On October 10-11, 2025, an unprecedented liquidation event triggered by a complex interplay of macroeconomic triggers and vulnerabilities within the crypto ecosystem resulted in nearly

$20 billion

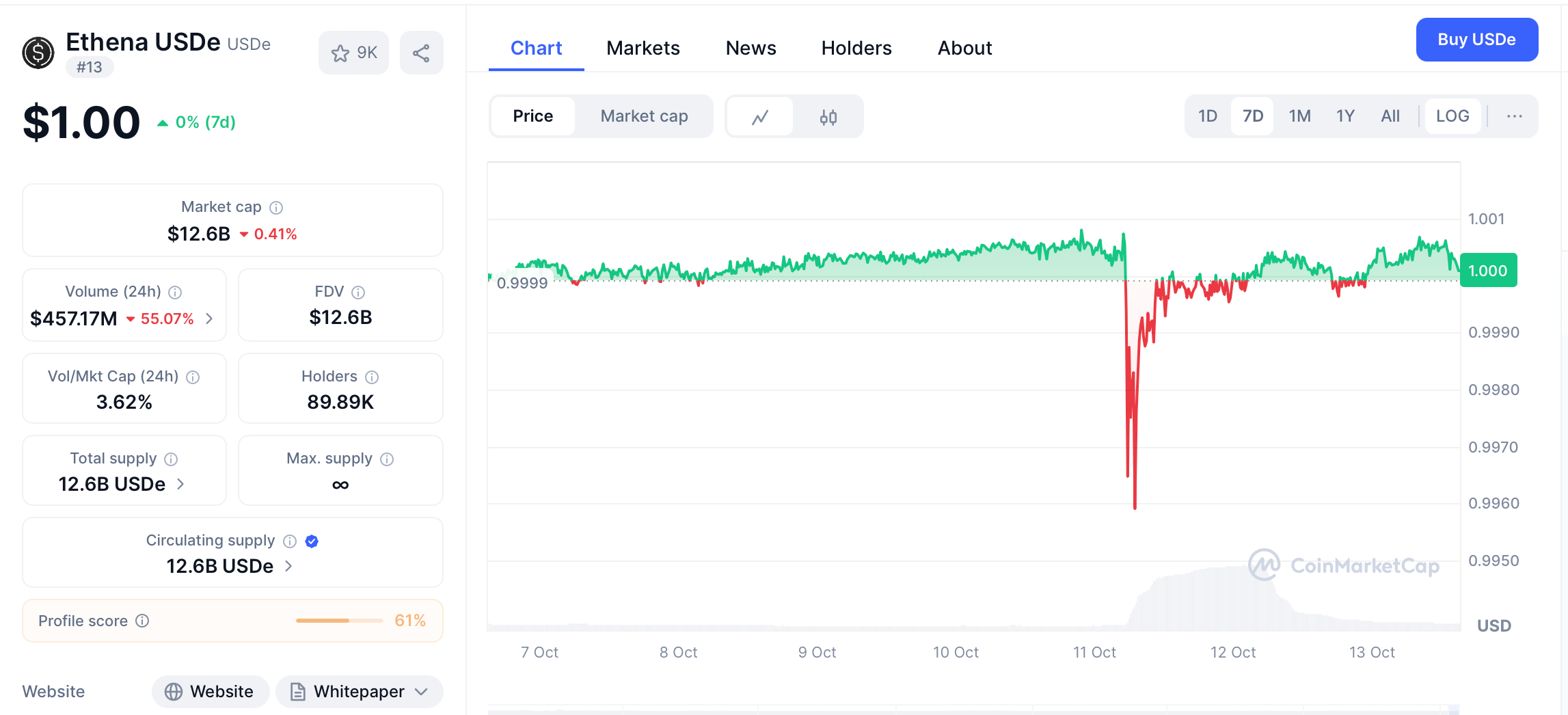

being wiped from the market. At the heart of this storm was USDe, the world's third-largest stablecoin, which dramatically lost its peg to the U.S. dollar, plummeting as low as

$0.65

. This article delves into the timeline of this "black swan" event, analyzes the structural weaknesses in USDe's design that were exposed, explores the catastrophic chain reaction of liquidations it helped fuel, and examines the ongoing implications for the future of stablecoins and decentralized finance.

