The cryptocurrency landscape is at a critical juncture where the fundamental ethos of transparency clashes with growing demands for data sovereignty and regulatory compliance. Privacy-centric blockchains like Monero and

Zcash

have long operated in the shadows, facing delistings and regulatory scrutiny due to their opaque nature. Enter Midnight, a pioneering protocol developed within the Cardano ecosystem, which aims to redefine this space. Launched in December 2025, Midnight is not merely another privacy coin; it is an ambitious attempt to construct a "privacy-first" data protection blockchain that seamlessly integrates with regulatory frameworks. By leveraging zero-knowledge proofs and a novel dual-token economy, Midnight seeks to enable confidential smart contracts and transactions for regulated industries like finance and healthcare, all while maintaining public verifiability where required. This article explores the architecture of Midnight, delves into the mechanics of its NIGHT and DUST tokens, analyzes its turbulent market debut and future price trajectories, and critically assesses the significant risks and challenges it must overcome to succeed.

What Is Midnight?

Midnight is a data-protection blockchain developed as a sidechain within the broader Cardano ecosystem. Its core mission is to resolve the persistent tension between blockchain transparency and the need for privacy in commercial and personal data handling. Unlike fully anonymous networks, Midnight employs a principle of "selective disclosure". This allows users or applications to cryptographically prove specific facts about their data, such as proving they are over 18 or have sufficient funds without revealing the underlying data itself. This functionality is powered by

zero-knowledge proofs (ZKPs), particularly zk-SNARKs, which form the bedrock of its privacy features.

A key differentiator for Midnight is its vision as cross-chain privacy infrastructure. Although built on Cardano, it is designed to be a multi-chain layer, with plans for direct integrations with major networks like Bitcoin, Ethereum, and Solana starting in Q3 2026. This positions Midnight not as a Cardano-exclusive product, but as a universal privacy layer for the broader Web3 ecosystem. Furthermore, it emphasizes "programmable compliance," meaning developers can build decentralized applications (dApps) where privacy is by design, but compliance rules (like KYC/AML checks) can be programmatically enforced on-chain, creating a hybrid model of private yet regulatable interactions.

Features of Midnight

Midnight's architecture incorporates several innovative features aimed at achieving high performance, developer accessibility, and practical privacy.

First, its consensus mechanism, Jolteon, is engineered for speed and scalability. It boasts the capability to process up to 5,000 transactions per second (TPS) with sub-second block times, addressing a common bottleneck in blockchain adoption for high-frequency use cases. Second, developer accessibility is a priority. Midnight utilizes TypeScript, a widely adopted programming language, as its primary smart contract framework, significantly lowering the barrier to entry for developers compared to learning new, niche languages. This strategic choice aims to attract a large pool of talent to build privacy-focused dApps.

Third, the protocol's dual-token model is a cornerstone of its economic and privacy design. This system cleanly separates the functions of network security and private transaction execution. Finally, Midnight's roadmap follows a phased and cautious rollout. The protocol initiated with a nine-month testing period, with its federated mainnet (the Kūkolu phase) targeted for Q1 2026. This deliberate pace is intended to ensure stability, security, and a managed integration into the market, mitigating volatility and building a solid foundation for developers and enterprises.

What Is the NIGHT Token?

The NIGHT token is the native utility and governance token of the Midnight network. With a fixed total supply of 24 billion tokens minted on the Cardano blockchain, NIGHT serves several primary functions.

-

Resource generation: holding NIGHT will generate DUST, the Midnight network capacity resource used to power transactions and smart contract execution.

-

Block production rewards: NIGHT will be distributed as a reward to incentivize block production via a protocol-managed token Reserve.

-

Decentralized governance: over time, NIGHT will enable holders to take part in decentralized, on-chain governance, helping to shape the protocol’s future.

-

Ecosystem incentives: it is expected that a NIGHT on-chain Treasury will be used to fund Midnight ecosystem growth activities and projects that are selected via future on-chain governance mechanics.

NIGHT Tokenomics

Midnight’s NIGHT token has a fixed total supply of 24 billion tokens. This entire supply is created at the start, but not all of it is immediately in circulation. The initial distribution of NIGHT tokens begins with the Glacier airdrop.

