The cryptocurrency market demonstrated a cautious recovery on December 17, 2025, following Monday's significant decline that resulted in Bitcoin reaching multi-week lows. The total market capitalization increased to approximately $2.94 trillion, reflecting a modest gain of 0.61% over the past 24 hours. Trading volume rose to $98.6 billion, representing a 16.54% increase and indicating renewed market activity. Bitcoin led the upward movement, trading around $86,389 with a 0.51% increase for the day, while Ethereum remained stable near $2,917, with minimal variation of 0.02%. Meanwhile, the Republic of the Marshall Islands (RMI) has completed the world’s first on-chain disbursement of universal basic income (UBI) using a digitally native sovereign bond, USDM1, via the Stellar blockchain. Lending in decentralized finance hit a new quarter-end high as the total active loans on DeFi applications neared $41 billion. J.P. Morgan Asset Management on Monday, Dec. 15, launched its first tokenized money market fund (MMF) on Ethereum.

Crypto Market Overview

BTC (+0.51% | Current Price: $86,389.44)

Bitcoin's price movement on December 17 demonstrated cautious optimism, as the asset rose to $86,389 after reaching intraday highs near $87,000 during Asian trading hours. The daily gain of 0.51% concealed intraday volatility, with BTC consolidating within a narrow range following Monday's sharp decline. The rebound from the $85,000 support level aligns with oversold conditions observed on shorter timeframes, where the RSI increased from below 30 to neutral levels.

From a technical perspective, Bitcoin remains in a corrective phase within the broader bullish cycle. The daily chart indicates continued trading below the 50-day EMA near $88,000, with resistance zones around $87,500 to $90,000, levels that have capped upward movement since early December. A confirmed close above $88,000 could open the door to a target of $92,000, potentially reclaiming the upper boundary of the descending channel. Conversely, if support at $85,000 fails, it could lead to further downside towards the $80,000 to $82,000 range, where previous volume profile and Fibonacci retracement levels intersect.

On December 16th, Bitcoin exchange-traded funds (ETFs) registered a total net outflow of $227.2 million, with BlackRock's IBIT saw an inflow of $210.7 million.

ETH (+0.29% | Current Price: $2,924.91)

On December 17, Ethereum's price remained relatively stable, trading around $2,940 with a minimal change of 0.04%, underperforming Bitcoin and reflecting ongoing challenges for the leading smart contract platform. This sideways movement continues a multi-week consolidation below the $3,000 level, as layer-2 scaling solutions increasingly impact base-layer revenue and activity.

Network fundamentals remain subdued, with daily transaction counts and active addresses at multi-month lows. Consequently, Ethereum's gas fees have dropped to historic lows of approximately 0.032 Gwei. While lower fees benefit users, they also indicate subdued demand across DeFi, NFTs, and dApps, sectors that previously contributed significantly to network activity. Monthly revenue has experienced a sharp decline, raising questions about the sustainability of Ethereum's narrative as a store of value amid the fragmentation caused by layer-2 solutions.

From a technical perspective, the ETH/BTC trading ratio is testing multi-year lows, indicating relative weakness. Key support levels are observed near $2,800-$2,900, with resistance at approximately $3,200. A sustained upward move would likely require catalysts such as renewed ETF inflows or ecosystem upgrades. Institutional interest remains evident, as major investors continue accumulating ETH, viewing current levels as attractive for long-term position-building.

On December 16th, ETH ETFs experienced a total net outflow of $224.2 million, with BlackRock's ETHA saw an outflow of $221.3 million.

Altcoins

On December 17, altcoins exhibited mixed performance, with the sector generally underperforming compared to Bitcoin's stability. Notable performers included

Ripple (+2.30% to $1.91),

Dogecoin (+1.45% to $0.1307), and

Solana(+1.18% to $127.65). Additionally, assets such as

Cardano (+0.60%) and

TRON (+0.33%) experienced modest gains. While there were no major laggards within the top 10 cryptocurrencies, smaller-cap assets continued to lose market share. The Crypto Fear & Greed Index rose to 25 on December 17, indicating a persistent state of caution, though it is an improvement from yesterday's reading of 22. This index, which considers factors such as volatility, momentum, social media activity, and market dominance, reflects ongoing investor sentiment of apprehension following recent declines. Historically, readings of extreme fear below 20 have often marked local market bottoms, suggesting heightened investor caution and potential contrarian buying opportunities.

