On November 10, 2025, Uniswap founder Hayden Adams, along with Uniswap Foundation leaders Devin Walsh and Kenneth Ng, unveiled the

“UNIfication” governance proposal, which is a transformative initiative designed to reshape the value accrual mechanics of the UNI token fundamentally. The proposal, which activates long-awaited protocol fees and incorporates a multi-tiered UNI token burn mechanism, triggered an

immediate and explosive market reaction, sending the price of UNI soaring by over 50% and reigniting investor enthusiasm for the decentralized exchange’s native asset. This move marks a pivotal shift for Uniswap, which has processed a cumulative volume exceeding $4 trillion but has historically faced criticism for the UNI token’s limited value capture.

UNIfication Explained

Uniswap Labs and the Uniswap Foundation are to make a joint governance proposal that turns on protocol fees and aligns incentives across the Uniswap ecosystem, positioning the Uniswap protocol to win as the default decentralized exchange for tokenized value.

The protocol has processed ~$4 trillion in volume, made possible by thousands of developers, millions of liquidity providers, and hundreds of millions of swapping wallets. But the last several years have also come with obstacles: the legal battles and navigated a hostile regulatory environment under Gensler’s SEC. This climate has changed in the US, and milestones like Uniswap governance adopting

DUNI, the

DUNA, have prepared the Uniswap community for its next steps.

This proposal comes as DeFi reaches an inflection point. Decentralized trading protocols are

rivaling centralized platforms in performance and scale, tokens are going mainstream, and institutions are building on Uniswap and other DeFi protocols.

This proposal establishes a long-term model for how the Uniswap ecosystem would operate, where protocol usage drives UNI burn and Uniswap Labs focuses on protocol development and growth. We propose to:

-

Turn on Uniswap protocol fees and use these fees to burn UNI

-

Send Unichain sequencer fees to this same UNI burn mechanism

-

Build Protocol Fee Discount Auctions (PFDA) to increase LP returns and allow the protocol to internalize MEV

-

Launch aggregator hooks, turning Uniswap v4 into an onchain aggregator that collects fees on external liquidity

-

Burn 100 million UNI from the treasury representing the approximate amount of UNI that would have been burned if fees were on from the beginning

-

Focus Labs on driving protocol development and growth, including turning off our interface, wallet, and API fees and contractually committing to only pursue initiatives that align with DUNI interests

-

Move ecosystem teams from the Foundation to Labs, with a shared goal of protocol success, with growth and development funded from the treasury

-

Migrate governance-owned Unisocks liquidity from Uniswap v1 on mainnet to v4 on Unichain and burn the LP position, locking in the supply curve forever

The Core of UNIfication: Protocol Fees, Token Burns, and Governance Restructuring

Activating the Protocol Fee Switch

The cornerstone of the proposal is the formal activation of the

protocol fee switch, a feature embedded in Uniswap’s code but never enabled. This mechanism will allow the protocol to capture a portion of the trading fees generated across its platforms, a monumental shift from the existing model where fees accrued solely to liquidity providers. The fee activation will be implemented in phases, commencing with the v2 and v3 pools on Ethereum, followed by a rollout to Layer 2 deployments (L2s), other Layer 1 chains (L1s), v4, and UniswapX. This measured approach ensures systematic integration across the entire Uniswap ecosystem.

A Multi-Pronged Token Burn Mechanism

The generated protocol fees will be directed toward an

automated UNI token burn process, creating a direct, usage-driven deflationary pressure on the token’s supply. The proposal further augments this burn mechanism with several key components. First, it mandates a

one-time, retroactive burn of 100 million UNI tokens from the project’s treasury. This substantial figure is intended to symbolically represent the tokens that would have been burned had the fee mechanism been active since the token’s launch in 2020. Second,

sequencer fees from Unichain, Uniswap’s proprietary Layer 2 network, will be entirely funneled into the same burn mechanism. Unichain has generated approximately $7.5 million in annualized fees since its launch nine months ago, providing a consistent revenue stream for these burns.

