The RWA market has exploded from niche concept to trillion-dollar opportunity, with tokenized RWA market size projected to reach $2 trillion by 2025-end, up from just $300 billion in 2024 . At the forefront of this financial transformation stands

OpenEden

, a regulated protocol bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi) by bringing U.S. Treasury yields on-chain.

OpenEden represents more than just another DeFi protocol – it's a complete architectural frameworkfor integrating the safety and stability of traditional finance with the efficiency and accessibility of blockchain technology. Founded in 2022, OpenEden has positioned itself as the gold standard for regulated RWA tokenization, solving what many have called the "regulatory-innovation paradox" that has plagued previous attempts to merge these two worlds . As traditional financial institutions increasingly explore blockchain solutions and DeFi participants seek sustainable yields beyond token farming incentives, OpenEden emerges as a crucial infrastructure layer enabling secure, compliant access to some of the world's safest assets: U.S. Treasury Bills.

Why You Should Pay Attention to EDEN Recently?

The OpenEden ecosystem and its native EDEN token have garnered

significant market attention throughout 2025, driven by several crucial developments that signal both growing institutional acceptance and expanding market reach. These recent advancements position EDEN as one of the most

promising tokens in the rapidly evolving RWA landscape.

Major Exchange Adoptions and Listings

September 2025 marked a pivotal moment for OpenEden's visibility and accessibility when leading cryptocurrency exchanges announced support for EDEN tokens. Most significantly, Binance revealed it would add EDEN to multiple services including futures contracts and leverage trading. This integration enables traders to access EDEN with up to 75x leverage, a substantial show of confidence from the world's largest crypto exchange. On the same day, OKX announced it would list EDEN perpetual contracts supporting up to 50x leverage. These simultaneous listings across major trading platforms significantly enhance EDEN's liquidity and accessibility while exposing the token to millions of new potential investors.

Unprecedented Regulatory Credibility

In early October 2025, OpenEden achieved what no other RWA tokenization project has accomplished – dual ratings from top credit agencies. Following its initial "A-bf" fund rating from Moody's, OpenEden's TBILL Fund received an "AA+f" fund credit quality rating and "S1+" fund volatility rating from S&P Global, representing the highest categories in their respective rating systems. This milestone is particularly significant because credit ratings have traditionally served as the trust framework for traditional finance institutions, providing them with the confidence needed to allocate substantial capital to tokenized assets. The S&P rating specifically acknowledges the fund's "very strong capacity to meet financial obligations" and "minimal sensitivity to shifts in interest rates", effectively certifying OpenEden as an institutional-grade product in the often-unregulated crypto space.

Strategic Banking Partnerships and TGE Timing

OpenEden's August 2025 partnership with The Bank of New York Mellon (BNY) fundamentally strengthened its institutional credentials. Under this collaboration, BNY – the world's largest custodian bank with $52 trillion in assets under custody – serves as custodian for the fund's underlying assets, while BNY Mellon Investment Management acts as the sole investment manager . This partnership provides OpenEden with a level of fiduciary oversight rarely seen in blockchain projects. Concurrently, the EDEN Token Generation Event (TGE) positioned the token as a governance and utility asset within a fully operational ecosystem rather than a speculative pre-product launch . With the RWA narrative gaining momentum throughout 2025 and institutional demand for tokenized Treasuries growing exponentially, EDEN's arrival coincides with what many analysts consider the perfect market conditions for sustainable growth.

What Is OpenEden (EDEN)?

OpenEden is best understood as a bridge protocol connecting traditional U.S. Treasury markets with the blockchain ecosystem. At its core, OpenEden operates as a BVI-domiciled investment fund that invests primarily in U.S. Treasury Bills, then tokenizes these assets to make them accessible to institutions, DAOs, and Web3 investors . Unlike many DeFi protocols that generate yields through token inflation or trading fees, OpenEden offers real yield derived from actual Treasury Bill interest, creating a sustainable income source that doesn't depend on new investor inflows.

The protocol functions through a triple-product ecosystem designed to serve different market segments while creating synergistic benefits across the platform:

TBILL Vault: This permissioned platform allows verified, qualified investors to mint TBILL tokens by depositing USDC. Each TBILL token represents a

legal right to the exchange value of net assets held by the fund, with tokens issued in quantities corresponding 1:1 to underlying U.S. Treasuries. The vault operates under strict regulatory compliance, requiring investors to meet "Professional Investor" standards as defined by British Virgin Islands legislation or "Accredited Investor" criteria in the United States.

USDO Stablecoin: Unlike algorithmic or overcollateralized stablecoins, USDO is a

TBILL-backed stablecoin that automatically earns interest for holders. This unique characteristic bridges the gap between traditional finance's reliability and DeFi's composability, creating a stablecoin that maintains its peg through actual asset backing while providing yield – a combination largely absent in the current stablecoin landscape.

EDEN Token: Serving as the

utility and governance token for the entire network, EDEN powers ecosystem incentives, enables community governance, and captures value through fee distribution from TBILL and USDO operations.

