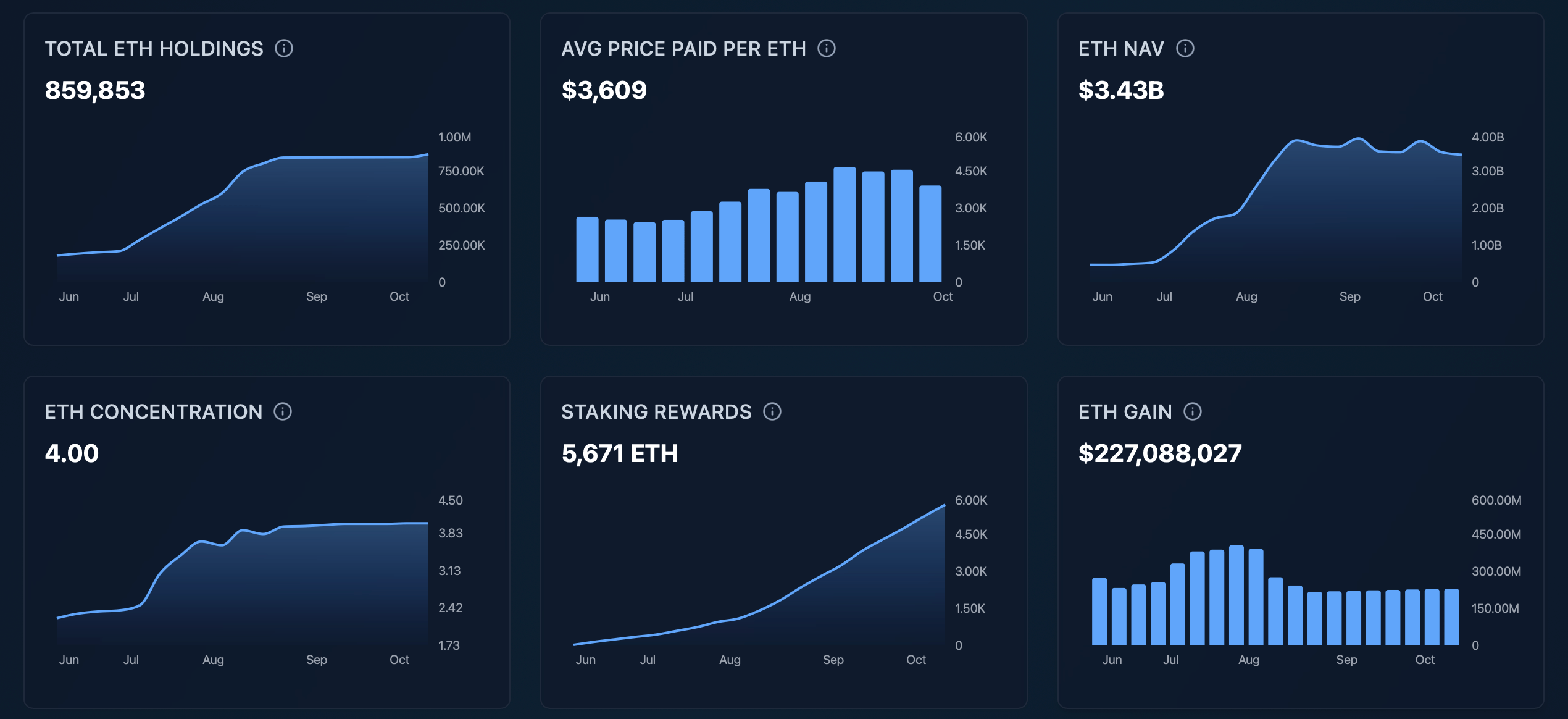

SharpLink Gaming, Inc. (NASDAQ: SBET) has solidified its position as one of the world’s largest corporate holders ofEthereum (ETH), acquiring an additional 19,271 ETH worth approximately $76 million in October 2025. This purchase brings its total holdings to 859,853 ETH, valued at roughly $3.5 billion as of October 19, 2025. Despite this aggressive accumulation of digital assets, the company’s stock price remains stagnant near $14–$15, a fraction of its earlier peaks. This divergence highlights a critical question: Can a crypto-heavy treasury strategy translate into sustained equity value, or are underlying market and structural factors suppressing SBET’s potential? This article examines SharpLink’s strategic pivot, the financial impact of its Ethereum investments, and the challenges it faces in convincing investors of its long-term vision.

