The U.S. financial markets entered a new phase of cryptocurrency integration this week as Nasdaq and the New York Stock Exchange (NYSE) began trading the first-ever spot exchange-traded funds (ETFs) for Solana (SOL), Hedera (HBAR), and Litecoin (LTC). This landmark event, unfolding amidst a partial U.S. government shutdown represents a significant expansion of the crypto scenario beyond the established Bitcoin and Ethereum products. The successful launch of these funds, achieved through a strategic regulatory workaround, demonstrates the growing demand for diversified crypto exposure and marks a pivotal moment for institutional and retail investors seeking to access alternative cryptocurrencies within a regulated framework. This article delves into the details of these launches, analyzes their first-day market performance, and explores the broader implications for the future of cryptocurrency investment.

The ETF Launches: A Regulatory Breakthrough

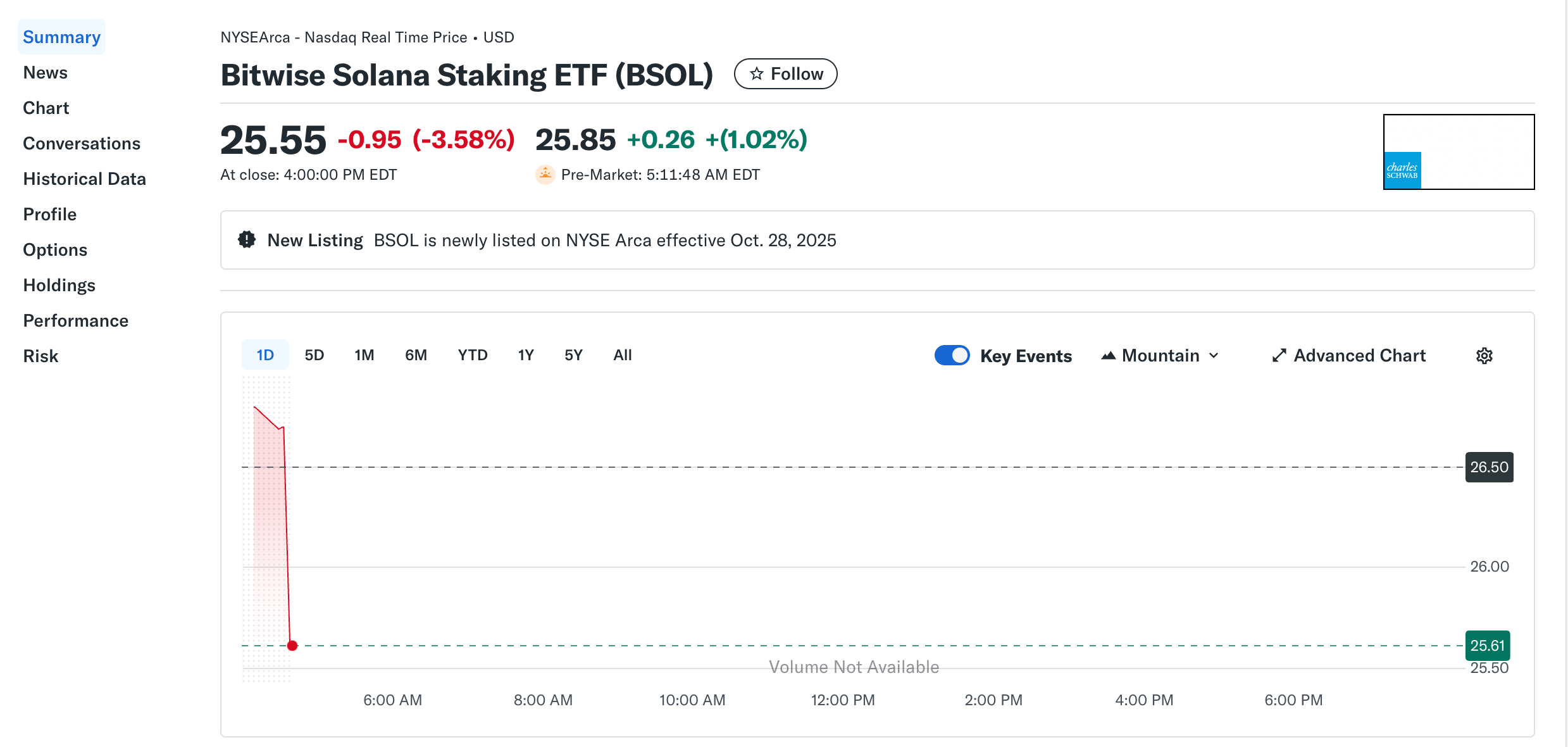

