On November 5th, the crypto market experienced a significant downturn on November 5th, characterized by a sharp drop in Bitcoin's price and a widespread rout in altcoins. The overall market sentiment has drastically shifted from greed to extreme fear, with the Crypto Fear & Greed Index plunging to a level of 20. Meanwhile, Bitcoin and Ethereum spot exchange-traded funds in the U.S. saw a combined net outflow of $797 million on Tuesday as institutional investors repositioned holdings during a market meltdown. Zynk, a stablecoin-enabled cross-border payments infrastructure firm that says it supports instant settlements without pre-funding, has raised $5 million in a seed round led by Hivemind Capital. Gemini exchange is planning to launch prediction market contracts. If approved by the US derivatives regulator, Gemini would compete with dominant players, including Kalshi and Polymarket.

Crypto Market Overview

BTC (-3.08% | Current Price: $101,763.05)

Bitcoin faced substantial selling pressure on November 5, declining 3.08% and testing a critical psychological support level. This retreat marked a significant pullback from recent highs and reflected multiple bearish catalysts converging simultaneously. The primary drivers behind BTC's weakness included persistent outflows from US spot Bitcoin ETFs, which saw $946 million in net outflows over the past week. These institutional outflows occurred against a backdrop of macroeconomic uncertainty, with a surging US dollar creating headwinds for dollar-denominated risk assets like cryptocurrencies. The strengthening dollar environment prompted capital rotations away from crypto markets as traditional safe-haven assets gained appeal among institutional allocators. From a technical perspective, Bitcoin is testing crucial support zones that could determine its near-term trajectory. The $99,500 level represents an important psychological and technical barrier that, if broken decisively, could open the path toward lower support regions. Some analysts have identified the $74,000 area as the next significant support level in a continued downturn scenario.

On November 4th, Bitcoin exchange-traded funds (ETFs) registered a net capital outflow of $566.4 million. BlackRock's IBIT ETF saw an outflow of $356.6 million.

ETH (-6.24% | Current Price: $3324.86)

Ethereum significantly underperformed Bitcoin during the sell-off, declining nearly 6% and breaking below the critical $3,600 support level. This bearish price action occurred despite generally positive fundamental developments within the Ethereum ecosystem, suggesting that technical and market structure factors dominated trading decisions: The funding rate for Ethereum perpetual futures contracts turned negative on several major exchanges, indicating that traders holding short positions were paying those with long positions. This represents a strongly bearish sentiment shift in the derivatives market and can create additional selling pressure as long positions become increasingly expensive to maintain.

Ethereum's technical structure appears fragile but not yet broken according to analysis of key indicators. The 50-day moving average has begun crossing below the 200-day moving average, forming a potentially bearish "death cross" pattern that often signals extended downward momentum. Meanwhile, the Relative Strength Index (RSI) has entered oversold territory, suggesting that the recent selling may be overextended in the short term and potentially setting the stage for a technical bounce.

On November 4th, ETH ETFs experienced a total net outflow of $219.4 million, including an outflow of $111.1 million from BlackRock ETHA and 19.9 million from Fidelity's FETH.

