Introduction

When exploring investments in cryptocurrency, stocks, real estate, or any other asset class, you'll frequently encounter markets categorized in one of two ways: as a bull market or a bear market. At their core, a bull market refers to a market on the rise, while a bear market describes one in decline. Given that markets typically experience daily (or even moment-to-moment) fluctuations, these terms are generally used to characterize:

What is a Bull Market?

A bull market refers to a sustained upward trend in asset prices within financial markets. While commonly associated with stocks, this term applies to all tradable markets—including forex, bonds, commodities, real estate, and cryptocurrencies. It can also describe an individual asset (e.g., Bitcoin or Ethereum) or a sector (e.g., DeFi tokens or AI stocks).

Bullish vs. Bearish Sentiment

Traders often use the terms:

A bullish outlook doesn’t always mean an immediate buying opportunity—it simply reflects confidence in an upward trend. Traders may take long positions (betting on price increases), but bullishness alone doesn’t guarantee short-term gains.

Key Characteristics of Bull Markets

-

Not Always Smooth – Even in a bull market, prices experience dips and sideways movement. The overall trend, however, remains upward.

-

Best Viewed Long-Term – Short-term volatility doesn’t negate the broader trend. For example, Bitcoin has seen major corrections but has historically trended upward over time.

-

Sector-Specific Trends – Some assets or industries enter bull markets while others stagnate or decline.

Practical Implications

-

Investors may hold assets longer during bull runs to maximize gains.

-

Traders might capitalize on short-term pullbacks within the larger uptrend.

-

Recognizing a bull market early can help optimize entry and exit strategies.

By analyzing price action over extended periods, traders and investors can better distinguish between temporary retracements and genuine trend reversals.

Bitcoin price chart. Source: CoinMarketCap

So, in this sense, the definition of a bull market depends on the time frame we are talking about. Generally speaking, when we use the term bull market, we refer to a timeframe of consecutive months or years. As with other market analysis techniques, longer time frame trends are more effective than shorter time frame trends.

Therefore, there can be prolonged declines in bull markets on longer time frames. These counter-trend price movements are notorious for being particularly volatile, but this can vary widely.

Bull Market Examples

Some of the most prominent examples of bull markets are observed in the stock market, characterized by increasing stock prices and rising market indexes such as the Nasdaq 100. The global economy typically experiences fluctuations between bull and bear markets, with these cycles potentially lasting several years or even decades. For example, the period following the 2008 financial crisis up to the COVID-19 pandemic is often referred to as "the longest bull market in history." However, interpretations of this timeline can vary depending on the perspective and criteria used to define the duration of such markets.

