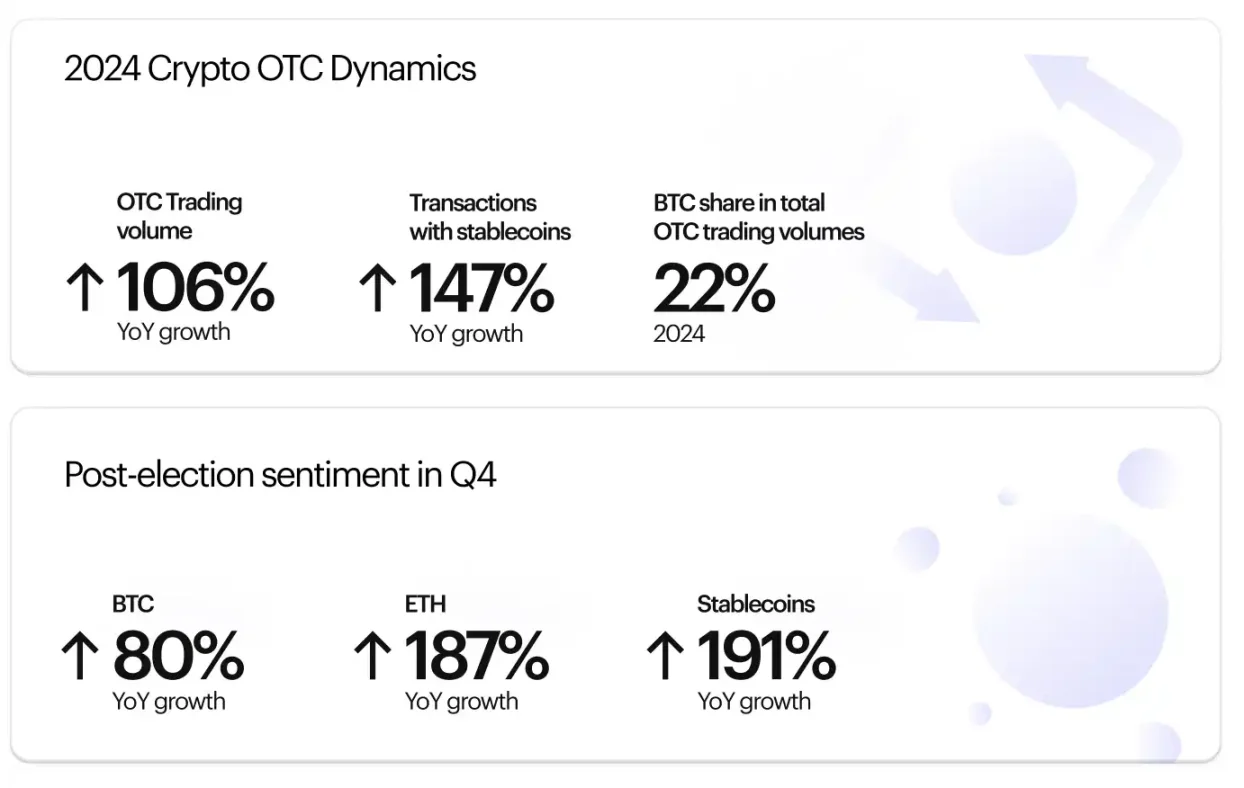

The development of cryptocurrency OTC platforms has seen two major breakthroughs. In 2024, the approval of Bitcoin and Ethereum ETFs was followed by the gradual introduction of frameworks (MiCA and VARA) in regions like the EU and Dubai, allowing OTC desks to operate legally and on a large scale, necessitating rapid procurement of underlying assets by institutions. In 2025, the overall trend of traditional finance underwent a 360-degree shift after US President Trump introduced the concept of a "crypto capital." Following the introduction of various new crypto policies, Bitcoin reached new highs in early 2025, while Ethereum saw strong gains. This surge in institutional asset allocation fueled explosive growth in OTC platform trading.

Typically, OTC trading directly matches buyers and sellers. They provide a single quote, eliminating slippage and bidding. Transfers are completed through custodial wallets and institutional accounts. Because orders never hit the public limit book, the market never sees your hand. As dark pools in the cryptocurrency market, OTC institutions don't disclose their users' specific trading details. However, unlike traditional finance, we can obtain clues through on-chain analysis.

The OTC Boom

The metamorphosis of OTC platforms into crypto’s "dark pool" ecosystem stems from two catalytic events. In 2024, Bitcoin and Ethereum ETF approvals unleashed institutional demand, while regulatory frameworks like the EU’s MiCA and Dubai’s VARA legitimized large-scale OTC operations. By 2025, former President Trump’s "Crypto Capital" rhetoric accelerated Wall Street’s embrace, with firms like SharpLink Gaming and CEA Industries (VAPE) allocating billions to crypto treasury reserves. Traditional exchanges proved ill-equipped to handle such volume, executing a $100 million ETH order on Binance could trigger 3-5% slippage, whereas OTC desks like Galaxy’s absorbed $4.36 billion ETH buys for SharpLink with zero market impact.

