This week, BTC fell 4.68% and ETH fell 12.38%, while some DeFi sectors bucked the trend and rose. The crypto market experienced its largest liquidation of the year, with $1.8 billion sold. Overleveraged crypto traders were liquidated out of nearly $2 billion in one of the year’s largest market flush-outs on Monday. ASTER Price Surged By More Than 2,000% in a Week of Its Launch on September 17, Reaching a Market Cap of $3.3 billion. Plasma will launch its mainnet beta and native token, XPL, on September 25, positioning itself as the eighth-largest blockchain by stablecoin liquidity from day one.

Market Overview

BTC: BTC fell 4.68% this week. BTC's current short-term moving average is showing signs of turning upward, putting its upward trend into question. The

MACD indicator's red bar is shortening, and the two lines are forming a death cross at a high level, indicating a significant weakening of bullish momentum. After retreating from a high of 115,656, the price is currently trading below 111,700. Short-term support is expected between 111,500 and 110,000. If the decline fails to halt, the price could retest the previous support level of 110,000. Conversely, if the price stabilizes and rebounds at significant volume, it will need to re-establish itself above 113,400 to regain its strength.

ETH: ETH fell 12.38% this week. ETH's hourly chart shows relative weakness, with prices falling for several consecutive candlesticks and breaking below the lower edge of the consolidation platform. The 10- and 30-day moving averages are in a bearish alignment. The MACD formed a downward death crossover, with increasing green bars, and momentum shifted to the downside, indicating that bears are regaining control. Trading volume also increased, indicating active selling pressure. Current support lies at 4,067. A break below this level will further test the support range of 4,000 to 3,950.

Altcoins: Sentiment started the week at a “neutral” level of 49 on September 19 and has since moved lower, reaching 41 as of September 25. This persistent state of “fear” typically means investors are becoming more

cautious and risk-averse. Notably, this cautious sentiment contrasts with some positive on-chain activity. For example, despite market fear, the Ethereum network continues to demonstrate

strong fundamentals, including high transaction volume and continued institutional accumulation. This disconnect between sentiment and fundamentals may indicate that current market sentiment is driven more by short-term uncertainty. This week, mainstream altcoins saw mixed performance, with only a few tokens recording gains. However, the IP and Perpetuals sectors performed relatively strongly, with the relevant tokens averaging gains of over 5% over the past seven days.

ETF: US Bitcoin spot ETFs saw record inflows this wee. BlackRock's IBIT led the way with $1 billion in net buying, while Fidelity's FBTC and ARK 21Shares' ARKB also saw strong gains, adding $843 million and $182 million, respectively. Despite strong institutional demand, Bitcoin prices fluctuated this week, briefly falling below $113,000 to reach a two-week low around $112,000.

Monday saw the largest liquidation of the year, with over $1.7 billion in leveraged long positions liquidated, driving Bitcoin's price lower.

Ethereum spot ETFs also experienced volatility this week, experiencing significant outflows, raising questions about institutional cryptocurrency strategies and the future of ETH as a "safe" investment. However, Ethereum ETFs still saw significant inflows mid-week, with nearly $2.13 billion flowing into them on September 19th alone, pushing ETH briefly above $4,500: Fidelity's FETH saw $159.38 million in inflows in a single day, while Grayscale's ETH and Bitwise's ETHW also saw net inflows of $22.9 million and $17.47 million, respectively.

Despite the Federal Reserve's 25 basis point rate cut on Wednesday, Ethereum spot ETFs still saw a net outflow of $189 million. The U.S. Securities and Exchange Commission (SEC) approved the first spot ETFs based on Ripple and Dogecoin: the REX-Osprey XRP ETF (XRPR) and the REX-Osprey DOGE ETF (DOJE) launched on September 18th, with trading volumes of $37.7 million and $17 million, respectively. The adoption of universal listing standards is expected to accelerate the approval process for more cryptocurrency ETFs.

Overall, the crypto market is undergoing a transition from retail speculation to institutional investment, with ETFs becoming a major buyer of Bitcoin and Ethereum. Despite the Federal Reserve's interest rate cut, the crypto market exhibited cautious risk-off sentiment this week, with traders remaining on the sidelines amid macroeconomic uncertainty.

