On October 10, BTC briefly surged above $123,600 before quickly falling back and subsequently falling below $121,000, forming a clear downward structure; ETH has fallen from a high of around $4,755, breaking through short-term support and hitting a low of $4,265, before rebounding from oversold levels. The crypto market is experiencing a significant pullback led by Bitcoin, with over $600 million in leveraged positions liquidated. Meanwhile, Crypto exchange Coinbase and payments giant Mastercard have each held advanced acquisition talks to buy BVNK. DeFi protocols collectively locked in $237 billion, the highest total value locked (TVL) ever recorded in space. Aave Labs and Blockdaemon are eyeing institutional-grade access to Aave’s decentralized finance markets and are tapping into Blockdaemon’s Earn Stack and Aave Vaults to unlock this.

Crypto Market Overview

BTC (-0.50% | Current Price: $121,373.04)

Bitcoin fell 0.5% to $121,373 over the past 24h. The BTC market is currently experiencing a volatile and weak trend. After briefly rising above $126,000 on October 8th, the price quickly retreated and subsequently fell below the MA30 (approximately $121,800) on October 9th, forming a clear downward trend. If BTC fails to regain its footing above the MA30 and break through the $122,000 area, a short-term retest of the $120,000 support level is possible. If this support level fails, the current low around $119,600 is a concern. On October 9th, BTC ETFs saw a net inflow of $197 million, with BlackRock IBIT receiving $255 million and Fidelity FBTC receiving $13.2 million.

ETH (+2.11% | Current Price: $4,192.10)

ETH's recent price trend has exhibited a pattern of volatile decline followed by a stabilizing rebound. Since retreating from its high near $4,755 on October 7th, ETH has briefly broken through short-term support and hit a low of $4,265, before rebounding from oversold conditions. Currently trading near $4,320, if ETH can break through the MA30 with significant volume and stabilize above $4,400, it could potentially test the $4,450–$4,500 resistance zone in the short term. Conversely, if the rebound falters and the price falls below $4,320 again, caution is warranted regarding the risk of a re-entry into the $4,250 region. On October 9th, ETH ETFs experienced a net outflow of $8.7 million, with BlackRock ETHA receiving $39.3 million and Fidelity FETH receiving $30.3 million.

Altcoins

The Fear & Greed Index currently stands at 54. Most major altcoins fell slightly, with market sentiment dominated by "neutral" and "buy." The Altseason Index currently stands at 46, off its lows, indicating early signs of a rotation from Bitcoin to altcoins, but not yet entering altcoin season (which typically requires a reading above 75).

The sell-off was not isolated to Bitcoin. Ethereum and other major altcoins like BNB and DOGE saw steeper declines of 3-4%. This underperformance is a classic sign of a "risk-off" environment where traders flee smaller, riskier assets.

Macro Data

The US Department of Labor is preparing to release the September CPI data during the government shutdown, and the release time may be delayed but is expected to be released before the Federal Reserve's FOMC policy meeting on October 28-29. There are differences within the Federal Reserve on interest rate policy. Governor Barr emphasized inflation risks and said that interest rate cuts need to be cautious, while "No. 3" Williams supports further interest rate cuts this year and does not think the economy is on the verge of recession. The US dollar strengthened, and the prices of gold and silver fluctuated violently. On October 10th, the S&P 500 dropped 0.28% to 6,735.11 points; the Dow Jones Industrial Average fell 0.52% to 46,358.42 points, and the Nasdaq Composite dropped by 0.08% to 23,024.63 points.

Trending Tokens

ZORA ZORA (+49.35%, Circulating Market Cap: $376.85 Million)

ZORA is trading at $0.08431, up approximately 49.35% in the past 24 hours. ZORA (ZORA) is cryptocurrency and operates on the Base platform. It is currently trading on 192 active market(s) with $61,260,900.71 traded over the last 24 hours. ZORA surged 69% to $0.09213 on October 10 after its Robinhood listing. The exchange’s 23M+ users likely drove retail buying, with volume spiking 660% to $462M. Listings often trigger short-term FOMO, especially for tokens with strong narratives like Zora’s creator economy focus. However, the price stabilized at $0.08159 (-12% from peak), suggesting profit-taking.