Governance Unification and Strategic Reorganization

Beyond token economics, the “UNIfication” proposal seeks to streamline the ecosystem’s organizational structure. The plan involves merging the

non-profit Uniswap Foundation into Uniswap Labs, the for-profit entity leading protocol development. This consolidation is designed to align the teams under a single, focused growth strategy, thereby eliminating potential operational redundancies and clarifying the chain of command. The new, unified board will be expanded to five members, including Hayden Adams, Devin Walsh, Ken Ng, Callil Capuozzo, and Hart Lambur. Concomitantly, Uniswap Labs will cease collecting fees from its frontend interface, wallet, and API, forgoing a revenue stream that has cumulatively generated over $137 million, to further align its incentives with the broader protocol's success.

Market Response and Price Analysis

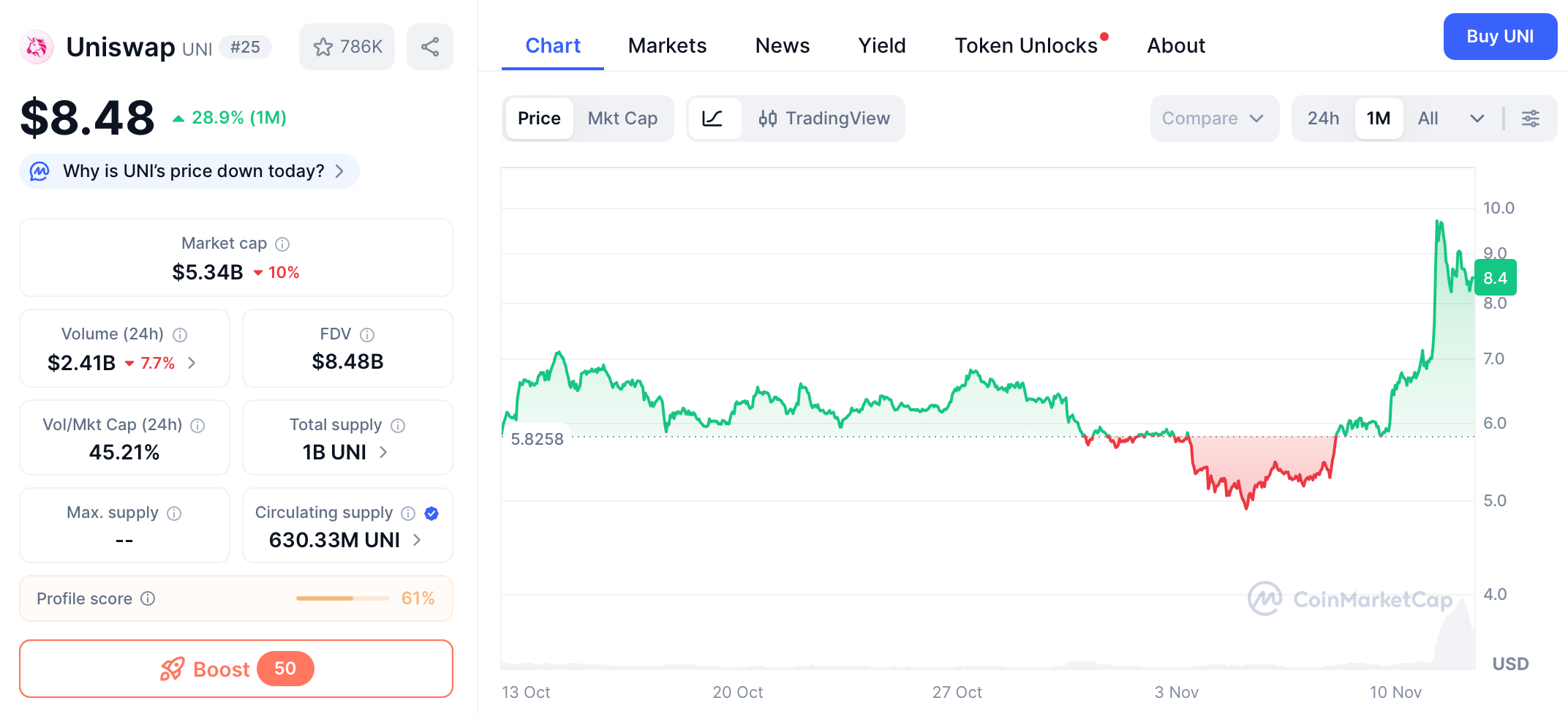

Uniswap price chart. Source: CoinMarketCap

The announcement acted as a powerful catalyst for the UNI token, which had struggled with stagnant price action for an extended period. The market reacted with a sharp and decisive upward surge, with the token’s price catapulting from approximately $5.80 to breach $10 within hours. Although the price later stabilized near the $8.20–$8.65 range, the rally still represented a remarkable 24-hour gain of 30-50%, accompanied by a dramatic spike in trading volume that underscored intense market participation.