Macro Data: Following the Federal Reserve's interest

rate cut, the US stock market experienced an overall correction on September 25th, suggesting that the market may be reassessing the future economic outlook and interest rate path after a period of "buying expectations and selling facts." The Fed's rate cut had a direct impact on the US dollar. According to analysts, the US dollar index fell to 96.218 after the rate cut, before rebounding slightly and consolidating around 97.3. Rate cuts typically reduce a country's currency's appeal to yield-seeking investors, leading to its weakening. As a traditional safe-haven asset, gold faced short-term pressure on September 25th. COMEX December gold futures closed down 1.25% at $3,768.1 per ounce. The pullback in gold prices was primarily driven by a slight rebound in the US dollar and rising US Treasury yields.

As of September 25, 2025, the gold is trading at $3,747.04 US Dollars per ounce, down $7.30. The S&P 500 Index fell 0.28% to close at 6,637.97 points. The Dow Jones Industrial Average dropped 0.37% to 46,121.28 points. The Nasdaq Composite Index slipped 0.33% to settle at 22,497.86 points.

Stablecoins: The overall market capitalization of

stablecoins is currently US$307.8 billion, and stablecoins such as USDC and USDe continue to attract market attention.

Gas Fees: The gas fee of the Ethereum network has increased this week. As of September 25, the average gas fee was 0.511 Gwei.

Weekly Trending Coins

Despite the overall weakness of major altcoins this week, some

DeFi sectors (such as automated strategies, lending protocols, and derivatives trading platforms) have bucked the trend and seen gains. According to Coingecko data, over the past seven days, these protocols have benefited from product updates, market incentives, and a rebound in market sentiment, driving significant price increases.

AVNT Avantis (+76.63%, Market Cap: $528.91 Million)

The

AVNT token is currently trading at $2.04, up 76.63% over the past 7 days. Avantis is the largest RWA perps DEX in DeFi, built on and backed by Base. Avantis allows users to trade crypto and real-world assets (RWAs), including FX, commodities, indices, and equities. Backed by Pantera and Coinbase, Avantis is the largest DEX on Base by volumes, and brings institutional-grade products to DeFi, letting users trade with up to 500x leverage in a transparent, permissionless environment. AVNT’s Binance listing on September 15 triggered a 67.3% single-day rally, with over 500,000 trades in the first hour (AVNT Token Surges 67.3%). The Gate Launchpool event (ended Sep 24) further incentivized buying via a 750,000 AVNT reward pool for stakers. The listings enhance liquidity and visibility, often creating reflexive demand cycles. The Launchpool’s conclusion reduced immediate sell pressure from yield farmers, allowing price consolidation.

AWE AWE (+56.34%, Market Cap: 211.14 Million)

The

AWE token is currently trading at $0.1086, up 56.34% over the past 7 days. AWE Network is opening the portal to Autonomous Worlds where AI Agents collaborate, adapt and evolve. The Autonomous Worlds Engine (AWE) is a modular framework enabling the creation of self-sustaining worlds for scalable agent-agent and human-agent collaboration. AWE’s price broke above the 23.6% Fibonacci retracement ($0.0934) and pivot point ($0.10044), with RSI14 at 88.18 indicating intense buying pressure. The

MACD histogram turned positive (+0.0033), confirming bullish momentum. Traders likely interpreted the breakout as a signal to enter, especially with the 24h volume spiking 230% to $131M. However, the extreme RSI suggests short-term consolidation risk.

TWT Trust Wallet Token (+49.23%, Market Cap: 507.86 Million)

The

TWT token is currently trading at $1.18, up 49.23% over the past 7 days. Trust Wallet Token, or TWT, is a simple BEP-20 utility token that provides a range of benefits and incentives to Trust Wallet users. Trust Wallet itself is a mobile cryptocurrency wallet that supports dozens of popular native assets, in addition to popular tokens on the Ethereum, Binance and

TRON blockchains.