SQD Subsquid (+45.35%, Circulating Market Cap: $212.65 Million)

SQD is trading at $0.2475, up approximately 45.35% in the past 24 hours. Subsquid Network is an innovative decentralized data lake and query engine designed to offer developers performant and permissionless access to data, aiming to build a neutral and open internet rooted in Web3 principles. Secured by ZK proofs, the Subsquid network boasts a modular architecture that enables exceptional scalability and developer convenience optimized for blockchain indexing, dApp development, and analytics. Rezolve AI (NASDAQ: RZLV) completed the acquisition of Subsquid on October 9, 2025, with the intention of integrating its AI commerce platform with SQD’s decentralized data network. Rezolve plans to rebrand SQD and has committed to purchasing tokens equivalent to at least 1% of its annual revenue, thereby establishing a consistent demand sink. Supply constraints: 30.6% of SQD’s total supply is currently secured through staking and node operations. Rezolve’s buyback initiatives may further diminish liquidity. Enterprise validation: SQD’s infrastructure, which includes 2.1PB of data and handles 5 million daily queries, now supports a publicly traded AI company, enhancing its credibility.

XVG Verge (+23.65%, Circulating Market Cap: $227.86 Million)

XVG is trading at $0.008897, up approximately 23.65% in the past 24 hours. Verge is a privacy-focused cryptocurrency and blockchain that seeks to offer a fast, efficient, decentralized payments network that improves upon the original Bitcoin (BTC) blockchain. It includes additional privacy features including integrating the anonymity network Tor into its wallet, called vergePay, and providing the option of sending transactions to stealth addresses. Privacy coins like ZEC (+167% weekly) and DASH (+67%) led October’s “Uptober” rally, driven by narratives around regulatory resilience and institutional interest (e.g., Grayscale’s Zcash Trust). XVG’s 24h surge aligns with this sector rotation. Traders are rotating into undervalued privacy assets amid renewed focus on anonymity features. XVG’s low market cap ($144M) magnified its upside compared to larger peers.

Market News

Coinbase and Mastercard Held Talks to Buy Stablecoin Fintech BVNK for Up to $2.5B

Crypto exchange Coinbase and payments giant Mastercard have each held advanced acquisition talks to buy BVNK, a London-based fintech that builds a stablecoin payment infrastructure, according to six people familiar with the matter who spoke with Fortune.

The discussions have not been finalized, but several of the sources told Fortune that the potential sale price is between $1.5 billion and $2.5 billion. The talks may still fall apart, yet Coinbase appears to be ahead of Mastercard at this stage, three of the sources told Fortune. If completed, the acquisition would be the largest stablecoin-related deal yet, signaling how mainstream financial and crypto firms are competing to control the next wave of digital payments.

A year ago, Stripe acquired another stablecoin startup, Bridge, for $1.1 billion, underscoring the growing demand for blockchain-based payment networks. BVNK operates in a similar space, providing tools that help businesses send and receive funds using stablecoins, digital tokens pegged to traditional currencies like the U.S. dollar. Its technology enables instant settlement and lower fees compared to legacy systems such as SWIFT or card networks.

