The

decentralized finance (DeFi)

landscape is undergoing a significant transformation, shifting from purely speculative activities toward building tangible utility and bridging traditional finance. A key innovation driving this change is the

tokenization of real-world assets (RWA)

, which brings familiar financial instruments like U.S. Treasuries onto the blockchain. At the forefront of this evolution is

Falcon Finance

, a protocol introducing a novel concept:

universal collateralization infrastructure

. Falcon Finance aims to redefine capital efficiency in DeFi by allowing a diverse range of assets—from cryptocurrencies to tokenized RWAs—to be used as collateral to generate a synthetic U.S. dollar, USDf. With recent milestones including a major strategic investment and listings on top-tier exchanges, Falcon Finance is positioning itself as a critical bridge connecting the multi-trillion dollar traditional finance market with the burgeoning digital asset ecosystem.

What Is Falcon Finance (FF)?

Falcon Finance is best described as a

universal collateralization infrastructure for the digital asset ecosystem. Its core mission is to transform how liquidity is created and utilized on-chain by allowing any custody-ready asset—including cryptocurrencies,

stablecoins, and, critically,

tokenized real-world assets (

RWA

)—to be used as collateral to mint USDf, an overcollateralized synthetic U.S. dollar . Unlike many DeFi projects that cater to a single niche, Falcon Finance is building a comprehensive ecosystem designed to serve a broad audience, from individual users to large institutions.

The protocol's ecosystem is supported by three key pillars. The first is the

USDf synthetic dollar, which is minted when users deposit approved collateral assets. USDf is designed to be overcollateralized, with a minimum collateral ratio of 150%, ensuring that its value remains stable and pegged 1:1 with the U.S. dollar. The second pillar is

sUSDf, a yield-bearing version of USDf. Users can stake their USDf to receive sUSDf, which automatically accrues yield from the protocol's diversified, institutional-grade trading strategies. The third pillar is the

FF token, the native governance and utility token that powers the entire network, enabling community-led governance and allowing holders to share in the protocol's success.

A significant factor behind Falcon Finance's rapid growth is its

strong backing and partnerships. The project is supported by DWF Labs, a major market maker in crypto space, and received a

$10 million investment from

World Liberty Financial

(WLFI), a project associated with the Trump family. This association has provided Falcon with a unique political narrative and potential regulatory advantages. Furthermore, the protocol's integration with

Chainlink's Cross-Chain Interoperability Protocol (CCIP) and Proof of Reserve provides real-time, verifiable transparency that USDf remains fully overcollateralized, significantly enhancing trust and security for users.

How Does FF Work?

The Falcon Finance protocol operates on a sophisticated yet user-accessible model that centers on its universal collateralization mechanism and yield-generation strategies.

The process begins with

collateral deposition. Users can deposit a wide array of liquid assets into the Falcon Finance protocol. This includes volatile cryptocurrencies like BTC and ETH, common stablecoins such as USDC and USDT, and increasingly, tokenized real-world assets like U.S. Treasuries. This diverse acceptance is the foundation of its "universal" claim. Once deposited, these assets are used as

collateral to mint USDf. The protocol mandates overcollateralization, meaning the value of the deposited assets must exceed the value of the USDf minted, typically starting at 150% or higher. This buffer protects the system's stability against market volatility.

For users seeking yield, the next step is

staking USDf to generate sUSDf. By staking their USDf, users receive sUSDf, a yield-bearing token. The value of sUSDf increases over time relative to USDf as it accumulates yield from the protocol's revenue-generating activities. The

yield generation for sUSDf is not reliant on a single source. Falcon Finance, leveraging the trading expertise of its backers like DWF Labs, employs a diversified set of institutional-grade, market-neutral strategies. These include funding rate arbitrage in perpetual futures markets, cross-exchange price arbitrage, staking of Proof-of-Stake (PoS) assets, and providing liquidity on decentralized exchanges. This multi-pronged approach aims to deliver sustainable returns across various market conditions, currently offering yields that are highly competitive compared to traditional finance.

A particularly powerful feature for advanced users is the

looped leverage strategy. This allows users to take the sUSDf they receive from staking, use it as collateral on platforms like Pendle Finance to borrow more USDf, and then repeat the process. This looping can significantly amplify the base yield, potentially boosting returns to 40% or 60% APY, though it concurrently amplifies the risks involved, including liquidation during market downturns.

