On October 13, 2025, the cryptocurrency market showed strong signs of recovery following a historic liquidation event. Major cryptocurrencies like Bitcoin and Ethereum rebounded significantly, though the market was still digesting the impact of recent volatility. Meanwhile, the total global stablecoin supply has exceeded $301.5 billion, reaching a record high. On October 12, Grayscale filed a Form 10 for its Bittensor Trust ($TAO) – a regulatory milestone that could bring the AI-focused crypto asset closer to public markets and deeper investor access. Polymarket could soon launch a token and the airdrop could be massive.

Crypto Market Overview

BTC (+3.40% | Current Price: $115,461.53)

Bitcoin gained 3.4% to $115,461.53 over the past 24 hours. BTC is rebounding from lows below $105,000 experienced during the weekend. The Bitcoin Long/Short Bias chart indicates an increase in net short positions among institutional traders, signaling a cautious market sentiment despite price recovery. On October 10th, BTC ETFs saw a net outflow of $4.5 million, with BlackRock IBIT receiving $74.2 million and Fidelity FBTC outflowing $10.2 million.

ETH (+2.11% | Current Price: $4,192.10)

ETH priced at approximately

$4,192.10 after dipping below $3,500 over the weekend. Affected by the tariff news and the decoupling of the USDE, ETH experienced a significant decline on October 11, reaching a low of $3,394, but then quickly stabilized and rebounded, showing a strong repair trend in the short term. Analysts project that Ethereum could potentially reach between $7,300 and $8,600 in 2025, driven by institutional demand and network upgrades.. On October 10th, ETH ETFs experienced a total net outflow of $174.9 million, including an outflow of $80.2 million from BlackRock ETHA and $30.1 million from Fidelity FETH.

Altcoins

Altcoins are showing mixed performance as traders assess the market direction. Some altcoins like Cardano and Dogecoin are leading the rebound. The Crypto Fear & Greed Index plummeted from 64 to 40 following the weekend sell-off, reflecting the rapid shift in sentiment. Retail sentiment on Stocktwits was "bullish" for Bitcoin as of October 13, 2025.

Macro Data

The Crypto Fear & Greed Index plummeted from 64 to 27 following the weekend sell-off, reflecting the rapid shift in sentiment. Retail sentiment on Stocktwits was "bullish" for Bitcoin as of October 13, 2025. President Trump's announcement of 100% tariffs on China imports triggered the recent crypto market volatility and a $19 billion crypto bet liquidation. Easing rhetoric from Trump and Vice President JD Vance has helped calm markets.BlackRock's IBIT ETF achieved a $100 billion milestone, becoming the fastest ETF to reach this figure, highlighting increased institutional interest in crypto. Spot Bitcoin ETFs recorded nearly $6 billion in inflows for the month, driven by concerns about the US economy. However, ETF sentiment remains split, with IBIT dipping -3.7% and ETHA falling -7.9%. The ongoing US government shutdown is creating data blackouts and adding to market uncertainty. Concerns about US economic prospects and potential monetary policy easing are contributing to ETF inflows. Historically, government shutdowns have led investors to seek safe-haven assets like Bitcoin and gold. On October 13th, the S&P 500 dropped 2.71% to 6,552.51 points; the Dow Jones Industrial Average fell 1.90% to 45,479.60 points, and the Nasdaq Composite dropped by 3.56% to 22,204.43 points.

Trending Tokens

SNX Synthetix (+90.1%, Circulating Market Cap: $649.92 Million)

SNX is trading at $1.89, up approximately 90.1% in the past 24 hours. Synthetix is building a decentralized liquidity provisioning protocol that any protocol can tap into for various purposes. Its deep liquidity and low fees serve as a backend for many exciting protocols on both

Optimism and

Ethereum. Many user-facing protocols in the Synthetix ecosystem, such as Kwenta (Spot and Futures), Lyra(Options), Polynomial (Automated Options), and 1inch & Curve (Atomic Swaps), tap into Synthetix liquidity to power their protocols. SNX rallied alongside ETH (+10.5%) and DOGE (+12.5%) as crypto recovered from a $500B selloff triggered by U.S.-China trade tensions. SNX’s 24h volume spiked 923% to $621M, signaling panic buying/short covering. Thin liquidity (turnover ratio 0.976) exaggerated moves: SNX’s $636M market cap swung wildly on modest inflows. The Fear & Greed Index has rebounded from “Fear” (31) to “Neutral” (40), favoring high-beta alts like SNX.