This price surge propelled UNI’s market capitalization past $6 billion, allowing the token to forcefully re-enter the ranks of the top 30 crypto assets. From a technical analysis perspective, the rally was significant enough for UNI to reclaim its 50-day and 100-day moving averages, key indicators of medium-term momentum. However, analysts note that the token still faces a formidable resistance zone between $9.50 and $10.00, which coincides with the 200-day moving average. A sustained breakout above this level is widely viewed as critical for confirming a longer-term bullish trend reversal. The significant trading volume and the presence of strong accumulation pressure below the $6.00 level suggest the market has established a solid foundation for future price appreciation.

Strategic Rationale and Competitive Landscape

Navigating a Shifting Regulatory Environment

For years, the activation of the fee switch was stalled, with Hayden Adams explicitly citing a

“hostile regulatory environment” as the primary impediment. The U.S. Securities and Exchange Commission (SEC), under former Chair Gary Gensler, had targeted Uniswap and other DeFi protocols, creating significant legal uncertainty. The decision to move forward with the “UNIfication” proposal at this time is therefore widely interpreted as a strategic response to

improving regulatory clarity. This shift was previewed in August 2025 when the Uniswap Foundation proposed adopting the DUNA DAO framework, a move perceived as proactively structuring the organization for compliance and paving the way for fee activation.

Countering Competition and Enhancing Value Capture

The proposal also addresses Uniswap’s need to remain competitive. The decentralized exchange landscape has become increasingly crowded, with rivals like Aerodrome Finance implementing their own value-accrual mechanisms for token holders. By finally enabling protocol fees and token burns, Uniswap is not only responding to years of community pressure but also executing a strategic pivot to

fortify its dominance in the DEX sector. The proposal effectively transforms UNI from a pure governance token into a token with direct value accrual through cash flow and deflationary supply dynamics, enhancing its appeal to a broader set of investors.

Potential Impacts and Future Challenges

Implications for Liquidity Providers (LPs)

While the proposal is decidedly bullish for UNI token holders, it introduces complex dynamics for Liquidity Providers. The diversion of a portion of trading fees to the protocol could potentially

reduce the earnings for LPs. In a competitive liquidity environment, this creates a risk that some LPs may migrate their capital to rival platforms that offer higher fee shares, which could, in turn, impact liquidity depth on Uniswap. The proposal seeks to mitigate this risk through innovative mechanisms like the

Protocol Fee Discount Auctions (PFDA), which are designed to transform MEV revenue into additional yields for LPs and create a more favorable outcome for them.

Broader DeFi Precedent and Governance Scrutiny

The “UNIfication” proposal is being closely watched across the DeFi industry, as it could establish a

new standard for value capture by major decentralized protocols. A successful implementation may pressure other blue-chip DeFi projects to adopt similar fee-and-burn models to remain competitive for investor capital. However, the governance process itself faces scrutiny. Despite a structured three-stage process (Temperature Check, Consensus Check, On-Chain Vote), concerns about

voter concentration persist. Data indicates that approximately 11 wallets control over 50% of Uniswap’s voting power, highlighting a centralization risk that could influence the outcome and perceived legitimacy of the vote.

Conclusion:

The “UNIfication” proposal represents the most significant evolution of the Uniswap protocol and its token since UNI’slaunch in 2020. By activating fees, implementing a robust burn mechanism, and unifying its organizational structure, Uniswap is taking a decisive step to transition UNI from a governance token with limited utility into a

productive asset with embedded cash flow and deflationary characteristics. The market’s initial response—a 50% price surge—demonstrates strong approval for this new direction.

The proposal’s success is not yet guaranteed, as it must pass a community vote, and its long-term effects on liquidity providers and competitive positioning remain to be seen. Nevertheless, it signals a maturation of the DeFi space, where leading protocols are now prioritizing

sustainable economic models and direct value distribution to stakeholders. For Uniswap, this is a bid to secure its status as the default global venue for decentralized trading of tokenized value. For the wider crypto ecosystem, it is a case study of how foundational projects can adapt and innovate to thrive in an increasingly competitive and regulated world.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.