What is BBO?

BBO (Best Bid Offer), also known as the best buy price, is a type of limit order. It allows traders to quickly set a limit order price aligned with the current top 1 or top 5 bid/ask prices. This increases the chances of securing better counterparty prices and faster order execution. When placing a BBO order, the price is automatically adjusted to match the user-specified position on the order book.

How Does a BBO Order Work?

When you place a BBO order, the price is determined based on the BBO option you select:

Counterparty Price 1:

For buy orders, this is the lowest ask price on the current order book.

For sell orders, this is the highest bid price on the current order book.

Same-Side Price 1:

For buy orders, this is the highest bid price on the current order book.

For sell orders, this is the lowest ask price on the current order book.

Counterparty Price 5:

For buy orders, this is the 5th lowest ask price on the current order book.

For sell orders, this is the 5th highest bid price on the current order book.

Same-Side Price 5:

For buy orders, this is the 5th highest bid price on the current order book.

For sell orders, this is the 5th lowest ask price on the current order book.

Difference Between BBO Orders and Regular Limit Orders

A BBO order automatically adjusts its limit price to match the specified position on the order book at the time of placement, rather than using a fixed price input.

BBO Orders

Dynamic Pricing:

The limit price of a BBO order dynamically adjusts to the user's specified position, such as the top 1 or top 5 bid/ask price, at the time of order placement.

Partial Execution and Remaining Quantity:

If a BBO order is partially executed due to limited availability in the order book, the unfilled portion will remain at the initial order price in the order book. This is different from market orders, which continue executing at the next available price until fully filled.

Non-BBO Limit Orders

No Automatic Price Adjustment:

Unlike BBO orders, non-BBO limit orders do not automatically adjust their price to align with the top bid or ask prices on the order book at the time of placement.

Market Orders

Instant Execution at Current Price:

Market orders are executed immediately at the current market price, without control over the execution price.

Potential Slippage:

Market orders may experience slippage, where execution occurs within a reasonable price range until the entire order is filled.

How to Use BBO?

BBO orders can be applied to spot trading, futures trading, and take-profit/stop-loss orders.

Steps to Place a BBO Order:

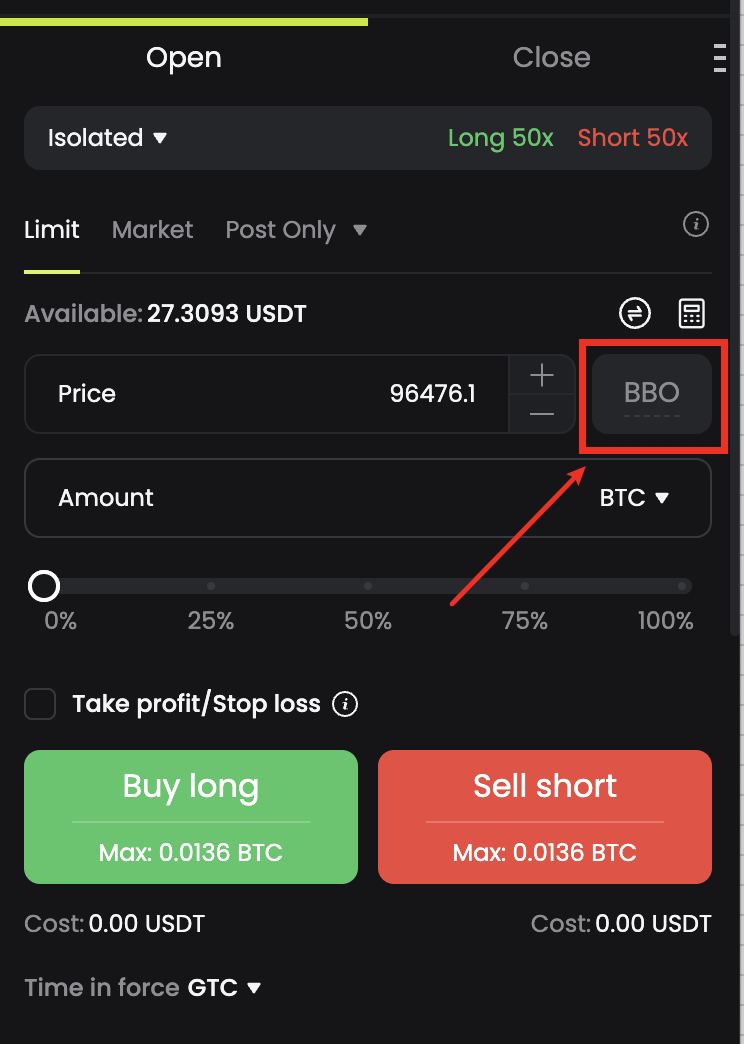

Switching to Limit Orders

-

Switch Order Type: In the limit order settings, switch between standard limit orders and BBO limit orders, selecting the latter.

