October 11, 2025, has etched itself into the history of cryptocurrency as a day of unprecedented market turmoil. Within a mere 24 hours, the market witnessed the largest liquidation event ever recorded, erasing nearly $20 billion from books and leaving over 1.6 million traders facing devastating losses. This seismic event, now dubbed the "1011" crash, sent shockwaves through the global financial landscape, starkly illustrating the extreme volatility and inherent risks within the digital asset space. Triggered by a perfect storm of geopolitical tensions, excessive leverage, and technical vulnerabilities, this flash crash serves as a sobering case study on the interconnectedness of modern finance and the fragility of over-leveraged markets.

The Timeline of the Incident

The stage for the crash was set on October 10, 2025. Earlier in the week, Bitcoin had been trading at a historic peak above $125,000, with market sentiment buoyed by optimistic price predictions from major financial institutions. However, the foundation of this bull run was fragile.

The first tremors were felt on the evening of October 10. Bitcoin's price began a gradual descent from around $117,000, an initial drop that few recognized as the precursor to a full-blown avalanche. The true catalyst struck at 10:57 AM EST, when former President Donald Trump, on his Truth Social platform, announced that the U.S. would impose a 100% tariff on imports from China, effective November 1. This declaration dramatically escalated trade war fears, igniting a violent sell-off across global risk assets.