ETH holdings. Source: Sharplink official website

The Strategic Pivot: From Gaming to Crypto Treasury

SharpLink began as a digital marketing and technology provider for the online sports betting and fantasy sports industries, focusing on user acquisition and data-driven engagement tools. In 2025, however, the company underwent a dramatic transformation. Under new leadership, including Ethereum co-founder Joseph Lubin as Chairman, SharpLink shifted from a gaming-centric model to a digital asset treasury operation. The pivot was backed by a $425 million private investment round led by ConsenSys, an Ethereum infrastructure firm, and signaled a deliberate embrace of blockchain-based finance.

This strategic overhaul positioned SharpLink as a pioneer in corporate Ethereum adoption, mirroring MicroStrategy’s approach to Bitcoin but with a focus on ETH’s yield-generating potential. The company’s stated mission now centers on leveraging Ethereum for balance sheet strength, staking rewards, and long-term value creation. As one of the largest publicly traded entities to hold ETH as a primary treasury asset, SharpLink aims to capitalize on the growing institutional acceptance of cryptocurrency while diversifying its revenue streams beyond gaming.

$76 Million Ethereum Purchase: Details and Execution

In mid-October 2025, SharpLink raised $76.5 million through a direct equity offering, issuing 4.5 million shares at $17 per share. The company swiftly deployed these proceeds to acquire 19,271 ETH at an average price of $3,892 per token. This purchase was executed during a brief downturn in Ethereum’s price, allowing SharpLink to buy at a discount relative to the capital raise, a move management described as “immediately accretive to shareholders”.

The acquisition increased SharpLink’s total ETH holdings to 859,853 tokens, comprising both native ETH and LSD assets like LsETH. Additionally, the company’s staking program has generated significant passive income, with 5,671 ETH earned in rewards since June 2025—valued at over $22 million at current prices. This yield-generating strategy aligns with SharpLink’s goal of transforming its treasury into a productive, revenue-generating asset.

