The launch of a new Layer-1 blockchain is always a significant event in the crypto market, but few have arrived with the level of anticipation and institutional backing as Monad (MON). Despite a broader market downturn that has erased over $1.2 trillion from the total crypto market cap, Monad has managed to capture the spotlight. Its successful mainnet launch on November 24, 2025, coupled with a massive $269 million token sale on Coinbase that attracted nearly 86,000 participants, has positioned it as one of the most talked-about projects of the year. Monad promises to break the scalability trilemma without sacrificing the familiar environment of the Ethereum Virtual Machine (EVM). This article provides a comprehensive analysis of Monad, delving into its underlying technology, the value proposition behind its native MON token, its tokenomics, and its potential to carve out a sustainable niche in the fiercely competitive Layer-1 landscape.

What is Monad?

Monad is a high-performance

Ethereum Virtual Machine (EVM) compatible Layer-1 blockchain engineered to deliver unprecedented transaction speed and scalability while maintaining full compatibility with Ethereum's ecosystem. The project aims to solve the long-standing blockchain trilemma, which is balancing scalability, security, and decentralization, by re-architecting the blockchain stack from the ground up. Unlike

Layer-2 scaling solutions that build on top of Ethereum, Monad is a standalone blockchain that seeks to offer a superior foundational layer.

A key differentiator for Monad is its team's background. The core developers, including CEO Keone Hon and CTO James Hunsaker, hail from Jump Trading, a renowned high-frequency trading firm. This experience in building low-latency, high-throughput financial systems is deeply embedded in Monad's design philosophy, giving it unique credibility in its pursuit of institutional-grade blockchain infrastructure.

The Core Technology Behind Monad: How It Works

Monad's performance claims are not merely incremental improvements; they leap forward, targeting 10,000 transactions per second (TPS) and achieving transaction finality in about one second. This is made possible by several groundbreaking technological innovations that work in concert.

Parallel Execution: Traditional blockchains like Ethereum process transactions sequentially, creating a majorbottleneck. Monad introduces an optimistic parallel execution engine. This allows the network to process multiple non-conflicting transactions simultaneously, dramatically increasing throughput. The system assumes transactions are independent and processes them in parallel. If a conflict is detected (e.g., two transactions accessing the same smart contract state), only the affected transactions are re-executed in the correct order, ensuring state consistency without sacrificing the gains from parallel processing.

Asynchronous Execution and Pipelining: Monad decouples the consensus mechanism from the transaction execution. In many blockchains, validators must execute all transactions in a block before reaching consensus, which slows down block production. In Monad, consensus on the

order of transactions is achieved first, and their execution happens separately and in parallel. This pipelining of tasks allows the network to make progress on multiple fronts at once, optimizing hardware usage and reducing latency.

MonadBFT Consensus: The network is secured by MonadBFT, a customized version of the HotStuff consensus algorithm. This Byzantine Fault Tolerance (BFT) protocol is optimized for low latency and fast finality. It features single-slot finality, meaning a block is finalized in one consensus round, and includes leader rotation and timeout mechanisms to ensure the network remains live and resilient even if some validators fail.

MonadDB: To support its high-speed execution engine, Monad requires a powerful state management system. MonadDB is a custom-built state storage layer designed specifically for blockchain workloads. It utilizes a versioned key-value store and is optimized for solid-state drives (SSDs), enabling low-latency read/write operations that are essential for handling the vast amount of data generated by parallel transaction processing.

Why Monad is Gaining Attention?

Monad's rise to prominence is fueled by a powerful combination of technical ambition, strong financial backing, and strategic market positioning.

Institutional and Financial Backing: Before its mainnet launch, Monad Labs had already raised over $225 million from top-tier venture capital firms like Paradigm and Electric Capital. This was followed by a highly publicized public token sale on Coinbase that raised another $269 million, demonstrating massive retail and institutional demand and providing the project with a formidable war chest for ecosystem development.

EVM Compatibility as a Strategic Advantage: Monad’s full EVM bytecode compatibility is a critical feature. It allows developers from the vast Ethereum ecosystem to seamlessly migrate their existing dApps (written in Solidity and using standard Ethereum tooling like MetaMask) to Monad with minimal changes. This grants Monad immediate access to the largest developer community in crypto, bypassing the cold-start problem that non-EVM chains often face.

Addressing a Clear Market Need: As decentralized applications become more complex and user bases grow, the limitations of existing blockchains in terms of throughput and cost become more apparent. Monad positions itself as a scalable base layer for high-frequency DeFi, gaming, and tokenized assets, offering a compelling alternative for developers and users frustrated by network congestion and high fees.

MON Tokenomics: Supply, Distribution, and Utility

The MON token is the native asset of the Monad network, with a total fixed supply of 100 billion tokens. Its economic model is designed to balance incentives for long-term growth with market stability.