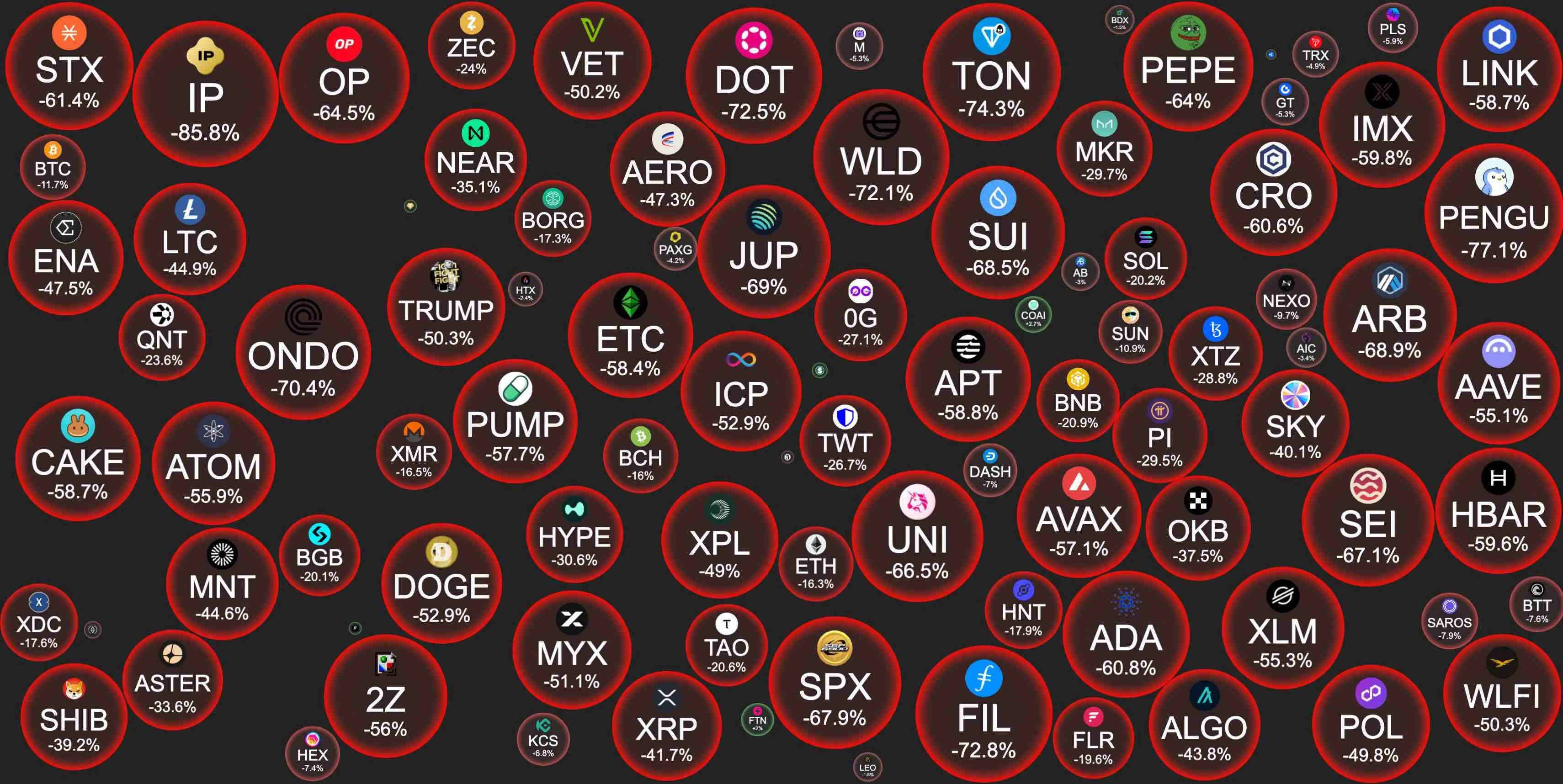

The situation turned catastrophic in the early hours of October 11. Starting around 5:00 AM UTC, Bitcoin entered a phase of what traders call "no-resistance decline." Its price plummeted in a near-vertical line, at one point crashing over 4% in a single minute and ultimately "wicking" down to a low of $101,516. In under an hour, more than $7.5 billion in leveraged positions were vaporized. The domino effect spread rapidly across the entire crypto market, with Ethereum, XRP, Solana, and a host of smaller "altcoins" experiencing even more severe percentage drops, many falling 80-90% from their recent highs.

