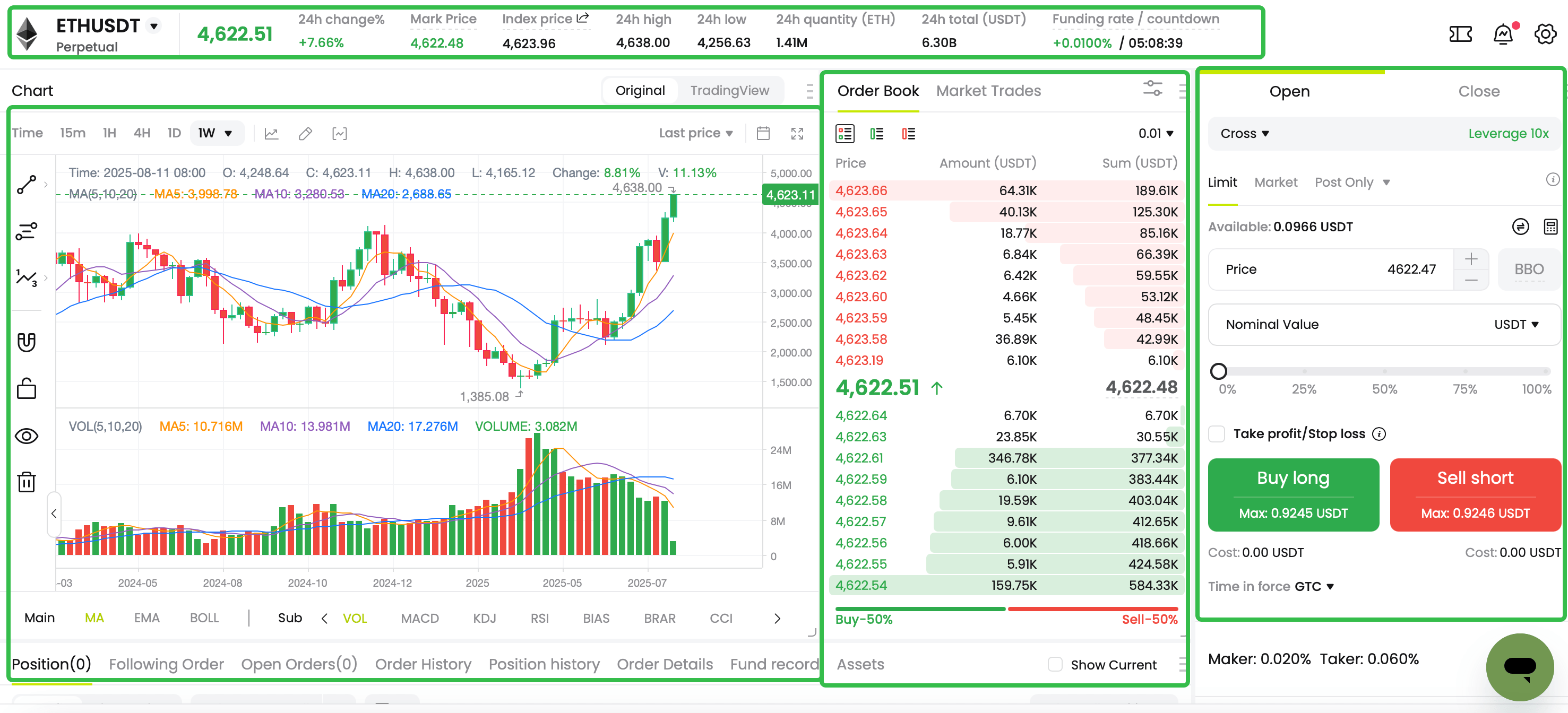

For beginners, futures trading can be more complex than spot trading, as it involves a greater number of professional terms. To help new users understand and master futures trading effectively, this article aims to explain the meanings of these terms as they appear on the CoinCatch futures trading page. We will introduce these terms below:

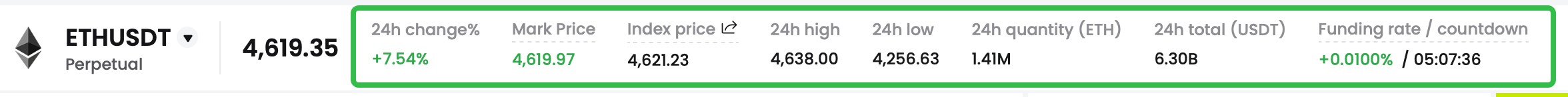

Terms Above the K-Line Chart

Perpetual: "Perpetual" denotes continuity. The commonly seen "perpetual futures" (also known as perpetual futures contracts) evolved from traditional financial futures contracts, with the key difference being that perpetual futures have no settlement date. This means that as long as the position is not closed due to forced liquidation, it will remain open indefinitely.