-

Choose Order Book Position: Specify the desired position on the order book, such as Counterparty Price 1, Counterparty Price 5, Same-Side Price 1, or Same-Side Price 5.

-

Place the Order: Click the Buy or Sell button. The system will automatically place the order based on your selected parameters.

Important Notes:

BBO orders cannot be used in the following scenarios:

Post-Only Orders

Immediate-Or-Cancel (IOC) Orders

Fill-Or-Kill (FOK) Orders

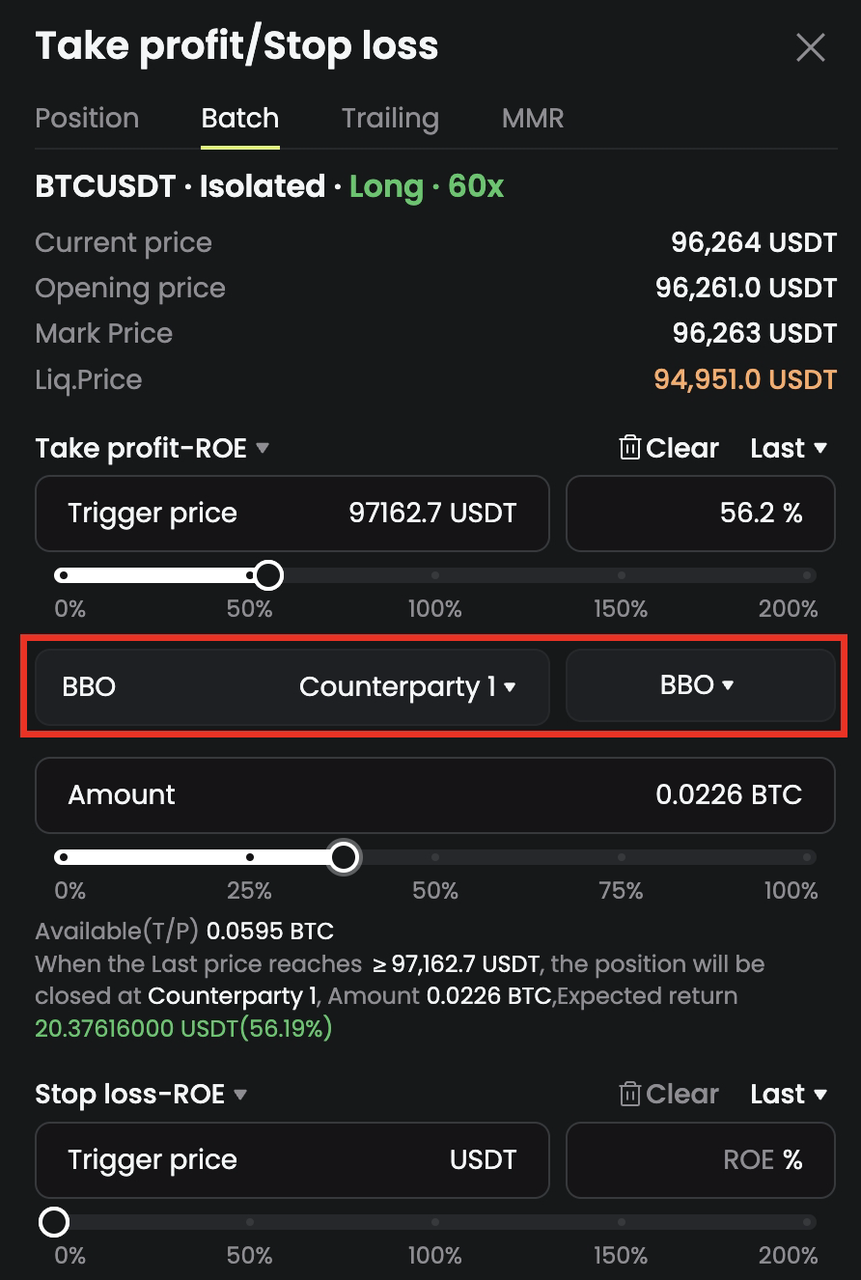

Using BBO Orders for Take-Profit and Stop-Loss

When using take-profit/stop-loss in futures trading, you can select the BBO type when setting the trigger price.

Once the trigger price is reached, the system will place an order at the price corresponding to your specified position on the order book at that moment.

This ensures precise execution based on dynamic market conditions.

Using BBO for Take-Profit and Stop-Loss in Spot Trading

When setting a limit take-profit/stop-loss order in spot trading, you can switch to the BBO type.

Once the trigger price is reched, the system will execute the order at the price corresponding to your specified position on the order book at that moment.

This enables dynamic and precise execution based on real-time market conditions.

Encuéntranos en

Equipo CoinCatch