The decentralized finance (DeFi) landscape continues to evolve with innovative protocols, and Momentum (MMT) has rapidly emerged as a standout project within the Sui ecosystem. Since its beta launch in March 2025, Momentum has positioned itself not merely as another decentralized exchange (DEX) but as a comprehensive global financial operating system for the tokenized future. With impressive growth metrics—including over 2.1 million users and $200 billion in total value locked (TVL)—alongside recent listings on major exchanges like Bitget and Binance, Momentum is capturing significant attention in the DeFi space. This article explores MMT's fundamentals, technology, tokenomics, and market potential.

What Is Momentum?

Momentum is a

decentralized finance protocol built on the Sui blockchain to create a unified financial infrastructure for tokenized assets. It functions as a

community-driven ecosystem that combines advanced liquidity strategies with next-generation tokenomics. The project has gained substantial traction, processing

cumulative trading volumes exceeding $27 billion as of November 5, 2025.

Beyond its core DEX functionality, Momentum offers an expanding suite of DeFi solutions, including

automated yield vaults,

liquid staking, and

institutional-grade compliance tools through its Momentum X module. The platform is backed by prominent crypto organizations such as

Coinbase Ventures,

Circle, and

OKX Ventures, providing credibility and resources for continued development.

The Technology Behind MMT

Concentrated Liquidity Market Maker (CLMM)

At the heart of Momentum's architecture is its

Concentrated Liquidity Market Maker model, a significant improvement over traditional automated market makers. Unlike standard DEXs that spread liquidity across the entire price curve, Momentum's CLMM allows

liquidity providers to concentrate their capital within specific price ranges. This design results in

tighter spreads,

deeper liquidity at active trading prices, and significantly

reduced slippage for traders.

ve(3,3) Governance Model

Momentum implements a

ve(3,3) governance model that combines vote-escrowed (ve) token mechanics with game-theoretic incentives. Users can lock their MMT tokens to receive

veMMT, which grants

voting rights over liquidity pool incentives,

protocol fee sharing, and influence over

ecosystem development. This model aligns long-term participant interests with protocol health by rewarding committed stakeholders while discouraging short-term "farm-and-dump" behavior.

Multi-Layer Architecture

The protocol features

sophisticated multi-layer architecture that supports various financial functions, including

decentralized trading,

yield optimization vaults, and

cross-chain interoperability through integration with Wormhole. This infrastructure enables Momentum to function as a comprehensive financial operating system rather than just a trading venue.

Why Momentum MMT Stands Out

Dominant Position in Sui Ecosystem

Momentum has established itself as a

core liquidity hub within the Sui ecosystem, accounting for

24%-43% of Sui's total DeFi volume. Its TVL ranging between

$3.57-6 billion and daily trading volume often exceeding

$1 billiondemonstrates its central role in Sui's DeFi landscape.

Real-World Asset (RWA) Integration

A key differentiator for Momentum is its focus on

real-world asset tokenization, including traditional assets like

stocks,

bonds, and

real estate. This strategic direction positions Momentum at the intersection of traditional and decentralized finance, potentially unlocking trillions of dollars in traditional asset value for the DeFi ecosystem.

Institutional-Grade Infrastructure

Through Momentum X, the protocol offers

institutional-grade tools featuring

on-chain compliance and

identity verification via zero-knowledge proofs. This focus on regulatory compatibility addresses a critical barrier to institutional DeFi adoption.

