The cryptocurrency landscape is witnessing the emergence of a new class of Ethereum Layer-2 scaling solutions designed to finally bridge the performance gap between decentralized networks and traditional web applications. At the forefront of this movement is MegaETH, a project that has generated unprecedented market excitement, as evidenced by its record-shattering token sale in late October 2025. With its ambition to function as the world's first "real-time blockchain" and backing from Ethereum co-creator Vitalik Buterin, MegaETH is poised to redefine the possibilities for decentralized applications. This article explores the technological foundations of MegaETH, analyzes the overwhelming response to its Initial Coin Offering (ICO), and assesses the project's potential impact on the broader Ethereum ecosystem and the future of high-performance decentralized computing.

Introduction to MegaETH: The "Real-Time Blockchain"

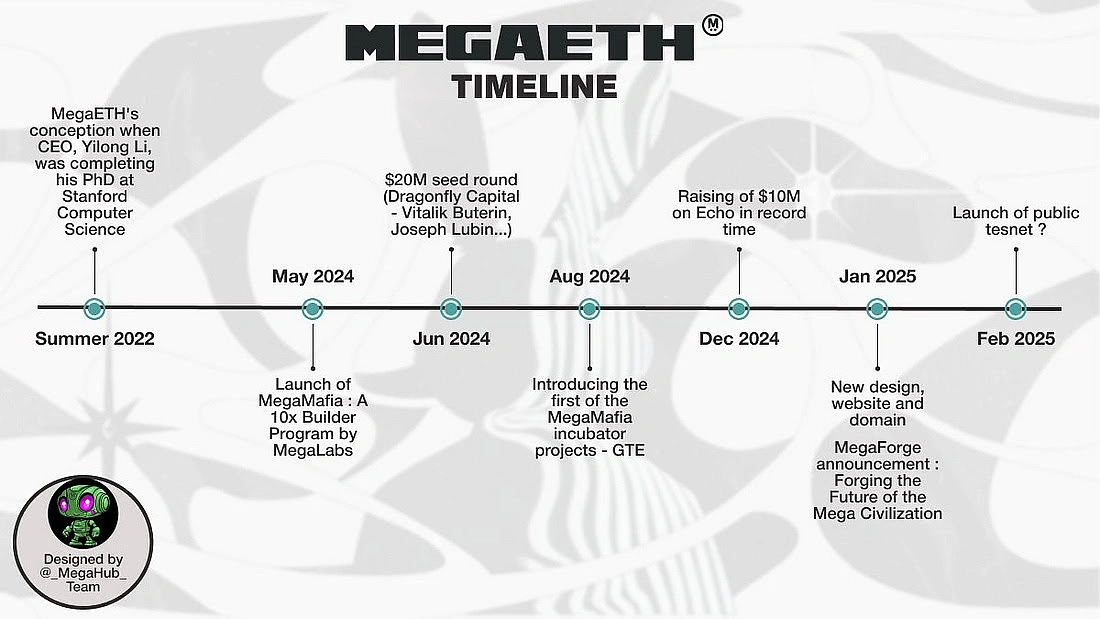

MegaETH is an emerging high-performance Ethereum Layer-2 (L2) network designed to deliver what its creators term "real-time blockchain" performance . Founded by Yilong Li in 2022, the project aims to solve Ethereum's persistent scalability challenges without compromising on decentralization or developer compatibility. Its core mission is to make on-chain activities as fast and fluid as using contemporary Web2 applications, thereby enabling a new generation of decentralized applications (dApps) that require instantaneous responses, such as high-frequency trading platforms, real-time games, and AI-integrated services.

The project positions itself as a significant leap forward in the L2 space by targeting extraordinary technical specifications: a throughput of over 100,000 transactions per second (TPS) and block times as low as 10 milliseconds, with a long-term roadmap to achieve 1 millisecond. For context, this performance would vastly outpace the capabilities of the Ethereum mainnet, which handles around 30 TPS, and even exceed the reported throughput of networks like Solana. Furthermore, MegaETH maintains full Ethereum Virtual Machine (EVM) compatibility, allowing developers to migrate existing smart contracts and dApps from Ethereum with minimal code changes, thus leveraging the vast existing Ethereum developer toolkit and ecosystem.