Altcoins

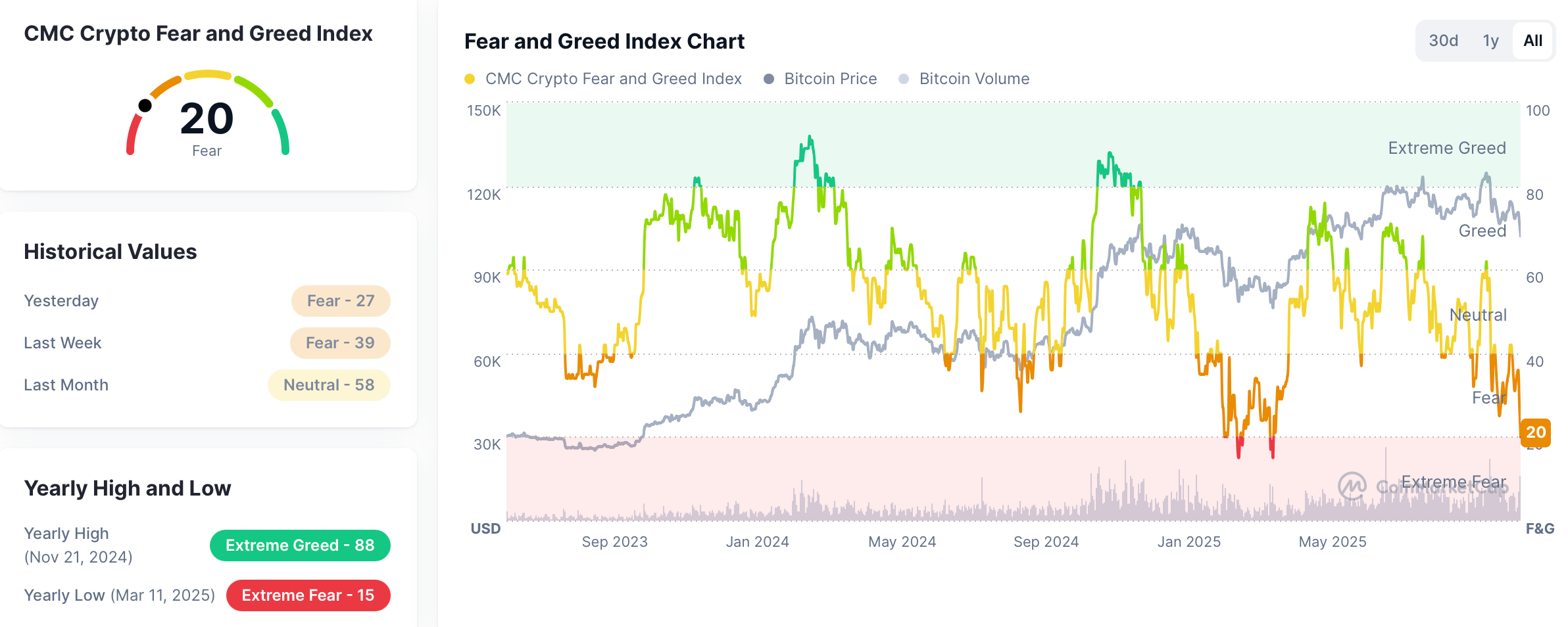

The Crypto Fear & Greed Index plummeted to 20 on November 4, 2025, standing in the fear zone. The Altcoin Seasonality Index remained in a range of 25-29, firmly indicating that the market is in a "Bitcoin Season" with little evidence of the broad-based altcoin rallies that characterized previous market cycles.

The altcoin market experienced what can only be described as a bloodbath scenario on November 5, with most sectors posting significant losses amid the Bitcoin-led downturn. The selling pressure was particularly brutal in the SocialFi sector, which led the decline with a 10.1% drop, followed by Layer2 projects (-8.48%) and DeFi tokens (-7.66%). This broad-based weakness reflected a market-wide flight to safety, with investors reducing exposure to more speculative assets during the period of elevated uncertainty and volatility. Despite the overwhelmingly negative sentiment, a handful of tokens managed to post gains, potentially signaling areas of residual strength.

Macro Data

Cryptocurrency markets faced significant macroeconomic headwinds on November 5, with the Reserve Bank of Australia holding its cash rate at 3.6% amid persistent inflation, signaling a prolonged period of restrictive monetary policy that may limit crypto market liquidity and risk appetite in the Asia-Pacific region. Simultaneously, a surge in US dollar demand pushed the greenback to a four-month high, creating a strong dollar environment that typically leads to capital outflows from crypto assets and heightened volatility in

BTC and

DeFi markets . These developments occurred against a backdrop of mixed signals from the US Federal Reserve, which implemented a modest rate cut in late October, which is the first in over a year, but subsequently tempered market expectations when Fed Chair Jerome Powell emphasized that further rate cuts were "not a foregone conclusion". Powell's warning that elevated interest rates were beginning to slow the US economy triggered a wave of caution across financial markets, prompting a risk-off shift that hit equities and crypto alike.