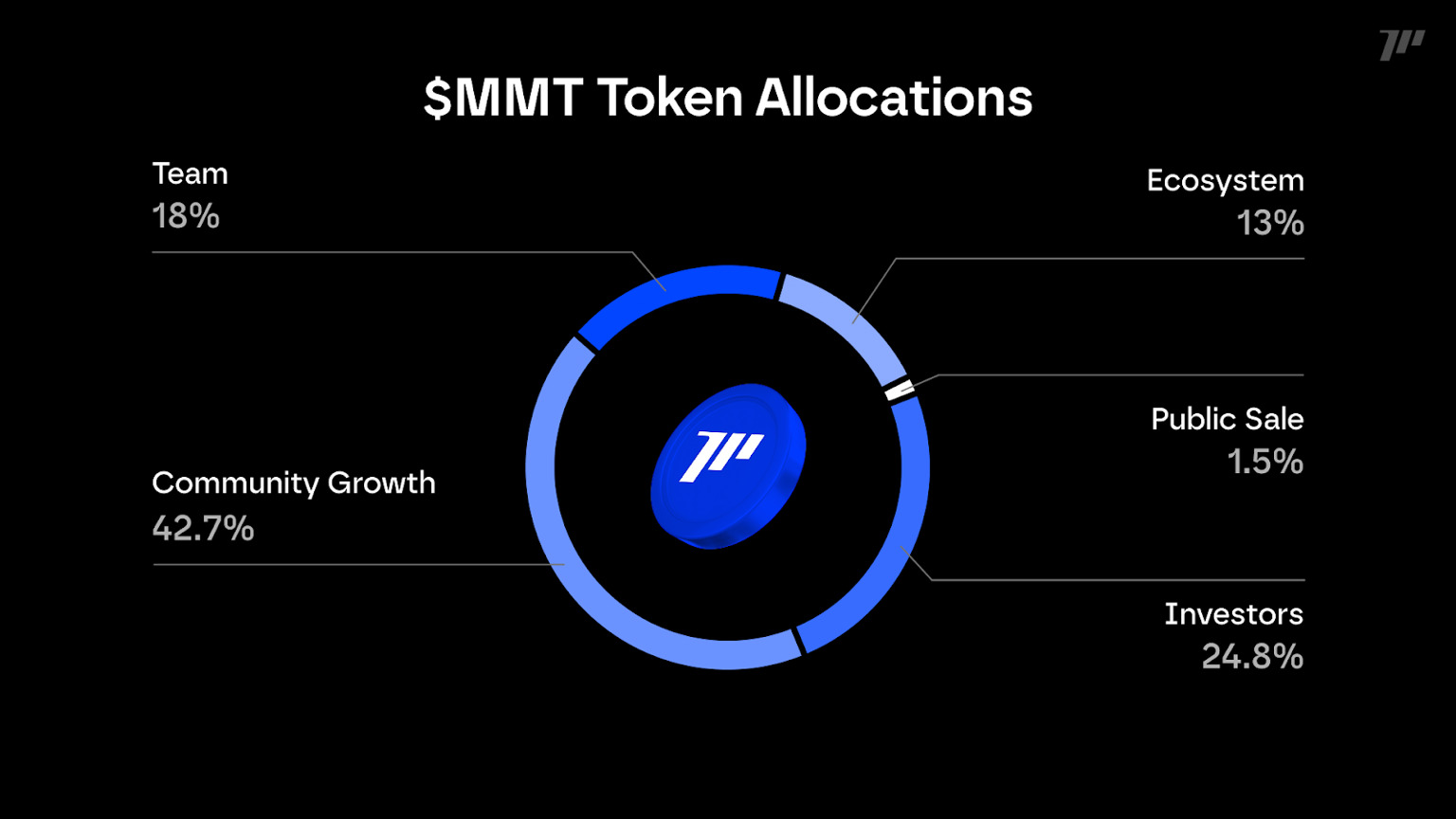

MMT Tokenomics

Token Distribution

MMT has a

fixed total supply of 1 billion tokens, with an

initial circulating supply of approximately 204 million(20.4% of total supply) at its November 2025 listing. The distribution follows a carefully structured model:

-

Community Growth: 42.72% (9.91% unlocked at TGE, remainder over 60 months)

-

Institutional Investors: 24.78% (0% unlocked at TGE, 12-month cliff, then 48-month linear release)

-

Team Allocation: 18% (0% unlocked at TGE, 48-month vesting)

-

Ecosystem Fund: 13% (9% unlocked at TGE, remainder over 24 months)

-

Public Sale: 1.5% (fully unlocked at TGE)

Value Accumulation Mechanics

The MMT token is designed to capture value through multiple revenue streams within the ecosystem.

veMMT holders earn a share of protocol fees generated from trading activities, while also influencing

emission distributions to liquidity pools. The project established a

fully diluted valuation target between $250-350 million during its initial phases, benchmarked against similar ve(3,3) protocols.