The Perfect Storm: A Timeline of the Crash

The crisis unfolded with startling speed, creating a perfect storm that left traders and exchanges reeling.

The Macroeconomic Trigger: The immediate catalyst was a major geopolitical announcement. On October 10, 2025, former U.S. President Donald Trump declared on his Truth Social platform the intention to impose

100% tariffs on all Chinese imports, escalating trade war fears to a new level. This announcement sparked a massive flight to safety, causing a sharp downturn in global risk assets, including cryptocurrencies.

The Market Plunge: The crypto market, which had been trading near all-time highs, went into a freefall. Bitcoin (

BTC) price tumbled from around

$121,300 to a low of

$105,000 in under an hour. Other major assets like Ethereum (

ETH), Solana (

SOL), and XRP saw even steeper declines, with losses ranging from

15% to 30%. This violent price movement set the stage for a cascade of liquidations.

USDe Loses Its Peg: Amid the market chaos, the synthetic dollar stablecoin USDe, with a market capitalization exceeding

$140 billion, began to decouple from its $1 peg. On the Binance exchange and decentralized platforms like Uniswap, its price nosedived to as low as

$0.62 - $0.65. This

38% depeg from the U.S. dollar created panic and exacerbated the ongoing market sell-off, leading to a historic liquidation event.

Understanding USDe's Structural Vulnerabilities

To comprehend why USDe became the epicenter of this crisis, one must look at its unique and complex underlying mechanism, which differs fundamentally from traditional stablecoins.

-

The "Synthetic Dollar" Model: Unlike traditional stablecoins like USDT and USDC, which claim to be backed by real-world assets such as cash and U.S. Treasuries, USDe is a "synthetic dollar". It is generated when users deposit cryptocurrencies like Bitcoin or Ethereum. Ethena Labs, the issuer, then employs a

"delta-neutral" hedging strategy. This involves holding the underlying crypto assets while simultaneously establishing equivalent short positions in the perpetual futures markets. Theoretically, this combination is designed to maintain a stable value pegged to the dollar regardless of market direction.

-

High Returns and Hidden Risks: The model's appeal lay in its ability to generate high yields for holders, often around

5.5%, derived from the funding fees paid by perpetual contract traders. However, this very mechanism contained critical vulnerabilities. The stability of USDe was intrinsically linked to the smooth functioning and liquidity of derivatives markets. During the market crash, the hourly funding rate for Ethereum plunged to its lowest level in years, causing the core revenue-generating mechanism of USDe to falter. Furthermore, the stablecoin's spot liquidity was notoriously thin; reports indicated that a sell order of just

$6 million could cause a

4% price slip, making it a fragile asset under pressure.

The Domino Effect: Cascading Liquidations and Platform Failures

The depegging of USDe acted as a powerful accelerant, turning a market correction into a historic liquidation crisis.

-

The Liquidation Cascade: The cryptocurrency market is built on leverage. As prices fell, leveraged long positions began to get liquidated automatically. This forced selling further drove down prices, triggering more liquidations in a vicious cycle. The situation was severely worsened because USDe was widely used as

collateral for margin trading and loans. When its value dropped by over 35%, users who had posted USDe as collateral saw their borrowing power evaporate and their leverage multiply unintentionally, leading to forced liquidations of positions that would otherwise have been safe. Data from CoinGlass revealed that a staggering

$19.1 - $19.3 billion was liquidated in 24 hours, with long positions accounting for over

$16.6 billion of the total. This figure dwarfed previous liquidation records set during the COVID crash and the FTX collapse.

