As of December 19, 2025, the cryptocurrency market exhibited signs of tentative stabilization following a period of volatility characterized by significant declines and partial recoveries. The total market capitalization remained around $2.90 trillion, representing a 0.81% decrease over the past 24 hours amid decreased trading activity and ongoing caution among investors. Bitcoin traded near $86,400, reflecting a 0.25% decline, while Ethereum decreased to approximately $2,862, a 1.14% decrease for the session. These developments occurred in the context of macroeconomic considerations, including the Bank of Japan's expected rate hike decision on this date, which may impact global liquidity and market risk sentiment. Meanwhile, president Donald Trump finally landed permanent appointments to helm two of the most important U.S. Crypto regulators: Mike Selig. Bitcoin’s "realized capitalization" is at an all-time high of $1.125 trillion, suggesting that BTC remains in a bull market despite the near-40% plunge in prices over the past 10 weeks. Cryptocurrency theft totaled over $3.41 billion from January through early December, blockchain intelligence firm Chainalysis said.

Crypto Market Overview

BTC (-0.25% | Current Price: $86,391.14)

Bitcoin's price action on December 19 reflected a market grappling with downside pressure but finding tentative footing at critical support levels. The asset opened the day near $85,669 and traded as low as $84,669 amid intraday volatility, marking a 1.36% decline that extended the week's corrective phase. This movement followed a broader retreat from $90,000 levels earlier in the week, driven by profit-taking and reduced liquidity as holiday trading thinned participation.

Technically, Bitcoin tested the $85,000 zone, which aligns with the 50-day exponential moving average and a key Fibonacci retracement level from the October rally. Oversold conditions on the relative strength index, dipping below 30 on shorter timeframes, suggested potential exhaustion among sellers, setting the stage for short-term relief if buying pressure materialized. However, the daily MACD remained bearish, with negative histogram expansion indicating sustained momentum to the downside unless a catalyst reversed the trend. Resistance clustered around $88,000 to $90,000, where prior breakdowns occurred, while a clean break below $84,000 could expose deeper support at $80,000 to $82,000.

For the immediate outlook, Bitcoin must defend $84,000 to avoid deeper probes, with a potential bounce toward $88,000 if the BoJ decision passes without major surprises. Failure here could accelerate losses, but historical patterns in December suggest average gains of 9.7%, offering hope for a year-end rally if sentiment improves.

On December 18th, Bitcoin exchange-traded funds (ETFs) registered a total net outflow of $194.1 million, with Fidelity seeing an outflow of 170.3 million.

ETH (-1.14% | Current Price: $2,862.58)

Ethereum faced amplified pressure on December 19, trading around $2,862 after a 1.14% decline that extended its underperformance relative to Bitcoin. The asset breached $2,900 support intraday, reflecting broader weakness in layer-1 networks amid low on-chain activity and capital rotation toward majors.

Price dynamics showed Ethereum consolidating in a descending pattern, with daily lows approaching $2,800, which is a level that coincides with prior range bottoms and the 200-day moving average. The ETH/BTC ratio extended its downtrend to multi-month lows, underscoring relative lag as investors favored Bitcoin's perceived safety. Momentum indicators like the MACD confirmed bearish bias, though oversold RSI readings hinted at potential short-covering if catalysts emerged.

Outlook favors defense of $2,800 for any rebound toward $3,000, but persistent dormancy suggests underperformance until ecosystem catalysts materialize in 2026.

On December 18th, ETH ETFs experienced a total net inflow of $5.6 million.

Altcoins

Altcoins exhibited mixed but predominantly weak performance on December 19, with the sector shedding 2-4% on aggregate as capital concentrated in Bitcoin. Major tokens like Solana traded near $124 after a decline, while

XRP held around $1.86, down 2.67%.

BNB and

TRON showed relative resilience, but smaller caps faced sharper losses amid reduced liquidity. Overall, altcoins' lag reinforced Bitcoin's dominance, with recovery contingent on major stabilization. The Crypto Fear & Greed Index stood at 21 on December 19, firmly in extreme fear territory and reflecting heightened panic amid recent drawdowns. This reading, down from 22 the previous day, captured over-selling and emotional lows, historically preceding rebounds as capitulation exhausts sellers.

