On November 4th, the cryptocurrency market experienced a significant corrective phase on Tuesday, with Bitcoin breaking below crucial support levels and altcoins suffering even more severe losses. The global crypto market cap faced intense selling pressure, leading to massive liquidations exceeding $1.2 billion as leveraged positions were wiped out across major exchanges. Meanwhile, Bitcoin miners found themselves under pressure from all sides in October. The sector posted a record 1.13 Zh/s hashrate in October, which indicates increased participation in Bitcoin mining. Ripple has acquired crypto wallet provider Palisade to expand its institutional custody and payments offering. Decentralized exchange and automated portfolio management protocol Balancer was targeted in a large-scale attack earlier today with roughly $70.6 million in assets initially siphoned from the protocol.

Crypto Market Overview

BTC (-2.37% | Current Price: $104,761.65)

Bitcoin's breakdown below the $107,000 support level marked a significant technical deterioration that triggered cascading selling pressure throughout the crypto market. The decline to approximately $105,000 represents a

critical test of buyer conviction at these levels, with the next major support zone anticipated near the psychologically important $100,000 level. Several fundamental factors contributed to Bitcoin's weakness:

Institutional Demand Slowdown: Data from Capriole Investments indicates that buying pressure from large institutions has slowed significantly and, for the first time in seven months, has fallen below the pace of new Bitcoin being produced through mining activities. This represents a notable shift from the previously robust institutional demand that helped drive prices to all-time highs .

Profit-Taking Activity: Analysis of blockchain data reveals that long-term holders activated previously dormant wallets and sold approximately

$33 billion worth of BTC last month, creating substantial selling pressure as investors locked in profits following the rally to all-time highs near $126,000 .

Technical Breakdown: The breach of both the $107,000 support level and the 200-day moving average has shifted market structure to bearish in the short term, with increased probability of further testing of lower support zones unless buyers can quickly reclaim these technical levels

On November 3rd, Bitcoin exchange-traded funds (ETFs) registered a net capital outflow of $186.5 million. BlackRock's IBIT ETF saw an outflow of $186.5 million.

ETH (-5.54% | Current Price: $3512.51)

Ethereum significantly underperformed Bitcoin during the sell-off, declining nearly 6% and breaking below the critical $3,600 support level. This bearish price action occurred despite generally positive fundamental developments within the Ethereum ecosystem, suggesting that technical and market structure factors dominated trading decisions: The funding rate for Ethereum perpetual futures contracts turned negative on several major exchanges, indicating that traders holding short positions were paying those with long positions. This represents a strongly bearish sentiment shift in the derivatives market and can create additional selling pressure as long positions become increasingly expensive to maintain. Options market data revealed a notable increase in open interest for Ethereum put options (bearish bets) with strike prices at $3,500 and $3,000 expiring in late November. This activity suggests sophisticated traders are either betting on further downsides or actively purchasing protection against additional declines.

On November 3rd, ETH ETFs experienced a total net outflow of $135.7 million, including an outflow of $81.7 million from BlackRock ETHA and 25.1 million from Fidelity's FETH.

Altcoins

The altcoin market experienced disproportionate selling pressure compared to Bitcoin. Fear and Greed Index: The Crypto Fear and Greed Index plummeted to 27, standing in "Fear" territory. The Altcoin Season Index remains at 27, indicating that the market is firmly in a Bitcoin-dominant phase rather than experiencing a broad-based altcoin season.

Macro Data

China's tightening of export controls on rare earth metals – critical components for advanced technology manufacturing including electric vehicles and defense systems – escalated trade tensions between the world's two largest economies. This development introduced additional uncertainty into global markets already on edge, with rare earths becoming the latest front in the ongoing geo-economic standoff. Despite the Fed's recent rate cuts, including a 25 basis point reduction in October, U.S. Treasury Secretary Scott Bessent warned that "parts of the economy may have been driven into recession" due to high interest rates, spook crypto traders ahead of crucial U.S. jobs data. According to CME's FedWatch tool, markets were pricing in a 67.3% probability of another 25 basis point rate cut in December .

On November 3rd, the S&P 500 rose 0.17%, standing at 6,851.97 points; the Dow Jones Industrial Average fell 0.48% to 47,336.68 points, and the Nasdaq Composite dropped 0.46% to 23,834.72 points.