Key Ecosystem Projects

MegaETH’s ecosystem is home to a variety of innovative applications across DeFi, GameFi, and SocialFi sectors. Notable projects include:

GTE (Global Token Exchange)

GTE is a decentralized exchange (DEX) that combines Automated Market Making (AMM) and Central Limit Order Book (CLOB) models. This hybrid approach leverages MegaETH’s real-time capabilities to enable high-speed trading and liquidity optimization.

Euphoria

Euphoria is a gamified derivatives platform that merges blockchain technology with gaming mechanics. It offers users an engaging way to trade derivatives while benefiting from MegaETH’s high-speed performance.

CAP

CAP functions as a stablecoin engine within the ecosystem, providing a reliable foundation for DeFi applications.

Biomes

Biomes is an on-chain metaverse project that showcases the creative potential of MegaETH’s high-speed blockchain, enabling immersive virtual experiences.

The Technology Behind Speed: A Three-Tiered Architecture

MegaETH's groundbreaking performance claims are underpinned by a sophisticated and modular three-layer architecture that departs from the structure of conventional blockchains. This design is key to understanding its potential. The network operates through a coordinated system of Sequencer Nodes, Executor Nodes, and Verifier Nodes.

The

Sequencer Nodes are responsible for ordering transactions in real-time, batching them efficiently for processing.The

Executor Nodes then take these batched transactions and process them in parallel, a crucial design choice that allows the network to distribute workloads across multiple machines to achieve massive scalability. This parallel execution is a core innovation, enabling the system to handle a high volume of simultaneous operations without congestion. Finally,

Verifier Nodes generate cryptographic proofs, specifically

zero-knowledge (ZK) proofs, to validate the correctness of the transactions before the data is settled on the Ethereum mainnet, thereby ensuring security and trustlessness.

This division of labor creates a highly optimized system. By separating the tasks of sequencing, execution, and verification, MegaETH can achieve sub-second transaction finality and maintain low, predictable transaction fees, reportedly under $0.01 on average. The network also utilizes in-memory data storage for state updates, which drastically reduces latency compared to systems that rely on disk storage. While this architecture promises Web2-like speed, it does raise questions about potential centralization, as critical tasks like sequencing might initially be handled by a limited number of nodes. The MegaETH team has stated that their design aims to balance this trade-off, maintaining speed without compromising the core decentralized principles of blockchain technology.