On November 4th, the S&P 500 fell 1.17%, standing at 6,771.55 points; the Dow Jones Industrial Average fell 0.53% to 47,085.24 points, and the Nasdaq Composite dropped 2.04% to 23,348.64 points.

Trending Tokens

RESOLV RESOLV (+41.43%, Circulating Market Cap: $19.4 Million)

RESOLV is trading at $0.06177, up approximately 29.71% in the past 24 hours. Resolv (RESOLV) is a decentralized protocol powering USR, a delta-neutral stablecoin backed by ETH and BTC, designed to generate sustainable yield through risk-segregated strategies while maintaining a tight USD peg. RESOLV’s RSI14 hit 28.61 on November 4, signaling extreme oversold conditions. The

MACD histogram flipped positive (+0.0011), confirming a bullish divergence. Traders often interpret oversold RSI and MACD crossovers as buy signals, especially in low-cap tokens. However, resistance looms near the 200-day SMA (~$0.068), which could cap gains if volume falters.

KITE Kite (+41.38%, Circulating Market Cap: $169.79 Million)

KITE is trading at $0.09432, up approximately 41.38% in the past 24 hours. Kite AI refers to a blockchain-based platform designed for the "agentic economy," where autonomous AI agents can transact and coordinate with each other. It is an EVM-compatible Layer-1 blockchain built to be an economic and infrastructure layer for AI, using a unique consensus mechanism called Proof of Attributed Intelligence (PoAI). KITE was listed on Binance Launchpool (3 Nov), Coinbase (4 Nov), KuCoin, Bitget, and WhiteBIT within 48h. Listings typically trigger buying pressure due to increased accessibility and perceived credibility. Listings expanded KITE’s investor base, particularly retail traders. Binance’s 150M KITE rewards pool for stakers likely incentivized short-term demand. However, the 18% circulating supply (1.8B tokens) creates dilution risk if early investors sell.

ALCH AIchemist AI (+22.24%, Circulating Market Cap: $139.15 Million)

ALCH is trading at $0.08145, up approximately 22.24% in the past 24 hours. Alchemist AI democratizes software development by letting users create apps, games, and interactive environments through natural language prompts. Its AI agents handle graphics, logic, and testing – exemplified by generating a playable snake game in minutes from a text instruction. The platform targets creators without coding expertise, bridging the gap between ideas and deployable products. The U.S. government shutdown on October 1, 2025, intensified market volatility, prompting traders to shift focus from large-cap coins to AI and niche projects. ALCH, as a no-code AI development platform, benefited from this rotation, with AI coins rising 12% in 24h. AI projects like ALCH are seen as higher-risk, higher-reward plays during macro uncertainty. The shutdown’s limited economic impact but heightened volatility amplified speculative interest in ALCH, driving volume up 121.84% to $44.57M.

Market News

Bitcoin and Ethereum ETFs Post $800 million in Combined Outflows Amid 'Extreme Fear' in Market

Bitcoin and Ethereum spot exchange-traded funds in the U.S. saw a combined net outflow of $797 million on Tuesday as institutional investors repositioned holdings during a market meltdown.

According to data from SoSoValue, spot bitcoin ETFs recorded a net outflow of $577.74 million, which is the largest single-day outflow since Aug. 1. Fidelity's FBTC saw $356.6 million exit the fund, Ark & 21Shares' ARKB saw $128 million in outflows, and Grayscale's GBTC saw $48.9 million worth of outflows. A total of seven BTC funds reported negative flows on Tuesday. This extends the funds' outflow streak to five days, during which the ETFs saw $1.9 billion in outflows.