FF Falcon Finance (+37.85%, Circulating Market Cap: $384.61 Million)

FF is trading at $0.1593, up approximately 37.85% in the past 24 hours. Falcon Finance is building a universal collateral infrastructure that turns any liquid asset, including digital assets, currency-backed tokens, and tokenized real-world assets, into USD-pegged onchain liquidity. $FF is the protocol's native token and it serves as the gateway to governance, staking rewards, community incentives, and exclusive access to unique products and features. FF secured a $10M investment on October 9 from UAE-based M2 Capital and Cypher Capital to accelerate DeFi infrastructure development. The protocol has grown to $1.6B in USDf stablecoin circulation and launched tokenized U.S. Treasury integrations. Fresh capital validates FF’s universal collateralization model and funds expansion into fiat gateways/RWA adoption. The timing aligns perfectly with the price surge, suggesting institutional confidence is attracting retail buyers.

TAO Bittensor (+32.91%, Circulating Market Cap: $4.24 Billion)

TAO is trading at $421.45, up approximately 32.91% in the past 24 hours. Bittensor is an open-source protocol that powers a decentralized, blockchain-based machine learning network. Machine learning models train collaboratively and are rewarded in TAO according to the informational value they offer the collective. TAO also grants external access, allowing users to extract information from the network while tuning its activities to their needs. TAO broke above a 308-day diagonal resistance trend line, reaching $420 (~11-week high). The daily RSI (62.44) and MACD bullish crossover signal momentum, while a falling wedge pattern suggests a 236% upside target ($1,353) if $450 resistance is cleared. Technical traders interpret the breakout as a bullish reversal, especially after TAO held the $300 support during last week’s market crash. Rising volume (+125% 24h) confirms buyer conviction.

Market News

Stablecoin Supply Hits Record $301.5B: Key Liquidity Signals for BTC and ETH Traders

According to the latest on-chain data, the total global stablecoin supply has exceeded $301.5 billion, reaching a record high. This growth indicates that the stablecoin market continues to accelerate its expansion momentum. Especially against the backdrop of continued regulatory compliance and institutional adoption, stablecoins are becoming one of the most deterministic asset classes in the global crypto-financial system.

Stablecoin supply has reached a new high, reflecting the continued growth in market demand for on-chain US dollars. Against the backdrop of rising uncertainty in traditional markets and a resurgence in DeFi yield-generating assets, stablecoins have evolved from a medium of exchange to a "crypto liquidity anchor." The entry of institutions and payment giants (such as PayPal and Visa) is driving stablecoins into the mainstream financial system. The market size is expected to continue to expand, becoming a core driver of the "on-chain dollarization" process.

Grayscale’s $TAO Move Shakes Crypto: Bittensor Trust Form 10 Filing

Grayscale, one of the world’s largest digital asset managers, has taken another decisive step toward integrating artificial intelligence into mainstream crypto investing. On October 12, the company filed a Form 10 for its Bittensor Trust ($TAO) – a regulatory milestone that could bring the AI-focused crypto asset closer to public markets and deeper investor access.

Grayscale announced the filing through its official X (formerly Twitter) account, calling it “the first step toward becoming an SEC-reporting company – increasing accessibility, transparency, and regulatory standing.” If the U.S. Securities and Exchange Commission (SEC) deems Form 10 effective. The Grayscale Bittensor Trust will fall under Section 12(g) of the Securities Exchange Act of 1934. That means the Trust will begin filing quarterly (10-Q), annual (10-K), and current (8-K) reports, including audited financial statements, just like public companies do.

This kind of openness would foster investor trust in $TAO, the original token of Bittensor, a decentralized machine-learning hub that pays AI model contributions in crypto.