Macro Data

The macroeconomic environment remains mixed, with recent Federal Reserve commitments indicating a cautious approach to easing in 2026. Upcoming data on inflation and employment will influence risk appetite across markets, including cryptocurrencies. Bitcoin continues to demonstrate a correlation with equities, which increases its sensitivity to shifts in yields and the strength of the US dollar.

On December 16th, the S&P 500 dropped 0.16%, standing at 6,816.51 points; the Dow Jones Industrial Average fell 0.09% to 48,416.56 points, and the Nasdaq Composite fell 0.59% to 23,057.41 points. The price of gold is $4,285.09 up 0.36%, at 4:00 UTC, December 16th.

Trending Tokens

FOUR Form (+30.56%, Circulating Market Cap: $158.69 Million)

FOUR is trading at $0.4157, up approximately 30.56% in the past 24 hours. BinaryX ($BNX) is the platform cryptocurrency for the BinaryX ecosystem, which includes the DAO and all products & games utilizing $BNX. BinaryX began as a decentralized derivative trading system. Recognizing the burgeoning popularity of GameFi and interest in metaverse games, the team gradually evolved into developing decentralized video games and is now fully transitioning to being a GameFi platform offering IGO services to bridge Web2 developers to Web3. FORM broke above its 7-day SMA ($0.317) and 30-day EMA ($0.380), with RSI (7-day) at 74.86 signaling overbought conditions. The MACD histogram turned positive (+0.0122), indicating accelerating bullish momentum. Short-term traders likely interpreted the breakout above $0.369 (50% Fibonacci retracement) as a bullish signal, targeting $0.421 (23.6% Fib level). High turnover (0.88) suggests liquidity supported the move.

OM Mantra (+23.95%, Circulating Market Cap: $92.38 Million)

OM is trading at $0.08079, up approximately 23.95% in the past 24 hours. MANTRA is a Security first RWA Layer 1 Blockchain, capable of adherence and enforcement of real world regulatory requirements. Built for Institutions and Developers, MANTRA offers a Permissionless Blockchain for Permissioned applications. MANTRA confirmed a 1:4 token split via governance Proposal 26, effective January 2026. While non-dilutive, traders often front-run such events anticipating improved liquidity and accessibility. Historical precedent shows these events can temporarily boost retail participation. OM’s 484% 24h volume spike suggests traders priced this in early.

SWARMS Swarms (+15.9%, Circulating Market Cap: $17.27 Million)

SWARMS is trading at $0.01722, up approximately 15.9% in the past 24 hours. Swarms tackles limitations of single AI agents by enabling teams of specialized agents to collaborate. Use cases span automated research, enterprise data processing, and decentralized decision-making. For example, its "SenateSwarm" simulates legislative debates using 100+ agents, while medical swarms analyze patient data across hospitals. The platform aims to democratize access to advanced AI by decentralizing agent deployment and monetization. SWARMS’ RSI(14) hit 71.61 (approaching overbought), while its MACD histogram widened to +0.00059234 – the strongest bullish divergence since June 2025. Short-term traders are chasing momentum, but the 200-day EMA at $0.0247 remains a critical resistance level. A close above $0.0186 could target $0.0224 Fibonacci 23.6% retracement.

Market News

Marshall Islands Launches World’s First Blockchain-based UBI on Stellar Blockchain

The Republic of the Marshall Islands (RMI) has completed the world’s first on-chain disbursement of universal basic income (UBI) using a digitally native sovereign bond, USDM1, via the Stellar blockchain.

Developed in partnership with the Stellar Development Foundation (SDF) and infrastructure provider Crossmint, the multimillion-dollar initiative is part of RMI’s national UBI program, known locally as ENRA, the Marshalls Islands’ Finance Ministry confirmed. The program replaces quarterly physical cash deliveries with direct digital transfers to eligible citizens, many of whom live across widely dispersed islands.

USDM1 is a U.S. dollar-denominated sovereign bond fully backed by short-term U.S. Treasury bills. The bond is distributed through the Stellar Disbursement Platform into a custom-built digital wallet app called Lomalo. Developed by Crossmint, Lomalo allows recipients to receive funds instantly via Crossmint wallets on the Stellar network.

The government emphasized that USDM1 does not compromise the country’s monetary or technological sovereignty. “ENRA is a fiscal distribution program, not a currency initiative,” the spokesperson said. “Every unit is issued one-to-one against short-dated U.S. Treasuries held in trust, fully backed and legally segregated at all times.”

A white paper released alongside the initiative outlines the broader policy and financial framework for USDM1.

