The Decentralized Finance (DeFi) lending landscape, long dominated by pool-based models like Compound and Aave, has achieved remarkable feats in creating permissionless and transparent financial markets. However, these foundational protocols operate with an inherent inefficiency: capital within a pooled liquidity market is undifferentiated, leading to suboptimal returns for both lenders and borrowers. This is where Morpho enters the scene, not as another lending fork, but as a sophisticated meta-layer that optimizes the very infrastructure it builds upon. Positioned as a "capital efficiency layer," Morpho introduces a novel peer-to-peer (P2P) matching engine that sits atop existing lending pools, intelligently routing positions to maximize yields and minimize borrowing costs. In an ecosystem where every basis point of yield matters, Morpho's promise of optimizing idle capital has propelled it to become a critical piece of DeFi infrastructure. This article delves into the mechanics of the Morpho protocol, explores the utility and governance power of its MORPHO token, analyzes its evolving tokenomics and recent market performance, and assesses the challenges it faces in a competitive and rapidly evolving DeFi sector.

What Is MORPHO?

Morpho is a decentralized lending protocol that functions as an optimization layer for established pool-based lending markets. Its core innovation lies in enhancing the capital efficiency of platforms like Compound and Aave without replacing them. While traditional pool-based models aggregate all lenders' assets into a single liquidity pool from which borrowers draw, Morpho introduces a hybrid approach. It seamlessly matches lenders and borrowers in a peer-to-peer fashion when their terms align perfectly. When a perfect match isn't available, funds automatically and silently fall back to the underlying liquidity pool (e.g., Compound's cTokens or Aave's aTokens), ensuring users always earn at least the base pool rate. This best-of-both-worlds model means lenders can earn significantly higher yields through P2P matches, while borrowers can access lower interest rates, all while inheriting the battle-tested security and liquidity of the underlying blue-chip protocols.

The protocol’s flagship product is Morpho Blue, a reimagined, minimalist, and extremely capital-efficient lending primitive. It represents a shift from the monolithic, one-size-fits-all design of first-generation lending protocols to a permissionless marketplace where anyone can create and manage isolated, bespoke lending markets, known as "vaults," for specific collateral/loan pairs. This architecture provides unparalleled risk segmentation and flexibility, allowing for highly tailored markets that can offer better terms for both sides. By building on top of and now alongside the giants, Morpho has carved out a unique niche as the essential efficiency engine for decentralized debt markets.

Features of MORPHO

Morpho's feature set is defined by its relentless focus on optimization, security, and market flexibility. The primary feature is its peer-to-peer matching engine. This system algorithmically identifies complementary supply and demand within a market. For instance, if a lender deposits stablecoins seeking yield and a borrower wishes to take a loan against ETH collateral, Morpho can directly match them if the risk parameters align. This direct match bypasses the pooled liquidity, allowing the lender to earn the borrower's interest rate directly, which is often higher than the pool's supply rate, while the borrower pays less than the pool's borrow rate. The surplus, or the "spread," that would typically be lost to the pool's reserve factor is instead captured as value for Morpho's stakeholders.

The launch of Morpho Blue marked a paradigm shift. Its minimalist design reduces smart contract complexity, thereby enhancing security and lowering gas costs. Its most powerful feature is the concept of permissionless, isolated markets. Any user, or "curator," can deploy a lending vault for any asset pair by simply specifying a loan-to-value ratio, interest rate curve, and crucially, selecting a risk oracle and a liquidation engine. This unbundles risk, allowing for markets with highly competitive rates for well-understood collateral types without exposing lenders to the risk of unrelated, more exotic assets. This architecture has attracted sophisticated players and institutions looking to create bespoke debt products.

Furthermore, Morpho emphasizes security and risk minimization. By using established protocols as a fallback, it inherits their audited codebase and robust liquidation mechanisms. For Morpho Blue, security is prioritized through extreme simplicity in its core code and a decentralized network of independent risk auditors who review and verify the parameters of new markets. The protocol also employs a unique MetaMorpho vault system, where skilled managers can create diversified vaults that allocate capital across multiple Morpho Blue markets, automating yield-seeking strategies for passive lenders, thus abstracting complexity while maintaining efficiency.

What Is the MORPHO Token?

The MORPHO token is the governance and incentive mechanism at the heart of the Morpho ecosystem. It is an ERC-20 token that primarily empowers its holders to govern the protocol's critical parameters and future direction. Token holders can vote on proposals related to the protocol's treasury management, fee structures, integration of new underlying lending pools (or "adapters"), and upgrades to the core Morpho and Morpho Blue smart contracts. This decentralized governance ensures the protocol evolves in line with the community's and stakeholders' interests.

