On September 29, BTC was the first to recover and break through $112,000, and the price of ETH rose all the way to $4,146. This recovery aligns with a notable improvement in market sentiment. Meanwhile, the DeFi TVL on the stablecoin L1 blockchain Plasma surged to $5.6 billion three days after its launch, a 14.9% increase over the past 24 hours. Last week, nine ETH spot ETF products experienced net outflows for five consecutive days, totaling $795.8 million USD, the largest single-week outflow ever. Hyperliquid launched its Hypurr non-fungible token collection today on the HyperEVM mainnet, generating a notable floor price of $68,900 and millions in early trading volume.

Crypto Market Overview

BTC (+2.20% | Current Price: $111.846.47)

Bitcoin gained 2.20% to $111,846 over the past 24h. After falling below $110,000 over the weekend and briefly approaching its lowest support level since September at $108,615, the crypto market rebounded on Monday, with BTC leading the charge above $112,000. After breaking through the 5-, 10-, and 30-day moving averages, it maintained its upward trend. BTC's recovery has driven the total crypto market capitalization back to $3.958 trillion, indicating that the market has regained upward momentum after a short period of consolidation. If BTC can stabilize above $110,000, it will provide strong psychological support for the market and is expected to continue attracting institutional capital inflows, pushing the market towards higher valuations. On September 26th, BTC ETFs saw a net outflow of $418.3 million, including $300.4 million outflow from Fidelity's FBTC.

ETH (+2.39% | Current Price: $4,103.89)

Ethereum increaed by 2.39% over 24h. After two days of sideways trading over the weekend, ETH prices reversed course on Monday, rising from $3,978 to $4,146, breaking through the 5-day, 10-day, and 30-day moving averages. However, the 4-hour candlestick chart shows a rapid decline after the surge, testing upward near $4,150 before being pushed back by short sellers, indicating significant selling pressure from above. Over the past two days, whales have accumulated over 430,000 ETH, worth $1.73 billion, providing strong support on the demand side. Current resistance is $4,150, while support is $3,850. On September 26th, ETH ETFs saw an outflow of $248.4M, with BlackRock's ETHA saw an outflow of $199.99 million and Fidelity's FETH saw an outflow of 74.4 million.

Altcoins

The Crypto Fear and Greed Index accurately reflected the roller-coaster of investor emotions. Last week, the index plunged to 32, signaling a state of "extreme fear" among investors, which is a level not seen since April. This indicated significant market concern and a potential low point for the correction phase. The index has since recovered to 39 as of September 29. This rapid improvement suggests that panic selling may have subsided, and a sense of equilibrium is returning to the market.

Macro Data

While cryptocurrencies bled, traditional markets showed resilience and even strength, suggesting a rotation away from high-risk digital assets. Acted as safe havens. Gold continued its rally, approaching a record high of $3,809. Silver surged, breaking above $46 to a 14-year high. The dollar index retreated from a three-week high but still posted its best weekly performance in nearly two months. The 10-year U.S. Treasury yield hovered around 4.18%. This divergence underlines a classic flight to safety, with capital moving from volatile crypto assets to traditional hedges like gold and stable-performing equities. On September 29th, the S&P 500 declined by 0.50% to 6,604.72 points; the Dow Jones Industrial Average decreased by 0.38% to 45,947.32 points, and the Nasdaq Composite decreased by 0.50% to 22,384.70 points.

Trending Tokens

ICNT Impossible Cloud Network (+18.14%, Circulating Market Cap: $40.75 Million)

ICNT is trading at $0.2437, up approximately 18.14% in the past 24 hours. With its mainnet launched in July 2025 by a team based in Switzerland and Germany, Impossible Cloud Network (ICN) is a decentralized infrastructure protocol designed to support enterprise-grade cloud services. ICN enables permissionless access to distributed hardware resources across storage, compute, and networking. The protocol aims to serve as a foundational infrastructure layer for digital applications, including artificial intelligence platforms, enterprise software, and web services. ICNT broke above its 30-day SMA ($0.241) and Fibonacci 38.2% retracement level ($0.246), with the RSI-7 hitting 58.39 – nearing overbought territory. The breach of these levels suggests traders see upside potential, particularly after a 59.92% decline over 90 days. However, the MACD histogram remains negative (-0.00043513), indicating lingering bearish divergence.

PRAI Privasea (+17.2%, Circulating Market Cap: $6 Million)

PRAI is trading at $0.02275, up approximately 17.2% in the past 24 hours. Privasea AI (PRAI) is a privacy-focused blockchain project combining confidential AI computation with Proof-of-Humanity verification to secure sensitive data in Web3 applications. PRAI’s RSI-7 hit 48.26 (neutral) after a 35.79% weekly decline, signaling short-term exhaustion. The price ($0.0227) remains below the 7-day SMA ($0.02302), but bullish divergence in volume suggests a relief rally. Traders may interpret the dip as a buying opportunity, especially with altcoin season sentiment rising (Altcoin Season Index up 17.54% monthly). However, MACD remains bearish (-0.00061379 histogram), indicating weak momentum.