Unprecedented Market Reception: The Oversubscribed Token Sale

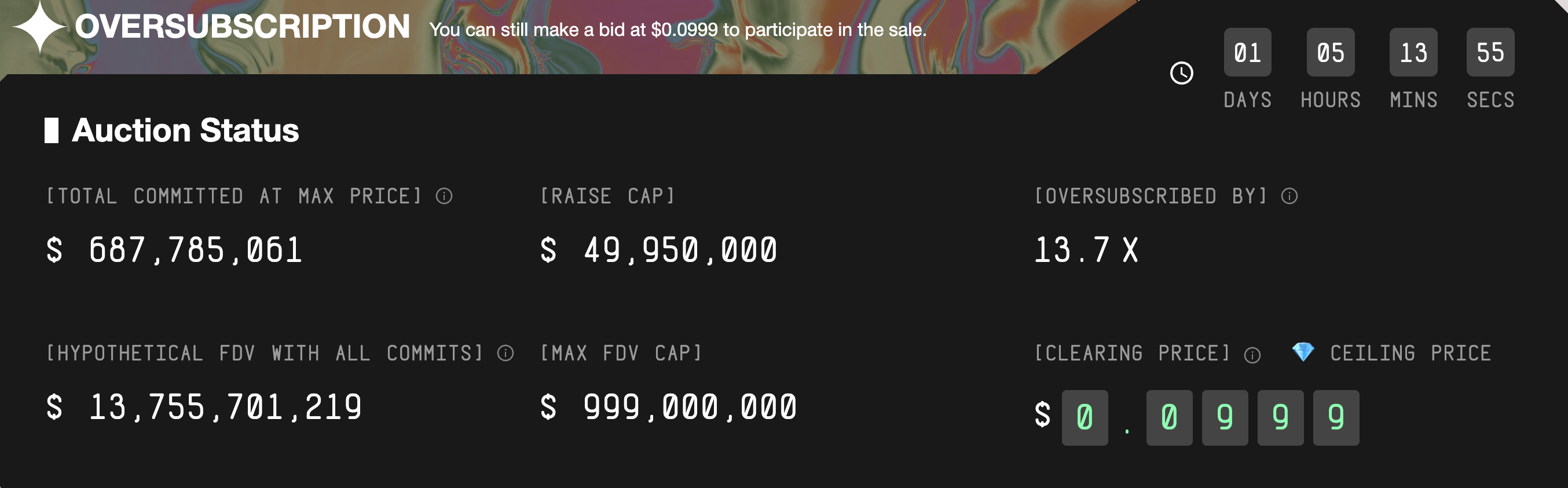

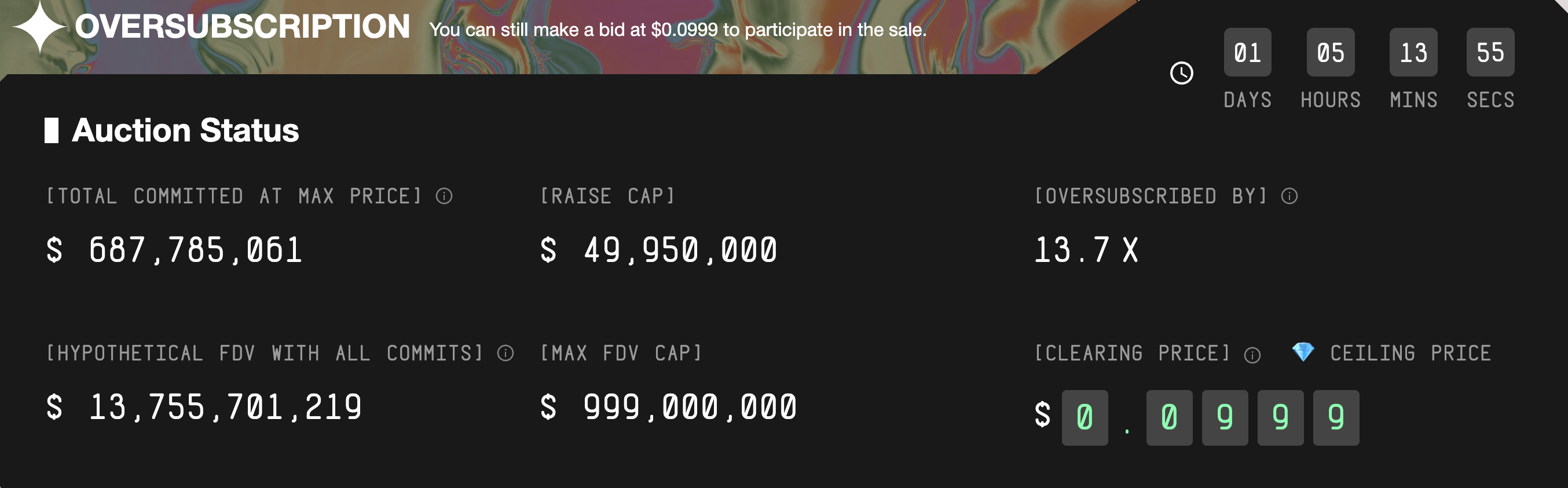

MegaETH transitioned from a promising technical project to a market sensation during its public token sale, which commenced on October 27, 2025. The demand was nothing short of explosive. According to multiple reports, the Initial Coin Offering (ICO) was oversubscribed within minutes of launching.