Tokenomics of Falcon Finance (FF)

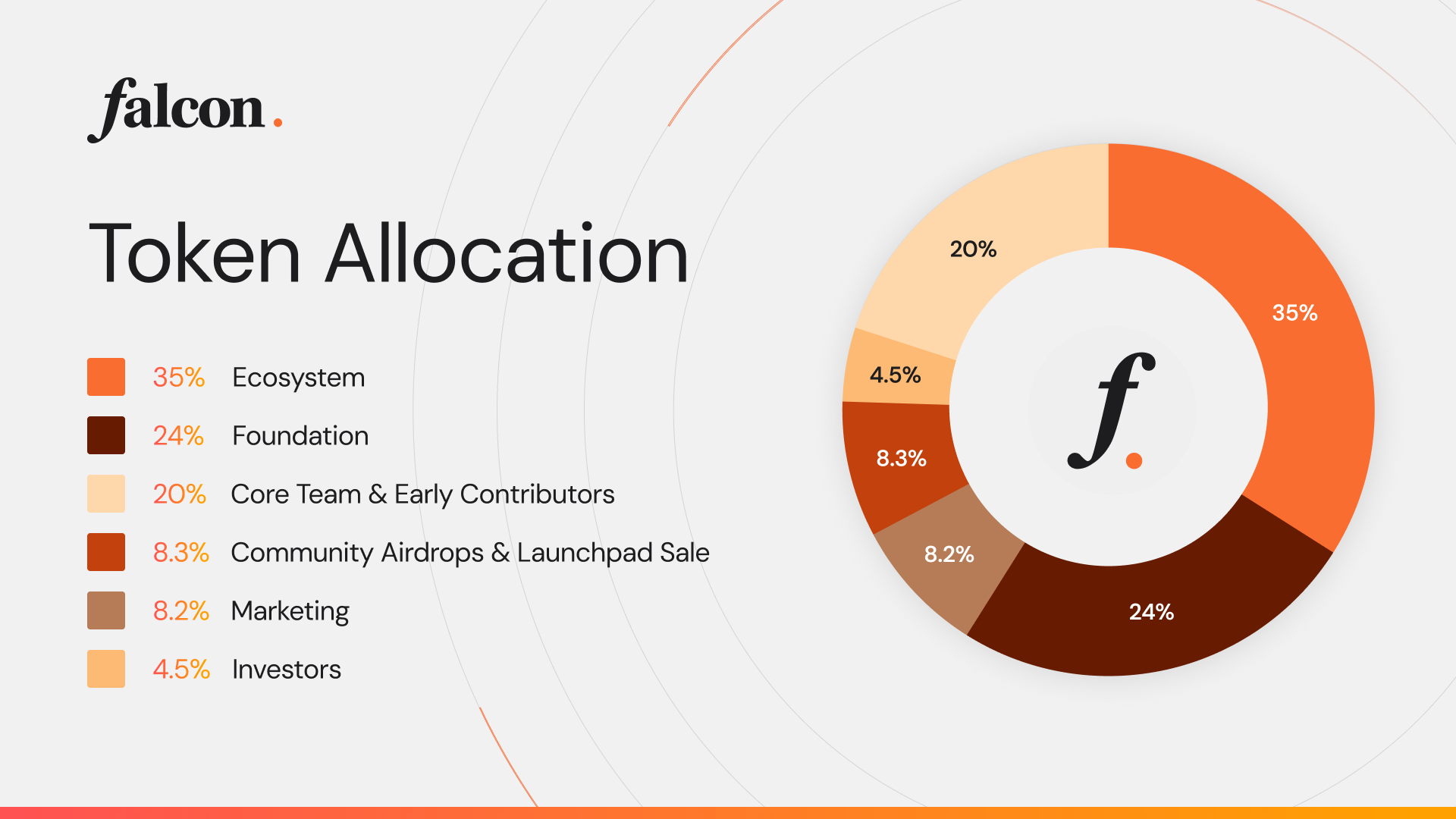

The FF token is designed with a fixed total supply of

10 billion tokens, incorporating a carefully structured allocation plan to promote long-term, sustainable growth and align the interests of all stakeholders.