Polymarket Could Soon Launch a Token and the Airdrop Could Be Massive

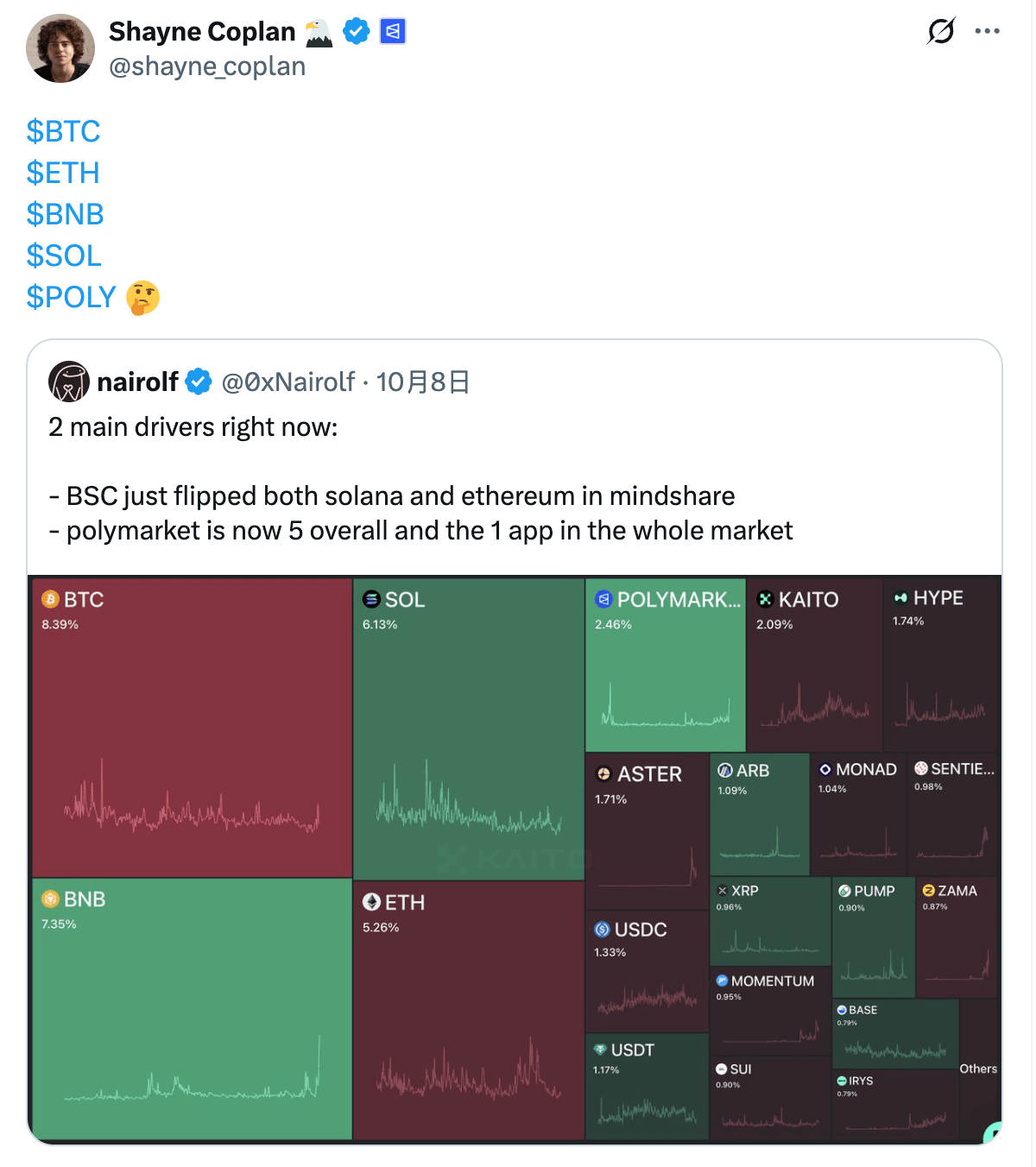

Polymarket CEO Shayne Coplan sparked buzz across the crypto community after he posted a cryptic tweet hinting at a possible POLY token. In the post, Coplan listed BTC, ETH, BNB, SOL before ending with “POLY”, suggesting something big might be brewing for the prediction market platform.

Polymarket currently holds a 2.46% share, trailing only behind Bitcoin (8.39%), BNB (7.35%), Solana (6.13%), and Ethereum (5.26%) — making it the fifth most talked-about crypto project. Coplan’s tweet ignited a flurry of speculation on crypto X about a potential POLY token airdrop, with one user saying, “Polymarket could easily end up being the biggest airdrop ever. Position yourself accordingly.” With 1.35 million active traders, a potential POLY airdrop could indeed be massive, making it one of the largest in terms of sheer number of recipients.

However, only a small fraction of Polymarket users are high-volume or highly active. Traders with over $1,000 in PNL make up just 0.51% of all wallets, while those with trading volumes exceeding $50,000 account for only 1.74% of users.

This suggests that the airdrop—if it happens—could be enormous in total token distribution, but, as is typical in crypto, only a handful of participants would likely receive the lion’s share.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.