What truly distinguishes OpenEden from other RWA projects is its comprehensive regulatory framework. As the first RWA token issuer to receive a bond fund rating from Moody's and now the first to achieve dual ratings from both Moody's and S&P, OpenEden has established a regulatory moat that competitors will find difficult to replicate. This institutional credibility has facilitated remarkable growth, with OpenEden's Total Value Locked (TVL) exceeding $517 million across its products and the TBILL Fund specifically growing over 1,000x since its April 2023 inception to reach $247 million in assets under management by September 2025.

How Does EDEN Work?

The EDEN token functions as the

economic engine of the OpenEden ecosystem, creating a synergistic relationship between protocol utility and value appreciation. Unlike many governance tokens that offer limited functionality beyond voting rights, EDEN is designed to become increasingly valuable as the broader OpenEden ecosystem grows.

Governance Mechanisms

EDEN token holders exercise direct influence over protocol evolution through a decentralized governance system. This includes voting rights on crucial matters such as fee structures (which directly impact token value), treasury management decisions, asset allocation strategies for the underlying TBILL fund, and protocol upgrade proposals. This governance framework transforms EDEN from a passive investment into an active participation tool, aligning the interests of token holders with the long-term health and growth of the OpenEden ecosystem.

Value Accumulation and Fee Distribution

Perhaps the most economically significant aspect of EDEN's design is its revenue-sharing mechanism. A portion of the yields generated from the TBILL Vault and fees from USDO operations are distributed to EDEN token holders, typically through staking rewards or similar value-distribution mechanisms. This creates a direct correlation between ecosystem usage and token valuation – as more institutions and individuals utilize TBILL or USDO, the revenue available to EDEN stakeholders increases correspondingly. This model represents a fundamental shift from traditional finance where such value would accrue to centralized intermediaries rather than protocol participants.

Ecosystem Incentivization

EDEN tokens serve as the primary incentive vehicle for encouraging desired behaviors within the OpenEden network. This includes providing liquidity to associated DeFi protocols, participating in governance, and engaging in community-building activities. Through carefully designed tokenomics, OpenEden aims to create a virtuous cycle where ecosystem growth drives token value, which in turn funds further development and adoption. The integration of EDEN across multiple blockchain networks – including Ethereum, XRP, and Polygon – further enhances its utility by enabling cross-chain functionality and expanding its potential user base beyond single-chain limitations.

Tokenomics of OpenEden (EDEN)

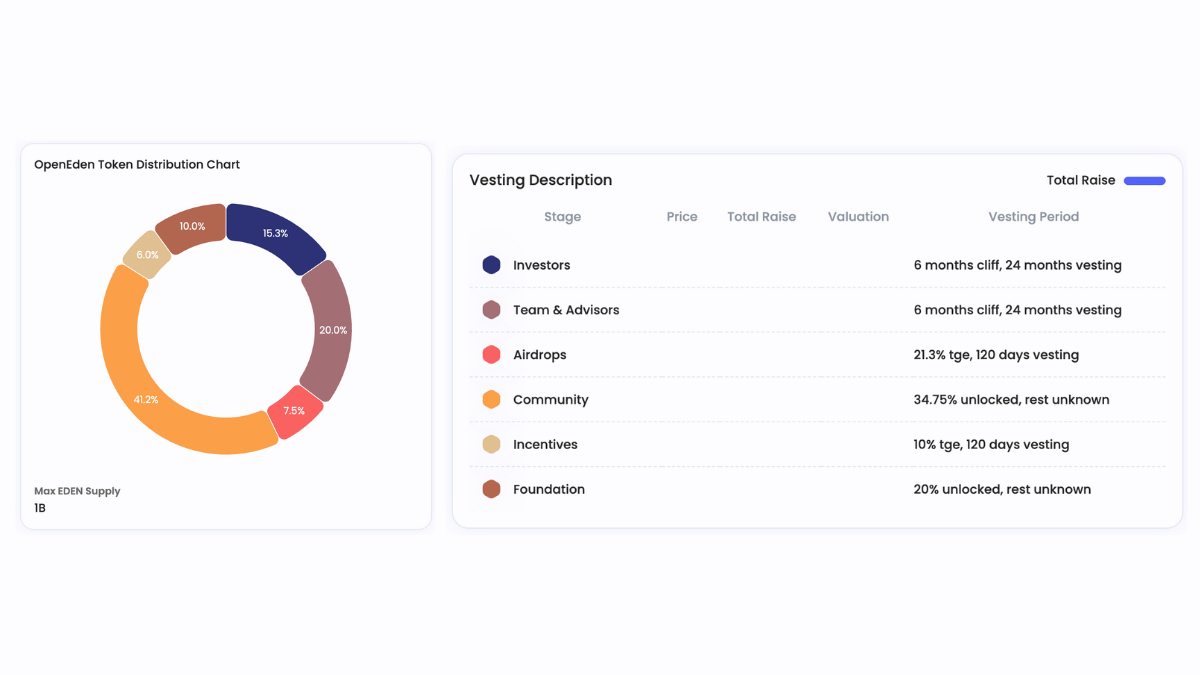

BILLS Airdrop: 7.50% Rewarding early TBILL users to bootstrap liquidity.

