Over the past week (October 24-30), the cryptocurrency market oscillated amidst macroeconomic events and internal structural adjustments.

The Federal Reserve cut interest rates by 25 basis points as expected , while

France proposed establishing a national strategic Bitcoin reserve , injecting long-term confidence into the market. In terms of market structure,

Bitcoin's dominance remained at 59% , continuing to lead the market, while

stablecoin supply hit a record high , indicating that funds continue to flow into the cryptocurrency ecosystem. Meanwhile, Mastercard (MA) is reportedly eyeing to acquire blockchain infrastructure startup Zero Hash as the competition for stablecoin payments is heating up. The platform’s Kalshi trading volume skyrocketed past an incredible $4 billion in October. IQ, in partnership with Frax, announced Thursday that it has launched KRWQ, a stablecoin pegged to South Korean won (KRW).

Market Overview

BTC

: Bitcoin faced downward pressure this week,

falling 1.57% to $110,490 , reflecting short-term uncertainty following the Federal Reserve's interest rate decision. Trading was concentrated in the

$104,000-$116,000 range, which forms a significant recent support and resistance level. MicroStrategy purchased 168 bitcoins this week with approximately $19 million in cash. Bitcoin's market

capitalization share remained at 59% , equivalent to $2.21 trillion, continuing to dominate the cryptocurrency market.

The week brought disappointing news on the ETF front, with U.S. Bitcoin ETFs experiencing substantial outflows. On October 16 alone, these products saw a record $530.9 million in net outflows, led by $132 million from Fidelity's FBTC and $29 million from BlackRock's IBIT. This outflow accelerated a broader trend that began in late September when Bitcoin ETFs lost $903 million, ending a six-week streak of inflows . The outflows reflected a macro-driven exodus from risk assets amid growing economic uncertainties.

ETH

: Over the past 24 hours, Ethereum has been trending weakly within the $3,839-$4,030 range. The 4-hour chart shows ETH has broken below the MA5, MA10, and MA30 moving averages, with the price positioned near the lower Bollinger Band, indicating significant short-term pressure. On the daily chart, the golden cross range of the moving averages is gradually narrowing, and ETH remains below the 100-day moving average, which currently constitutes a major resistance level. If the price can break through and hold above $4,000, it may retest the $4,200 supply zone; conversely, failure to break the upward trend line could indicate further short-term weakness. On the downside, the $3,500 area remains a key support level.

Despite these hurdles, some analysts highlight positive aspects of Ethereum’s technical outlook. The asset remains above its 200-day and 300-day moving averages, which generally indicate long-term strength. Additionally, the RSI reading is in neutral territory, suggesting the market is neither overbought nor oversold. Furthermore, Ethereum’s monthly chart indicates a breakout from a four-year price pattern, with the asset retesting previous support levels and maintaining above them—potentially establishing a solid foundation following recent corrections.

Altcoins: Market sentiment experienced a

dramatic deterioration during the review period, with the

Crypto Fear & Greed Index plunging to 34, representing a shift from neutral territory directly into "fear". This significant drop reflects growing investor apprehension amid price corrections and macroeconomic uncertainties.

The altcoin landscape presents a mixed picture of extreme outperformance and broad weakness, reflecting the fragmented nature of the current market cycle. While select tokens have posted dramatic gains, the broader altcoin market continues to lag Bitcoin, with the Altcoin Season Index stagnant at 37, far from signaling the start of a true altseason. This sentiment configuration reveals a market at a critical inflection point, where frustration with altcoin underperformance is testing investor patience, while Bitcoin continues to command the majority of institutional flows and market attention. Historical patterns suggest that such periods of extreme frustration and negative sentiment often precede significant market movements, though the timing and direction of such breaks remain uncertain.

ETF: The ETF landscape continues to evolve rapidly, with October 28th marking a significant milestone as the first US altcoin ETFs officially launched, covering Solana, Litecoin, and Hedera . This expansion beyond Bitcoin and Ethereum represents a potential game-changer for institutional accessibility to altcoins.

The pipeline for additional crypto ETFs remains substantial, with reports indicating 155 additional altcoin ETFs awaiting regulatory approval, covering 35 different digital assets . This includes 23 Solana-specific ETFs in the approval queue, signaling strong institutional interest in diversifying beyond the two largest cryptocurrencies.