Stagnant Stock Performance: Analyzing the Disconnect

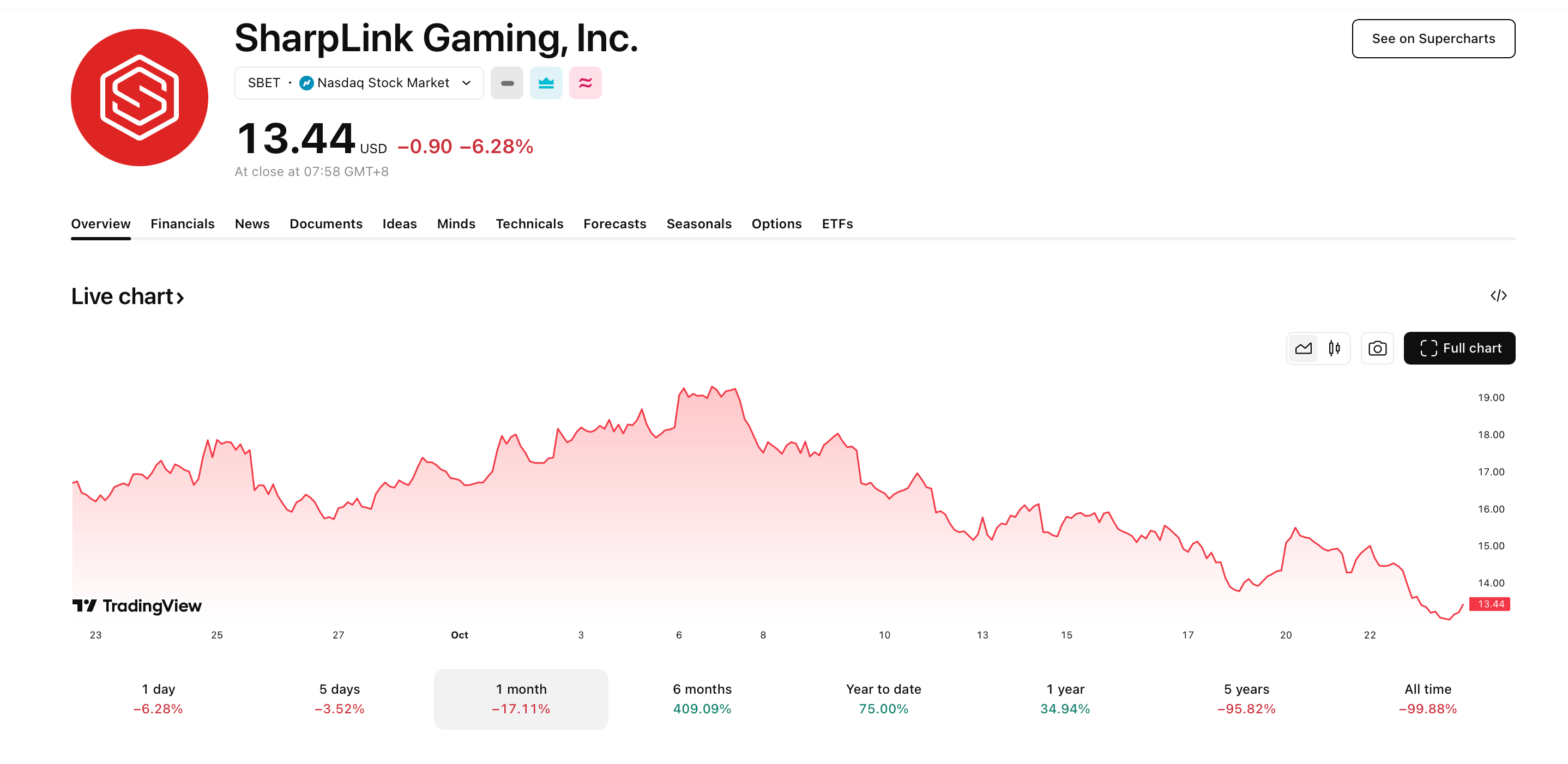

SBET stock price. Source: TradingView

Despite the growing value of its Ethereum treasury, SharpLink’s stock has struggled to gain traction. SBET shares traded in the $14–$15 range in late October 2025, far below the $32 price target set by B. Riley Securities and even further from earlier highs above $27. Several factors explain this disconnect:

Market Skepticism and Volatility Concerns: Investors appear cautious about the company’s heavy reliance on Ethereum, whose price volatility could directly impact treasury value. While ETH’s long-term potential is widely acknowledged, short-term fluctuations may deter traditional equity investors.

Capital Raise and Dilution Effects: The $76.5 million stock offering, though executed at a premium to the market price, contributed to shareholder dilution. Earlier capital raises, including a $425 million PIPE, similarly heightened dilution concerns.

Regulatory and Structural Ambiguities: SharpLink’s SEC filings, including an S-3 registration for potential resale of up to 5870 million shares, initially sparked fears of massive sell-offs, though leadership clarified these were for previously issued shares. Additionally, the emergence of a fake “SBET” token confused retail investors, further undermining confidence.