Beyond governance, the MORPHO token is central to the protocol's incentive distribution system. A significant portion of token emissions is directed towards rewarding users who provide liquidity and participate in the ecosystem. This includes liquidity mining programs for suppliers and borrowers in key markets, as well as incentives for MetaMorpho vault managers who successfully attract capital and generate yield. The token is designed to capture value from the efficiency gains it creates; a portion of the spread generated from P2P matches on the classic Morpho protocol, and potential future fee streams from Morpho Blue markets, can be directed to token stakers or the protocol treasury, linking the token's utility to the protocol's financial performance.

MORPHO Tokenomics

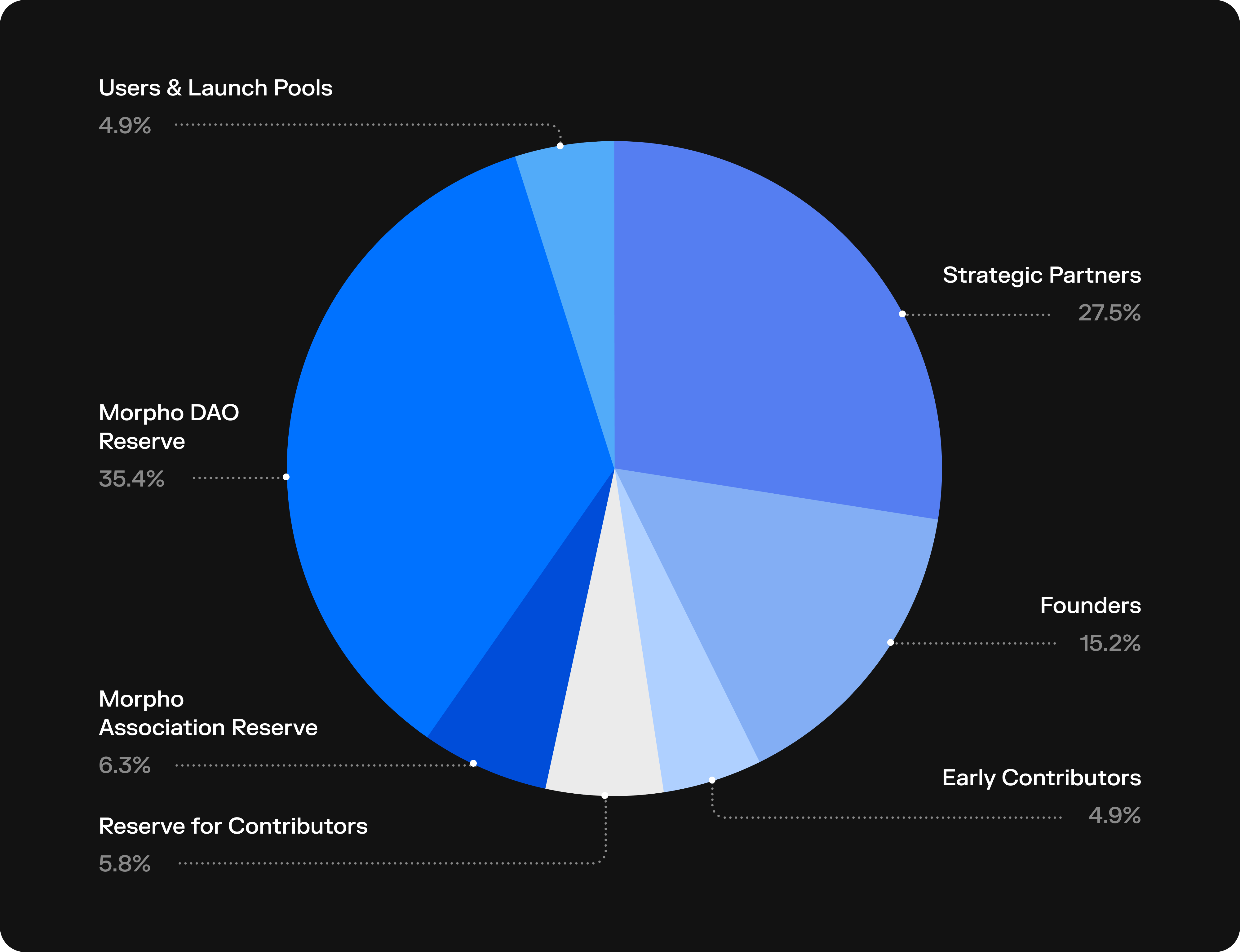

The tokenomics of MORPHO are designed for long-term alignment and sustainable growth. The initial total supply was set at 1,000,000,000 (1 billion) MORPHO tokens. The distribution of this supply is strategically allocated to various stakeholders to bootstrap participation and ensure decentralized control. A substantial portion, 50% of the total supply, was allocated to the community. This includes distributions for liquidity mining incentives, future community initiatives, and a retroactive airdrop to early users of the Morpho protocol who contributed to its initial growth and testing phases.