DeFi Lending Hit New Record in Q3

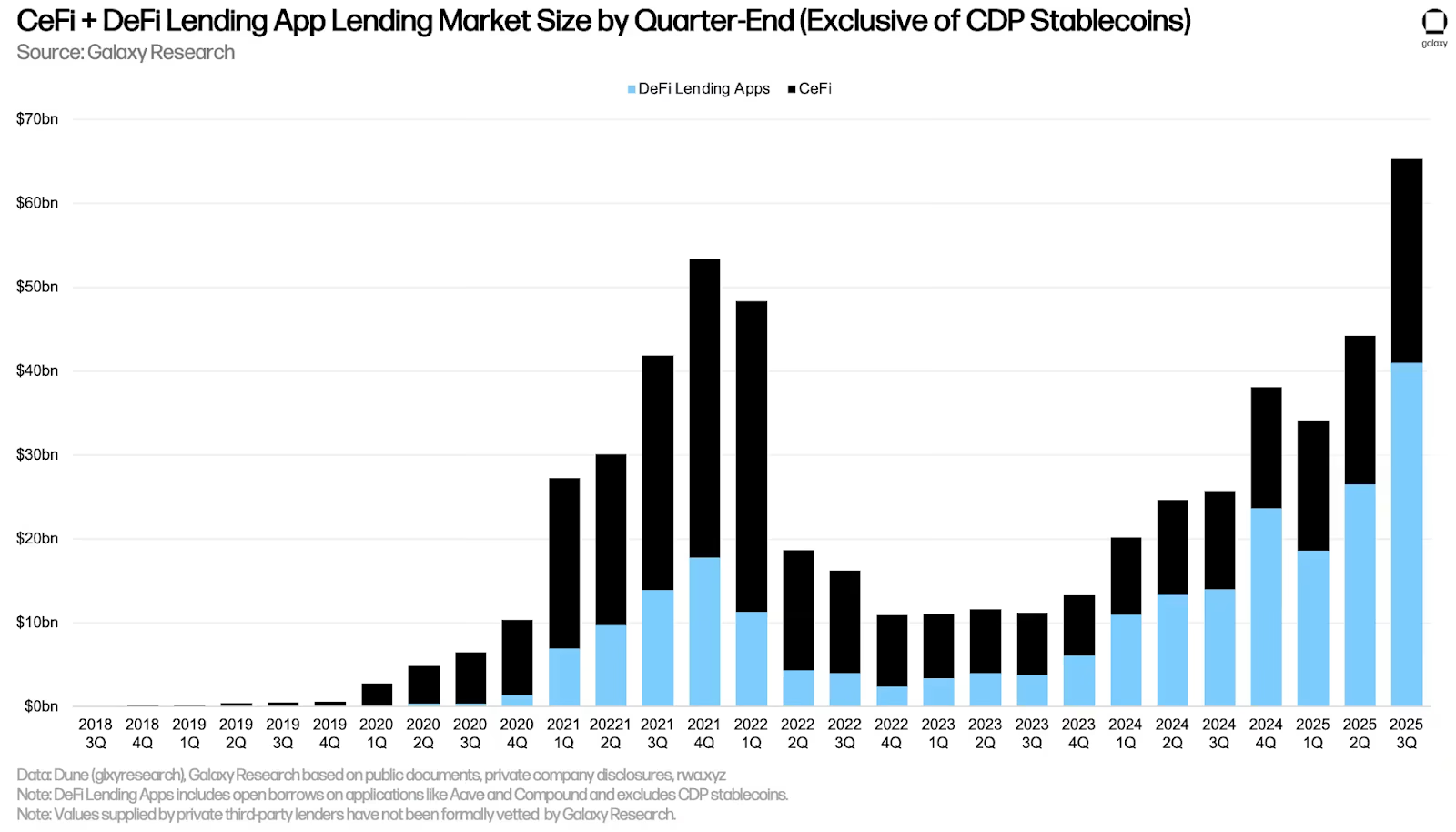

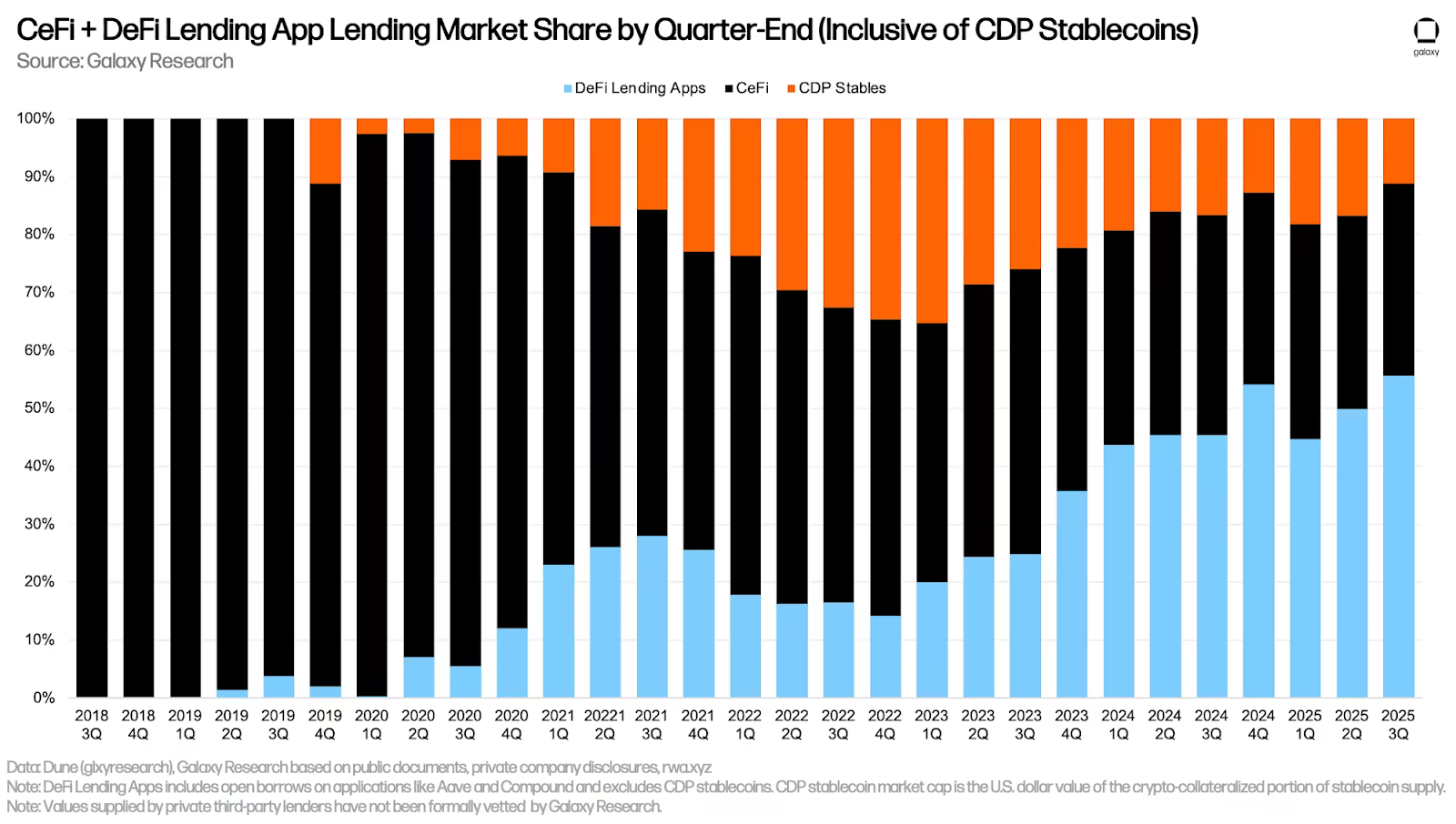

Lending in decentralized finance hit a new quarter-end high as the total active loans on DeFi applications neared $41 billion, Galaxy Digital said in its latest “State of Crypto” report for Q3. Galaxy’s research team wrote that DeFi borrowing grew by about $14.5 billion, or nearly 55% in the third quarter, alongside centralized crypto lending.

That growth helped push total crypto lending — across both DeFi and CeFi — to almost $73.6 billion, setting a new all-time high above the previous peak of $69.3 billion at the end of Q4 2021.