Macro Data: Macroeconomic factors significantly influenced market dynamics during the review period: The US Core CPI registered a 0.2% increase month-over-month, slightly below the expected 0.3%, offering some alleviation of inflationary concerns. Federal Reserve policy continued to be closely watched, with a 99.6% probability priced in for a 25 basis point rate cut at the October 30th meeting. Global regulatory developments included Canada's proposed stablecoin regulation under the Genius Act and the appointment of crypto-friendly Michael Selig as CFTC chairman.

Stablecoins: The stablecoin sector continued to exhibit growth and stability, serving as a vital liquidity foundation for the market. The stablecoin market capitalization reached $308.3 billion, representing a 0.39% increase over the past seven days. USDT remains the leading stablecoin, holding 59.27% of the total stablecoin market share.

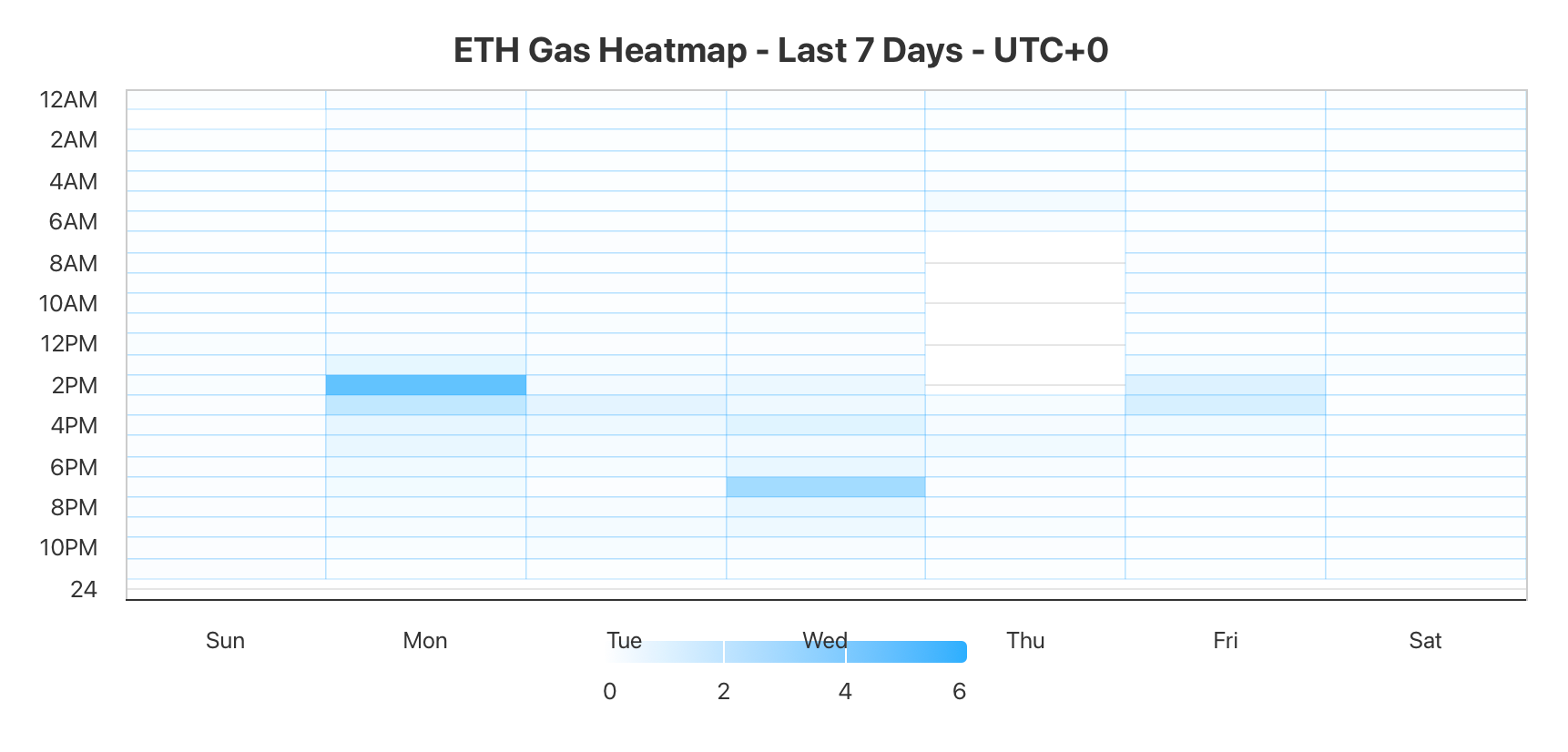

Gas Fees: Ethereum network gas fees fell from a peak of 15.9 Gwei on October 10, with an average daily gas fee of 0.117 Gwei as of October 30.

