This week, BTC rose 3.18%, ETH rose 2.81%, and major altcoins continued to rise overall. Gate launched a staking feature, supporting major assets. Pendle's TVL increased by over 10% over the past seven days, reaching a new high. The OpenSea Foundation plans to release the SEA token TGE in early October. The altcoin index rose rapidly, showing clear signs of capital rotation.

Market Overview

BTC: BTC rose 3.18% this week. After an initial period of volatile consolidation, BTC has recently continued its upward trend, reaching a high of $124,400, a new high for this period. Looking at the moving averages, the short-term MA5 and MA10 are steadily rising, and the price remains above the MA30, indicating a continuation of the overall bullish trend. Weekly trading volume remains relatively active, indicating continued strong buying momentum. If the price can stabilize above the $118,000-$120,000 range, it remains poised to challenge previous highs and continue its upward trend. However, caution should be exercised regarding the potential selling pressure from prolonged sideways trading at high levels. If the price falls below the $112,000 support level and is accompanied by declining trading volume, there is a risk of technical correction. Overall, the medium-term trend remains strong, and attention will be focused on whether the price can break through the $125,000 resistance level.

ETH: ETH rose 2.81% this week. After bottoming out at $4,248, ETH rebounded strongly, recently reaching a high of $4,450, approaching a previous key resistance zone. Regarding the moving averages, the 5- and 10-day moving averages have clearly turned upward and are separating from the 30-day moving average, indicating strong short-term bullish momentum. A large weekly bullish candle with strong volume indicates a significant return of funds. If the price can maintain above $4,200, it will have the potential to retest and potentially break through the $5,000 mark. However, it is important to note that after a period of continuous growth, there is a certain risk of overbought conditions in the short term. If the price falls back below $4,000 and trading volume weakens, a pullback to confirm support is possible. Overall, ETH's medium-term structure is strong, and if trading volume continues to increase, it is expected to continue to challenge new highs.

Altcoins: The Crypto Fear & Greed Index (CFI) read

47 (Neutral) on September 11th, up from the previous day. The average for the past seven days is 44, and the average for the past 30 days is 62. This indicates that current market sentiment is relatively balanced, neither dominated by excessive greed nor extreme fear. This neutral sentiment generally indicates a relatively balanced balance of forces between bulls and bears, with investors neither overly optimistic nor overly pessimistic. It may suggest that the market lacks clear direction or is in a consolidation phase. For some contrarian investors, this may be a potential tactical entry point, but it should be considered in conjunction with other market indicators.

ETF: After experiencing a period of net outflows at the end of August, Bitcoin spot ETFs

have recently seen a resurgence of funds . Data shows that Bitcoin spot ETFs saw

net inflows of nearly $1.29 billion last week, marking two consecutive weeks of net inflows. BlackRock's IBIT saw the strongest performance, with net inflows of $405.6 million last week. Meanwhile,

Ethereum spot ETFs face funding challenges . Last week, Ethereum spot ETFs experienced

a historic net inflow of nearly $119 million.

Macro Data: The recent surge in the cryptocurrency market is primarily due to

signs of easing inflationary pressures in the United States . While the search results did not provide specific data for the US Producer Price Index (PPI) released on September 10, 2025, some analysts are pessimistic about the outlook, noting that September has historically been a period of correction for the crypto market. Renowned analyst Benjamin Cowen believes that the strong performance of July and August often reverses in September. Another analyst, Doctor Profit, suggests that the Federal Reserve's September rate cut may introduce uncertainty, suggesting it may not be a "soft landing" rate cut but a truly significant turning point, triggering a simultaneous correction in both the stock and crypto markets.

Stablecoins: The overall market value of stablecoins is currently US$290.1 billion, and stablecoins such as USDC and USDE have attracted strong market attention.

Gas Fees: On September 11th, the gas fee is 1.71 GWEI. We recommend that users can effectively reduce costs by choosing to trade during off-peak hours (such as 2-6 am UTC), using Layer 2 networks, or optimizing operations.

Weekly Trending Coins

This week, the RWA sector led gains, benefiting from regulatory push and innovation in stablecoin supply. While the stablecoin sector saw modest gains, it maintained steady market capitalization, demonstrating its essential role in the market. L1 platforms saw moderate gains, reflecting continued market traction for the underlying blockchain ecosystem. This demonstrates that regulatory guidance and improved infrastructure remain the core drivers of the current sector's gains.