The overall distribution of MORPHO tokens, including vested and unvested allocations, as of 7 November 2024.

Morpho governance

35.4% of MORPHO tokens are owned and controlled by the Morpho governance. Holders of the MORPHO token can vote on how these tokens are used.

Users & Launch Pools

4.9% of MORPHO tokens have been distributed from Morpho governance to users of the Morpho Protocol and launch pool participants. The Morpho governance continues to distribute MORPHO tokens as rewards.

Morpho Association

6.3% of MORPHO tokens are allocated to the Morpho Association for ecosystem development. This allocation can be used to fund partnerships, contributors, and any other initiatives that help grow the Morpho Protocol and advance Morpho’s network.

Reserve for Contributors

5.8% of MORPHO tokens are reserved for contributors to the Morpho Protocol for their role in the development and growth of the network. This reserve includes unallocated tokens set aside by the Morpho governance for future contributors to the Morpho Protocol such as Morpho Association employees, service providers, contractors, and research institutes.

Strategic Partners

27.5% of MORPHO tokens have been allocated to Strategic Partners tokens in exchange for providing support — monetary support or otherwise — to the Morpho Protocol. These MORPHO tokens are distributed according to three vesting schedules based on the time these Strategic Partners joined the Morpho ecosystem.

Cohort 1: 4.0% allocated over a 3-year vest, with a 6-month lockup from when the MORPHO token contract was deployed on 24 June 2022.

Cohort 2: 16.8% originally allocated over a 3-year vest, with a 6-month lockup from 24 June 2022. However, these strategic partners have agreed to relock to a 6 month linear vesting, following a 6 month lockup from 3 October 2024. This means 100% is vested by 3 October 2025 at the latest.

Cohort 3: 6.7% allocated over 2 year linear vest, following a 1 year lockup from 21 November 2024. This means 100% is vested by 21 November 2027 at the latest.

Founders

15.2% of MORPHO tokens have been allocated to Morpho’s founders. The tokens were originally allocated over 3 year vest, with a 1-year lockup from when the token was deployed on 24 June 2022. However, all co-founders have agreed to relock to an additional 2-year linear vest, following a 1-year lockup from the earliest of any future transferability date or May 17th 2025. This means 100% is vested by 17 May 2028 at the latest.

Early Contributors

4.9% of MORPHO tokens have been allocated to early contributors, including Morpho Association's contributors, independent researchers, and advisors, in exchange for contributions to the Morpho Protocol. These tokens have been subject to either:

A 3-year vesting schedule with a 6-month lockup, or

A 4-year vesting schedule with a 4-month lockup.

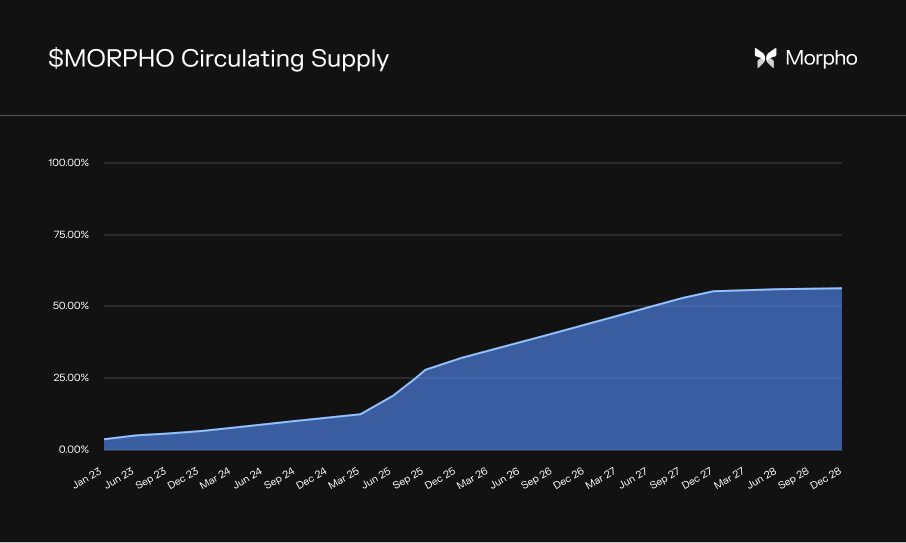

Circulating Supply

The circulating supply on transferability date is expected to be approximately 11.2%.