Gas Heatmap. Source: Milk Road

Weekly Trending Sectors

Amidst the broader market cooldown, capital flowed into specific sectors, with Meme and Layer 1 projects leading the charge.

Meme Sector: This was the top performer, driven by significant double-digit gains in tokens like PUMP and

OFFICIAL TRUMP (TRUMP). The sector's strength is also reflected in the ssiMeme index, which rose 1.42%.

Layer 1 (L1) Sector: The underlying blockchain networks also had a strong week.

Zcash (ZEC) continued its significant upward trend, while

Hedera (HBAR) also posted a solid gain. This suggests investor interest is spreading beyond the two largest L1 blockchains, Bitcoin and Ethereum.

Other Noteworthy Sectors: The CeFi, DeFi, and Layer 2 sectors all posted modest gains, with individual tokens like Merlin Chain (MERL) in the L2 space standing out with a 7.50% increase. Despite the overall decline.

Weekly Market Focus

Fed Cuts Rates by Quarter Point as Shutdown Data Blackout Clouds Outlook

As most anticipated, the Federal Open Market Committee (FOMC) lowered the benchmark federal funds rate by 25 basis points to a range between 4% and 3.75%.

"Available indicators suggest that economic activity has been expanding at a moderate pace," the committee said Wednesday in a statement. "Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated." The rate cut passed by a 10–2 vote. Governor Stephen Miran again dissented, favoring a steeper half-point reduction to counter softening conditions, while Kansas City Fed President Jeffrey Schmid opposed any cut, preferring to hold rates steady.

The Federal Reserve also said it will halt balance sheet reduction on Dec. 1. The inclusion of the words "available indicators" is notable, as the U.S. government shut down one month ago, which has led to a pause in various economic data releases, such as weekly jobs reports. Fed Chairman Jerome Powell addressed as much during Wednesday's press conference.

Lower interest rates typically make traditional investments less attractive, leading many investors to seek higher returns through alternative assets such as cryptocurrencies. Today will shed light on whether politics or data is in the driving seat, according to Nic Puckrin, investment analyst and co-founder of The Coin Bureau. While volatility may reign supreme in the short term, Puckrin says the long-term investment case for Bitcoin and other risk assets remains intact.

KRWQ Launches as First Korean Won Stablecoin on Base

IQ, in partnership with Frax, announced Thursday that it has launched KRWQ, a stablecoin pegged to South Korean won (KRW). The two companies said in a press release that it is the first Korean won-pegged stablecoin on Coinbase's Ethereum Layer 2 Base, as they launched a KRWQ-USDC pair on Aerodrome.

KRWQ is also said to be the first won-pegged multichain token, as it uses LayerZero's Omnichain Fungible Token (OFT) standard and Stargate bridge to allow transfers across multiple blockchains. IQ announced it is bringing Frax's expertise in regulatory compliance, specifically with frxUSD, to the design of KRWQ to support institutional adoption and due diligence.

Meanwhile, KRWQ is not yet marketed or offered to South Korean residents, as local efforts to establish fundamental rules on stablecoins are still underway. Minting and redemption of the stablecoin is also limited to eligible counterparties such as exchanges, market makers, and institutional partners. Last month, South Korean custody service provider BDACS said it launched the country's first won-pegged stablecoin KRW1 on Avalanche, noting that it remains at the proof-of-concept stage as local regulations are yet unclear.

Since the election of pro-crypto President Lee Jae Myung in June, South Korea has been pushing to develop a local currency-pegged stablecoin market, mainly to strengthen its monetary sovereignty in the age of digital finance.

Hyperliquid Strategies Looks to Raise $1B to Fund HYPE Treasury Purchases

Hyperliquid Strategies, a new digital asset treasury company, has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission, signaling its intent to raise $1 billion for general purposes, including the accumulation of Hyperliquid's native token HYPE. Hyperliquid Strategy is a merger-in-progress involving Nasdaq-listed biotech firm Sonnet BioTherapeutics and a special purpose acquisition firm, Rorschach I LLC. The impending crypto treasury company will focus on the Hyperliquid ecosystem.

The company plans to issue up to 160 million shares of common stock, with Chardan Capital Markets acting as the financial advisor for this fundraising effort, according to a Wednesday filing. "In addition to its HYPE token accumulation strategy, to further enhance Pubco’s ability to generate income and seek to create value for Pubco’s shareholders, it aims to deploy its HYPE token holdings selectively, primarily through staking substantially all of its HYPE holdings, which Pubco expects will generate ongoing staking rewards," the company said in its filing.