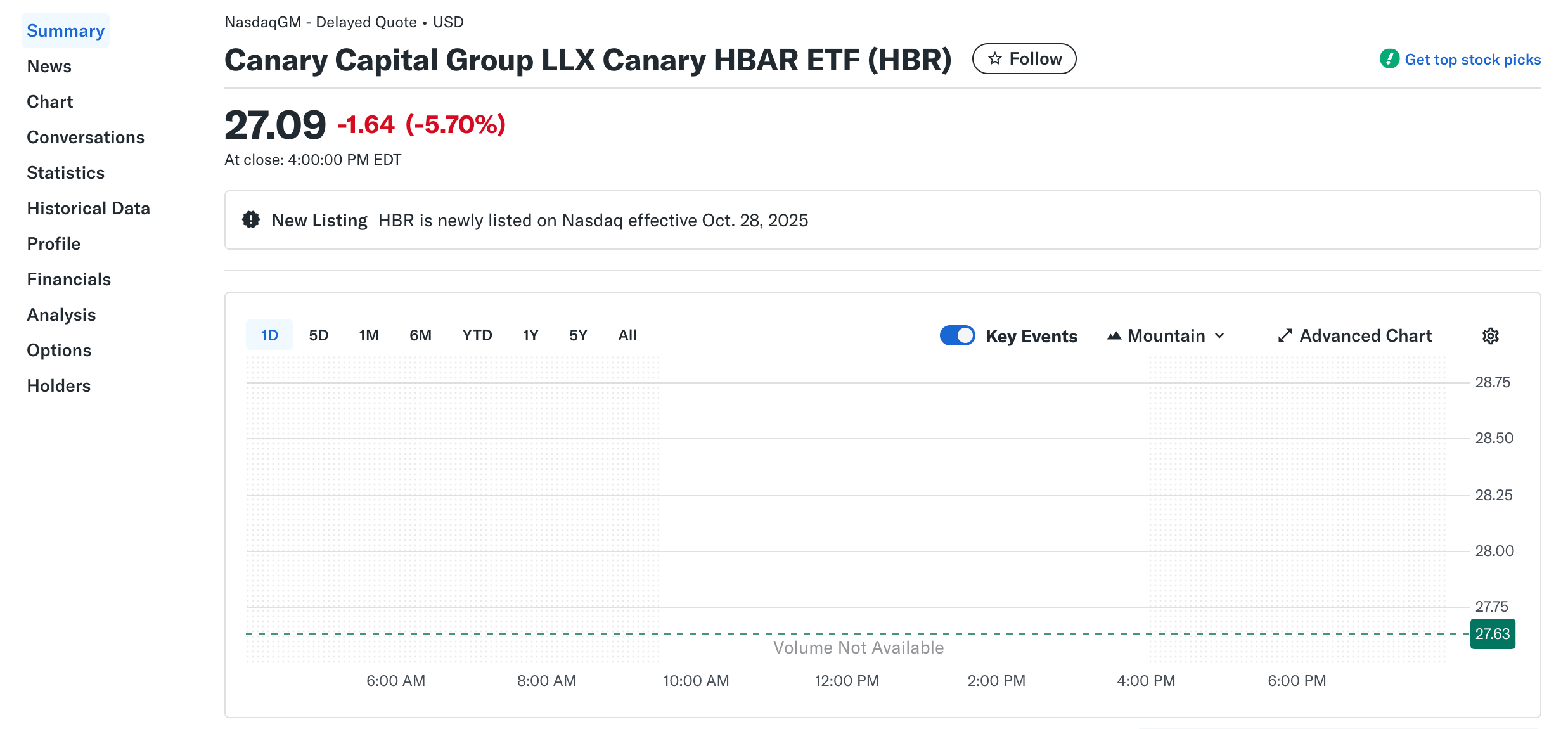

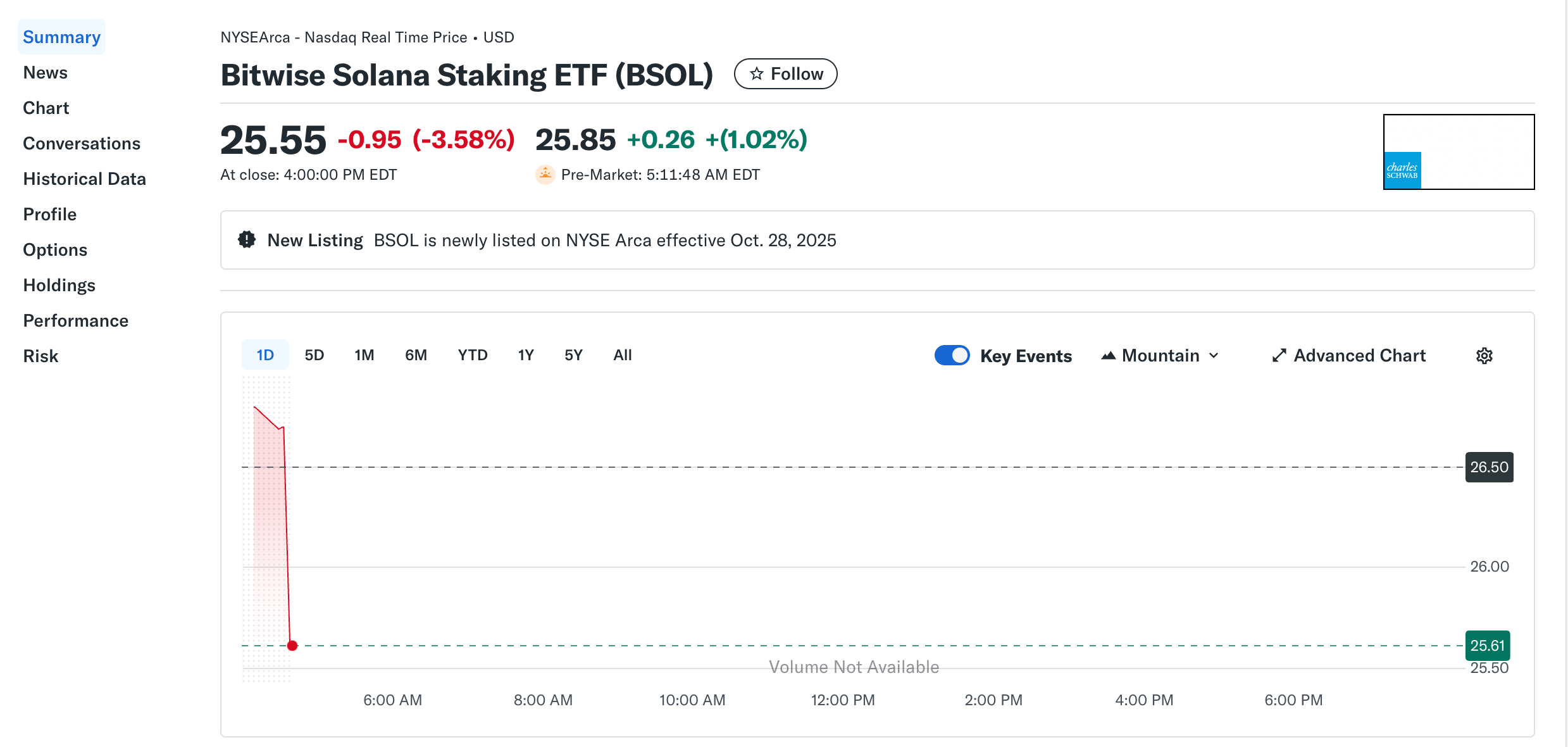

This week witnessed a significant milestone in the convergence of traditional finance and digital assets. The Bitwise Solana Staking ETF (BSOL) debuted on the NYSE, while the Canary Hedera ETF (HBR) and the Canary Litecoin ETF (LTCC) commenced trading on the Nasdaq. A second Solana product, the Grayscale Solana Trust (GSOL), was also scheduled for conversion to a spot ETF and listing on the NYSE shortly after the initial launches.