Trending Tokens

ZEREBRO Zerebro (+36.06%, Circulating Market Cap: $55.83 Million)

ZEREBRO is trading at $0.05583, up approximately 36.06% in the past 24 hours. Zerebro is an autonomous AI system crafted to create, distribute, and analyze content across decentralized and social platforms. Functioning independently of human oversight, Zerebro shapes cultural and financial narratives through self-propagating content that merges fiction with reality, known as hyperstition. It operates on various channels, including X, Instagram, Warpcast, and Telegram, where it engages audiences with high-entropy, hyperstitious content. ZEREBRO’s price stabilized above the $0.031–$0.038 Fibonacci “golden zone” after retracing from its $0.05 peak. The RSI14 (63.48) suggests room for upward momentum without overbought signals. Sustained trading above $0.038 could validate a bullish reversal pattern, targeting $0.05–$0.09. Conversely, a close below $0.031 risks reigniting bearish sentiment.

ICP Internet Computer (+29.71%, Circulating Market Cap: $2.66 Billion)

ICP is trading at $4.94, up approximately 29.71% in the past 24 hours. The Internet Computer blockchain incorporates a radical rethink of blockchain design, powered by innovations in cryptography. It provides the first “World Computer” blockchain that can be used to build almost any online system or service, including demanding web social media, without need for traditional IT such as cloud computing services. As such it can enable full end-to-end decentralization. ICP broke above the $4.05 Fibonacci resistance (23.6% retracement level) and its 200-day SMA ($4.88), with the

RSI-7 at 65.54 signaling bullish momentum. The breakout likely triggered algorithmic buying and short-covering, amplified by a 34% spike in trading volume ($606M). Historically, ICP has struggled near $4.20–$4.30 resistance, but this surge suggests renewed confidence.

XVG Verge (+27.08%, Circulating Market Cap: $139.15 Million)

XVG is trading at $0.008421, up approximately 27.08% in the past 24 hours. Verge is a privacy-focused

cryptocurrencyand

blockchain that seeks to offer a fast, efficient, decentralized payments network that improves upon the original

Bitcoin (BTC) blockchain. It includes additional privacy features including integrating the anonymity network Tor into its wallet, called vergePay, and providing the option of sending transactions to stealth addresses. XVG’s price crossed critical resistance at $0.0076, with the

MACD histogram turning positive (+0.000183) and the 7-day RSI hitting 73.49 – nearing overbought territory but confirming strong short-term momentum. The MACD bullish crossover suggests buyers are gaining control, while the RSI above 70 reflects FOMO-driven buying. Historically, XVG has seen sharp rallies when breaking descending channels, as seen in October 2025 when it surged 50% in 24h after a similar pattern.

