Crypto exchanges remain the

primary gateway

for millions into the cryptocurrency world. This guide will equip you with practical

risk management strategies

from a user's perspective, helping you navigate trading more safely and confidently. We'll focus on understanding common risks, utilizing built-in exchange tools, and adopting smart habits.

Understanding Market and Trading Risks

The crypto market is known for its

sharp price swings. This volatility can lead to significant gains but also substantial losses, especially if you use leverage.

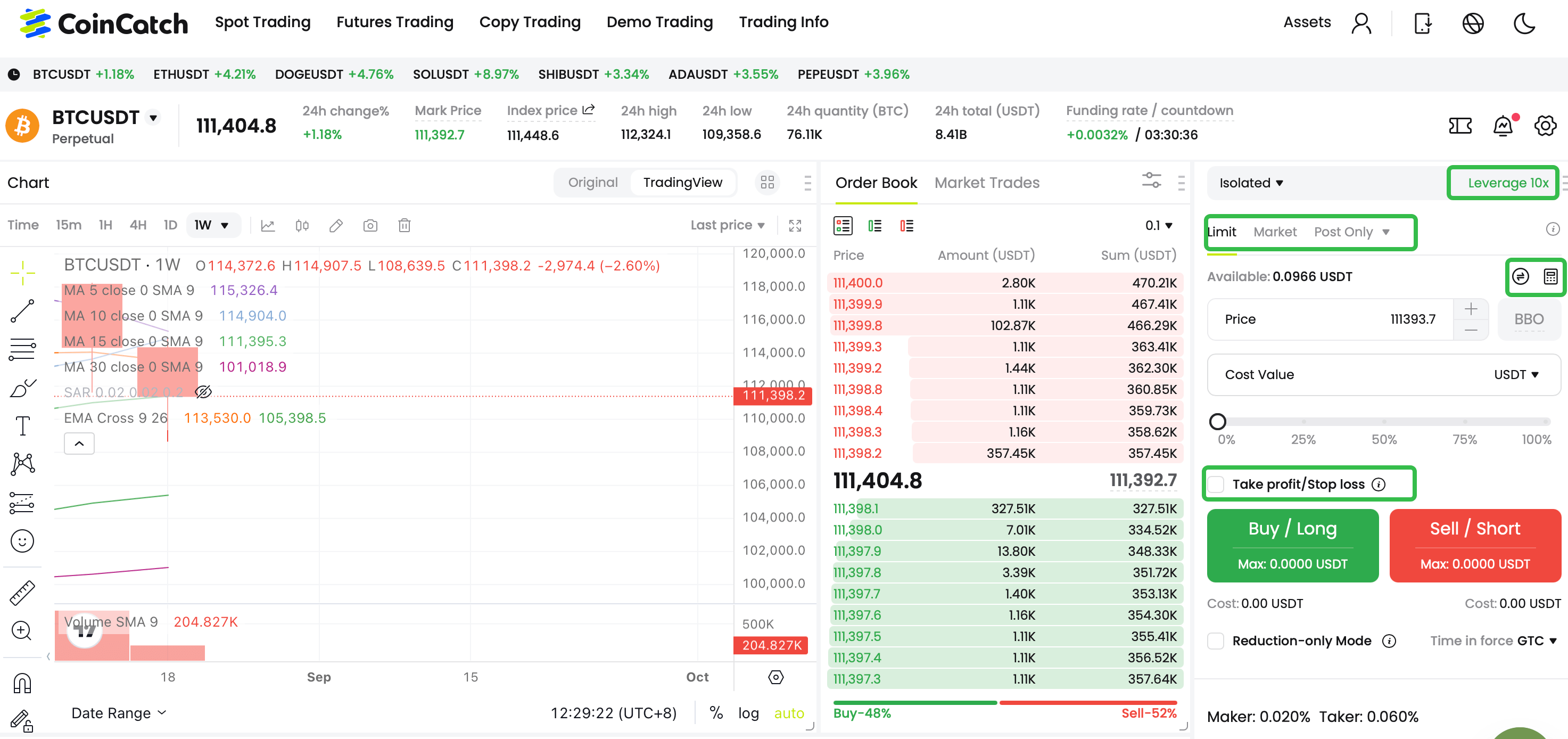

Leverage Risks: Trading with

borrowed funds (leverage) can amplify gains but also losses. It increases the risk of

liquidation, where your position is automatically closed if the market moves against you.

User-Centric Strategies:

Use Stop-Loss Orders

: This tool allows you to set a price at which your asset will automatically be sold to

limit potential losses.

Practice Diversification: Avoid concentrating all your funds on a single cryptocurrency. Spreading investments across different assets can help manage risk.

Invest Responsibly: A fundamental rule is to

only invest money you are prepared to lose. Avoid investing funds essential for your daily life.

