The cryptocurrency landscape in 2025 is increasingly marked by a paradoxical phenomenon: the proliferation of ghost chains—blockchains that remain technically operational but are functionally dead, devoid of development, user activity, or community engagement. These digital remnants, often born from ambitious promises and substantial funding, now litter the crypto ecosystem, posing significant risks to investors and developers alike. Recent data highlights the scale of this issue; in June 2024, Binance delisted tokens like WAVES, OMG, and XEM due to "low trading volume, weak liquidity, and limited development activity," classic symptoms of projects drifting into ghost status. This article explores the anatomy of ghost chains, their causes, identification strategies, and associated risks, providing a comprehensive guide for navigating this hidden threat in crypto investments.

What Are Ghost Chains in Crypto?

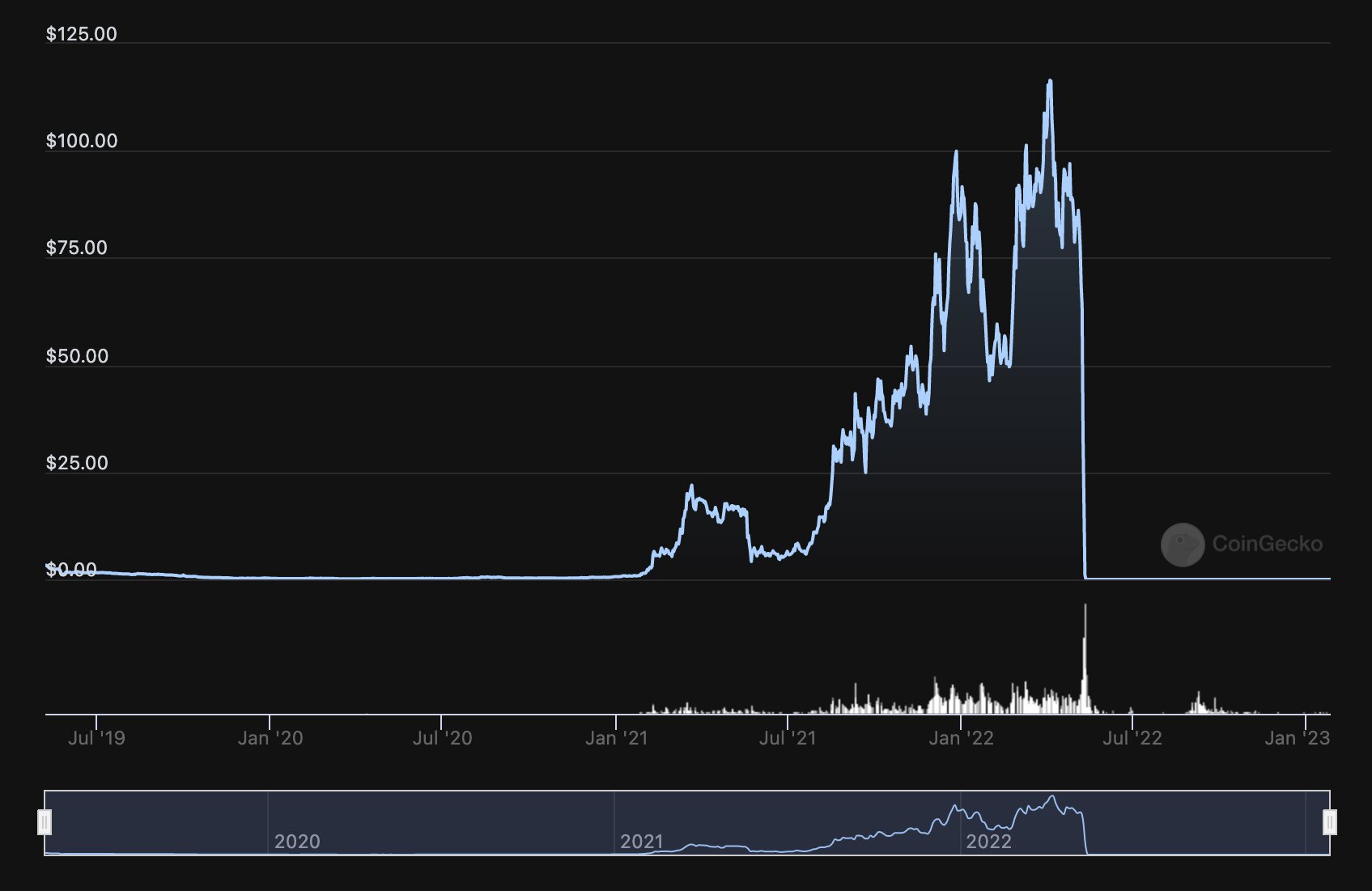

Ghost chains are blockchain networks that, while technically active, exhibit little to no real-world utility, development progress, or community interaction. They are characterized by stagnant code repositories, abandoned social channels, and minimal on-chain transactions. Despite boasting momentum or hype, these projects gradually fade into obscurity, becoming "digital ghost towns". For instance, Feathercoin, launched in 2013 as a faster alternative to Litecoin, eventually succumbed to competitive pressures and developer attrition, evolving into a ghost chain. Even well-funded projects like Meta’s Diem (formerly Libra) and Terra (LUNA) collapsed due to regulatory pressures or algorithmic failures, joining the ranks of ghost chains despite initial corporate backing.