Index Price: The comprehensive price index obtained by referencing the prices of major mainstream exchanges and calculating the weighted average of their prices. The index price displayed on the current page is the MX index price.

Mark Price: Improving the stability of the futures market, reducing unnecessary explosions when there are abnormal market fluctuations, using the marked price to calculate user's unrealized profit and loss.

Funding Rate / Countdown: The Real-Time Funding Rate is calculated based on the Premium Index per minute over the recent period. CoinCatch uses a dynamic funding rate calculation mechanism based on the size of a user's position, updating every 8 hours. The funding fee is determined based on the size of a user's position. If the funding rate is positive, the long position holder will pay fees to the short position holder, and vice versa.

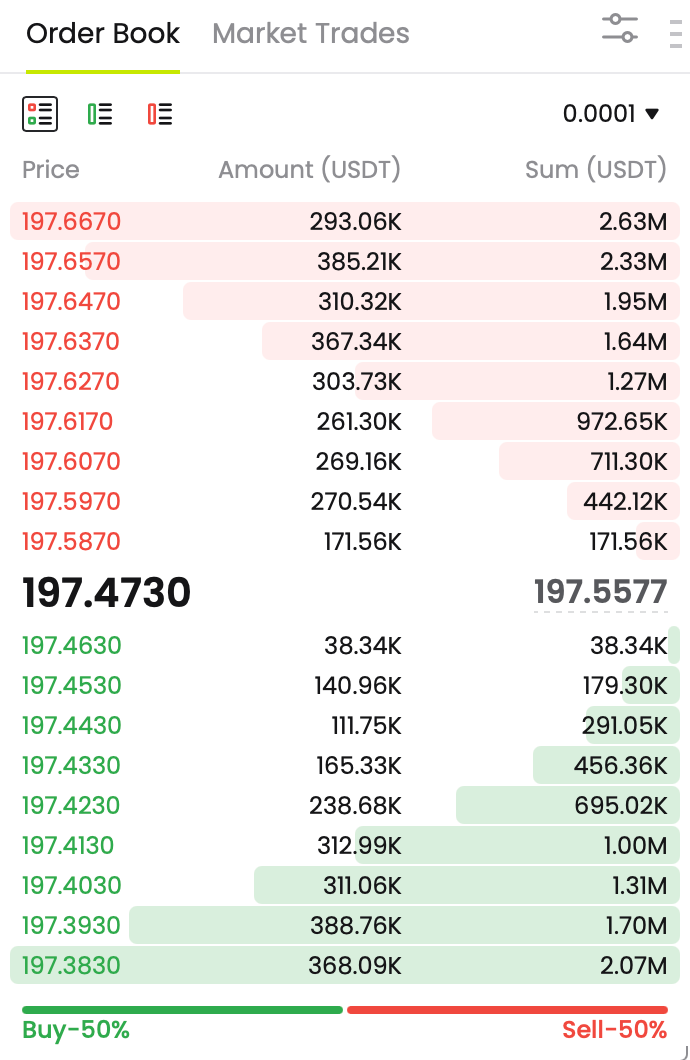

Terms in the Order Book Area

Order Book: A window to observe market trends during the trading process. In the order book area, you can observe each trade, the proportion of buyers and sellers, and more.