AWE AWE (+15.09%, Circulating Market Cap: $227.86 Million)

AWE is trading at $0.1173, up approximately 15.09% in the past 24 hours. AWE Network is opening the portal to Autonomous Worlds where AI Agents collaborate, adapt and evolve. The Autonomous Worlds Engine (AWE) is a modular framework enabling the creation of self-sustaining worlds for scalable agent-agent and human-agent collaboration. AWE’s 7-day RSI sits at 78.48 (overbought threshold = 70), while the MACD histogram shows bullish momentum at +0.0036. The price broke above its 7-day SMA ($0.0985), now trading at $0.117. Traders are interpreting sustained RSI strength above 70 as a momentum play, despite traditional overbought risks. The MACD crossover suggests short-term bullish conviction, amplified by a 73% surge in trading volume to $47.1M.

Market News

Plasma DeFi TVL Rises to $5.6 Billion

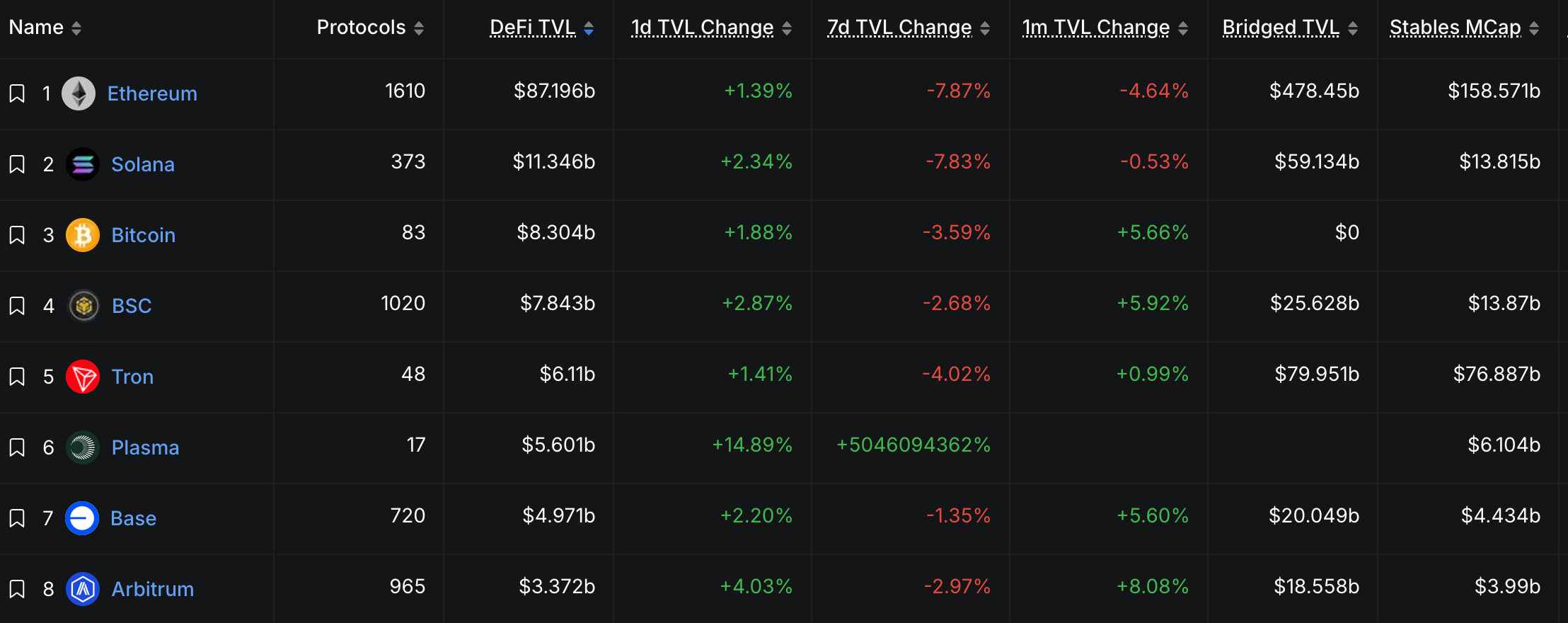

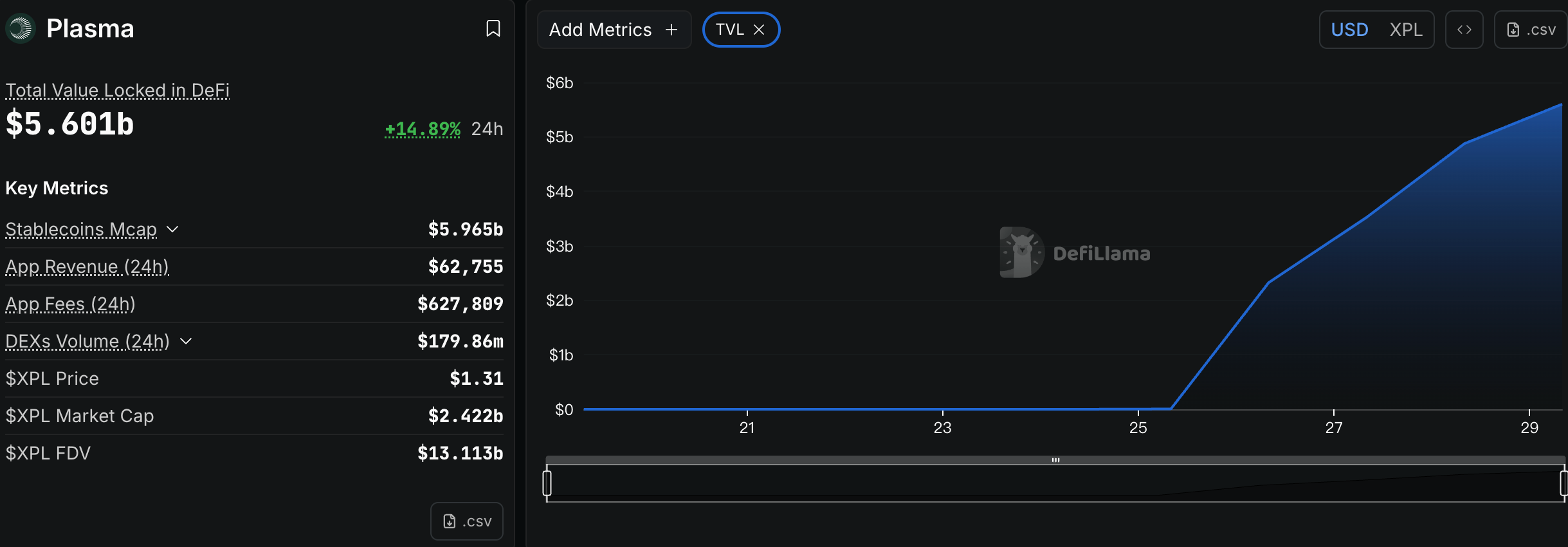

According to Deflama data, the DeFi TVL on the stablecoin L1 blockchain Plasma surged to $5.6 billion three days after its launch, a 14.9% increase over the past 24 hours. Plasma surpassed Base and Arbitrum to rise to sixth place in the DeFi TVL by chains. Plasma currently integrates 17 protocols, with a 24-hour DEX trading volume of $179.86 million.

This increase in TVL is primarily driven by the ability for users to earn XPL, the network's native token, by locking assets in the Plasma lending vault and partner DeFi protocols. The new public chain, Plasma, essentially follows a typical "high-yield capital inflow" model. Its core focus lies in its lending vault offering a nearly 24% APY, incentivized by the native XPL token, which has attracted significant user participation. Plasma's recent surge has had a significant impact on the DeFi space, marking a significant shift in the decentralized ecosystem and intensifying competition. This development highlights Plasma's growing ability to attract financial applications to its Layer 1 network.

Plasma TVL rankings by chains and total TVL. Source: DefiLlama

Spot Ethereum ETFs See Largest Outflow Week Since Inception