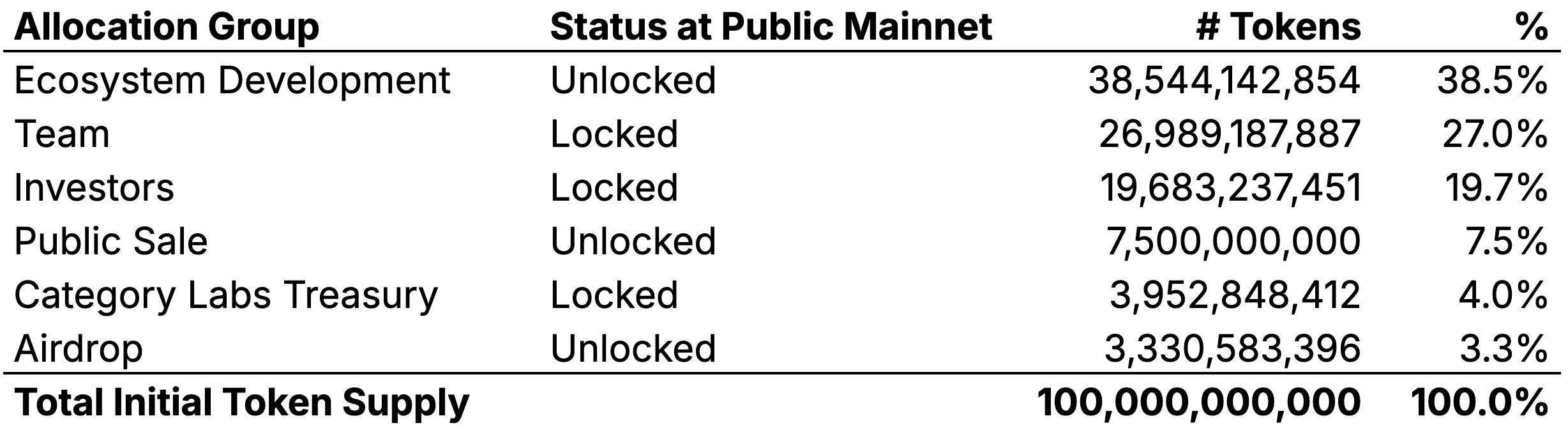

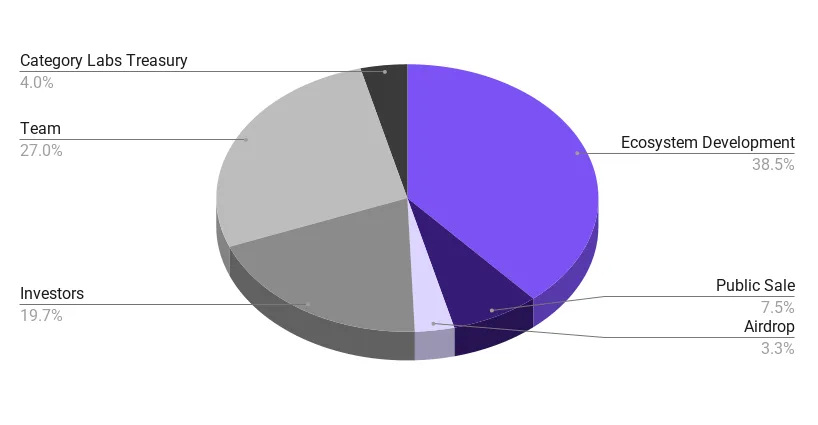

Token Allocation: The distribution is as follows: 38.5% is allocated to ecosystem development; 27% to the team; 19.7% to early investors; 7.5% was sold in public sales; 4% is reserved for the project treasury; and 3.3% was distributed via airdrops. This model has been described as balanced, though it's noted that a significant portion (team, investors, treasury) is held internally.

Circulating Supply and Unlocks: At the mainnet launch, only approximately 10.8% of the total supply entered circulation. Crucially, 50.6% of the total supply—comprising team, investor, and treasury allocations—remains locked and is subject to vesting schedules, with unlocks starting in the second half of 2026 and continuing through 2029. This structure is designed to prevent early, large-scale sell-offs.

Token Utility and Mechanics: The MON token has several core functions:

-

Network Gas: It is used to pay for transaction fees and smart contract execution on the network.

-

Staking: Holders can stake MON to secure the Proof-of-Stake (PoS) network and earn rewards.

-

Governance: MON is expected to grant holders voting rights in future protocol governance decisions.

-

Value Accrual: The network implements an EIP-1559 fee-burning mechanism, which burns a portion of the base transaction fee, potentially making MON deflationary during periods of high network usage.

Use Cases and Key Features

Monad's architecture is tailored to support a new class of high-performance decentralized applications.