Ecosystem & Community: 38.50% Fuels grants, marketing, and partnerships to grow the user base.

Early Adopters: 6.00% Bonus for pioneers who joined before launch.

Foundation: 10.00% Supports ongoing development and operations.

Investors: 18.00% Vested to align backers with long-term success.

Team & Advisors: 20.00% Locked with cliffs to ensure commitment.

The tokenomics model appears designed to create long-term alignment between various stakeholders rather than maximizing short-term speculation. This approach likely includes gradual vesting schedules for team and investor allocations, treasury reserves for ecosystem development, and liquidity provisioning to ensure stable market operations. While specific details regarding total supply, emission schedules, and allocation percentages were not fully public at launch, the overall structure seems positioned to avoid hyperinflationary traps that have plagued many DeFi tokens, instead creating sustainable value accumulation mechanisms tied directly to protocol performance.

Is EDEN Worth Buying?

Evaluating EDEN as a potential investment requires balancing its

substantial strengths against the

inherent risks of emerging asset classes. The RWA sector represents one of blockchain's most promising use cases, but successful navigation requires careful consideration of multiple factors.

Bullish Considerations

Massive Total Addressable Market: The potential market for tokenized RWAs is enormous, with global Treasury markets exceeding $26 trillion and over $170 billion in stablecoins seeking yield opportunities. OpenEden's first-mover advantage in regulated tokenization positions is to capture significant portions of this market as institutional adoption accelerates.

Regulatory Moat: OpenEden's dual ratings from Moody's and S&P, combined with its BNY Mellon partnership, create significant

barriers to entry for potential competitors. Replicating this level of regulatory compliance and institutional trust would require substantial time and resources, giving OpenEden a durable competitive advantage.

Proven Product-Market Fit: With over $517 million in TVL and 1,000x growth since inception, OpenEden has demonstrated clear demand for its products. This traction substantially de-risks the investment proposition compared to pre-product tokens.

Sustainable Yield Model: Unlike algorithmic or incentive-based yields that often prove unsustainable, OpenEden's revenue derives from

actual U.S. Treasury interest, creating a reliable income stream that isn't dependent on token inflation or perpetual new investor inflows.

Risks and Challenges

Regulatory Uncertainty: Despite OpenEden's compliance-focused approach, the broader regulatory landscape for digital assets remains uncertain. Potential regulatory shifts could impact token functionality or limit certain use cases.

Concentration Risks: The protocol's TVL initially showed concentration among relatively few large depositors, creating potential vulnerability to large-scale withdrawals, though this risk typically diminishes as ecosystems mature and diversify.

Traditional Finance Competition: As the RWA space grows, traditional financial giants like BlackRock and J.P. Morgan may develop competitive solutions leveraging their established reputations and client relationships.

Interest Rate Sensitivity: OpenEden's yields correlate with U.S. Treasury rates, making the protocol susceptible to shifts in Federal Reserve policy and broader economic conditions that affect interest rates.

Investment Outlook

Analysts have assigned OpenEden an overall score of 8.27/10 in pre-TGE assessments, with particularly strong marks for product maturity (9/10) and competitive advantage (9.5/10). The investment thesis suggests a

55% probability for a bullish scenario where OpenEden captures significant RWA market share, versus a

25% probability for bearish outcomes dominated by competitive pressures.

For potential investors, these factors suggest that EDEN may represent a

compounding opportunitywithin the RWA ecosystem rather than a short-term trade. The token's long-term value will likely correlate strongly with OpenEden's ability to maintain its regulatory advantages while expanding product offerings and ecosystem integrations.

Conclusion

OpenEden represents a fundamental shift in how traditional financial assets can integrate with blockchain technology. By successfully solving the regulatory-innovation paradox that has long hindered RWA tokenization, OpenEden has positioned itself as a

pioneering infrastructure at the intersection of TradFi and DeFi. The EDEN token serves as both the governance mechanism and value accumulation vehicle for this ecosystem, creating aligned incentives between developers, investors, and users.

As the RWA market continues its exponential growth – potentially exceeding $2 trillion by 2025's end – OpenEden's first-mover advantages, institutional partnerships, and regulatory compliance create a strong foundation for continued expansion. While risks remain, particularly regarding broader regulatory developments and competitive pressures, OpenEden's unique positioning as a

fully regulated, institutionally-grade protocol with deep DeFi integrations offers a compelling value proposition in the rapidly evolving digital asset landscape.

For investors and participants interested in the convergence of traditional finance and blockchain technology, OpenEden and its EDEN token represent one of the most credible opportunities to engage with this transformation while maintaining the safeguards and oversight characteristic of traditional financial markets.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.