Last week, ETH spot ETFs continued to struggle. Nine of its products experienced net outflows for five consecutive days, totaling $795.8 million USD, the largest single-week outflow ever. On September 27th, another $248.4 million was withdrawn. This outflow exceeded the previous weekly record of $787.7 million on September 5th. This pullback can be correlated with the 10.25% drop in ETH prices over the week. With ETH prices currently down 11.08% over the past month, the outflows suggest investors are panicking.

There are two possible reasons for this. On the one hand, regulatory uncertainty looms large over the cryptocurrency sector, and hesitation over the approval of altcoin ETFs has instilled a sense of caution in the market, prompting startups and individual investors to consider alternative assets rather than being constrained by ETFs. On the other hand, market analysts believe the large-scale withdrawal of funds from ETFs is not a spur-of-the-moment move, but rather a strategic adjustment by major institutions such as Fidelity and BlackRock. Notably, in contrast to these ETF outflows, recent on-chain indicators show a trend of investors directly accumulating ETH assets, pointing to growing demand for asset management. This also suggests that ETH's position in the market is solidifying, potentially providing greater resilience against economic turmoil.

Hyperliquid Unveils 4,600 Hypurr NFTs, Floor Price Surges Past $60,000

Hyperliquid launched its Hypurr non-fungible token collection today on the HyperEVM mainnet, generating a notable floor price of $68,900 and millions in early trading volume. The collection, comprising 4,600 NFTs, commemorates the supporters of the decentralized perpetuals trading platform and its deployment of HyperEVM, the general programmability interface to Hyperliquid's Layer 1 chain. Participants were given the chance to opt in to receive the NFT during last November's genesis event, where Hyperliquid launched its native HYPE token. 4,313 Hypurr NFTs were allocated to the event participants, 144 to the Hyper Foundation, and 143 to developers and artists.

Hypurr launched at around 12:00 a.m. on Sunday, and its trading activity surged shortly after. OpenSea shows that since its launch, the collection has seen a trade volume of about 952,000 HYPE, equivalent to roughly $45 million. The NFT platform currently shows that the Hypurr collection has a floor price of 1,463 HYPE ($68,930). Notably, Hypurr #21 sold for 9,999 HYPE, which is nearly $470,000.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.