Weekly Market Focus

Ethereum's Fusaka Upgrade Focuses on Data Availability and Security, While PeerDAS Opens a New Chapter in L1 Scaling

Ethereum co-founder Vitalik Buterin recently stated that the Fusaka upgrade aims to address data availability bottlenecks in the current Layer 1 network. Its core mechanism, PeerDAS (Peer-to-Peer Data Availability Sampling), allows nodes to download only a small number of data blocks and, through probabilistic sampling, determine whether more than 50% of the data is available. If a majority of data blocks are available, nodes can use erasure coding to restore the remaining blocks, thereby reducing bandwidth costs while improving data distribution efficiency and laying the foundation for higher-frequency block data processing in the future.

However, Vitalik emphasized that security remains the primary design consideration for Ethereum. In the first version of the Fusaka upgrade, nodes will still need to obtain complete data during initial broadcast and reconstruction. As long as there is a single honest participant, network security is guaranteed. He added that the number of blobs will be gradually increased based on operational results, promoting the coordinated expansion of Ethereum's Layer 1 and Layer 2 capacity. This strategy demonstrates Ethereum's commitment to decentralization and security while pursuing scalability.

Uniswap Labs Unveils ‘Compact v1’ System to Tackle Fragmentation Across Blockchains

Uniswap Labs has released "The Compact v1," an ownerless ERC-6909 contract designed to reduce cross-chain fragmentation.

The system enables secure, reusable resource locks across blockchain networks, creating a shared framework for developers to build customizable and composable systems, said Uniswap in a Tuesday blog post.

According to the post, The Compact is an ownerless ERC‑6909 contract that manages resource locks. At its core, The Compact allows sponsors to deposit tokens into a contract, creating Resource Locks represented by ERC-6909 tokens. These locks remain under the sponsors' control but can back multiple "Compacts," or verifiable commitments that specify the conditions under which others may claim the assets. The architecture includes four key components. Allocators prevent double-spending by authorizing the use of resources. Arbiters verify that commitment conditions have been met. Tribunal serves as a settlement engine for cross-chain swaps, and Emissaries provide fallback verification for smart contract wallets.

The system is set to power cross-chain swaps on UniswapX and is being adopted by LI.FI and Rhinestone. "Cross-chain applications face a fundamental challenge: different execution environments operate asynchronously, making atomic transactions impossible," Uniswap said. "This breaks the basic atomic guarantee that makes single-chain transactions safe and predictable."

Plasma Announces Mainnet Beta with $2B Stablecoin Liquidity on September 25th

Plasma will launch its mainnet beta and native token, XPL, on September 25, positioning itself as the eighth-largest blockchain by stablecoin liquidity from day one.

According to the project, more than $2 billion in stablecoins will be active on the network immediately, distributed across over 100 decentralized finance (DeFi) partners, including Aave, Ethena, Fluid and Euler. The rollout also enables users to withdraw USD₮0 through bridged vault deposits, marking the final stage of Plasma’s launch process.

The project’s early campaigns drew substantial liquidity commitments, including $1 billion in deposits within 30 minutes and a $373 million oversubscribed public sale via the Echo platform. Plasma later partnered with Binance Earn to distribute the first onchain USD₮ yield product, which reached its $1 billion cap and became the program’s largest campaign to date.

XPL, the network’s native token, underpins validator incentives and governance. At launch, 25 million tokens will be distributed to community participants, while 2.5 million will be reserved for the Stablecoin Collective, an educational forum turned adoption hub. US participants in the token sale will face a one-year distribution delay due to securities law considerations.