Key Market Data Highlights

Bitwise’s Spot Solana ETF Sees $69.5M in First-Day Inflows, Outpacing Rival SSK

The figure is nearly six times the $12 million debut haul of its closest competitor, the Rex-Osprey Solana Staking ETF (SSK), according to data from Farside. Bitwise Solana ETF Marks “Watershed Moment” as Institutions Enter SOL Market

The Bitwise Solana Fund (BSOL) now stands as the clear favorite among institutional and retail investors eyeing Solana-based exposure. The two ETFs represent divergent strategies in Solana exposure. Bitwise’s BSOL offers a fully spot-based structure, directly staking all held SOL tokens in-house to pass along Solana’s full network yield, around 7% annually, to investors. The fund trades on the New York Stock Exchange and carries a modest 0.20% management fee, which Bitwise has waived for the first three months.

In contrast, SSK takes a diversified approach. Roughly 54% of its portfolio is held in direct Solana, 43.5% in the CoinShares Physical Staked Solana ETP listed in Switzerland, and the remainder in JitoSOL, short-term government securities, and cash. Its staking rewards are paid monthly and classified as a return of capital for tax purposes. SSK trades on the Chicago Board Options Exchange with a 0.75% expense ratio. Analysts say BSOL’s early traction reflects institutional enthusiasm for Solana as a high-throughput blockchain with growing on-chain revenue.

Grayscale’s own Solana ETF, GSOL, is also set to begin trading on Wednesday, joining the race to capture institutional demand for Solana exposure. Despite the positive sentiment around the launches, traders remain cautious. Prediction market Myriad currently gives Solana just a 32.7% chance of reaching a new all-time high this year.

Mastercard Eyes Zero Hash Acquisition for Nearly $2B Bet on Stablecoins

Mastercard (MA) is reportedly eyeing to acquire blockchain infrastructure startup Zero Hash as the competition for stablecoin payments is heating up.

The global payments and card provider is in late stage talks and could pay $1.5 billion-$2 billion for the crypto firm, Fortune reported on Wednesday citing sources familiar with the matter. That comes as Mastercard might be losing out against Coinbase on bidding for crypto payments firm BVNK, the report added.

The news comes as stablecoins, or cryptocurrencies tied to fiat money like the U.S. dollar, have emerged as the next frontier for global payment flows. These digital tokens aim to offer cheaper, faster alternative to traditional rails by settling on blockchains, circumventing banks. Stablecoin payment volume could reach $1 trillion by 2030 with institutional adoption, FX settlement and cross-border flows driving growth, a report by Keyrock and Bitso this past summer projected.

Visa unveiled plans to launch its tokenization platform, helping banks to issue and handle stablecoins. Stripe, for example, acquired stablecoin infrastructure provider Bridge for $1.1 billion and wallet provider Privy, and is building its own blockchain rail with Paradigm.

Kalshi Trading Volume Hits Unprecedented $4 Billion in October

The world of financial markets is constantly evolving, and prediction platforms are carving out a significant niche. Recently, Kalshi, a leading regulated prediction market, made headlines with its astonishing performance. The platform’s Kalshi trading volume skyrocketed past an incredible $4 billion in October, marking an unprecedented all-time high. This remarkable achievement signals growing interest and activity in event-based trading, prompting many to wonder about the forces driving such explosive growth.

Kalshi allows users to trade on the outcome of future events, ranging from economic indicators to political outcomes and even pop culture happenings. Unlike traditional financial markets, where you buy stocks or commodities, on Kalshi, you buy contracts that pay out based on whether a specific event occurs. This unique approach offers a novel way for individuals to hedge risks, express opinions, and even profit from their insights.

Understanding how prediction markets operate is key to appreciating their growing appeal. On Kalshi, each contract represents a ‘yes’ or ‘no’ outcome for a specific event. For instance, you might trade on whether ‘The Federal Reserve will raise interest rates in its next meeting.’ You can buy ‘yes’ shares or ‘no’ shares. The price of these shares fluctuates based on supply and demand, reflecting the market’s collective probability of the event occurring. If a ‘yes’ share costs 70 cents, the market believes there’s a 70% chance of the event happening. If the event does occur, your ‘yes’ shares are worth $1 each. If it doesn’t, they’re worth $0. This mechanism provides a fascinating real-time barometer of public sentiment and expectation. It’s a dynamic environment where information is quickly priced in, often with surprising accuracy.