Navigating Security and Operational Risks

Your first line of defense is understanding and using the security features provided by your exchange.

Account Security: Reputable exchanges like Coincheck emphasize measures like

cold storage for user funds and

two-factor authentication (2FA) for account access. CoinCatch also reportedly encourages users to employ 2FA.

User-Centric Strategies:

Maximize Security Settings: Always enable

2FA using an authenticator app.

Stay Informed: Follow exchange announcements and official channels for any news about security incidents or policy changes. Please follow

CoinCatch X account and

CoinCatch Academy to keep updated on the latest news.

Utilizing Exchange Tools for Risk Management

Many CEXs provide built-in tools to help users manage their risk.

Security Dashboards: These centralized hubs let you review active sessions, manage API keys, and monitor account activity. Exchanges like CoinCatch are noted for providing users with a clear view of their security settings and active sessions.

API Key Management: If you use trading bots, create API keys with

strict permissions, only granting the necessary access (e.g., read-only or trade-only, never withdrawal). For more information, please read:

How to Create and Integrate CoinCatch API?

Use CoinCatch Trading Tools

Developing Personal Risk Management Habits

Technology alone isn't enough. Your habits are critical for safety.

Continuous Learning:

Crypto space changes fast. Make an effort to

stay updated on market news, potential vulnerabilities, and new regulations.

Track Federal Reserve Policy

Federal Reserve monetary policies have profound impacts on global financial markets, particularly high-risk assets such as cryptocurrencies. Affiliates must understand and monitor these policy shifts in order to mitigate market risks. Focus areas:

Monitor interest rate decisions: Fed rate hikes/cuts directly affect market liquidity. Rate hikes typically put pressure on risk assets. Affiliates should proactively remind clients to adjust leverage ratios or reduce position risk.

Follow key economic data: Non-Farm Payroll (NFP), Consumer Price Index (CPI), and other data will influence Fed policy expectations and trigger crypto market volatility. It is recommended that affiliates alert clients to potential market volatility before and after major data releases.

Understand U.S. Dollar Index (DXY) trends: The strengthening of the U.S. dollar often suppresses crypto prices. Track DXY via Bloomberg, TradingView, or other tools, correlating it with crypto market performance to refine risk strategies.

Review FOMC meeting minutes: Federal Open Market Committee (FOMC) minutes can reveal future policy direction. It is recommended to analyze their implications for crypto post-release and adjust business tactics accordingly.

Track industry news daily to maintain keen insights: The cryptocurrency market changes rapidly, and industry news is a key source for affiliates to understand market trends and identify risks. Recommendations:

Subscribe to authoritative sources: Follow leading crypto media such as CoinDesk, Cointelegraph, and The Block to stay informed on market trends, project developments, and regulatory updates. It is recommended to review top headlines daily, with a focus on news related to CoinCatch or its ecosystem.

Track social media activity: Crypto communities (such as X) are important channels to spread information. Monitor crypto communities, focusing on industry KOLs, exchange official accounts, and project announcements to gauge market sentiment shifts.

Analyze on-chain data: Use tools like Dune Analytics and Glassnode to monitor on-chain trading volume, whale movements, and liquidity changes. The data helps anticipate risks, such as price fluctuations signaled by abnormal large transfers.

Implement information filtering: In the face of overwhelming information, affiliates must learn to verify the authenticity of content and avoid being misled by rumors or FUD (Fear, Uncertainty, and Doubt). It is recommended to prioritize official announcements and credible sources.

Phishing Awareness: Be extremely cautious of unsolicited messages, emails, or websites asking for your login credentials or private keys.

Never click on suspicious links. Set up Anti-phishing code on CoinCatch:

What's Anti-Phishing Code and How to Set it Up

Secure Your Devices: Use strong, unique passwords and consider using a

password manager. Keep your software and antivirus programs updated.

Beware of FOMO: Avoid making investment decisions based solely on

fear of missing out (FOMO). Conduct thorough research before investing in any asset. For more information, please read:

What Is FOMO in Crypto & How to Deal with It?

Maintain Records: Keep records of your transactions, deposits, and withdrawals. This can be helpful for tax purposes and if you need to resolve issues with support. For more information, please read:

How to View Spot Order History and Asset History

Conclusion

Navigating centralized cryptocurrency exchanges requires a healthy balance of

enthusiasm and caution. While CoinCatch offer incredible convenience and access, understanding the risks from market volatility and security threats to regulatory shifts is paramount. By

maximizing the security tools they provide, and adopting

smart personal habits, you can significantly reduce your exposure to these risks. Remember, in the world of crypto,

your security is ultimately your responsibility. Empower yourself with knowledge, stay vigilant, and trade responsibly.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.