Key Market Data Highlights

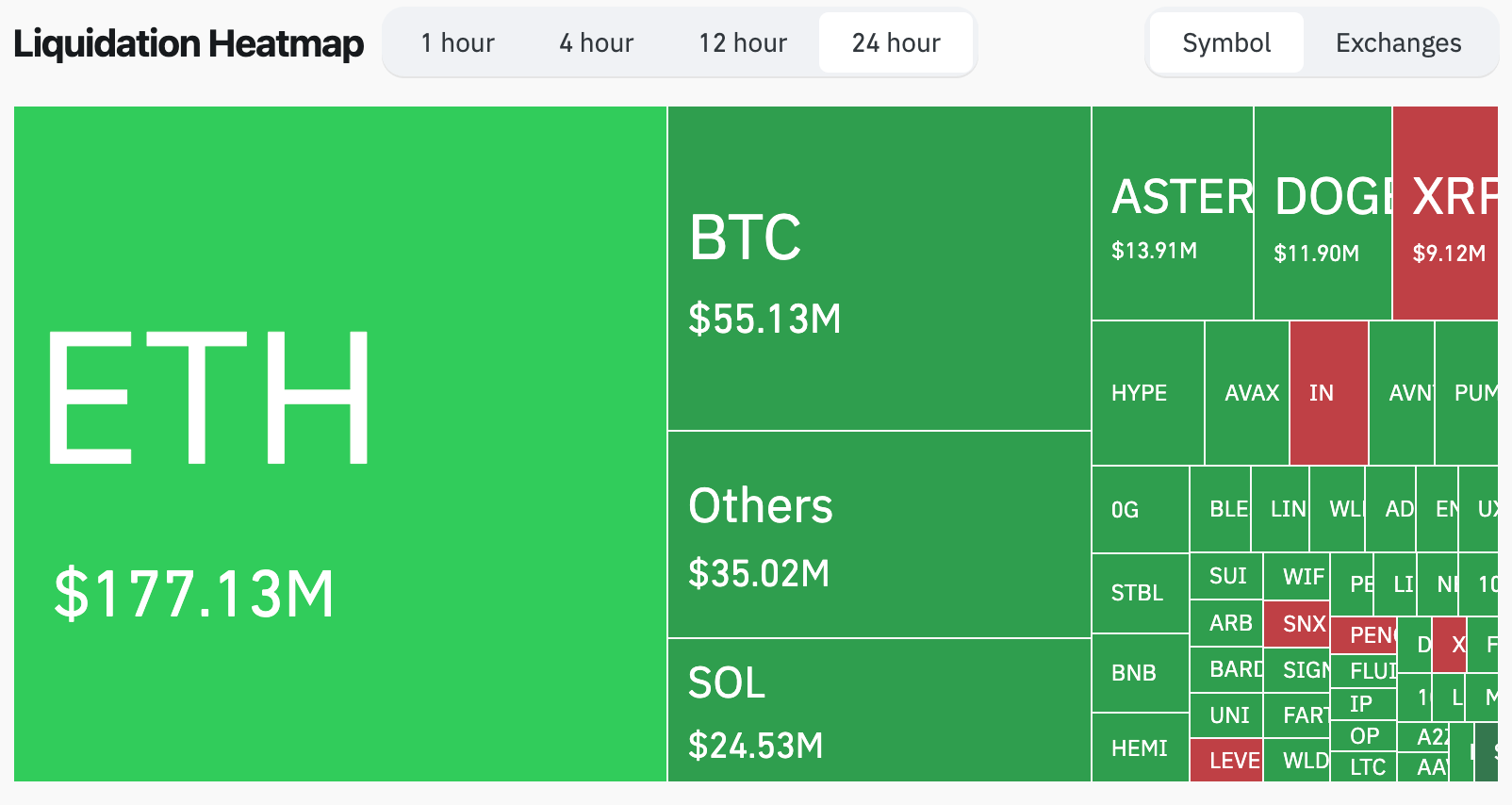

Crypto Markets See Biggest Liquidation of the Year, with $1.8 Billion Sold

Overleveraged crypto traders were liquidated out of nearly $2 billion in one of the year’s largest market flush-outs on Monday, in what some analysts blame on technical factors rather than weakening market fundamentals. More than 370,000 traders have been liquidated to the tune of $1.8 billion over the past 24 hours, according to data from CoinGlass. The majority of those positions had bet on Ether and Bitcoin, while altcoins also got hammered across the board.

The liquidations came as crypto market capitalization tanked by more than $150 billion, falling to a two-week low of $3.95 trillion as BTC fell below $112,000 on Coinbase and ETH fell below $4,150, its most significant pullback since mid-August.