SharpLink vs. Other Ethereum Treasuries

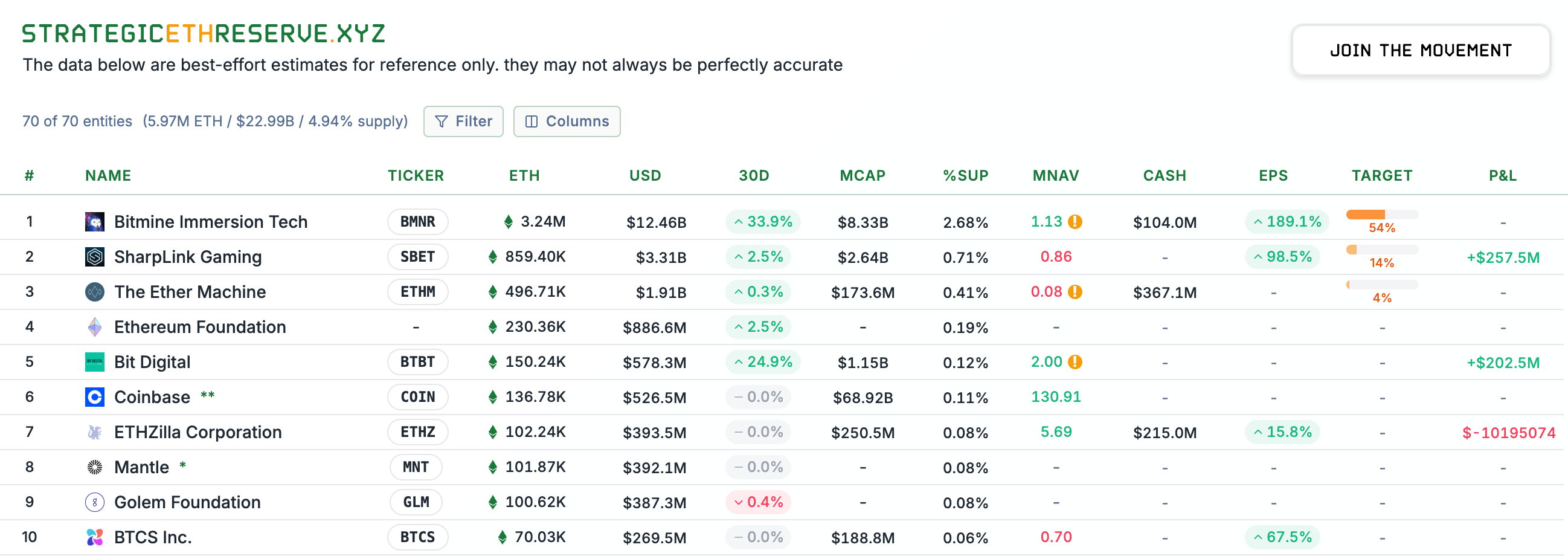

SharpLink is not alone in embracing Ethereum as a treasury asset. It ranks as the second-largest corporate holder of ETH behind Bitmine Immersion Technologies, which holds approximately 3.24 million ETH valued at over $12 billion. Bitmine’s aggressive accumulation strategy—aiming to control 5% of ETH’s circulating supply—highlights a growing trend of companies using Ethereum for treasury management.

ETH reserves ranking. Source: StrategicETHReserve.xyz

Globally, Ethereum treasury firms collectively hold 5.97 million ETH, underscoring institutional confidence in Ethereum’s utility and value proposition. SharpLink’s approach distinguishes itself through active staking and a metric called “ETH concentration,” which tracks ETH holdings per 1,000 diluted shares. This focus on per-share value reflects management’s commitment to aligning shareholder returns with treasury growth.

ETH total reserves. Source: StrategicETHReserve.xyz

Strategic Initiatives to Boost Investor Confidence

To address the stock’s underperformance, SharpLink has implemented several measures. These include a stock repurchase program designed to buy back shares if prices fall below net asset value (NAV). This mechanism aims to create a price floor while emphasizing the discounted valuation relative to the company’s Ethereum holdings.

Leadership has also emphasized transparency, regularly disclosing staking rewards, ETH concentration metrics, and cash reserves. Joseph Chalom, SharpLink’s Co-CEO, reiterated the company’s “relentless focus on accretive ETH accumulation” as central to long-term value creation. Additionally, the appointment of Joseph Lubin as Chairman reinforces ties to the Ethereum ecosystem, potentially strengthening credibility among crypto-native investors.

Risks and Challenges Ahead

SharpLink’s strategy faces several headwinds. Ethereum price volatility remains a primary risk, as a sustained ETH downturn could erode treasury value and exacerbate stock price pressures. The company’s significant leverage to crypto markets also exposes it to regulatory uncertainties, particularly as global policymakers scrutinize digital assets.

Operationally, SharpLink must balance its crypto investments with its legacy gaming business. While the pivot to Ethereum has dominated recent headlines, the company’s core gaming operations continue to face industry-specific challenges. Finally, investor patience may wear thin if the stock fails to reflect treasury growth over time, potentially inviting activist pressure or strategic shifts.

Conclusion: A High-Stakes Bet on Ethereum’s Future

SharpLink’s aggressive Ethereum accumulation strategy represents a bold experiment in corporate treasury management. The company has demonstrated conviction in ETH’s long-term value, leveraging staking rewards and strategic buying to enhance shareholder value. Yet, the persistent gap between its $3.5 billion treasury and depressed stock price underscores the complexities of transitioning from a traditional business model to a crypto-centric asset holder.

For investors, SharpLink offers a unique vehicle to gain exposure to Ethereum’s growth while benefiting from potential NAV convergence. However, realizing this potential requires navigating regulatory hurdles, market sentiment, and Ethereum’s price trajectory. As institutional adoption of cryptocurrencies accelerates, SharpLink’s success or failure may influence how other companies integrate digital assets into their financial strategies—making it a case study worth watching in the evolving landscape of crypto-based corporate finance.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.