WLD Worldcoin (+99.09%, Market Cap: $1.31 Billion)

The

WLD token is currently trading at $1.75, up 99.09% over the past 7 days. Worldcoin, founded by OpenAI co-founder Sam Altman, aims to promote inclusive finance and a universal digital identity system through iris recognition and a global identity network. Its WLD token serves as both an incentive tool and a medium of exchange within ecosystem applications. WLD saw a significant price surge this week, primarily driven by institutional capital inflows and exchange expansions. Eightco Holdings announced a $250 million strategic allocation for its treasury, adding WLD to its core asset reserves, significantly boosting market confidence. Furthermore, the South Korean exchange Upbit listed WLD, boosting regional liquidity and trading activity. Benefiting from the growing global interest in digital identity and payments, WLD saw a short-term surge of over 100%, driven by both capital inflows and market sentiment.

OPEN OpenLedger (+89.26%, Market Cap: 206.12 Million)

The

OPEN token is currently trading at $1.75, up 89.26% over the past 7 days. OpenLedger is the AI blockchain, unlocking liquidity to monetize data, models, apps and agents. It enables the training, deployment and on-chain tracking of specialized AI models and data, solving critical challenges around transparency, attribution and verifiability in AI. OPEN secured listings on Upbit and Bithumb—South Korea’s largest exchanges—on 10 September, following its Binance debut on 8 September. The token’s price surged 95% weekly post-listings, though it corrected 26% in 24 hours amid broader market volatility. Binance also distributed OPEN via its 36th HODLer Airdrop to BNB stakers. Listings on tier-1 exchanges enhance OPEN’s liquidity and visibility, though short-term volatility reflects speculative trading.

WLFI World Liberty Financial (+11.33%, Market Cap: 4.94 Billion)

The

WLFI token is currently trading at $0.2003, up 11.33% over the past 7 days.

WLFI stands for World Liberty Financial, a decentralized finance (DeFi) project launched in 2024 with direct ties to Donald Trump and his family. The project includes a USD-pegged stablecoin ($USD1) and a governance token ($WLFI). World Liberty Financial combines political branding, decentralized governance, and a USD-centric stablecoin to position itself as a U.S.-focused DeFi alternative. Its success hinges on balancing institutional adoption, regulatory navigation, and maintaining decentralized ideals. World Liberty Financial (WLFI) fell 1.5%over the last 24 hours, contrasting with a 10.6% weekly gain. The decline aligns with governance controversies and market skepticism despite broader crypto stability.

Weekly Market Focus

U.S. Marks Down Payroll Gains By 911K in Largest Benchmark Revision Ever

The U.S. preliminary benchmark payroll revision revealed a downward adjustment of 911,000 jobs for the one-year period ending March 2025, the largest on record.

The news suggests the labor market was far weaker than previously suggested by the government's monthly Nonfarm Payrolls reports. Those very closely watched reports are responsible for tens of billions of capital allocation decisions, not to mention playing a major factor in Federal Reserve monetary policy.

Had those numbers been previously available, it's highly likely that the Fed would have been trimming rates all through 2025. At the moment, the U.S. central bank is overwhelmingly expected to cut rates for the first time this year at its meeting next week. This news could put a 50 basis point rate cut on the table as opposed to forecast 25.

OpenSea Foundation Plans to Announce the SEA Token TGE in Early October

OpenSea announced the release of a new mobile app with native integration of AI, called “OpenSea Intelligence,” enabling real-time analysis of cross-chain investment portfolios and one-stop trading. The Flagship Collection Plan has been launched, with OpenSea committing over $1 million to acquire both historical and emerging NFTs, with the first piece being CryptoPunk #5273.

The pre-TGE reward program has entered its final stage—starting September 15th, 50% of platform fees will be used to reward users, with the treasury injecting $1 million in OP and ARB tokens. The OpenSea Foundation will announce TGE details in early October, emphasizing long-term value and sustainable design.

Ethereum L2 Linea Opens Claims for 9.4B Token Airdrop

Linea, the zkEVM Layer 2 built by Consensys, has launched its long-awaited token generation event, opening a 90-day claim window for over 9.36B LINEA tokens. Eligibility for this airdrop is primarily based on actual user usage of LXP and LXP-L tokens. The redemption window runs from September 10, 2025, to December 9th, a total of 90 days. All airdropped tokens will be fully unlocked upon redemption, with no additional vesting period required. Regarding token distribution, 85% will enter the ecosystem, with 10% going to early users and builders, and the remaining 75% used as an ecosystem fund.

Linea's TGE, combining a no-lockup airdrop with a significant allocation to an ecosystem fund, demonstrates the project's focus on long-term ecosystem development over short-term price performance. While some selling pressure may occur as the airdropped tokens begin circulating, the ecosystem fund will, in the long term, become a more attractive asset for developers and partnerships.