LUNA vaporized over the span of a couple weeks. Source: CryptoVantage

Why Some Crypto Projects Become Ghost Chains

It is normal to see crypto projects that started well and strong, but their momentum stopped. Here are some of the reasons why some of these projects became ghost chains.

Less Substance, More Hype

Many ghost chain projects were launched during

bull cycles. Hence, they ran on the hype of the season, presenting their projects as ideal through flashy marketing strategies and ICOs (Initial Coin Offerings).

However, when the bull run hype ended, it became clear that these projects had little to no real-world utility or use cases. This obvious reality caused many users to abandon the project to invest in others with real substance.

Abandoned Development Teams

Sometimes, ghost crypto projects emerge from good crypto projects whose developers lose interest or funding.

Some of these projects lacked active team leadership, prompting developers to seek new opportunities, which ultimately stalled the projects.

High Competition Levels in The Ecosystem

In the DeFi world, for instance, the kings of the ecosystem are

Ethereum, Solana, and Binance Coin.

These

blockchain networks control and attract more than 80% of DeFi activities. Smaller or weaker blockchains entering the DeFi ecosystem have little to no room for survival in the presence of these big names.

Pressure From Crypto Regulations

Promising crypto projects can slip into obscurity when they face too much pressure from regulatory bodies. A very good example of a project that became a ghost chain because of regulation is $DIEM.

The Project’s Weak Ecosystem

A blockchain project without decentralized applications, an active community, and a reward for loyalty can easily become irrelevant.

In summary, many projects fail and become ghost chains or dead coins because they fail to deliver on the promises that could have kept their users engaged. Only a small fraction of ghost chain projects emerged from bad luck.

Signs of a Ghost Chain Project: Red Flags Every Trader Should Watch

Identifying ghost chains early requires vigilance toward these indicators:

Stagnant Developer Activity: Absence of recent code commits, version releases, or bug fixes on GitHub. Projects with no meaningful updates in six months are high-risk.

Inactive Communities: Social platforms (Discord, Telegram, X) dominated by bot spam or silence, alongside abandoned forums.

Low On-Chain Activity: Few daily transactions, mostly automated or internal. Blockchain explorers reveal "near-empty blocks" and minimal wallet engagement.

Exchange Delistings: Removal from major platforms like Binance due to poor liquidity or volume.

Outdated Resources: Broken websites, stale documentation, and absence from crypto events.

How to Spot Ghost Coins Early

Proactive due diligence mitigates exposure to ghost chains:

Monitor On-Chain Metrics: Tools like Etherscan or Solana Explorers reveal transaction volumes and wallet activity. Chains with consistently low throughput (e.g., <100 daily transactions) warrant skepticism.

Assess Ecosystem Health: Thriving blockchains host active DApps, DeFi protocols, and NFT markets. Barrenecosystems indicate decline.

Evaluate Developer Engagement: Regular GitHub commits and roadmap updates signal vitality. Conversely, abandoned repositories predict failure.

Scrutinize Token Performance: Plummeting prices with negligible volume reflect eroded market confidence—cross-reference liquidity across exchanges.

Community Vibrancy: Active AMAs, community-driven content, and moderator presence imply health. Ghost chains exhibit "digital silence".

Risks Associated with Ghost Chain Investments

Investing in ghost chains invites multifaceted dangers:

Capital Erosion: Tokens often depreciate to near-zero values. For instance, investors in Iron Finance’s TITAN faced near-total losses during its 2021 collapse.

Security Vulnerabilities: Abandoned smart contracts and domains become phishing traps. Malicious actors repurpose old code to deploy malware.

Resource Drain: Wasted development time and infrastructure costs, compounded by eroded trust in newer projects.

Regulatory Entanglements: Projects like Tornado Cash, sanctioned for anonymity, demonstrate how compliance risks can freeze assets.

How to Avoid Ghost Chain Investments

Adopt a disciplined, research-driven approach:

Prioritize Established Ecosystems: Favor projects integrated with robust networks like Ethereum or Solana, which benefit from institutional adoption (e.g., $19.2B ETF inflows) and upgrades.

Verify Utility and Adoption: Invest in chains with real-world use cases—e.g., Ethereum’s role in DeFi and NFTs post-Pectra upgrade.

Diversify with Caution: Allocate funds to assets with proven liquidity and governance. Avoid overexposure to speculative, low-cap tokens.

Leverage Analytics Tools: Use platforms like CoinGlass or AICoin to track developer activity, social sentiment, and on-chain metrics.

Embrace Regulatory Compliance: Prefer projects with transparent KYC/AML frameworks, reducing risks of sudden shutdowns.

Conclusion

Ghost chains represent a critical vulnerability in the crypto market, underscoring the disparity between technological potential and sustainable execution. As the industry matures, investors must recognize that viability hinges not on hype but on continuous development, community engagement, and real-world utility. The delisting of tokens like XEM and OMG by Binance serves as a stark reminder: in an era of institutional dominance (e.g., Ethereum’s $287.6 Million ETF inflows), projects lacking these pillars will inevitably join the blockchain graveyard. By prioritizing due diligence and embracing metrics over marketing, stakeholders can navigate this evolving landscape, ensuring capital flows toward innovations that genuinely advance the ecosystem, not toward digital ghosts haunting the periphery of progress.

Reference:

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.