Midnight’s token distribution model is structured in three distinct phases, each designed to promote fairness, broad accessibility, and decentralized ownership. At the heart of this model is a commitment to allowing up to 100% of the NIGHT supply (24 billion tokens) to be claimed by the public, with no pre-allocated tokens for the team, foundation, or investors at launch. How many tokens ultimately end up in the hands of the community , the same as going to reserves and protocol entities, depends entirely on participation in Phase 1.

Phase 1: Glacier Drop

The Glacier Drop is the initial and primary phase of distribution. It makes the entire NIGHT supply available to eligible users across eight blockchain ecosystems (including Cardano, Bitcoin, Ethereum, and Solana). Participation is based on self-custody holdings of at least $100 worth of native assets at a snapshot date. The claim window lasts 60 days, and claimed tokens unlock gradually over a year.

This phase is designed to empower a diverse, multi-chain community. However, if a user doesn’t claim their allocation during this window, their share is considered unclaimed and moved to the next phases and internal allocations.

Phase 2: Scavenger Mine

Any NIGHT left unclaimed after Phase 1 becomes eligible for redistribution in Phase 2, known as Scavenger Mine. This 30-day event allows new participants to earn NIGHT by solving computational puzzles — a form of proof-of-work challenge. The protocol guarantees that at least 1% of the total supply (240 million NIGHT) will be available in this phase, provided there are enough unclaimed tokens. If less than 1% is unclaimed in Phase 1, the Scavenger Mine allocation is proportionally smaller.

Phase 3: Lost-and-Found

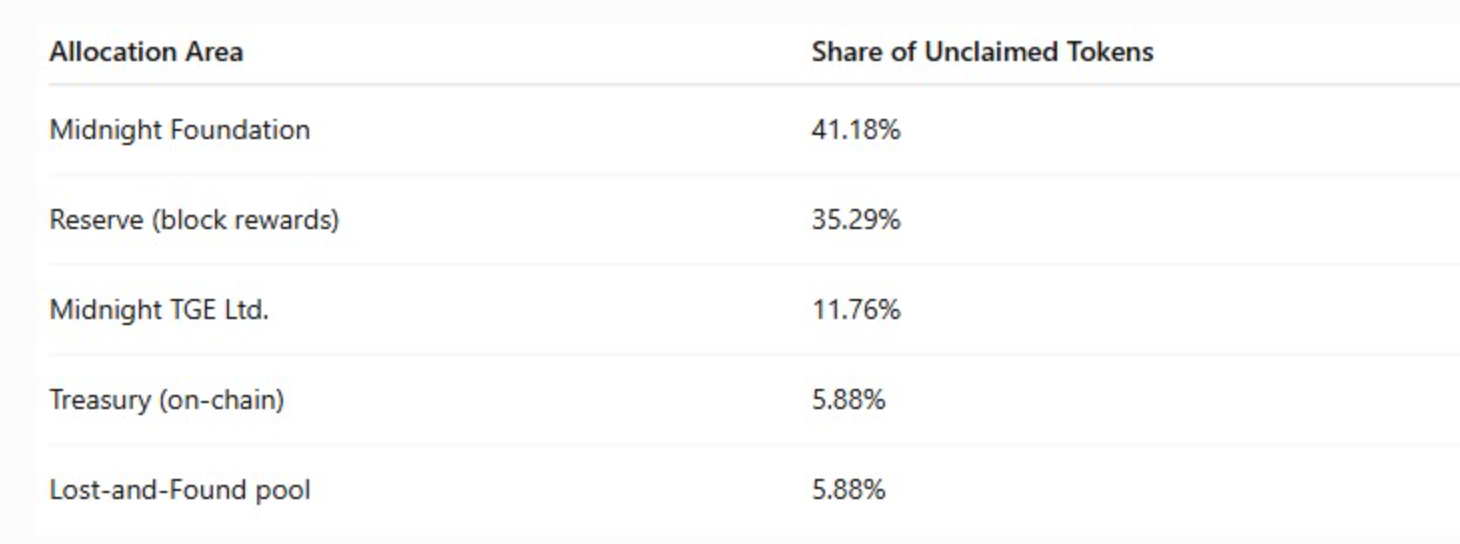

Phase 3 serves as a final opportunity for users who missed the Glacier Drop. Over a four-year window, eligible users who failed to claim during Phase 1 can still recover their NIGHT, sourced from a dedicated Lost-and-Found pool. This pool is capped at 5.88% of the supply, but again, only if those tokens remain unclaimed after previous phases.