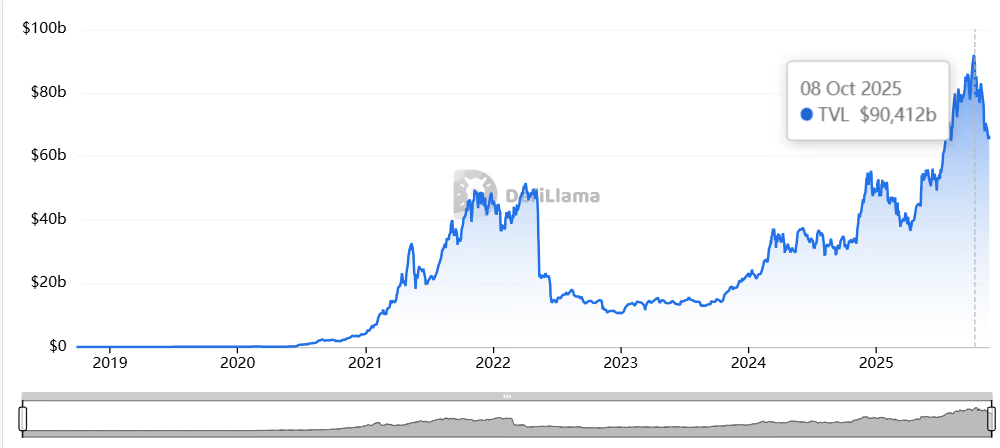

It’s worth noting that DefiLlama data shows that the total value locked in DeFi lending protocols was at around $90.9 billion as of early October.

Although TVL doesn’t necessarily reflect the amount actually borrowed from the protocols, if that $90 billion indeed held in early Q4, it could suggest that on-chain lending, combined with CeFi, was significantly higher than Galaxy’s Q3 snapshot.

A spokesperson for Galaxy Digital clarified that the wording about all-time high was meant “as of the end of Q3 2025,” which means that the historic maximum was likely reached in early Q4.

In the report, Galaxy Digital explained that several factors helped borrowing increase. Airdrops, points programs, better collateral products, and rising prices boosted users’ ability to borrow as the value of their collateral grew.

But Galaxy Digital also warned about possible double-counting between CeFi and DeFi numbers. As the report’s author, Galaxy research associate Zack Pokorny, wrote, some CeFi lenders borrow on-chain and then lend off-chain, which can show up twice without clear disclosures

Galaxy Digital also noted that while DeFi and on-chain CeFi lending numbers can be seen on the blockchain and are easy to access, getting CeFi data “is tricky” because of “inconsistencies in how CeFi lenders account for their outstanding loans and how often they make the information public.”

But still, combined, DeFi and CeFi loans totaled $65.3 billion at the end of Q3, up $21.1 billion from Q2, with most of the increase coming from DeFi. DeFi’s share of the market also grew, rising to 62.7% from 59.8% in the previous quarter.

In the weeks following Oct. 10 market crash, which resulted in record daily liquidations for crypto, the DeFi sector as a whole has struggled. The market shock in early November from the Balancer exploit, followed almost immediately by Stream Finance's collapse, further eroded trust in the sector. Total DeFi TVL has been down more than 25% since Oct. 10 to $125 billion, down from $170 billion.

J.P. Morgan Launches Tokenized Money Market Fund on Ethereum

J.P. Morgan Asset Management on Monday, Dec. 15, launched its first tokenized money market fund (MMF) on Ethereum, marking another step by a major bank to move traditional financial products onto public blockchains. The fund, called My OnChain Net Yield Fund (MONY), is open to qualified investors. It is issued on Ethereum, the world’s largest smart contract blockchain, which currently has more than $74 billion in total value locked across decentralized finance (DeFi) applications, according to DefiLlama.

MONY is built using J.P. Morgan’s tokenization platform, Kinexys Digital Assets, and is structured as a private placement fund. The fund holds only U.S. Treasury securities and repurchase agreements backed by Treasurys.

With MONY, investors can earn U.S. dollar yield through Morgan Money, J.P. Morgan Asset Management’s platform for liquidity management. Meanwhile, dividends are reinvested daily, the release explained.

The launch highlights how large financial institutions are increasingly using blockchain infrastructure to deliver traditional products, rather than creating entirely new ones. By tokenizing a standard MMF, J.P. Morgan is testing how blockchain rails can be used for settlement, ownership and transfers.

The move follows other recent efforts by the bank to bring traditional financial vehicles on-chain. Earlier this month, J.P. Morgan arranged Galaxy Digital’s first U.S. commercial paper issuance on the Solana blockchain, with Coinbase and Franklin Templeton as buyers. The transaction was issued and settled on-chain using USDC, The Defiant previously reported.

Meanwhile, in November, E-commerce giant Alibaba revealed plans to launch a stablecoin-like global payments system sometime this month using J.P. Morgan’s blockchain technology. This news came shortly after J.P. Morgan officially launched its tokenized deposit asset, JPMD, on Coinbase’s Layer 2 Base.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.