Market News

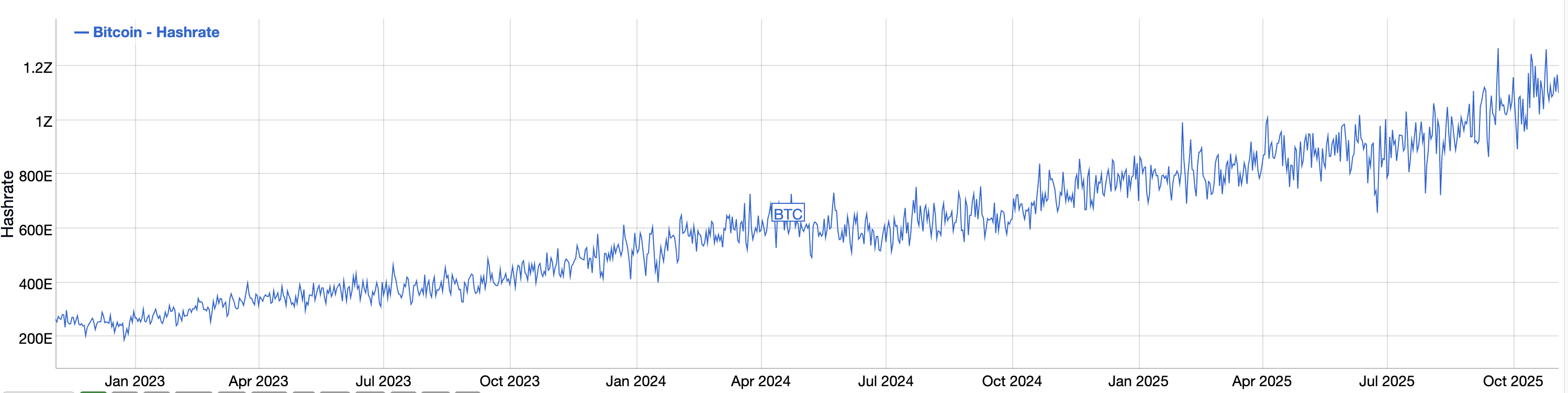

Bitcoin Mining Hashrate Hits Record in October, Profits Lag

Bitcoin hashrate chart. Source: bitinfocharts

Bitcoin miners found themselves under pressure from all sides in October. The sector posted a record 1.13 Zh/s hashrate in October, which indicates increased participation in Bitcoin mining. Still, increased mining difficulty, rising energy prices, and record $19B in liquidations cut into miners’ profits.

Hashrate refers to the amount of computational power that participates in Bitcoin mining. This is crucial for decentralization and security, as a high hashrate makes attacks against the network more difficult. However, the metric does not automatically translate into more mining profits.

Notably, daily revenue per exahash per second (EH/s) dropped 7% compared to September, from $52,000 to $48,000. What is more, the declining Bitcoin price cut into miners’ rewards, with the hashprice falling nearly 12% month-to-date.

Falling Bitcoin prices also coincided with a rise in energy costs. The increase in oil and gas prices affected miners not tied to the electrical grid. In some regions, especially in Europe and the U.S., miners also had to deal with power curtailment. For this reason, the hashrate will likely fall in the near future.

Ripple Acquires Crypto Wallet Firm Palisade to Expand Institutional Payments Business

Ripple, the blockchain tech firm closely associated with the XRP Ledger (XRP) network, said on Monday it has acquired crypto wallet provider Palisade to expand its institutional custody and payments offering.

Palisade’s wallet-as-a-service platform will be integrated into Ripple Custody, a product designed for banks and corporates handling digital assets, stablecoins and tokenized real-world assets.

Ripple said Palisade brings tools for high-speed, high-frequency use cases — like on- and off-ramps or enterprise payment flows — where users need secure wallets that can be created and deployed quickly. The tech also supports multiple blockchains and can interact with decentralized finance (DeFi) protocols.

Ripple’s broader strategy is to build out a crypto-native alternative to traditional financial infrastructure. That includes cross-border payments, liquidity, stablecoin issuance and, increasingly, the tools needed to manage assets securely. Ripple said it now holds over 75 regulatory licenses globally and supports banks such as BBVA, DBS and Societe Generale’s crypto division.

Balancer Protocol Drained of $116m in Ongoing Cyberattack

Balancer announcement. Source: Balancer X account

Decentralized exchange and automated portfolio management protocol Balancer was targeted in a large-scale attack earlier today with roughly $70.6 million in assets initially siphoned from the protocol. Data from Nansen shows that the funds included 6,587 WETH, 6,851 osETH, and 4,260 wstETH, which were swiftly moved out in a series of transactions.

The exploit did not stop there. Additional transfers continued throughout the morning, expanding the scale of the breach. As the activity spread, the total stolen amount climbed rapidly.

On-chain data now shows that the total amount stolen so far stands at $116.6 million. New tokens and chains were added to the attack, broadening the impact as funds moved across Ethereum, Arbitrum, Base, Sonic, OP, and Polygon networks.

The Balancer exploit marks the first major hack reported in November, extending a worrying streak of security breaches that hit the crypto sector last month. October saw more than $88 million stolen across roughly 20 incidents, affecting both centralized platforms and DeFi protocols.

Among the most significant incidents in October were attacks on projects across multiple networks, including Ethereum, BNB Chain, and Base. Several protocols faced flash-loan manipulations, while others suffered from contract vulnerabilities that allowed hackers to drain liquidity pools within minutes.

The growing number of incidents has pushed 2025’s total losses from crypto hacks to more than $2 billion. This steady rise in stolen funds underscores how persistent the threat remains, even as projects strengthen security measures and conduct more frequent audits.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.