On November 12th, the market is currently characterized by a tug-of-war between short-term bearish pressure and longer-term bullish potential. Meanwhile, PMorgan (JPM) and Singapore’s DBS Bank (D05) are developing a framework to let institutional clients move tokenised deposits across different blockchain networks. Coinbase Global has said it will not proceed with plans to acquire BVNK, a London-based stablecoin infrastructure startup, unwinding what had been a roughly $2b transaction. Lighter led the market with a trading volume of $10.7 billion in the past 24 hours, demonstrating its strong appeal.

Crypto Market Overview

BTC (-2.99% | Current Price: $103,318.68)

Bitcoin is at a critical juncture, with its short-term trajectory hinging on a few key price levels and macroeconomic factors. Now, bulls may be losing patience and that a decisive recovery above $116,000 is needed to reinvigorate the market. On the support side, the recent trading cycle shows a bottom at $99,013, making the $99,000 - $100,000 zone a critical area for buyers to defend . Resistance levels are identified at $103,462, $105,540, and $106,995. With the current macro backdrop, with mixed communication from the Federal Reserve, supports a period of sideways consolidation as a necessary stabilizing phase. Despite the recent pullback, some analysts remain optimistic. Some traders predict a return to green candles, citing Bitcoin's historical average gain of 41.78% in November. Some forecasts even point to a potential 24.83% surge, which could push BTC toward the $125,700 level.

The market is closely watching the Federal Reserve. The probability of a 25-basis-point rate cut in December has decreased to 67.9%, down from over 90% in previous months . Fed rate cuts are generally bullish for crypto, so any hesitation can spook participants.

On November 11th, Bitcoin exchange-traded funds (ETFs) registered an inflow of $299.8 million. Fidelity's FBTC ETF saw an inflow of $165.9 million.

ETH (+0.01% | Current Price: $3626.58)

From the latest data as of November 12, 2025, Ethereum (ETH) is at a critical technical juncture. After a short-term price drop, there are some signs of positive capital inflows, but overall market sentiment remains cautious. $3,400 is the key support level in the near term, followed by $3,330. Holding above this level could establish a basis for a rebound. The first resistance level is around $3,520. A successful break above this level could target the $3,550 to $3,600 range.

On November 11th, ETH ETFs experienced a total net outflow of $87.3 million, including an outflow of $3.4 million from Fidelity's FETH.

Altcoins

The altcoin market presents a mixed picture, with a clear divergence in performance and momentum among major tokens. The low Altcoin Season Index reading of 28 confirms that this is not a broad-based altcoin boom. Investors are exhibiting risk aversion, favoring Bitcoin's relative safety over speculative altcoin investments.

The Fear & Greed Index is sitting at 26, indicating a state of "Extreme Fear" among market participants . Historically, such levels can sometimes precede significant price recoveries. The market is still recovering from the October 10 crash, which wiped out roughly $19 billion in leveraged positions. This has likely made the market structurally healthier by removing excess leverage.

Macro Data

The Federal Reserve has already begun its interest rate cut cycle, and its ongoing quantitative easing (QT) policy has ended. This means that global market liquidity is becoming more relaxed, which is theoretically very beneficial to high-risk assets such as Bitcoin. However, the recent performance of the cryptocurrency market has not fully kept pace with the gains of other risky assets. This indicates that, in addition to macro liquidity, the market needs stronger internal catalysts to attract large-scale capital inflows. The much-watched Crypto Markets Structure Act and the approval process for a batch of non-Bitcoin ETFs (a total of 16 applications) have been delayed due to factors such as the US government shutdown, with the timeline pushed back to later, perhaps even later, in 2025. These delays directly impact the market's short-term performance.

On November 11th, the S&P 500 gained 0.21%, standing at 6,846.61 points; the Dow Jones Industrial Average increased 1.18% to 47,927.96 points, and the Nasdaq Composite fell 0.25% to 23,468.30 points.

Trending Tokens

LSK Lisk (+43.12%, Circulating Market Cap: $73.42 Million)

LSK is trading at $0.1797, up approximately 57.33% in the past 24 hours. Lisk is an Ethereum Layer 2 blockchain built on the Optimism Superchain and designed to support founders in high-growth markets who are launching real-world applications. Lisk goes beyond providing infrastructure; it is a full-stack growth platform that offers access to funding, strategic support and integrated resources through its chain, DAO and founder-focused initiatives. LSK broke out of a descending wedge pattern, triggering a 258% surge in open interest to $38.9M and $1.6M in short liquidations as bears capitulated. The RSI14 hit 77.08 (approaching overbought), while the MACD histogram turned positive (+0.012558). Technical traders interpreted the breakout above $0.32 as a bullish signal, amplified by negative funding rates (-1.96%) that forced short positions to close. The 5,500% spike in 24h volume to $476.6M confirms strong speculative interest.

RESOLV Resolv (+13.97%, Circulating Market Cap: $42.76 Million)

RESOLV is trading at $0.1346, up approximately 13.97% in the past 24 hours. Resolv is a decentralized stablecoin protocol offering a delta-neutral stablecoin (USR) backed by ETH/BTC and an insurance liquidity pool (RLP), governed by the $RESOLV token to align incentives across its ecosystem. Resolv's recent price increase is driven by a combination of technical breakouts, fundamental improvements, and market sector rotation. Whether its price can continue to rise depends on whether it can hold key support levels (e.g., the $0.145-$0.155 range) and digest short-term overbought pressure.