DeFi TVL Hits Record $237B as Daily Active Wallets Fall 22% in Q3

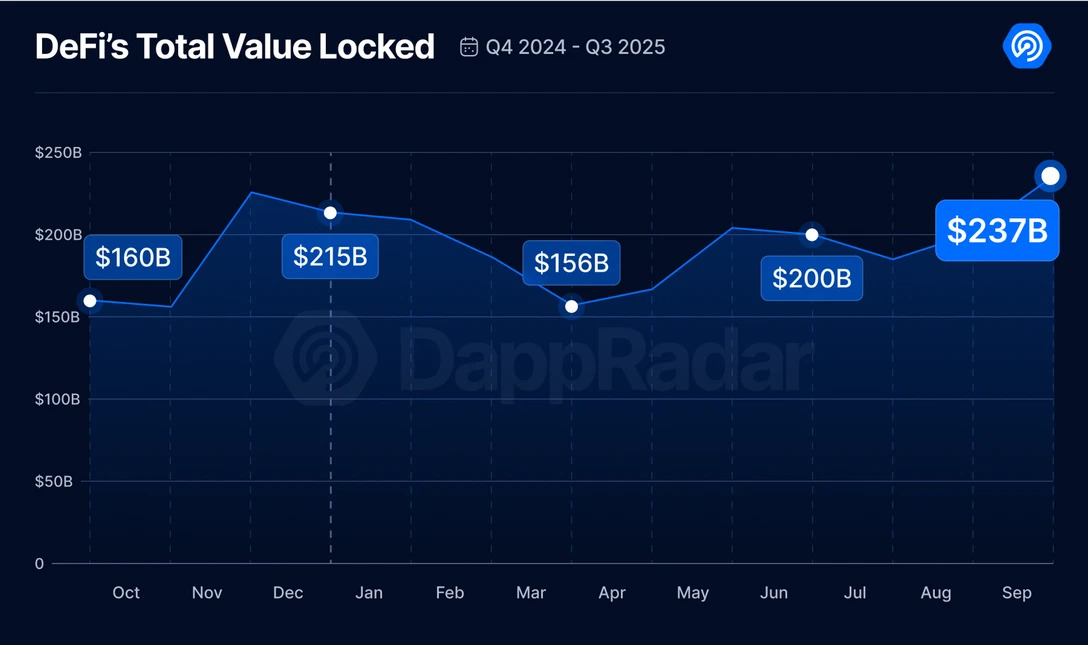

The decentralized application (DApp) industry ended the third quarter of 2025 with mixed results, as decentralized finance (DeFi) liquidity surged to a record high while user activity fell sharply, according to new data from DappRadar. DappRadar said that daily unique active wallets averaged 18.7 million in Q3, down 22.4% compared to the second quarter. Meanwhile, DeFi protocols collectively locked in $237 billion, the highest total value locked (TVL) ever recorded in space.

Q3 2025 ended with $237 billion locked in DeFi smart contracts. Source: DappRadar

The report highlights an ongoing divergence between institutional capital flowing into blockchain-based financial platforms and the engagement of retail users with DApps. While DeFi TVL reached record levels of liquidity, overall activity lagged, suggesting weaker retail participation.