The Staggering Scale of Liquidation

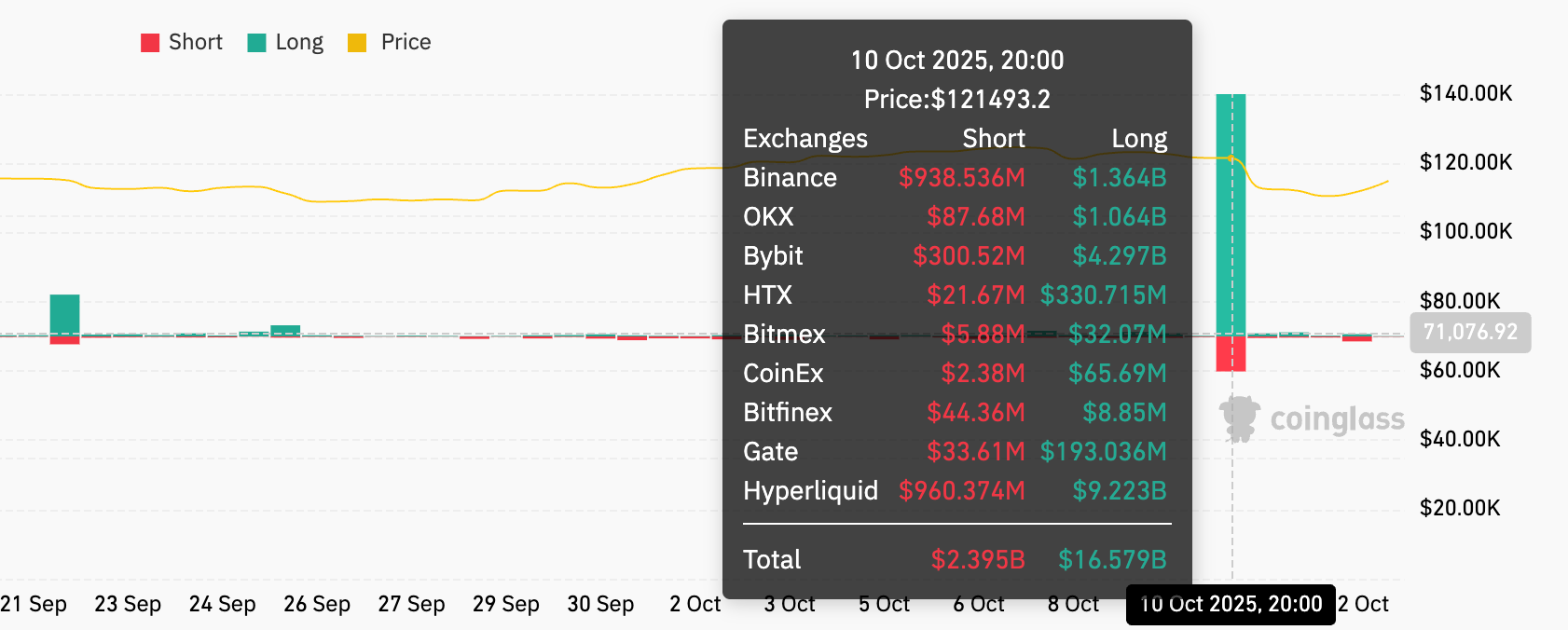

The scale of destruction was historic. Data from tracking platforms like CoinGlass revealed that a staggering

$191 to $193.7 billion in leveraged crypto positions were liquidated within 24 hours. This figure dwarfed all previous records, being approximately ten times larger than the liquidation events seen during the 2020 COVID crash and the 2022 collapse of FTX.

The human toll was equally immense. Over

1.6 million traders were caught in the storm and saw their positions forcibly closed. The imbalance was starkly evident in the data: the vast majority of liquidations were long positions betting on price increases. Longs accounted for a crushing $166 - $168 billion of the total, compared to just $24 - $25 billion in short positions. This lopsided ratio of nearly 7:1 highlighted a market that had become excessively and optimistically leveraged on continued price appreciation.

While the entire market suffered, one platform emerged as the unexpected epicenter of the disaster. Hyperliquid, a relatively new perpetual contracts exchange, recorded an astonishing $103.1 billion in liquidations, a figure that surpassed even those of industry giants like Binance and Bybit despite its smaller size. This pointed to specific vulnerabilities and user behaviors on that particular platform.

Analyse the Cause: Is This Just Because a Tariff Announcement?

While Trump's tariff announcement served as the immediate trigger, the underlying causes of the crash were more complex, rooted in a market that had become a tinderbox waiting for a spark.

Geopolitical Shock: The threat of a renewed and intensified U.S.-China trade war sent global investors scrambling for safety. Cryptocurrencies, still largely perceived as risk assets, were sold off aggressively alongside stocks and oil. The announcement's timing—late Friday after U.S. markets had closed—exacerbated the sell-off, as it hit during a period of typically lower liquidity in crypto markets, amplifying price swings.

Excessive Leverage: The primary fuel for the fire was the extremely high level of leverage in the system. In the days leading up to the crash, the market's "greed index" soared, reflecting widespread complacency and a rampant appetite for leveraged long positions. When prices began to fall, this over-leverage acted as an accelerant, triggering a cascade of mandatory liquidations. As Vincent Liu, CIO of Kronos Research, noted, the decline was "amplified by excessive institutional leverage".

Technical Domino Effect: The crash was intensified by a vicious cycle of automated selling. As leveraged long positions were liquidated, the platforms' automated systems sold the underlying assets to cover the losses. This forced selling pushed prices down further, in turn triggering more liquidations and creating a self-reinforcing downward spiral. Furthermore, the sharp de-pegging of the USDe stablecoin, which temporarily lost over 35% of its value, created chaos for traders using it as collateral, causing their leverage to multiply unexpectedly and leading to forced liquidations even in seemingly safe positions.