Spot Ethereum ETFs posted net outflows of $219.37 million yesterday, led by $111 million in net outflows from BlackRock's ETHA. Funds from Grayscale and Fidelity also reported outflows. Spot Solana ETFs reported net inflows of $14.83 million, posting the smallest amount of daily net inflows since their debut last week.

Last month's hawkish message from the U.S. Federal Reserve Chair Jerome Powell crushed hopes for a guaranteed December interest rate cut, which pushed up the U.S. dollar index (DXY) above 100 to a relatively strong dollar.

This put the crypto fear and greed index fell to 21 on Tuesday, down from 42 the previous day, placing it in the "extreme fear" territory.

The fear and greed index on November 5, 2025. Source: CoinMarketCap

Stablecoin-enabled Payments Infrastructure Platform Zynk Raises $5 Million from Coinbase Ventures and Others

Zynk, a stablecoin-enabled cross-border payments infrastructure firm that says it supports instant settlements without pre-funding, has raised $5 million in a seed round led by Hivemind Capital.

Coinbase Ventures, Alliance DAO, Transpose Platform VC, Polymorphic, Tykhe Ventures, and Contribution Capital also participated in the round, which was structured as a Simple Agreement for Future Equity (SAFE) and completed in August, Zynk co-founder and CEO Prashanth Swaminathan told The Block, declining to disclose a post-money valuation.

The firm said fresh capital will be primarily used to expand its corridor coverage, enhance its liquidity, technology, and compliance infrastructure, and build partnerships with leading payment providers globally. Zynk supports both fiat and stablecoin settlements, offering seamless integration for Web2 and Web3 payment companies, according to the firm, allowing partners to enter new markets "overnight." By embedding liquidity directly into its network, Zynk eliminates the need for payment firms to pre-fund local bank accounts in different markets or manage complex liquidity operations, freeing up trapped capital and reducing settlement costs.

Zynk said its optimized payment rails currently enable instant, cross-border settlement across United States Dollar (USD), Euro (EUR), United Arab Emirates Dirham (AED), Indian Rupee (INR), Mexican Peso (MXN), and Philippine Peso (PHP) corridors, allowing remittance providers, business-to-business payment platforms, trading networks, and payment service providers to scale globally without liquidity bottlenecks.

Gemini Exchange Prepares for Prediction Market Contracts Launch

Tyler and Cameron Winklevoss’ Gemini exchange is planning to launch prediction market contracts, Bloomberg reported Tuesday, citing unnamed sources. If approved by the US derivatives regulator, Gemini would compete with dominant players, including Kalshi and Polymarket.

Sources noted that the billionaire brothers-run crypto platform has discussed launching products “as soon as possible.” The exchange, in May, applied to create a designated contract market with the US Commodity Futures Trading Commission (CFTC). Gemini is considering listing prediction-based derivatives contracts on the platform. However, the US derivatives regulator can take months or years to approve a new exchange. Additionally, the recent government shutdown could further delay the approval process.

Gemini closed its initial public offering (IPO) in September, pulling in $425 million, marking one of the strongest debuts for a digital asset platform. At the time, the New York-based firm teased this new venture in a filing that it intended to launch event contracts for “economic, financial, political and sports forecasts.”

The move comes amid growing demand for prediction markets, driven by platforms like Kalshi and Polymarket showing record volume growth. Kalshi is already registered with the US CFTC, while Polymarket is considering reopening in the US soon. An analyst from investment bank Needham told Bloomberg that Gemini’s plans would expand beyond its current offerings, as prediction markets offer an “attractive opportunity.” Elsewhere, platforms like CME Group have made their own moves into the arena. Meanwhile, crypto exchange behemoth Coinbase said in a recent earnings call that it would expand into event contracts to broaden its offerings as part of “Everything Exchange.”

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.