High-Throughput DeFi: The combination of low latency (fast finality) and high TPS makes Monad an ideal environment for decentralized exchanges (DEXs) with order book models, high-frequency trading strategies, and sophisticated lending protocols that require instantaneous liquidation. At launch, the ecosystem already included DeFi projects like Uniswap and Curve.

Gaming and Social Applications: Applications that involve many users performing simultaneous, in-game actions or social interactions can benefit greatly from parallel execution, which prevents network congestion during peak activity.

Institutional and Real-World Assets (RWA): Monad is explicitly targeting institutional use cases, marketing itself as "engineered for Institutions". Its infrastructure supports stablecoin payments (like USDC) and the tokenization of real-world assets, such as the tokenized equity markets being built by partners like Blockstreet.

Multichain Expansion with Wormhole: Shortly after launch, MON became available on the Solana blockchain via Wormhole's Native Token Transfer (NTT) framework. This cross-chain interoperability allows MON holders to access Solana's deep liquidity and vibrant ecosystem without causing fragmentation, significantly broadening the token's utility and reach from day one.

Should You Buy MON? A Risk-Reward Analysis

Investing in a new Layer-1 token like MON involves weighing its significant potential against substantial risks.

The Bull Case: Proponents point to Monad's best-in-class technology, experienced team, and massive financial backing as key strengths. Its EVM compatibility provides a clear path for ecosystem growth, and tokenomics, with a majority of tokens locked for years, are designed to align long-term interests. If Monad can successfully attract developers and achieve significant network adoption, the MON token could see substantial appreciation.

Key Risks and Challenges:

Fierce Competition: The Layer-1 space is overcrowded with established players like Solana and Ethereum, alongside other well-funded newcomers. Monad's performance narrative is no longer unique, and it must prove that it can differentiate itself beyond technical specifications.

-

Ecosystem Development: A blockchain is only as valuable as the applications built on it. While over 280 projects were reported on the testnet, Monad's long-term success hinges on its ability to transition these projects to the mainnet and attract more developers to build unique and compelling dApps that create a sustainable economic loop.

-

Market Conditions and Token Unlocks: MON launched during a severe market downturn, which adds selling pressure. Furthermore, while token locks prevent immediate dumping, the future unlocking of team and investor tokens starting in late 2026 represents a known, future potential source of sell pressure that investors must monitor.

Recent Hot News and Price Action

Monad's launch week was a whirlwind of activity and volatility. The token debuted at a public sale price of $0.025. Upon distribution to buyers and listing on major exchanges like Coinbase, the price experienced initial volatility, dipping to around $0.02 before rallying sharply by approximately 46% to trade around $0.03068 by the afternoon of November 25. This price movement reflected initial selling pressure followed by strong buying interest.

The 24-hour trading volume surged to around $644 million, giving MON a market capitalization of roughly $332 million and a Fully Diluted Valuation (FDV) of approximately $3.06 billion at that price level. This active trading indicates significant market interest and liquidity from the outset.

MON Price Analysis and Future Trajectory

Predicting the price of a newly launched asset is inherently challenging. Analysts, before the launch, had outlined several potential scenarios based on Fully Diluted Valuation (FDV).

-

Bullish Scenario ($0.25 - $0.35): This scenario would require Monad to exceed expectations of its mainnet performance, rapidly grow its Total Value Locked (TVL) into billions, and benefit from a broader crypto market recovery. This would position its FDV alongside other major Layer-1s like Sui.

-

Base Scenario ($0.13 - $0.20): This is considered a more realistic outcome if Monad executes its roadmap as planned, with steady ecosystem expansion and stable market conditions.

-

Bearish Scenario ($0.08 - $0.12): This could materialize if the project faces delays, fails to retain developer interest, or if the crypto bear market deepens, leading to sustained selling pressure.

It is crucial to note that these are pre-launch models. The token's actual trading price will be the ultimate determinant, influenced by network metrics like daily active users, transaction volume, and TVL, as well as broader macroeconomic factors affecting the crypto market.

Conclusion

Monad has entered the blockchain arena with one of the most impressive launches of 2025, backed by formidable technology, a seasoned team, and unprecedented financial support. Its vision of a high-performance, EVM-compatible Layer-1 addresses a genuine need in the industry. However, the project's true test is just beginning. The technological narrative, while powerful, is no longer sufficient to guarantee success in an increasingly mature and competitive market.

The ultimate determinant of Monad's long-term value—and by extension, the value of the MON token—will not be its theoretical throughput, but its practical adoption. Can it cultivate a vibrant, unique, and self-sustaining ecosystem of applications that attracts and retains users? Can it navigate the scheduled token unlocks without destabilizing the market? While the risks are real, Monad has positioned itself as a serious and well-equipped contender. For investors and observers alike, the focus should now shift from the promise of the whitepaper to tangible growth and activity on its newly launched mainnet.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.