Key Market Data Highlights

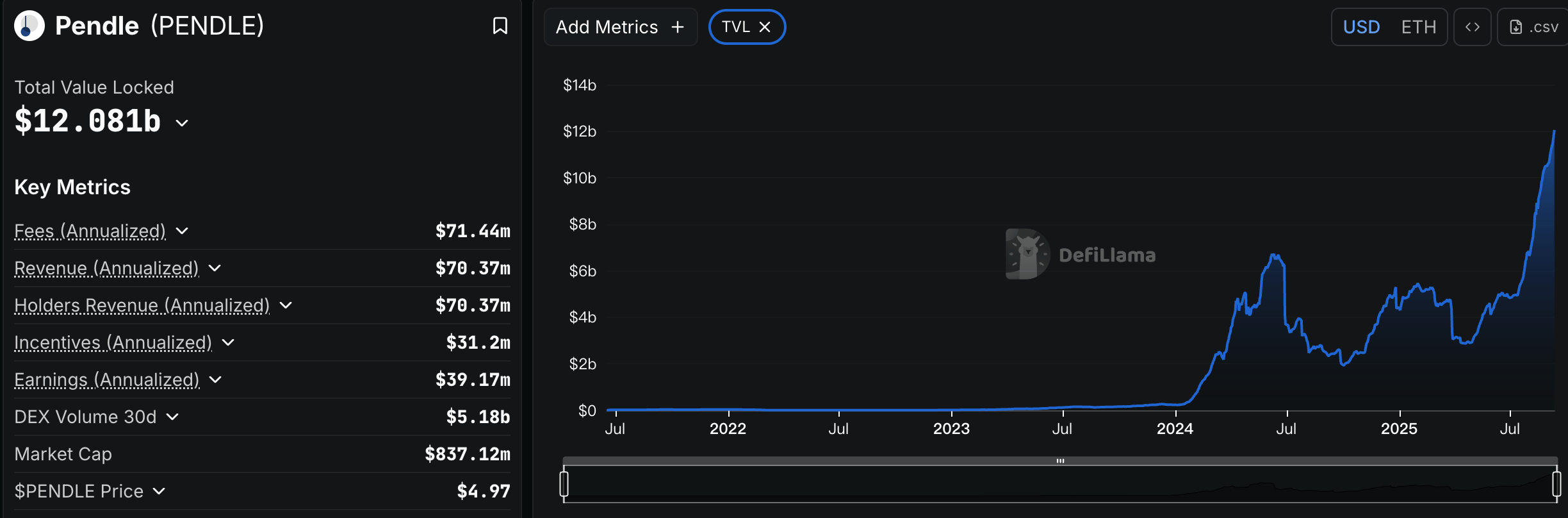

Pendle's TVL Has Increased By More Than 10% In the Past 7 Days, Reaching a New High

Pendle's total value locked (TVL) hit a new record this month, exceeding $12 billion, an increase of over 180% since the beginning of the year. Pendle is a decentralized yield trading protocol that splits yield-bearing assets (such as staked ETH) into principal (PT) and future yield (YT), allowing users to freely trade or lock in fixed returns. It also provides liquidity incentives and governance through an AMM and the PENDLE governance token. Simply put, it brings fixed-income/interest rate derivatives from traditional finance to DeFi, allowing users to more flexibly manage and utilize the returns of their crypto assets.

Pendle TVL. Source: DefiLlama

The protocol officially surpassed a record high of $11 billion in early September and continued to climb above $12 billion a few days later, sparking significant market interest in Pendle. A secondary driving force was the Ethena-Pendle-Aave circular yield engine: users can split the USDe stablecoin into PT and YT on Pendle, then use PT as collateral to borrow funds through Aave, creating a capital cycle that continuously re-injects funds into the Pendle ecosystem. This mechanism significantly improves capital efficiency and has become a primary driver of TVL growth. Furthermore, Pendle's expansion into a multi-chain ecosystem and potential integrations with platforms like Hyperliquid have broadened its application prospects, attracting more capital and users. Meanwhile, market analysts generally believe that Pendle's token valuation is undervalued relative to its strong TVL and fee revenue. This combination of undervaluation and growth has bolstered investor confidence. In summary, the convergence of multiple technical and market factors contributed to Pendle's rapid rise in TVL this week.

BitMine Adds $201 Million Worth of ETH to Treasury via BitGo

BitMine Immersion Technologies added 46,255 ETH, worth $201 million, to its corporate Ethereum treasury on Wednesday, according to blockchain analytics platform Onchain Lens.