Macro Data

Macroeconomic factors played a significant role, with the Bank of Japan’s interest rate decision on December 19 potentially supporting the appreciation of the yen and exerting downward pressure on cryptocurrencies. Recent indications of easing U.S. inflation provided some reassurance; however, strong employment figures tempered expectations of further easing, thereby increasing market correlations.

On December 18th, the S&P 500 increased 0.79%, standing at 6,774.76 points; the Dow Jones Industrial Average up 0.14% to 47,951.85 points, and the Nasdaq Composite gained 1.38% to 23,006.36 points. The price of gold is $4,319.65, down 0.51%, at 4:00 UTC, December 19th.

Trending Tokens

ACT ACT I: The AI Prophecy (+13.56%, Circulating Market Cap: $27.45 Million)

ACT is trading at $0.02896, up approximately 13.56% in the past 24 hours. Act I: The AI Prophecy Project (ACT) is a decentralized, open-source protocol designed to redefine AI interaction. This initiative fosters a diverse “ecosystem” where various AI systems, driven by the ACT token, can collaborate with each other and engage with human users, sparking innovative and unconventional AI interactions. Unlike mainstream chatbot approaches that prioritize "helpfulness, harmlessness, and honesty", as championed by companies like Microsoft, OpenAI, and Anthropic, Act I encourages a more open-ended, creative approach to AI development. On-chain trackers identified sustained buying by large holders (“whales”) on December 18–19, 2025, with two wallets aggressively accumulating ACT tokens. With 95% of its 948M supply already circulating, concentrated buying can sharply impact price. Whale activity often signals confidence in short-term upside or strategic positioning. The 24h trading volume surged 41.4% to $87.6M, confirming liquidity influx. However, 95% circulating supply raises redistribution risks if whales exit abruptly.

HMSTR Hamster Combat (+12.99%, Circulating Market Cap: $15.27 Million)

HMSTR is trading at $0.0002372, up approximately 12.99% in the past 24 hours. Hamster Kombat is a cryptocurrency-based clicker game that has garnered attention for its engaging gameplay and integration with the digital currency ecosystem. This game combines elements of strategy, management, and earning through play, appealing to a wide range of players interested in the crypto space. HMSTR broke above its 7-day SMA ($0.000210) and 30-day SMA ($0.000232) with a 63.75 RSI (7-day) – nearing overbought territory but signaling momentum. The MACD histogram turned positive (+0.00000414) for the first time in two weeks. Traders likely interpreted the cross above the 30-day SMA as a trend reversal signal, especially after HMSTR’s 67% decline over the past 90 days. The Fibonacci retracement zone ($0.000218–$0.000299) now acts as critical support.

HOLO Holoworld AI (+12.93%, Circulating Market Cap: $23.69 Million)

HOLO is trading at $0.06821, up approximately 12.93% in the past 24 hours. Holoworld AI is a decentralized application hub designed for artificial intelligence agents, applications, and digital intellectual properties (IPs). The project began in 2022 in Silicon Valley with the goal of providing infrastructure where developers, creators, and organizations can publish, distribute, and monetize AI-powered experiences in an open and composable environment. HOLO’s RSI-14 hit 25.09 (oversold) on December 18, coinciding with a bounce from the Fibonacci 78.6% retracement level ($0.071). The price reclaimed its 7-day SMA ($0.0675), but remains below the 30-day SMA ($0.0816). Short-term traders likely capitalized on oversold conditions, but the broader trend remains bearish (down 27% monthly). The MACD histogram (-0.0003) shows weakening downward momentum, though resistance at $0.087 (50% Fib) could limit gains.

Market News

Senate confirms Trump crypto-friendly nominees to take over CFTC, FDIC

As President Donald Trump's opening year wanes in his second administration, he's finally landed permanent appointments to helm two of the most important U.S. Crypto regulators: Mike Selig, chairman of the Commodity Futures Trading Commission, and Travis Hill , chairman of the Federal Deposit Insurance Corp.