The dust appears to have settled now, with major assets finding temporary support, but there could be more pain to come if previous September corrections are anything to go by.

Long ETH and BTC positions saw the lion’s share of liquidations. Source: CoinGlass

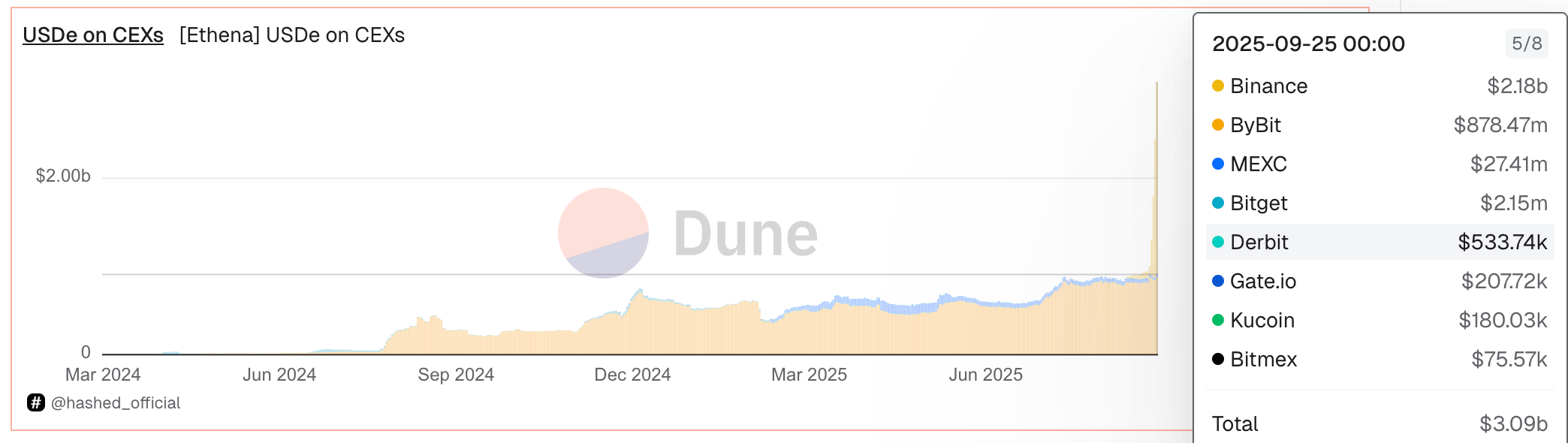

USDe Deposits on Binance Hit $2.18 Billion as Ethena TVL Tops $16 Billion

Ethena Labs’ stablecoins continue to record rapid growth, with USDe balances hitting nearly $2.2 billion on centralized exchange (CEX) Binance, surpassing those on Bybit, which currently stand at around $878 million.

USDe Balances on CEXs. Source: Dune

USDe is currently the third-largest circulating stablecoin, with a market capitalization of over $14 billion, up 145% from $5.7 billion in June. It has grown more than 200% from August 2024 to August 2025 – outpacing Circle’s USDC’s 87% and Tether’s USDT’s 39.5% growth over the same period. Meanwhile, the combined total value locked (TVL) of Ethena’s USDe and USDtb stablecoins has now surpassed $16 billion, with USDe holding just over $14 billion and USDtb at $1.83 billion, according to data from DeFiLlama.

USDtb, Ethena Labs’ synthetic stablecoin, holds over 90% of its reserves in BlackRock’s BUIDL tokenized Treasury fund. It is currently the ninth-largest stablecoin with a market capitalization of $1.8 billion.

Ethena Labs’ native token, ENA, however, has lagged in comparison: it’s currently trading at $0.60, down 14% over the past week and 25% over the past two weeks, according to CoinGecko. Notably, the coin is still up 117% over the year, though it remains well below its all-time high of $1.52.