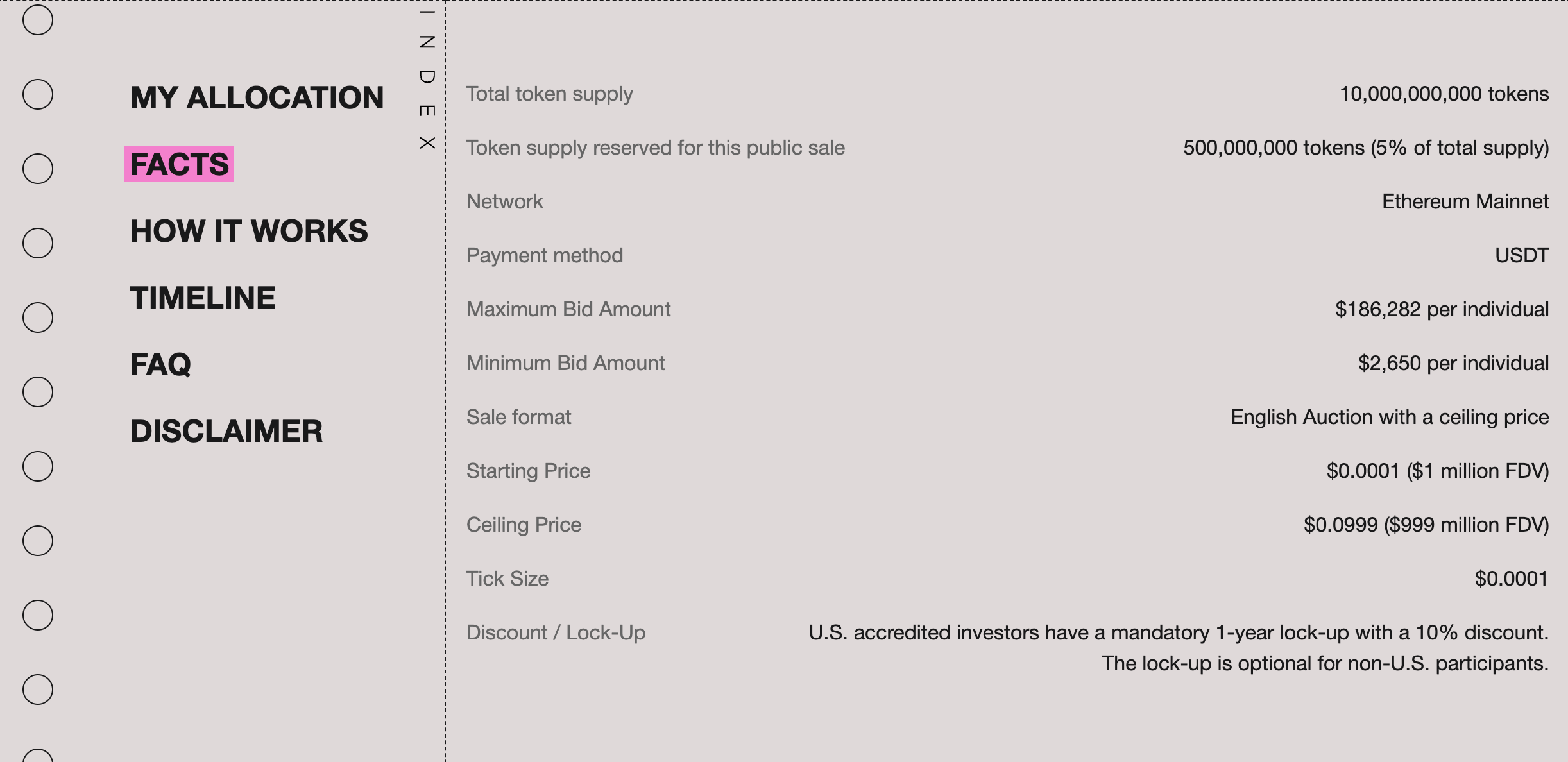

The sale, structured as a 72-hour English auction on the Sonar by Echo platform, was capped at raising $49.95 million for 5% of the total MEGA token supply (5 billion out of a total 100 billion tokens). However, investor commitments flooded in, far exceeding this cap. Data from the sale indicated that the offering was oversubscribed 13.7 times, with total commitments exceeding $680 million. On-chain analytics firm Arkham reported that within just the first two hours, 819 different wallet addresses had committed the maximum individual amount of $186,282. This frenzy of investment pushed the hypothetical fully diluted valuation (FDV) based on commitments to levels as high as $13.75 billion, though the official FDV post-allocation is set at $999 million.

The overwhelming demand necessitated a special allocation mechanism. With the fundraising limit exceeded, the project team announced that final token distributions would not be solely based on financial contribution but would also heavily weigh a participant's activity and engagement within the MegaETH and Ethereum communities, using bothsocial and on-chain metrics. The sale also included specific terms for different participants; U.S.-based investors face a mandatory one-year lock-up for their tokens, while non-U.S. participants can opt for a voluntary lock-up to receive a 10% discount on their allocation.