The most remarkable aspect of these launches is their timing; they occurred during a partial U.S. government shutdown that has left the Securities and Exchange Commission (SEC) operating with limited capacity. The fund issuers—Bitwise Asset Management, Canary Capital, and Grayscale Investments—navigated this challenge by utilizing a specific regulatory mechanism. They relied on Form 8-A filings and amended S-1 registration statements, which are designed to become effective automatically 20 days after filing, provided all requirements are met. This process did not require a manual sign-off from the SEC, allowing the ETFs to go live despite the agency's reduced operational status. Bloomberg analyst Eric Balchunas confirmed that all necessary exchange listing notices had been posted, the final step before trading could begin.

First-Day Performance: A Tale of Divergent Demand

The initial trading day revealed starkly different levels of investor interest in the three new crypto assets.

The Bitwise Solana Staking ETF (BSOL) emerged as the clear frontrunner. BSOL attracted net inflows of $69.45 million on its first day, bringing its total net asset value to approximately $289 million. Its trading volume reached $57.91 million, which Bloomberg analyst Eric Balchunas noted was the highest for any ETF debut in 2025. BSOL's features likely contributed to its strong appeal; it offers 100% direct exposure to SOL and incorporates a staking reward mechanism, aiming to pass on a 7%+ average yield to investors after fees. Its management fee is 0.20%, with a temporary waiver for the first three months or until assets under management reach $1 billion.

In contrast, the debut of the Hedera and Litecoin spot ETFs was considerably more subdued. The Canary HBAR ETF (HBR) and the Canary Litecoin ETF (LTCC) saw no net inflows or outflows on their first trading day. HBR recorded a trading volume of $8.63 million, concluding with a net asset value of $1.09 million, while LTCC's volume was a mere $1.38 million, finishing with a net asset value of $969,000. Both funds carry a management fee of 0.95% and, unlike the Solana ETF, do not support staking to generate additional yields for investors.

Underlying Asset Market Reaction

Interestingly, the launch of these novel investment vehicles was met with a "sell the news" reaction in the spot markets. On the day of the ETF debuts, the price of Solana (SOL) fell over 3%, Litecoin (LTC) dropped nearly 2.85%, and Hedera (HBAR), which had seen a double-digit surge in the days leading up to the launch, also slipped by 1.04%. This indicates that the event may have already been priced in by the market, leading to short-term profit-taking from traders.

Broader Market Context and Significance

The arrival of spot ETFs for Solana, Litecoin, and Hedera is a transformative development for the cryptocurrency industry. It provides a regulated and accessible pathway for a broader range of investors—particularly those who arehesitant to navigate crypto exchanges and manage digital wallets—to gain exposure to these specific digital assets through their standard brokerage accounts. This move significantly bridges the gap between decentralized crypto assets and mainstream traditional finance.

The successful launch also validates the investment thesis and underlying technology of these specific blockchains in the eyes of the traditional financial world. For Solana, being the sixth-largest cryptocurrency by market cap, this endorsement is particularly meaningful. The inclusion of a staking feature in the Bitwise ETF further enhances its attractiveness, offering a yield-generating component within a regulated product. While Litecoin and Hedera saw weaker initial demand, their mere presence on a major exchange like Nasdaq grants them unprecedented legitimacy and visibility in the investment community.

Future Outlook and Conclusion

The debut of Solana, Hedera, and Litecoin spot ETFs represents a decisive step forward in the maturation and institutionalization of the cryptocurrency market. It demonstrates the industry's ability to innovate and navigate complex regulatory environments to create new financial products. The divergent first-day performances highlight that while investor appetite for crypto ETFs is growing, it remains highly selective, with a clear preference for assets with stronger ecosystems and more attractive product features, such as staking rewards.

This week's launches are likely just the beginning. Analysts had previously assigned high probabilities of approval for these altcoin ETFs, and their successful listing, despite regulatory hurdles, sets a powerful precedent. The SEC is reportedly reviewing dozens of additional crypto-focused fund applications, including spots for other major tokens. The path forward for future crypto ETFs will undoubtedly be shaped by the ongoing regulatory landscape and the ultimate success of these pioneering Solana, Hedera, and Litecoin funds. For now, a new and significant channel for cryptocurrency investment has officially opened, expanding the digital asset universe for investors worldwide.

References:

RootData. (2025, October 29).

Data: The first Solana spot ETF in the United States was launched, with a net inflow of $69.45 million on its first day, bringing the net asset size to $289 million. Retrieved from

https://www.rootdata.com/news/406540

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.