CoinCatch New Listings

CoinCatch Weekly Event

CoinCatch Copy Trading Lucky Wheel: Win 1 ETH + 1M USDT Prize Pool

📅 Event Time: 2025.10.28 (UTC+8) - 2025.11.11 (UTC+8)

✨ Event 1: 1st Copy Trade = Instant Cashback

-

New users who register for the event and complete their first copy trade can receive a reward based on their first copy trade amount (any follow mode applies).

-

First-come, first-served, limited to the first 500 users!

| First Single Copy Trade Amount (USDT) |

Reward (USDT) |

| 20 |

20 |

| 50 |

50 |

| 100 |

100 |

🎰 Event 2: Trade & Earn, Spin to Win ETH

💎Complete more tasks below to earn up to

20 lucky spins! Win the top ETH prize and bonuses worth 10,000,000 USDT.

| Task |

Lucky Wheel Spins |

| Deposit Tasks |

|

| Deposit 100 USDT into Futures Account |

1 |

| Deposit 500 USDT into Futures Account |

2 |

| Copy Trading Tasks |

|

| Copy Trade Volume 20 USDT |

1 |

| Copy Trade Volume 1,000 USDT |

2 |

| Copy Trade Volume 5,000 USDT |

3 |

| Copy Trade Volume 10,000 USDT |

5 |

| Copy Trade Volume 50,000 USDT |

6 |

🎁 Rewards Explained

Prize pool includes:

New Spot Listing: Trade COMMON/USDT Spot with Zero Fees!

Event Period: From October 29, 2025, 07:00:00 to November 5, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Halloween Surprise Box: New Users 100% Win Plus Apple Gear + 20K!

📅 Event Time: 2025.10.30 (UTC+8) - 2025.11.05 (UTC+8)

📦 Halloween Mystery Box: New Users Win 100% Guaranteed!

✨ Exclusive for New Users

Only eligible for users who have never traded, deposited, or participated in any activities on our platform before the event.

🎯 How to Get Mystery Boxes Unlock Chances

-

Complete 100 USDT futures trading volume to get 1 mystery box unlocked.

-

Complete a single deposit of

50 USDT to get 1 mystery box unlocked.

-

Complete a copy trade of a trading volume over 20 USDT to get 1 mystery box unlocked.

-

Complete 1 share to get 1 mystery box unlocked.

Play CoinCatch Mystery Box. Catch your coin. Open your box for massive wins. The more tasks you complete, the more chances you will get!

🎁 Spooky-Great Prize Explained

Prize pool includes:

-

iPhone 17 Pro Max (Value: $1,199)

-

iPhone Air (Value: $999)

-

Apple Watch Ultra 2 (Value: $799)

-

AirPods Max (Value: $549)

-

Hot coins with a maximum value of $100

-

Up to 500 USDT trading bonus

-

Up to 10,000 USDT position bonus

💰 All-User Halloween Bonanza: Deposit & Trade for Big Rewards

🎃 All-User: Deposit & Earn 100%

-

Net deposit of

100 USDT, maintain for ≥3 days → Unlock

100 USDTposition bonus

-

Net deposit of

1,000 USDT, maintain for ≥3 days → Unlock

1,000 USDTposition bonus

👻 All-User: Trade for Up to 20,000 USDT Rewards

| Futures Trading Volume Requirement (USDT) |

Reward Unlocked |

| 10,000 |

100 USDT Position Bonus |

| 50,000 |

200 USDT Position Bonus |

| 200,000 |

500 USDT Position Bonus |

| 500,000 |

1,000 USDT Position Bonus |

| 2,000,000 |

5,000 USDT Position Bonus |

| 10,000,000 |

20,000 USDT Position Bonus |

📌 Important Notes:

Each reward is limited to a one-time claim. Eligibility is solely granted for the specific reward tier whose requirements you fulfill.

Token Unlocks Next Week

Tokenomist data indicates that from October 31 – November 6, 2025, several major token unlocks are scheduled. Some of them are:

REZ will unlock approximately $3.8 million worth of tokens over the next seven days, representing 8.79% of the circulating supply.

SUI will unlock approximately $109.46 million worth of tokens over the next seven days, representing 1.2% of the circulating supply.

ENA will unlock approximately $94.19 million worth of tokens over the next seven days, representing 3.0% of the circulating supply.

EIGEN will unlock approximately $40.5 million worth of tokens over the next seven days, representing 9.5% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization—presented a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered

financi

al

advice.