The CFTC is poised to become a leading regulator of U.S. crypto activity, especially if Congress completes the legislative work to give more specific crypto authority to the derivatives watchdog. The Senate approved Selig and Hill in a package of dozens of other nominees on Thursday with a 53-43 vote. Once sworn in, Selig will take over from Acting Chairman Caroline Pham, who has led a range of pro-crypto policy initiatives as she's waited for a permanent replacement at the agency.

One of Selig's complicating factors as he leaps into crypto work is the fact that the CFTC's five-member commission has been allowed to dwindle to a single member. Pham said she's planning to depart as soon as Selig arrives, which will leave him as the solo member of the commission. While that reduces friction in how easy it'll be for him to institute policies, it could leave some uncertainty about legal vulnerability to challenges that its policies are being properly established.

Hill has taken a leading role, too, in addressing crypto industry complaints over so-called "debanking" in which banks severed their relationships with crypto businesses and their executives, a situation that industry insiders and many of their Republican lawmakers allies say was encouraged by regulatory policy.

Republicans in the Senate have turned to an unusual, mass-confirmation approach to Trump's federal nominees. In the resolution that approved these two officials, 97 confirmation questions were attached to the same document, dodging a traditional confirmation process in which the Senate assessed each nominee individually.

Bitcoin's 'Realized Cap' Holds at Record High over $1 Trillion, Casting Doubt on Four-year Cycle