How Remaining NIGHT Is Allocated

If 100% of NIGHT is claimed in Phase 1, then no tokens are available for Scavenger Mine, Lost-and-Found, or internal protocol allocations. However, the protocol anticipates that many users will not claim their tokens — due to missed deadlines, lost keys, or lack of awareness — and has a dynamic fallback system to allocate unclaimed tokens to other essential areas of the ecosystem.

If a portion of the NIGHT supply goes unclaimed, it is redistributed according to the following approximate proportions:

Market News and Price Analysis

The launch of the NIGHT token on December 4, 2025, was highly anticipated but met with dramatic volatility. Contrary to broader market gains, the token price crashed over 60% within 24 hours of its debut. This severe correction was directly attributed to the "airdrop sell-off" and the massive initial circulating supply, which overwhelmed shallow buy-side liquidity. The sell pressure was so intense that market trackers reported a 20,000% surge in sell orders.

Despite the rocky start, the launch was hailed by Cardano founder Charles Hoskinson as "the single biggest event in the history of Cardano". The announcement and subsequent listing on major exchanges like HTX provided a significant catalyst for Cardano's native ADA token, which saw a 10-15% price surge as market sentiment shifted toward the potential of the Midnight ecosystem.

Price predictions for NIGHT remain highly speculative and bifurcated between short-term pessimism and long-term optimism. Analysts point to the ongoing token unlocks as a major headwind for 2025, with neutral price targets around $0.040 and bearish scenarios testing support at $0.028. The launch of the mainnet in Q1 2026 is seen as a pivotal event that could shift focus from token supply to real utility and adoption. If successful, predictions suggest a potential neutral price range of $0.075 by 2026 and $0.40-$0.55 by 2030, should Midnight establish itself as a leading compliant privacy protocol. Some more bullish forecasts even mention a long-term ceiling near $11.20 by 2030, though this is contingent on extraordinary adoption.

Risk and Challenges

Midnight's path forward is fraught with significant challenges across multiple fronts. The most immediate is ongoing token supply pressure. The scheduled unlocks throughout 2026 will continuously test the market's ability to absorb new tokens, potentially capping price appreciation until the distribution stabilizes. Second, regulatory uncertainty looms large. While its "compliance-friendly" design is a selling point, privacy-enhancing technologies are inherently scrutinized. Regulations like the European Union's Markets in Crypto-Assets (MiCA) framework could pose interpretation challenges. Midnight must successfully navigate a complex global regulatory maze without being categorized alongside fully anonymous coins.

Third, ecosystem and competitive risks are substantial. Midnight's success is inextricably linked to Cardano's ability to attract developers and increase its total value locked (TVL), metrics where it has historically lagged behind rivals. Furthermore, it faces competition from established privacy coins (Monero, Zcash) and other smart contract platforms integrating ZK-technology. Finally, there are technical and adoption execution risks. The mainnet launch, while promising 5,000 TPS, must deliver on its performance and security promises. Achieving its vision of cross-chain integration and convincing enterprises in regulated industries to build on its platform will be a long and arduous process with no guarantee of success.

Conclusion

Midnight represents a bold and necessary experiment in the evolution of blockchain technology. It directly tackles the critical dilemma of privacy versus transparency with a sophisticated architectural proposal centered on selective disclosure, a dual-token economy, and programmable compliance. Its launch, though marred by tokenomic-induced volatility, has undeniably injected new energy and a compelling narrative into the Cardano ecosystem. The project's long-term viability, however, does not hinge on its token price in the coming months, but on the successful deployment of its mainnet, the tangible adoption by developers building useful privacy-preserving dApps, and its ability to withstand regulatory scrutiny. Midnight is not just a token; it is a high-stakes attempt to build a bridge between the decentralized world and the regulated global economy. Its journey will be a key indicator of whether true, compliant privacy can find a sustainable home on the public blockchain.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.