Exchange Meltdowns and Systemic Vulnerabilities

At the very moment traders desperately needed liquidity and control, several major centralized exchanges (CEXs) faltered. During the peak of the volatility, users of Binance, the world's largest crypto exchange, reported widespread system delays and transaction failures, preventing them from executing orders or managing their positions. Social media flooded with accusations that the exchange had "pulled the plug," though Binance later stated its core systems remained operational and attributed the issues to "concentrated selling".

The event also cast a harsh light on specific risk mechanisms. The automatic-deleveraging (ADL) system used by Hyperliquid, designed to automatically close profitable positions to cover losses when insurance funds are insufficient, was criticized for potentially exacerbating the sell-off. Some analysts suggested this was not merely a market crash but a "targeted attack" that exploited systemic vulnerabilities, starting with the de-pegging of a specific asset.

The fallout was significant enough that Binance, while denying that the crash was caused by the de-pegging of its own yield products like WBETH and BNSOL, acknowledged that the de-pegging had contributed to user losses and announced a compensation package totaling approximately $283 million.

Winners and Losers in the Wreckage

In every market crash, there are those who lose everything and those who profit handsomely.

The losers were the vast majority, the over 1.6 million retail traders and institutions who were caught on the wrong side of trade. Stories of devastating losses emerged across social media. The human cost was tragically underscored by the suspected suicide of a prominent 32-year-old Ukrainian crypto blogger known as "Kudo," who was reportedly under severe stress from market volatility.

Conversely, a small group of prepared traders reaped enormous profits. The biggest winners were concentrated, short sellers who had bet against the market. Data from Hyperliquid indicated that its top 100 traders netted a combined profit of $9.51 billion. One particular wallet, address 0x5273...065f, stood out by realizing a profit of over $700 million from its short positions. Furthermore, a Bitcoin "OG whale" drew scrutiny for having placed a massive $1.1 billion short position just hours before Trump's announcement and the subsequent crash, ultimately pocketing an estimated $190-200 million. The remarkably precise timing of this bet sparked intense discussion and speculation about potential insider information.

Market Outlook and Lessons Learned

In the aftermath, the market has begun a tentative recovery, with Bitcoin stabilizing above $110,000. However, the trauma of the "1011" crash has left a deep imprint. Analysts are now closely watching the $100,000 level for Bitcoin, which Caroline Mauron of Orbit Markets identifies as critical psychological and technical support. A breach of this level, she warns, "will mark the end of the three-year bull cycle".

This event serves as a brutal lesson in risk management. It underscores the profound connection between cryptocurrencies and global macroeconomics, demonstrating that geopolitical events can instantly shatter the illusion of crypto as a decoupled asset class. For investors and the industry alike, the crash is a stark reminder of the dangers of excessive leverage and the technical fragilities that persist in many trading platforms. As the market digests this historic deleveraging, the path forward will likely be marked by heightened caution, even as some analysts see the cleansing of weak positions as a potential foundation for a healthier long-term rally.

The CoinCatch's Commitment

During periods of significant market volatility and mass liquidations, CoinCatch aims to stand out by prioritizing platform stability and user asset protection. Our robust system infrastructure is designed to handle extreme market conditions, ensuring continuous trading operations and reliable order execution when you need it most. We are committed to providing transparent and fair pricing mechanisms, coupled with advanced risk management tools to help you navigate turbulent markets. Furthermore, we emphasize responsive customer support to address user concerns promptly during these critical times.

CoinCatch also offers a key feature that can provide traders with a crucial advantage: Added Margin Automatically (also known as Auto-Transfer or Auto-Collateralization). This function is designed to help protect leveraged positions from being liquidated. When enabled, it automatically transfers collateral from your spot wallet to your leverage or futures account if your risk ratio hits a pre-set threshold. By adding more collateral to the position, this feature can lower its liquidation price, providing a buffer against short-term price swings. For traders, this means an automated and immediate response to margin calls, which is especially valuable during rapid market moves when manual intervention might be too slow.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.