Citing data from Arkham, Onchain Lens reported Wednesday that the company received ether from a BitGo wallet across three addresses. While one wallet was identified as BitMine's, the other two remain unmarked on Arkham. Onchain Lens told The Block in response to an earlier query that it identified the link between the two addresses and BitMine through forensic analysis and internal algorithmic framework. BitMine has not confirmed the reported acquisition. The Block has reached out to BitMine for confirmation.

With this latest acquisition, BitMine holds a total of 2,126,018 ETH that is worth nearly $9.3 billion, according to Onchain Lens. The company aims to accumulate 5% of Ethereum's total supply.

Spot Gold at $3,650/oz as U.S. PPI Cools More Than Expected in August

The gold market is experiencing some volatility after the latest data shows U.S. producers saw easing price pressures last month.

The headline Producer Price Index (PPI) fell -0.1% in August, following July’s unrevised 0.9% rise, the U.S. Labor Department announced on Wednesday. The latest inflation data was cooler than expected, as economists looked for a 0.3% increase.

In the last 12 months, headline wholesale inflation increased 2.6%, the report said, well below the consensus and July’s unrevised 3.3% reading.

Core PPI, which strips out volatile food and energy costs, fell -0.1% in August, below economists’ 0.3% consensus forecast and following July’s unrevised 0.9% reading. Annual core PPI was 2.8%, against the consensus expectation for a 3.5% reading and July’s downwardly revised 3.4% print.

Gold prices spiked higher immediately after the 8:30 am EDT data release, but pulled back just as quickly. Spot gold last traded at $3,650.78 for a gain of 0.65% on the day.

CoinCatch New Listings

Futures:

CoinCatch Weekly Event

5 Million THUMB Listing Celebration: 3,000,000 $THUMB +$2,000,000 Bonus Up for Grabs!

Event 1. Social Media Airdrop

-

-

Like, retweet, @ 3 friends

-

Submit UID in the comment

-

Rewards: 5,000 $THUMB per user

Event 2. Trade to Share 2,000,000 $THUMB & Up to 10,000 USDT

The top 100 users ranked by net buying volume (Buy-Sell) of

$THUMB during the event period will share 2,000,000

$THUMB with position bonus according to the proportion of their net buying volume.

| Ranking (Buying Volume) |

Rewards |

Extra Bonus |

| 🥇 Top 1 |

300,000 $THUMB |

10,000 USDT Position Bonus |

| 🥈 Top 2 |

150,000 $THUMB |

5,000 USDT Position Bonus |

| 🥉 Top 3 |

100,000 $THUMB |

1,000 USDT Position Bonus |

| Top 4–10 |

50,000 $THUMB each |

800 USDT Position Bonus |

| Top 11–30 |

20,000 $THUMB each |

500 USDT Position Bonus |

| Top 31–100 |

10,000 $THUMB each |

200 USDT Position Bonus |

Note: The top 3 users are required to complete a minimum buy volume of 1,000 USDT of THUMB and a minimum net deposit of 100 USDT.

Event 3. Sunshine Airdrop for Participants

Users who do not rank in the Top 100 in event 2 and achieve a spot trading volume of ≥ 20 USDT equivalent of $THUMB will receive a random position bonus reward.

New Spot Listing: Trade OPENNEW/USDT Spot with Zero Fees!

Event Period: From September 11, 2025, 6:00:00 to September 17, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Airdrop Alert: Claim Hot Coins & Share in $10,000 + $1,000 Airbnb Gift Cards

📅 Event Period: Sept 11, 2025 (UTC+8) - Sept 17, 2025 (UTC+8)

🎊 New User Benefits: Claim Hot Coin Airdrops!

💸 All Users: Trade to Share $10,000

-

Rules: Users who achieve a minimum trading volume of 1,000 USDT during the event period can participate in prize sharing. Sharing rules are as follows:

-

Top 10 users: Share

3,000 USDT based on trading volume

-

11th ~ 30th users: Share

2,000 USDT based on trading volume

-

Other eligible users: Share

5,000 USDT based on trading volume

-

Total Prize Pool: 10,000 USDT

🎁 Grand Prize: Airbnb Gift Cards

Rules: Among users who achieve a contract trading volume of

1,000,000 USDT during the event period, 3 lucky users will be randomly selected to receive a

$1,000 Airbnb Gift Card.

Token Unlocks Next Week

Tokenomist data indicates that from September 5–11, 2025, several major token unlocks are scheduled. Some of them are:

Starknet (STRK): Date: September 15. Tokens Unlocked: 127.6M STRK

Sei (SEI): Date: September 17. Tokens Unlocked: 95.2M SEI

ZKsync (ZK): Date: September 17. Tokens Unlocked: 173.08M ZK

Optism (OP): Date: September 21. Tokens Unlocked: 18M OP

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.