The token distribution is heavily weighted toward the ecosystem's future development. A substantial

35% of the total supply is allocated to the ecosystem fund. This portion is dedicated to ongoing developments, future airdrops, ecosystem growth initiatives, and fostering RWA adoption. Another

24% is allocated to the Foundation, which is reserved for core operational needs, risk management, and protocol audits. The

core team and early contributorsreceived 20% of the tokens, which are subject to a multi-year vesting schedule to ensure long-term commitment.

From a community and distribution perspective,

8.3% of tokens were allocated to community airdrops and launchpad sales, including the recent Binance HODLer airdrop, which helped decentralize ownership from the start. An additional

8.2% is reserved for marketing efforts to drive awareness and adoption. Finally, only

4.5% of the total supply was allocated to investors, with these tokens also subject to lock-up periods, preventing immediate market flooding post-listing.

At its Token Generation Event (TGE), the initial circulating supply was

2.34 billion FF tokens (23.4% of the total supply). The remaining tokens are locked and will be released linearly according to their respective vesting schedules. This controlled release mechanism is designed to mitigate sell pressure and support a healthier token price discovery process.

Is FF Worth Buying?

Evaluating FF as a potential investment requires a balanced consideration of its compelling opportunities against the inherent risks in a nascent and rapidly evolving market.

Bullish Considerations

Massive Addressable Market: Falcon Finance operates at the intersection of DeFi and the multi-trillion dollar traditional finance market. Its universal collateralization model is poised to capture value as the tokenization of real-world assets (RWA) accelerates, representing one of the most promising growth narratives in crypto.

Strong Institutional Backing: The protocol is backed by DWF Labs and has received investments from WLFI and, most recently, M2 Capital. This provides not just capital but also strategic partnerships, market-making expertise, and a unique political narrative that could be advantageous in a shifting regulatory landscape.

Proven Product and Traction: Unlike many projects that launch a token before a product, Falcon Finance has demonstrated real traction. With over $1.6 billion in USDf circulation and integration across multiple DeFi protocols, it has validated its product-market fit.

Sustainable Yield Model: The yield for sUSDf is generated from real, diversified trading strategies rather than token inflation. This creates a more sustainable economic model that isn't reliant on constant new investor inflows to sustain returns.

Risks and Challenges

Regulatory Uncertainty: The association with Trump's WLFI, while a potential political advantage, also introduces regulatory uncertainty. The project could face heightened scrutiny depending on the U.S. political climate.

Complexity and Technical Risks: Falcon's model, particularly its leveraged looping strategies, is complex. Users face smart contract risks, and the sophisticated trading strategies underpinning the yield are not risk-free and could underperform in certain market conditions.

Market and Liquidity Risks: Despite its overcollateralization, USDf experienced a temporary de-pegging to $0.91 in July 2025, highlighting its vulnerability to extreme market volatility or liquidity crises.

Competitive Pressure: The RWA and synthetic dollar space is becoming increasingly competitive. Falcon Finance must continue to innovate and execute flawlessly to maintain its first-mover advantage against both DeFi natives and eventual entrants from traditional finance.

Conclusion

Falcon Finance emerges as a pioneering force in the next wave of DeFi innovation, building critical infrastructure to bridge the vast world of traditional finance with the efficiency and transparency of blockchain technology. Its universal collateralization model, which allows diverse assets—including tokenized RWAs—to be transformed into productive, yield-generating capital, addresses a fundamental need for greater capital efficiency across the financial spectrum.

The recent $10 million investment from M2 Capital, coupled with the successful listing of its FF token on major exchanges like Binance, validates its model and provides substantial momentum. While the project is not without risks—including regulatory hurdles and the inherent complexity of its system—its strong institutional backing, proven traction with over $1.6 billion in USDf circulation, and a tokenomics model designed for long-term alignment position it favorably.

For investors and users alike, Falcon Finance represents a compelling vehicle to gain exposure to the high-growth narratives of real-world asset tokenization and the evolution of synthetic assets. As the protocol continues to execute its roadmap, expanding fiat corridors and deepening ecosystem integrations, FF is poised to be a token worth watching closely in the evolving DeFi landscape.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.