This structural advantage fueled explosive growth: OTC volumes consistently surpassed prior-year levels throughout 2024, culminating in a 112.6% YoY surge in H1 2025. Crucially, Asia emerged as a parallel hub, with Hong Kong’s OSL and UAE platforms complementing Galaxy’s transatlantic dominance. Market makers like Flow Traders further professionalized the space, deploying quant strategies to tighten spreads for billion-dollar trades.

Galaxy’s Execution Mastery: The $9B BTC Trade and Beyond

Galaxy’s handling of July’s historic 80,000 BTC ($9B) trade revealed its operational superiority. Acting for an early Bitcoin investor conducting estate planning, Galaxy navigated three existential risks:

market impact (preventing panic sells),

counterparty risk (securing a qualified buyer amid liquidity fragmentation), and

temporal leakage (completing transfers before price discovery). The solution involved direct wallet transfers via Galaxy’s OTC addresses, bypassing order books entirely. When news broke post-settlement, BTC dipped 4% but recovered within hours, a testament to Galaxy’s ability to "pre-absorb" sell pressure.

This trade exemplified Galaxy’s core value proposition: acting as a "white glove" for institutions seeking stealth accumulation or exit. Chain data reveals staggering scale: four known Galaxy OTC wallets processed $18B monthly ETH volume alone in Q2 2025. Recent 24-hour activity included a 29,311 ETH ($126M) transfer to a whale address, demonstrating relentless institutional flow velocity.

Beyond Bitcoin: ETH Vaults, BNB Pivots, and Revenue Diversification

While Bitcoin established Galaxy’s reputation, its expansion into altcoin OTC reflects institutional diversification:

Ethereum Dominance: Galaxy facilitated 856,554 ETH ($31.6B) buys for 14 new wallets in Q2 2025. SharpLink Gaming accounted for ~500,000 ETH, building a $1.8B position entirely via Galaxy/FalconX OTC desks.

BNB Breakthrough: When CEA Industries (VAPE) pivoted to a "BNB Treasury" strategy, Galaxy co-founder David Namdar became CEO, structuring a $1.25B OTC acquisition plan. Given Binance’s 71% control of BNB supply, Galaxy’s access to concentrated liquidity proved critical.

Revenue Synergies: Beyond trading fees, Galaxy monetizes via advisory services (guiding 20+ crypto reserve companies), asset management (overseeing $2B institutional holdings), and staking infrastructure for ETH/SOL holdings.

Regulatory Arbitrage

Galaxy’s licensing strategy built an insurmountable compliance advantage. Its April 2025 FCA derivatives license, permitting MiFID investment services in the UK—preceded BaFin’s approval for EURAU, Europe’s first MiCAR-compliant euro stablecoin. This positioned the Galaxy to capture two regulatory tailwinds:

Institutional Trust: Banks and corporates require regulated counterparties. Galaxy’s public listing and compliance pedigree satisfy audit committees wary of unlicensed entities.

Stablecoin Infrastructure: EURAU’s 100% collateralized design targets treasury management for EU governments, potentially enabling "stealth" sovereign debt issuance. Arthur Hayes projects such instruments could unlock $6.8T in dormant liquidity.

The Institutionalization Paradox: Centralization vs. Growth

Despite its triumphs, Galaxy faces strategic tensions as crypto institutionalizes. Novogratz himself acknowledged the "crypto reserve company frenzy may have peaked," signaling saturation among public firms copying MicroStrategy’s playbook. Meanwhile, Galaxy’s dominance concentrates systemic risk:

Market Fragility: 54% of SharpLink’s ETH sits in three wallets, creating vulnerability if liquidated.

Regulatory Scrutiny: As OTC’s "invisible hand," Galaxy could face antitrust probes akin to traditional dark pool operators like Citadel Securities.

Yet Galaxy’s diversification mitigates these risks. Its shift toward recurring revenue—charging management fees from reserve companies and earning yield via staking—reduces reliance on volatile trading income.

Conclusion

Galaxy Digital transcends the label of "OTC desk." It is the indispensable plumbing connecting traditional finance to crypto’s frontier—a role validated by its 268x revenue surge and institutional adoption milestones. The $9B Bitcoin transaction was no anomaly; it heralded a new paradigm where trillion-dollar flows migrate off-exchange.

For crypto markets, Galaxy’s rise signals maturation: volatility suppression via OTC liquidity enables safer institutional participation. For regulators, it presents a dilemma—how to monitor transactions occurring in legally compliant but opaque channels. And for competitors, Galaxy’s licensing moat and execution prowess set a daunting standard. As MiCA and similar frameworks expand, Novogratz’s vision of a "regulated but unbounded" crypto economy increasingly orbits around Galaxy’s invisible engine.

Reference:

Gate.io. (2025, August 11).

Galaxy Digital leads a new era of Block Trading as the OTC platform becomes the third largest Liquidity pillar in the crypto market.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.