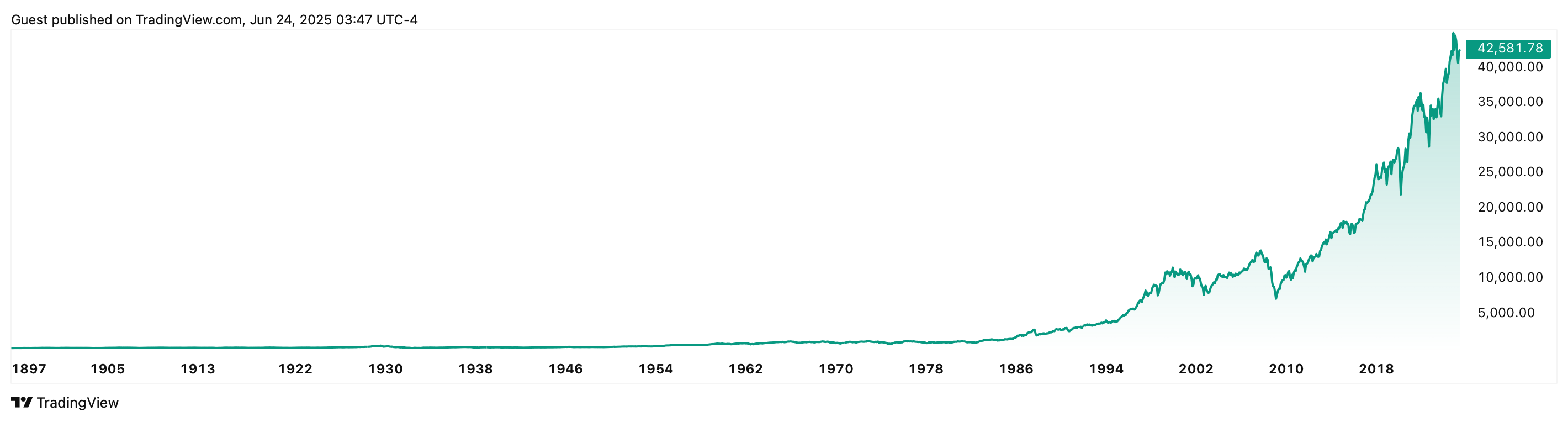

That said, let's take a look at the long-term performance of the Dow Jones Industrial Average (DJIA). We can see that it basically went through a century-long bull market. Of course, there were also recessions that lasted for several years, such as January 1929 or February 2008, but the overall trend was still upward.

DJIA performance. Source: TradingView

Some people believe that Bitcoin will see a similar trend. But we have no way of knowing if and when Bitcoin will experience a multi-year bear market. It's also worth noting that most other cryptocurrencies (i.e. altcoins) may never experience similar price appreciation, so you need to be extra cautious when investing.

What is the Difference Between a Bear Market and a Bull Market?

These are two opposite concepts, so the difference between them is not difficult to guess. In a bull market, prices continue to rise, and in a bear market, prices continue to fall.

This also leads to differences in the best ways to trade. In a bull market, traders and investors usually want to go long. And in a bear market, they either want to go short or hold cash.

In some cases, holding cash (or stablecoins) may also mean shorting the market because we expect prices to fall. The main difference is that holding cash is more about preserving capital, while shorting is about profiting from falling asset prices. But if you sell an asset hoping to buy it back at a lower price, you're essentially in a short position -- even if you don't profit directly from the decline.

Another thing to consider is the handling fee. There may be no fees for holding stablecoins, as there are typically no custody costs. However, many short positions will require funding fees or interest rates to maintain the position. Because of this, quarterly contracts can be ideal for long-term short positions since there are no funding fees associated with them.

How Traders Can Take Advantage of a Bull Market

The fundamental concept of a bull market is straightforward: asset prices are increasing, making long positions and buying during dips generally a prudent approach. Consequently, strategies such as buy-and-hold investing and dollar-cost averaging tend to be effective over the long term during upward trending markets.

There is a well-known adage: “A trend is your friend until it ends.” This highlights the importance of trading in alignment with prevailing market trends. Additionally, no trend persists indefinitely, and strategies that work in one phase of the market cycle may not be effective in another. The only certainty is that markets are dynamic and can change rapidly; as demonstrated by the COVID-19 pandemic, multi-year bull markets can be reversed within a short period.

Typically, investor sentiment in a bull market is optimistic, leading most to maintain bullish positions. Nonetheless, some investors may adopt bearish strategies even during bullish phases. When executed appropriately, these strategies—such as short selling—can generate profits from short-term declines.

Some traders attempt to short recent highs within a bull market; however, such advanced strategies are generally more suitable for experienced professionals. For less experienced investors, following market trends is often a safer approach. Attempting to short a rising market can be risky, akin to confronting a charging bull or a speeding locomotive—an analogy that underscores the importance of caution and proper strategy.

Summary

We have reviewed the definition of a bull market and explored strategies for trading within such an environment. In general, the most effective approach in any market trend is to align trading activities with the prevailing direction of the market. A bull market can present promising trading opportunities, even for novice or first-time investors. Nonetheless, it is essential to implement proper risk management practices and continuously expand your knowledge to minimize potential errors and ensure prudent decision-making.

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.