speculative excess and growing long-term confidence,” the analyst said, adding: “If this metric begins to turn upward from current levels, it could confirm that the recent sell-off was a cyclical bottom formation, supporting a renewed bullish phase into Q4. If history repeats itself, Bitcoin price could embark on a prolonged recovery, with analysts projecting short-term targets around $115,000 and even as high as $190,000 if the last leg of the bull run unfolds .

Tesla Booked $80M Profit on Bitcoin Holdings in Q3

Tesla (TSLA) continued to hold 11,509 BTC, valued at around $1.35 billion as of the end of the third quarter (valued somewhat less as of today).

The rise in bitcoin's value during the third quarter allowed the company to book an $80 million gain on its holdings. From perspective, adjusted EBITDA for the quarter was $4.3 billion and the company was sitting on total cash and equivalents of $41.6 billion as of the end of the quarter. The electric vehicle manufacturer reported third quarter revenue of $28.1 billion, topping estimates for $26.36 billion. Adjusted EPS (which would not include digital asset gains) of $0.50 was shy of forecasts for $0.54.

Thanks to new FASB rules, Tesla must now recognize bitcoin gains or losses every quarter. Previously, firms were required to mark their holdings down to the lowest value reached during the reporting period.

Shares of TSLA are modestly lower in after hours trading at $434.

CoinCatch New Listings

CoinCatch Weekly Event

CoinCatch Resurrection Potion: 100% Subsidy for Liquidation!

📅 Event Period: October 18, 2025 (UTC+8) – October 24, 2025 (UTC+8)

Dear CoinCatchers,

Worried about market volatility? Don't fret. Claim CoinCatch's exclusive resurrection potion 💊, covering 100% of your liquidation losses! Limited to the first 500 participants, join now!

Participation Rules:

Event 1. All users whose futures positions are liquidated on CoinCatch

from October 18 2025 (UTC+8) – October 24, 2025 (UTC+8) will be eligible for 100% liquidation grants if they complete the Google Form during the event period. (Up to 50 USDT per person)

Event 2. All users whose futures positions are liquidated on other exchanges

from October 18, 2025 (UTC+8) – October 24, 2025 (UTC+8) will be eligible for 100% liquidation grants if they upload a screenshot of the liquidation record to the Google Form during the event period. (Up to 50 USDT per person)

New Spot Listing: Trade YB/USDT and RECALL/USDT Spot with Zero Fees!

Event Period: From October 17, 2025, 2:00:00 to October 24, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

New Spot Listing: Trade ZBT/USDT Spot with Zero Fees!

Event Period: From October 21, 2025, 09:00:00 to October 28, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Halloween Lucky Wheel: Trade & Deposit to Get Millions & Gaming Kits

📅 Event Time: 2025.10.23 (UTC+8) - 2025.10.29 (UTC+8)

✨ Limited-Time Offer:

-

Complete 100 USDT futures trading volume to get 1 lucky spin.

-

Complete a single deposit of

50 USDT to get 1 lucky spin.

-

Complete 1 share to get 1 lucky spin.

💎Complete more tasks below to earn up to

20 lucky spins! Win your exclusive Gaming Kits and bonuses worth 10,000,000 USDT.

Mission 1: Complete Deposits to Get Lucky Spins

-

Net deposit ≥

100 USDT held for 5+ days →

1 lucky spin

-

Net deposit ≥

1,000 USDT held for 5+ days →

+1 lucky spin

-

Net deposit ≥

5,000 USDT held for 5+ days →

+1 lucky spin

Mission 2: Futures Trading Volume Challenge

-

Futures Trading Volume ≥

10,000 USDT →

1 lucky spin

-

Futures Trading Volume ≥

50,000 USDT →

+1

lucky spin

-

Futures Trading Volume ≥

100,000 USDT →

+1 lucky spin

-

Futures Trading Volume ≥

200,000 USDT →

+1 lucky spin

-

Futures Trading Volume ≥

500,000 USDT →

+1 lucky spin

-

Futures Trading Volume ≥

1,000,000 USDT →

+1 lucky spin

-

Futures Trading Volume ≥

5,000,000 USDT →

+2

lucky spins

-

Futures Trading Volume ≥

10,000,000 USDT →

+3 lucky spins

-

Futures Trading Volume ≥

50,000,000 USDT →

+6 lucky spins

🎁 Rewards Explained

Prize pool includes:

-

Nintendo Switch™ 2 (Value: $500)

-

Secretlab TITAN Evo 2025 (Value: $639)

-

SteelSeries Arctis Nova Pro Wireless (Value: $380)

-

Elgato Stream Deck XL (Value: $250)

-

Nintendo Switch™ 2 Pro Controller (Value: $85)

-

20 XRP

-

Multi-denomination coupons (trading bonus/position bonus; total value $10,000,000)

Complete tasks to earn lucky spins - more tasks completed = more winning opportunities!

Token Unlocks Next Week

Tokenomist data indicates that from October 23 – October 29, 2025, several major token unlocks are scheduled. Some of them are:

GRASS will unlock approximately $71.94 million worth of tokens over the next seven days, representing 57.6% of the circulating supply.

XPL will unlock approximately $31.07 million worth of tokens over the next seven days, representing 5.0% of the circulating supply.

JUP will unlock approximately $18.37 million worth of tokens over the next seven days, representing 1.7% of the circulating supply.

ZORA will unlock approximately $15.22 million worth of tokens over the next seven days, representing 3.8% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization—presented a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered

financi

al

advice.