Understanding and Trading USDT-Margined Futures

CoinCatch

2025-06-24 09:35

What is USDT-M Futures Trading?

-

Simplified Accounting: All profit, loss, and margin calculations are done in USDT, a stablecoin pegged to the US Dollar.

-

Perpetual Contracts: Trade perpetual contracts with no expiry date.

-

Leverage Options: Offers flexible leverage, enabling traders to amplify positions.

-

Hedging Capabilities: Hedge positions without needing to convert to other cryptocurrencies.

How to Start USDT-M futures Trading on CoinCatch Website?

1. Click on Derivatives in the top menu.

2. Select USDT-M Futures from the dropdown.

In the USDT-M Futures section, search for your desired trading pair (e.g., BTCUSDT, ETHUSDT).

1. Select the Margin Mode:

-

Cross Margin: Uses your entire account balance as collateral for all positions.

-

Isolated Margin: Limits collateral to the specific position you open.

2. Click Leverage and adjust the Multiplier for your trade.

3. Choose Order Type

4. Enter the order details and select Open long or Open short based on your market expectations.

5. Confirm the order.

1. Navigate to the Positions tab in the trading interface to view open trades.

2. Use the Close button to exit your trade.

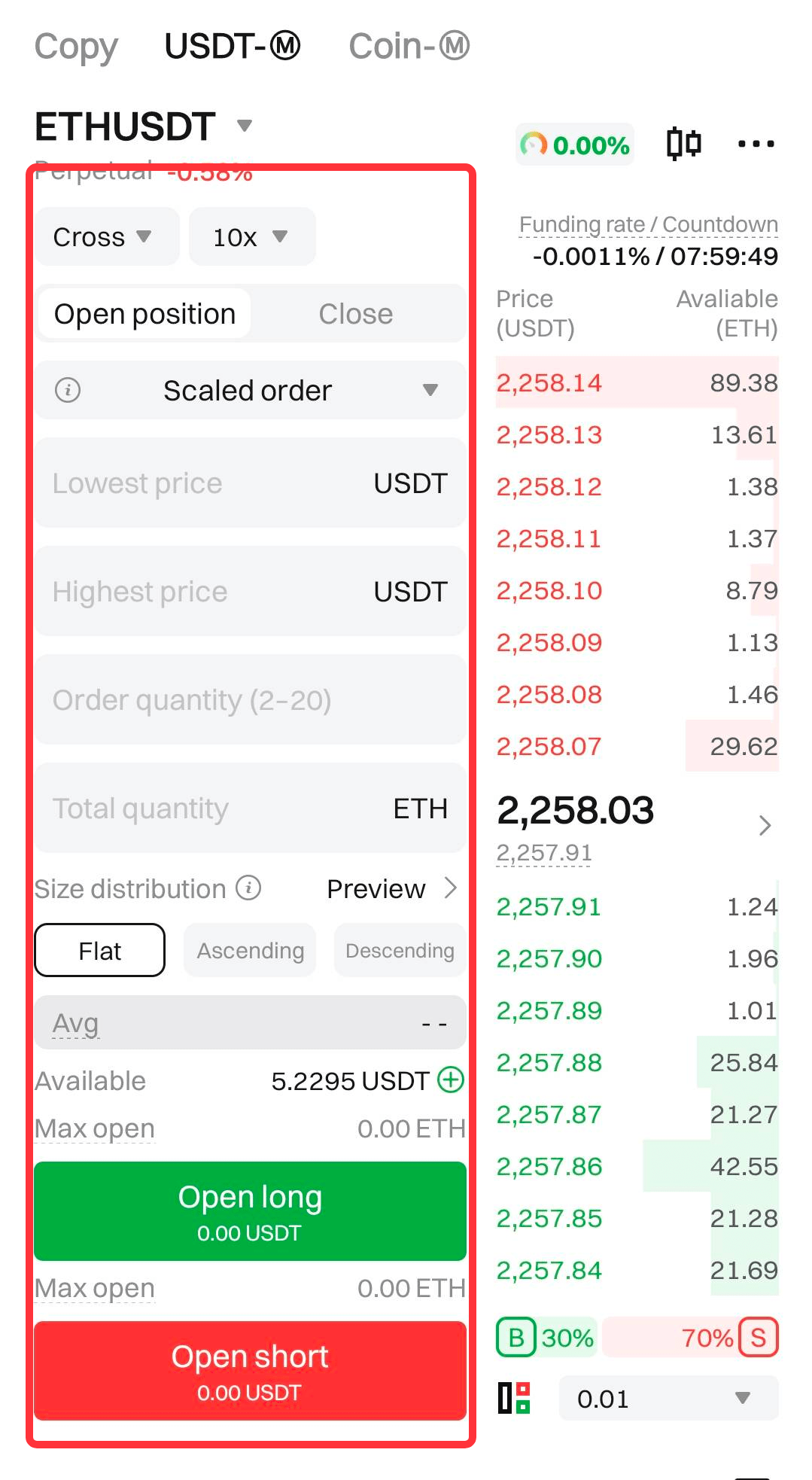

How to Start USDT-M Futures Trading on CoinCatch Mobile App?

1. Tap Futures on the bottom menu bar.

2. Select USDT-M to access the trading interface.

In the USDT-M Futures trading interface, search for and select your preferred trading pair (e.g., BTCUSDT, ETHUSDT).

1. Select the Margin Mode:

-

Cross Margin: Uses your entire account balance as collateral for all positions.

-

Isolated Margin: Limits collateral to the specific position you open.

2. Tap on Leverage to adjust the Multiplier for your trade.

3. Choose the Order Type

4. Enter the order details and tap Open long (if you expect the price to rise) or Open short (if you expect the price to fall).

5. Confirm the order.

1. Go to the Positions tab to track open trades.

2. Use Close Position to exit a trade when desired.

-

Understand leverage risks: Higher leverage magnifies both profits and losses. Trade responsibly.

-

Use TP/SL features: Set Take-Profit and Stop-Loss levels when placing your orders to automate exits based on predefined profit and loss thresholds.

-

Monitor liquidation risks: Maintain a healthy margin ratio to avoid forced liquidation.

-

Stay informed: Regularly check market trends and price movements to adjust your strategy.

-

What is the minimum amount required for USDT-M futures trading? The minimum amount depends on the trading pair and margin requirements. Check the trading interface for specific details.

-

How does margin work in USDT-M futures? Margin is collateral deposited in USDT to maintain your positions. You can choose between cross margin and isolated margin modes.

-

What happens if my margin ratio falls too low? If your margin ratio drops below the maintenance level, your position will be liquidated.

-

Can I trade USDT-M futures on both the app and website? Yes, USDT-M futures trading is supported on both the CoinCatch app and website, with similar features.

-

Can I change leverage after opening a position? Yes, you can adjust leverage for open positions, but the changes affect risk and margin requirements.