Use Cases and Features

Core Utilities

-

Governance: veMMT holders participate in protocol decisions through voting mechanisms

-

Fee Sharing: Locked MMT tokens earn a portion of protocol revenues

-

Liquidity Incentives: MMT distributes rewards to liquidity providers across various pools

-

Platform Access: The token grants exclusive rights to participate in Launchpad sales and special features

Ecosystem Products

-

Momentum DEX: The flagship concentrated liquidity DEX

-

Automated Vaults: Yield-optimizing strategies that automatically compound returns

-

Liquid Staking: Allows users to stake assets while maintaining liquidity

-

Token Generation Lab: Launchpad for new projects within the Sui ecosystem

-

MSafe Integration: Multi-signature security infrastructure for asset management

Investment Potential: Is MMT Worth Buying?

Strengths and Opportunities

Momentum's

established product-market fit within the Sui ecosystem,

robust tokenomics designed for long-term sustainability, and

strategic focus on RWA represent significant growth catalysts. The protocol's

impressive user adoption (over 2.1 million users) and

substantial trading volumes demonstrate real utility beyond speculative interest.

Backing by

reputable investors, including Coinbase Ventures and Circle, provides both credibility and resources for continued development. The project's

multi-chain expansion plans via Wormhole integration could significantly expand its addressable market beyond the Sui ecosystem.

Risks and Challenges

The

initial token unlock structure presents a potential near-term risk, with approximately

20.41% of tokens unlocked in the first month post-TGE. If ecosystem growth fails to keep pace with token releases, this could create selling pressure.

The protocol's

dependence on the Sui ecosystem represents both a strength and a potential vulnerability if Sui fails to maintain its competitive position against other Layer 1 networks. Additionally, the

complex ve(3,3) model requires sustained community participation to function effectively, which could diminish during market downturns.

Recent News and Market Performance

Major Exchange Listings

November 2025 marked significant milestones for MMT, with

listings on both Bitget and Binance on November 4. Bitget launched

perpetual contracts for MMT, while Binance opened

spot trading with MMT/USDT, MMT/USDC, MMT/BNB, and MMT/TRY pairs.

Price Action Analysis

Following its exchange debut, MMT reached an

initial peak of $4.229 before stabilizing around

$1.83 according to data from early November 2025. The token's

market capitalization positioned it within the top 150 cryptocurrencies by market cap, with

24-hour trading volume exceeding $3.3 billion at points, indicating substantial market interest.

Ecosystem Growth Initiatives

Binance allocated

7.5 million MMT tokens for airdrops and marketing campaigns, including

5 million MMT dedicated to post-listing initiatives. The platform also conducted a

HODLer Airdrop from October 17-20, 2025, rewarding users who staked BNB or participated in yield farming.

Conclusion

Momentum MMT represents a sophisticated attempt to build a

comprehensive financial operating system rather than just another DEX. Its

technological foundation, combining CLMM with ve(3,3) governance,

established tractionwithin the Sui ecosystem, and

strategic positioning toward RWA integration creates a compelling value proposition.

While the protocol faces challenges, including

token unlock management and

ecosystem dependence, its

strong institutional backing,

rapid user adoption, and

vision for bridging traditional and decentralized finance suggest significant long-term potential. As with any cryptocurrency investment, prospective MMT holders should conduct thorough due diligence, but Momentum's execution to date positions it as a noteworthy project in the evolving DeFi landscape.

References

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.