The chart below shows how the circulating supply of MORPHO tokens might evolve over time:

MORPHO Market News and Price Analysis

Morpho has consistently garnered attention from major players in the crypto space, serving as a strong validation of its technology. A pivotal market event was the investment from Binance Labs, the venture capital arm of the world's largest cryptocurrency exchange. In the first half of 2024, Binance Labs led a significant funding round for Morpho, signaling strong institutional confidence in its vision to redefine DeFi lending. This investment provided not only capital but also strategic credibility, linking Morpho to a vast ecosystem of users and potential integrations.

Following the investment, a major catalyst for the MORPHO token was its listing on the Binance exchange in July 2024. The listing on the world's premier trading venue dramatically increased the token's liquidity, accessibility, and visibility, leading to a substantial surge in trading volume and price. The token experienced the characteristic volatility associated with such a major exchange debut, but the listing firmly established MORPHO as a mainstream DeFi asset.

In terms of protocol performance, the launch of Morpho Blue has been a resounding success from a Total Value Locked (TVL) perspective. Within months of its release, Morpho Blue attracted billions of dollars in capital, demonstrating strong product-market fit. The protocol's overall TVL has consistently placed it among the top lending protocols in DeFi. Price analysis for the MORPHO token must consider this fundamental growth. While subject to the broad volatility of the crypto market, the token's price is fundamentally supported by the increasing usage of the protocol, the value of its captured fees, and its role in governing a multi-billion-dollar infrastructure. Analysts often view its performance as a barometer for sophisticated DeFi adoption, with its price action reflecting sentiment towards capital-efficient financial primitives. The sustainable yield opportunities created by Morpho's technology form a fundamental value proposition that underpins the token's long-term economic model.

Risk and Challenges

Despite its innovative approach and strong traction, Morpho faces several material risks and challenges. The foremost is smart contract risk. While Morpho benefits from the security of underlying protocols, its own complex matching engine and the new, minimalist yet permissionless codebase of Morpho Blue present attack surfaces. A critical bug or exploit in its smart contracts could lead to catastrophic losses, undermining user trust. The reliance on external oracles for price feeds in Morpho Blue markets also introduces oracle risk, where manipulated or stale data could trigger faulty liquidations or allow undercollateralized borrowing.

Secondly, competitive and ecosystem risk is significant. Morpho competes not only with incumbent giants like Aave but also with a new wave of modular lending protocols. Its success is partially tethered to the health and security of the underlying pools (Compound, Aave) it optimizes; a major failure in one could spill over. Furthermore, the innovative but complex nature of Morpho Blue, with its isolated markets, could lead to fragmented liquidity and, paradoxically, worse rates in some niche markets if they fail to attract sufficient depth.

Thirdly, regulatory uncertainty looms over the entire DeFi sector. Morpho's peer-to-peer matching and global permissionless access could draw regulatory scrutiny, particularly around securities laws and anti-money laundering (AML) compliance. How decentralized governance and anonymous curation of markets will be treated by regulators remains an open and critical question.

Finally, there are economic and adoption risks. The value accrual to the MORPHO token, while designed, must materialize in practice through fee mechanisms and governance value. If token incentives decline but usage fails to become self-sustaining through organic yield advantages, the protocol could struggle to retain liquidity. Additionally, the complexity of the protocol may present a barrier to entry for less sophisticated users, potentially limiting its market to a more niche, institutionally-focused audience unless abstracted effectively by front-end interfaces and MetaMorpho vaults.

Conclusion

Morpho stands as a testament to the iterative and innovative spirit of DeFi. It has successfully identified a critical inefficiency—suboptimal capital allocation in pooled lending and engineered an elegant, non-custodial solution. By augmenting rather than overthrowing the existing giants, it has achieved remarkable adoption and secured validation from industry leaders like Binance. The introduction of Morpho Blue showcases its ambition to not just optimize the past but to define a more flexible, efficient, and secure future for decentralized credit.

The MORPHO token serves as the coordinating mechanism for this ecosystem, aligning stakeholders through governance and incentives. While the protocol faces non-trivial risks related to security, competition, and regulation, its fundamental value proposition of extracting "free" yield from existing infrastructure is compelling and real. As DeFi matures from a phase of explosive, indiscriminate growth to one focused on optimization and risk management, protocols like Morpho that deliver tangible, measurable efficiency gains are poised to become indispensable infrastructure. Its journey will be a key indicator of whether DeFi can evolve into a robust, efficient, and deeply integrated component of the global financial system.

References:

Morpho. (2023).

Morpho Blue: A Minimalist, Capital-Efficient Lending Primitive. [Whitepaper/Blog Post]. Retrieved from

https://www.morpho.org/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.