Tokenomics and Key Supporters

The MegaETH ecosystem is powered by its native token, $MEGA. The total supply is fixed at 100 billion tokens. The tokenomics model reveals a significant focus on long-term ecosystem growth, with 70.3% of the total supply reserved for the team, advisors, ecosystem reserves, and staking rewards. The team and advisor allocation is 9.5%, which issubject to a one-year lock-up and a three-year linear vesting schedule. Venture capital investors hold 14.7%, while the public sale accounted for 5% sold in the ICO. A unique aspect of the distribution is "The Fluffle," a soul-bound NFT collection that represents at least 5% of the total $MEGA token supply allocated to its holders, rewarding early community supporters.

The project has garnered support from an impressive roster of investors, which has significantly contributed to its credibility and hype. Most notably, Ethereum co-founder Vitalik Buterin and ConsenSys CEO Joseph Lubin are early backers. The venture capital firm Dragonfly Capital led a $20 million seed round in June 2024. This combination of high-profile angel investment and institutional venture capital has positioned MegaETH as one of the most well-funded and closely watched Ethereum L2 projects of 2025.

MegaETH Launched USDm

In partnership with Ethena, MegaETH is launching USDm to align incentives across the network, run the sequencer at-cost, and deliver the lowest fees for users and builders.

USDm, a native stablecoin purpose-built to power real-time applications on MegaETH. USDm is issued through Ethena's stablecoin stack and designed to be deeply integrated across wallets, apps, and onchain services on MegaETH.

Most L2s monetize by charging an extra margin on sequencer fees. That puts the chain in tension with its ecosystem: the chain earns more when users pay more — but apps' ability to scale depends on network fees staying low. As throughput increases and data costs compress, that margin becomes more volatile and structurally harder to defend, while raising fees to protect margin actively discourages the very usage you need to grow.

With USDm, MegaETH redirects value from financial yield rather than users to fund the network:

Reserves & yield

USDm v1 is issued on Ethena's USDtb rails, where reserves are primarily invested in BlackRock's tokenized U.S. Treasury fund (BUIDL) via Securitize, alongside liquid stablecoins for redemptions, providing transparent, institutional-grade backing and a predictable yield base.

Reserve flexibility

Ethena's stablecoin stack is built for adaptability, which lets MegaETH adjust USDm's collateral mix to include other existing or future Ethena products, such as USDe. USDm will begin with USDtb as the foundation for v1, but its architecture enables reserve composition to change over time in response to market conditions.

OPEX coverage

The underlying reserve yield is programmatically directed to cover sequencer operations. That lets us price gas at-cost, keeping fees low and stable for users and builders without relying on a margin.

Incentives realigned

As network costs increase from growth, we don't need to raise fees on users to remain sustainable. Activity expands the ecosystem; the stablecoin yield finances the network.

Future Roadmap and Market Outlook

The next major milestone for MegaETH is the launch of its mainnet, which is anticipated by the end of 2025 or early 2026. The Token Generation Event (TGE) is currently scheduled for January 2026. Upon launch, the project will enter a competitive L2 market, but its real-time performance claims could allow it to carve out a niche for high-frequency, compute-intensive dApps that are not well-served by existing scaling solutions.

However, analysts have sounded notes of caution amid the euphoria. The staggering oversubscription of the token sale has been described by some as a potential "red flag". Santiment analyst Brian Q suggested that the activity reflects "social momentum rather than an objective assessment of fundamental indicators" and warned that such synchronized buying can create speculative pressure, increasing the likelihood of a sharp price correction after the token launches. The market will also be watching how the project tackles the inherent trade-offs between its high-speed, modular architecture and the decentralization that is fundamental to blockchain technology.

Conclusion

MegaETH represents a bold and ambitious endeavor within the Ethereum scaling landscape. Its vision of a real-time blockchain, backed by cutting-edge technology and high-profile supporters, has clearly captured the imagination and capital of the crypto market. The record-breaking demand for its token sale is a testament to the strong belief in its potential to finally enable a seamless, Web2-like user experience on a decentralized platform. While questions about decentralization and speculative hype remain, MegaETH's journey is one to watch closely. Its success or failure will not only determine the fate of its own ecosystem but could also have profound implications for the entire Ethereum network, potentially unlocking a new frontier of instant, scalable, and cost-effective decentralized applications.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.