COMMON COMMON (+8.64%, Circulating Market Cap: $26.34 Million)

COMMON is trading at $0.01127, up approximately 8.64% in the past 24 hours. Common is an AI-native workspace where every community, project, and thread is tokenized, so 1.7 million users (across 40 k communities) and their AI agents can do deep research, trade, code on feature requests, and earn on every idea or bounty in one place.

Market News

JPMorgan and DBS Bank Team Up on Cross-Border Tokenised Deposit Framework

JPMorgan (JPM) and Singapore’s DBS Bank (D05) are developing a framework to let institutional clients move tokenised deposits across different blockchain networks.

The system would link DBS Token Services with JPMorgan's Kinexys Digital Payments project, enabling cross-bank, cross-chain settlements, the banks said in an emailed announcement on Tuesday.

Both banks already allow instant payments within their own blockchain systems. This new effort would connect those closed networks, letting clients send value between institutions without relying on traditional payment rails.

JPMorgan, which made its first moves in blockchain finance several years ago, recently took a step further into decentralized finance (DeFi), issuing a USD deposit token on Coinbase’s Base blockchain, a public layer-2 ledger. The new tie-up would allow a JPMorgan client to use its deposit tokens on the Base blockchain to pay a DBS client, for example, who could then redeem or hold those tokens on DBS’s platform.

The move reflects a growing effort among major banks to make digital deposits work seamlessly across systems and jurisdictions. Roughly a third of banks worldwide have introduced or are exploring tokenised deposit projects, according to the Bank for International Settlements (BIS).

Coinbase Abandons Plan To Acquire UK Fintech BVNK In $2B Deal

Coinbase Global has said it will not proceed with plans to acquire BVNK, a London-based stablecoin infrastructure startup, unwinding what had been a roughly $2b transaction.

Talks had advanced in recent weeks. Fortune reported the companies were in late-stage discussions pending due diligence, and the firms entered exclusivity in October, which barred BVNK from engaging other bidders. It was not immediately clear why the deal collapsed. The deal was expected to be closed later this year or early next, given the pace of diligence and the exclusivity terms.

The move ends what would have been one of the largest stablecoin-focused acquisitions to date. BVNK helps customers use stablecoins for payments and cross-border transfers, and had become a target as exchanges and payments companies race to build settlement rails around dollar-linked tokens.

Fortune previously noted both Coinbase and Mastercard were in advanced discussions about a BVNK deal, signaling strong demand for assets that can speed settlement and lower costs in global payments. The decision now removes a key uncertainty from Coinbase’s short-term strategy. Even so, the exchange remains central to rising stablecoin flows. Meanwhile, BVNK continues to be well-funded and active in a market still attracting major buyers.

Looking ahead, investors will be watching closely. BVNK may reopen talks with new bidders, while Coinbase could turn its focus to smaller acquisitions or partnerships to expand its stablecoin and payments business.

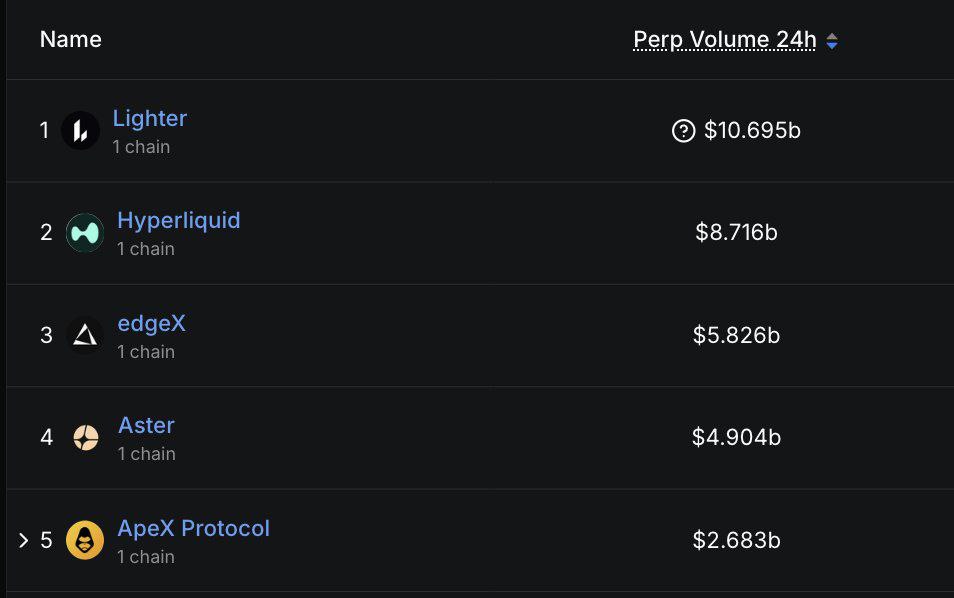

Lighter Leads 24h Perp DEX Volume at $10.7B, Followed by Hyperliquid at $8.7B and edgeX at $5.8B.

According to the latest data, Lighter led the market with a trading volume of $10.7 billion in the past 24 hours, demonstrating its strong appeal.

Hyperliquid followed closely behind, maintaining its second-place position with a trading volume of $8.7 billion. Emerging trading platform edgeX also performed well, ranking third with a trading volume of $5.8 billion, indicating its rapid growth into a formidable competitor in the field.

This trading volume ranking clearly demonstrates that current investor preferences for decentralized perpetual contract trading are concentrating on platforms with high capital efficiency and superior user experience. Lighter's leading position is attributed to its innovative architecture and highly competitive trading costs.

Reference:

CoinMarketCap. (n.d.).

Crypto Fear & Greed Index. Retrieved November 10, 2025, from

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.