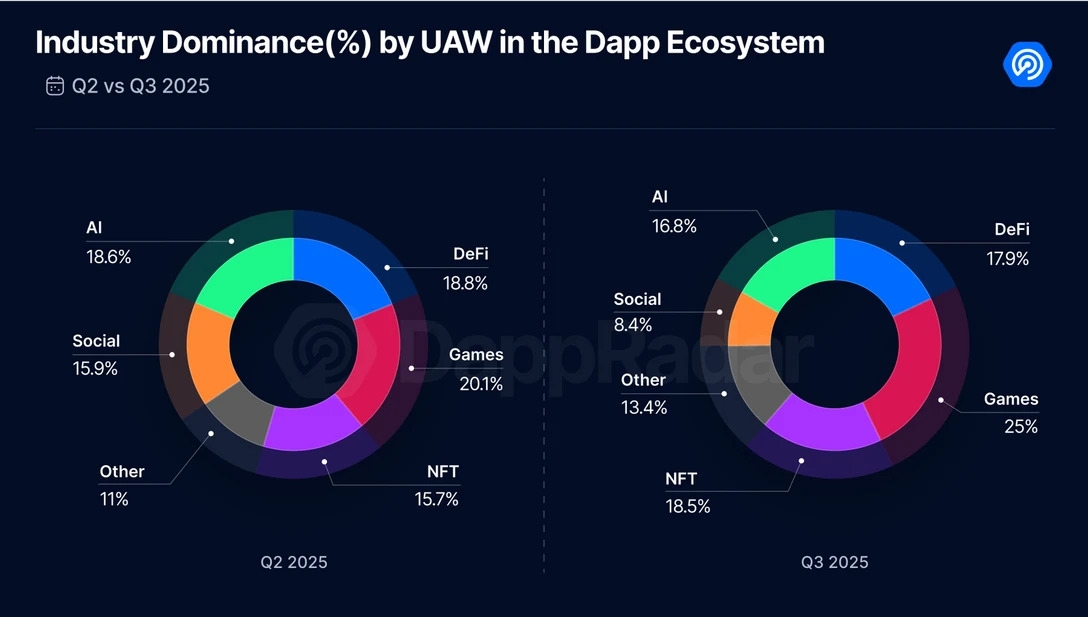

“Looking at the entire quarter, every category noted a drop in active wallets, but the impact was mostly felt in the Social and AI categories,” DappRadar wrote. AI-focused DApps lost over 1.7 million users, going from a daily average of 4.8 million in Q2 to 3.1 million in Q3, while SocialFi DApps went from 3.8 million to 1.5 million in Q3.

Unique active wallet categories in the decentralized apps ecosystem. Source: DappRadar

Aave and Blockdaemon Partner to Advance Institutional Access to DeFi

Aave Labs and Blockdaemon are eyeing institutional-grade access to Aave’s decentralized finance markets and are tapping into Blockdaemon’s Earn Stack and Aave Vaults to unlock this. Per an announcement on October 9, 2025, integration opens new opportunities for institutions.

According to details, Aave is set to be the exclusive primary lending provider for Blockdaemon Earn Stack, a non-custodial platform that offers staking services across more than 50 protocols. The integration will leverage Aave Vaults to allow institutional clients to access staking rewards. Providing access to on-chain markets unlocks over $70 billion in liquidity and allows institutional investors to tap into secure yield opportunities.

Aave is a leading DeFi lending protocol and the integration further expands this.

Importantly, Blockdaemon customers can now put staking rewards and their idle balances to work across DeFi markets. Furthermore, they retain full control of their assets.

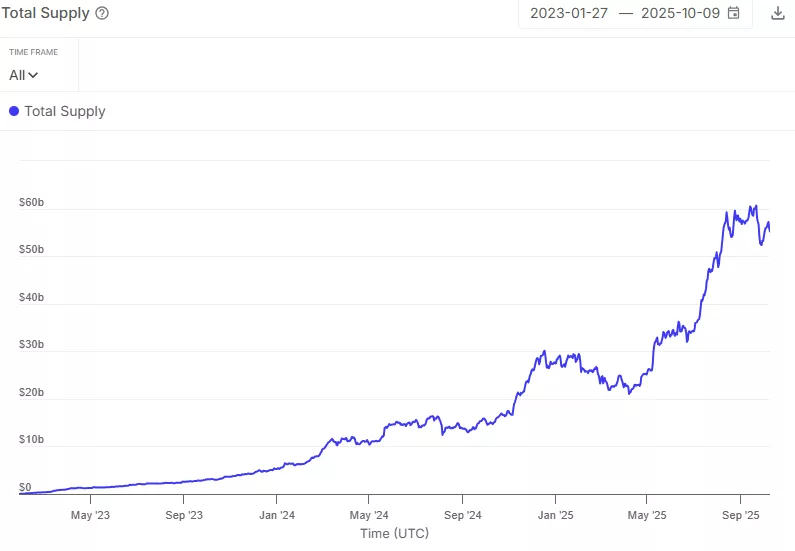

As noted, Blockdaemon has picked Aave as its primary lending provider given the DeFi protocol’s long-trusted operations and robust risk controls. Blockdaemon customers and the broader DeFi community will have access to a range of supported cryptocurrencies. This includes Bitcoin, Ethereum, and stablecoins. Support also includes assets on Horizon, an institutional market for borrowing against real-world assets. Tokenized RWAs are currently one of the sectors witnessing strong growth.

Data shows the Horizon RWA market size has surpassed $200 million, with over $54 million borrows. The platform launched in August 2025. Users supply stablecoins such as Ripple USD, USDC, and GHO Token, and tokenized assets like Superstate’s USTB and Janus Henderson’s JTRSY into RWA pools. Deposited tokenized assets serve as collateral for users looking to borrow USDC, RLUSD, or GHO.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.