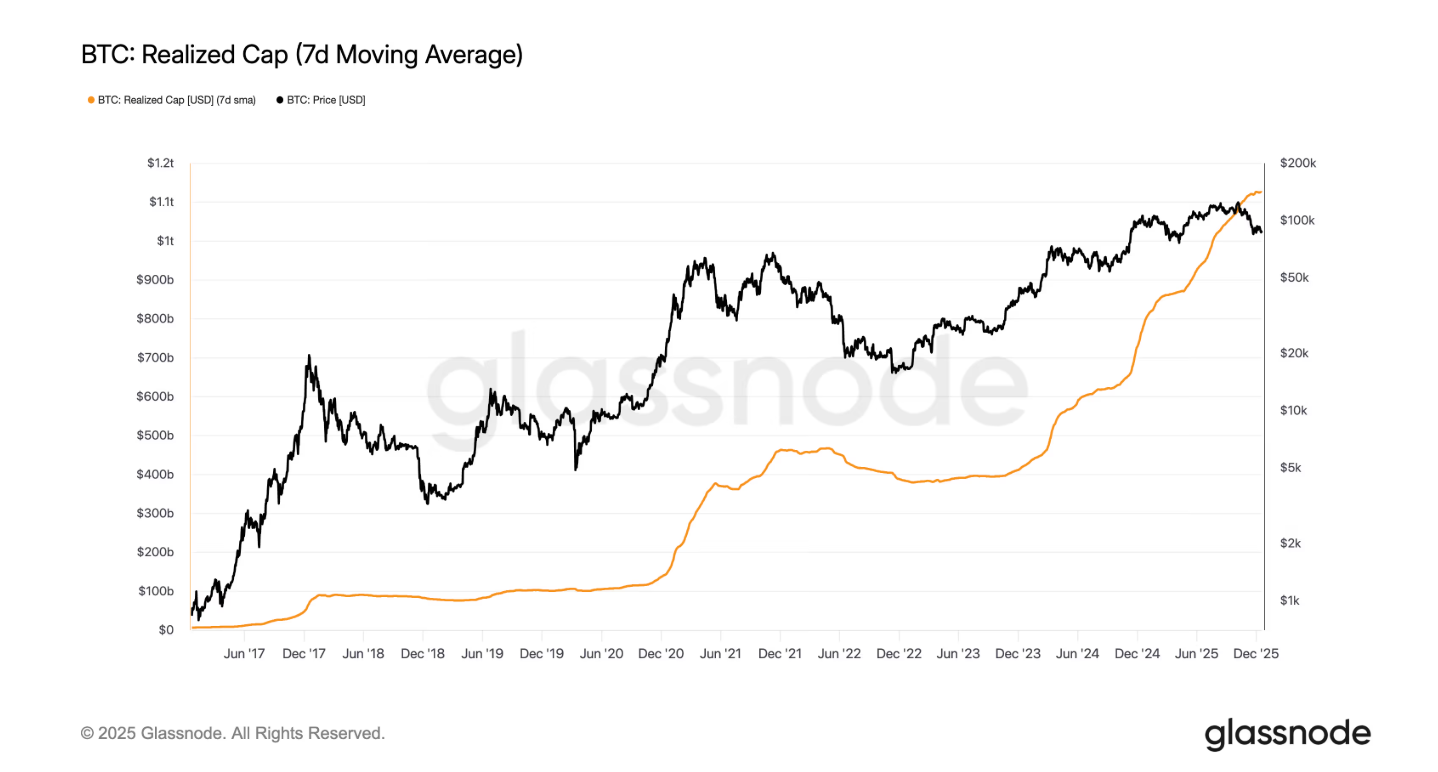

Bitcoin’s "realized capitalization" is at an all-time high of $1.125 trillion, suggesting that BTC remains in a bull market despite the near-40% plunge in prices over the past 10 weeks.

This on-chain metric, which values each bitcoin at the price it last moved, highlights actual capital inflows rather than speculative price action like total market capitalization.

Glassnode data shows realized cap continued to rise through the 36% correction from October all-time price high, even as it stalled late in the $1.125 trillion area. A similar pause was seen during the tariff tantrum in April 2025, when bitcoin bottomed near $76,000 before going on to make new highs.

During the 2022 bear market, realized cap fell from around $470 billion to $385 billion as investors capitulated and coins were sold at lower cost base — this sort of response is not being seen at the moment.

Andre Dragosch, European head of research at Bitwise, told CoinDesk that bitcoin could defy the four-year cycle narrative, with upside surprises in 2026. Dragosch pointed to resilient global growth combining with ongoing rate cuts to steepen the yield curve and expand liquidity, all conditions that could weaken the U.S. dollar, which is an environment that has historically been supportive of bitcoin.

Crypto Hacks Hit $3.4 Billion in 2025, Attacks on Individual Wallets Rise

Cryptocurrency theft totaled over $3.41 billion from January through early December, blockchain intelligence firm Chainalysis said. The figure marks an increase from last year's $3.38 billion.

A single incident, a $1.5 billion hack of Bybit exchange accounts for around 44% of the annual total. The top three hacks represented 69% of all losses from services, highlighting the escalating severity of major breaches.

Chainalysis said there was a notable increase in attacks on personal crypto wallets and private keys on centralized crypto services this year. "Personal wallet compromises have grown substantially, increasing from just 7.3% of total stolen value in 2022 to 44% in 2024," Chainalysis said.

Personal wallet compromises reached 158,000 cases involving at least 80,000 unique victims. The total value stolen from individuals declined to $713 million, down from $1.5 billion the previous year, suggesting that attackers targeted smaller amounts across a greater number of users. Ethereum and Tron showed higher rates of victims per 100,000 wallets compared to networks like Base and Solana.

Centralized services remain vulnerable to attacks despite professional security measures due to their susceptibility to private key breaches. Such attacks accounted for 88% of the stolen amounts in Q1 2025.

DeFi hack losses remained suppressed even as the total value locked rebounded. This is a key divergence from earlier cycles, where rising TVL usually meant more successful attacks. Chainalysis said this possibly indicates meaningful progress in the sector's security.

Following the attack, Venus passed a governance protocol to freeze $3 million in the attacker's control, leading the perpetrator to actually lose money as a result.

Reference:

https://www.coindesk.com/policy/2025/12/11/senate-confirms-trump-crypto-friendly-nominees-to-take-over-cftc-fdic

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.