ASTER Price Surged By More Than 2,000% in a Week of Its Launch on September 17, Reaching a Market Cap of $3.3 billion

CZ Binance has thrown his weight behind a new decentralized exchange, Aster, which is already making waves on the market. Backed by CZ-affiliated YZi Labs (formerly Binance Labs), BNB Chain’s leading DEX PancakeSwap, and other major players, Aster positions itself as a multi-chain perpetual and spot venue designed to compete directly with Hyperliquid. Within six hours of going live, Aster’s token ($ASTER) reached over $300 million market cap, after rising from a launch price of $0.08 to a high of $0.2181, delivering investors over 130% gains on its debut.

On-chain data shows that some whale addresses have been accumulating tokens on a massive scale during price increases. For example, one whale address purchased 6.72 million ASTER tokens at a cost of $2.08. This large purchase not only reduced the circulating supply but also exacerbated FOMO (fear of missing out) in the market, attracting more retail investors to follow suit.

Although ASTER is a decentralized exchange, it enjoys deep support from the Binance ecosystem. Binance's venture capital arm, YZi Labs (formerly Binance Labs), was an early investor in ASTER. Analysts believe this move by Binance is a "defense-plus-offense" strategy: by supporting DEX projects within the ecosystem, Binance counters potential threats to its derivatives market share from external competitors like Hyperliquid.

CoinCatch New Listings

CoinCatch Weekly Event

New Spot Listing: Trade BARD/USDT and AVNT/USDT Spot with Zero Fees!

Event Period: From September 22, 2025, 11:00:00 to September 27, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

October Spotlight: Deposit to Grab 200 XRP + $5,000 Bonus Plus $1,000 Registration Reward & LV Luggage!

📅 Event Time: 2025.9.25 (UTC+8) - 2025.10.8 (UTC+8)

🎊 Welcome October with Double Bonus: Register and Receive 1,000 USDT

-

Event Rules: During the event period, new users who register and complete the following tasks will receive a reward of

up to 1,000 USDT position bonus.

-

All new users who complete registration during the event will receive a

100 USDT position bonus.

-

Deposit 500 USDT net (need to transfer to the futures balance), you can get

200 USDT position bonus.

-

Complete 5,000 USDT futures trading volume to receive an additional

200 USDT position bonus.

-

Double your rewards: Users who complete 50,000 USDT contract trading volume during the event

will have their rewards doubled! You can receive up to

1,000 USDT position bonus as a reward.

-

Total prize pool: 5,000,000 USDT

💸 Double Rewards: Deposit to receive 200 XRP + $5,000 Trading Bonus

| Net Deposit(USDT) |

Futures trading volume(USDT) |

Position Bonus (USDT) |

Floating Reward (PEPE) |

| 500 |

- |

100 |

- |

| 100,000 |

200 |

10,000 - 100,000 |

| 1,000 |

- |

500 |

10,000 - 100,000 |

| 500,000 |

800 |

100,000 - 1,000,000 |

| 5,000 |

1,000,000 |

1,000 |

100,000 - 5,000,000 |

| 8,000,000 |

5,000 |

500,000 - 5,000,000 |

| 10,000 |

20,000,000 |

10,000 |

2,000,000 -10,000,000 |

| 50,000,000 |

200 XRP + 1,000-5,000 Trading Bonus |

🧳 Golden Travel Season: Get yours with the LV Horizon 55 Luggage

-

Event Rules: During the event period, simply complete 50,000 USDT futures trading volume to have a chance to win a golden autumn travel gift from CoinCatch: a LV Horizon 55 carry-on luggage valued at $5,300!

Token Unlocks Next Week

Tokenomist data indicates that from September 26 – October 02, 2025, several major token unlocks are scheduled. Some of them are:

-

SUI will unlock approximately $146 million worth of tokens over the next 7 days, representing 1.2% of the circulating supply.

-

EIGEN will unlock approximately $65.91 million worth of tokens over the next 7 days, representing 10.6% of the circulating supply.

-

PARTI will unlock approximately $26.62 million worth of tokens over the next seven days, representing 76.9% of the circulating supply.

-

JUP will unlock approximately $24.28 million worth of tokens over the next seven days, representing 1.7% of the circulating supply.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.