-

The "USDe Loop" Trap: A particularly dangerous strategy, known as the "

USDe loop," amplified the losses. Traders would stake (mortgage) USDe to borrow other stablecoins, use those stablecoins to mint more USDe, and repeat the process to build highly leveraged positions. When USDe depegged, this strategy backfired catastrophically, causing a spiral of automatic liquidations that dumped more USDe onto the market, fueling the downward price spiral.

-

Exchange System Strain: At the peak of the volatility, major centralized exchanges experienced significant technical difficulties. Users on

Binance, the world's largest crypto exchange, reported widespread system delays, order book failures, and an inability to execute trades or manage positions. This further eroded liquidity and trapped users, preventing them from taking defensive actions. Compounding the issue, Binance's ETH hot wallet reportedly automatically halted withdrawals due to high gas fees, which critically blocked the on-chain arbitrage path that could have helped restore USDe's peg.

Aftermath and Response: Compensation and a Call for Regulation

In the wake of the disaster, a complex process of damage assessment and accountability began.

-

Exchange Compensation and Mea Culpa: Facing immense pressure from the community, Binance acknowledged the issues and announced a compensation plan for affected users of its futures, margin, and lending products. The compensation, which was to be automatically distributed within 72 hours, covered the price difference for users liquidated due to the depegging of USDe, BNSOL, and WBETH between 05:36 and 06:16 (UTC+8) on October 11. Binance also pledged to strengthen its risk controls, including adding a

minimum price limit for USDE and incorporating redemption prices into its index calculations. Binance co-founder He Yi also issued a public apology, though it was somewhat marred by a customer service miscommunication that sparked community anger.

-

Ethena Labs' Defense: Ethena Labs, the creator of USDe, responded to the crisis by asserting that the protocol's minting and redemption functions never went offline and that USDe remained

over-collateralized throughout the event. They released an off-schedule proof of reserves, verified by third parties like Chaos Labs and Chainlink, showing an excess collateral of about

$66 million. Founder Guy Young dismissed much of the criticism as "FUD from unreliable sources".

-

A Watershed Moment for Stablecoin Regulation: The event has ignited a fierce debate about the very nature of stablecoins. Some industry leaders have argued that USDe is not a true stablecoin but a

"hedge fund product"or a high-yield savings instrument with significant, albeit hidden, risks. This distinction is crucial for future regulation. The event is widely seen as a catalyst that will push global regulators to accelerate the development of clear

compliance frameworks for stablecoins, focusing on transparency, reserve backing, and risk management.

Conclusion: Lessons from Wreckage

The "1011" liquidation event is a stark reminder of the inherent risks in cryptocurrency's highly leveraged and interconnected world. It was not merely a market crash but a

stress test that exposed critical flaws in a popular financial primitive. The event underscored several key lessons for the industry and investors alike. It demonstrated that

high yields always come with high, often complex, risks. The allure of returns from mechanisms like the "USDe loop" blinded many to the underlying fragility. Furthermore, the crisis highlighted the

systemic risk posed by the interdependence of leverage, complex DeFi products, and centralized exchange infrastructure.

For the market to mature and attract broader adoption, a greater emphasis on

robust risk management, transparent product labeling, and resilient exchange systems is non-negotiable. While the market has since stabilized, with USDe regaining its peg and Bitcoin recovering above $110,000, the memory of this flash crash will linger. It serves as a powerful cautionary tale that in the pursuit of innovation and yield, the fundamental principles of risk assessment should never be overlooked.

References:

USDE, BNSOL, and WBETH Depegging Follow-up: Binance Initiates Compensation and Risk Parameter Adjustment Measures. (2025, October 12).

Followin.

https://followin.io/en/feed/20727442

benmo.eth:

The USDe depegging event has become the main battleground for leveraged trading, and Binance's withdrawal mechanism unexpectedly locks down arbitrage paths. (2025, October 13).

RootData.

https://www.rootdata.com/news/390871

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.