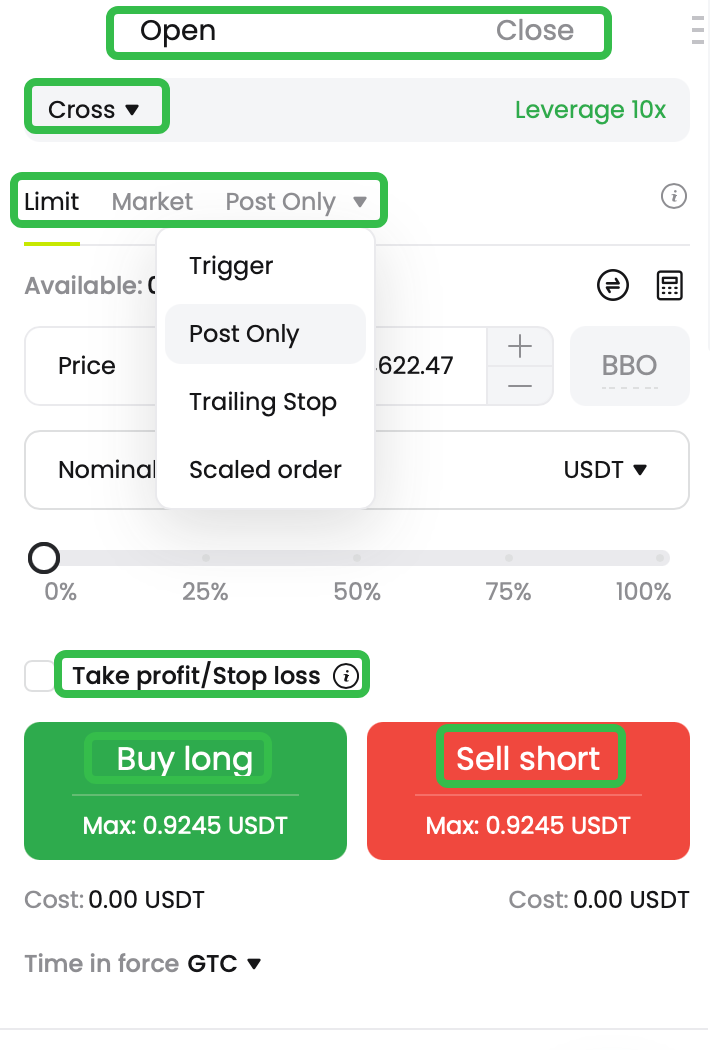

Terms in the Trading Area

Open and Close: After entering the price and quantity based on your judgment of the market direction, you can choose to open a long or short position. If you predict an increase in price, you open a long position; if you predict a decrease, you open a short position. When you sell the contract you bought, you close the position. When you open a position by purchasing a contract and hold it without settling, it is called a holding position. You can view your holding positions by clicking on [Open Position] at the bottom of the page.

Open Long: When you predict that the token price will rise in the future and open a position based on this trend, it is known as opening a long position.

Open Short: When you predict that the token price will fall in the future and open a position based on this trend, it is known as opening a short position.

Margin and Margin Mode: Users can engage in futures trading after depositing a certain percentage of funds as financial collateral. This fund is known as margin. The margin mode is divided into isolated margin or cross margin.

Isolated: In isolated margin mode, a certain amount of margin is allocated to a position. If the margin for a position decreases to a level below the maintenance margin, the position will be liquidated. You can also choose to add or reduce margin to this position.

Cross: In cross margin mode, all positions share the cross margin of the asset. In the event of liquidation, the trader may lose all the margin and all positions under the cross margin of that asset.

Order Types: The order types are divided into limit order, market order, trigger order, trailing stop order, scaled order, and post-only order.

Limit: A limit order is an order placed to buy or sell at a specific price or better. However, a limit order's execution isn't guaranteed.

Market: A market order is an order placed to buy or sell quickly at the best available price in the market.

Trigger: For trigger orders, users can set a trigger price, order price, and quantity in advance. When the market price reaches the trigger price, the system will automatically place an order at the order price. Before the trigger order is triggered successfully, the position or margin will not be frozen.

Trailing Stop: A trailing stop order is submitted to the market based on the user's settings as a strategic order when the market is in a retracement. Actual Trigger Price = Market's Highest (Lowest) Price ± Trail Variance (Price Distance), or Market's Highest (Lowest) Price * (1 ± Trail Variance). At the same time, users can set the price at which the order is activated before the trigger price is calculated.

Scaled Order: A scaled order is a trading strategy where a large order is divided into smaller limit orders placed across a specified price range. This allows traders to execute large positions more gradually, potentially minimizing the impact on market prices and achieving a better average execution price.

Post Only: A post-only order will not be immediately executed in the market, ensuring that the user will always be the maker. If the order were to be matched with an existing order immediately, it would be canceled.

TP/SL: A TP/SL order is an order with preset trigger conditions (take profit price or stop-loss price). When the last price / fair price / index price reaches the preset trigger price, the system will close the position at the best market price, based on the preset trigger price and quantity. This is done to achieve the goal of taking profit or stopping losses, allowing users to automatically settle the desired profit or avoid unnecessary losses.

Stop Limit Order: A stop limit order is a preset order where users can set the stop-loss price, limit price, and buy/sell amount in advance. When the last price reaches the stop-loss price, the system will automatically place an order at the limit price.

COIN-M: Coin-margined futures provided by CoinCatch are a reverse contract that uses cryptocurrency as collateral, meaning that cryptocurrency serves as the base currency. For example, in the case of BTC coin-margined futures, Bitcoin is used as the initial margin and for PNL calculations.

USDT-M: USDT-margined futures provided by CoinCatch is a linear contract, which is a linear derivative product quoted and settled in USDT, a stablecoin pegged to the value of the US dollar.

Terms in the order area below the K-line chart

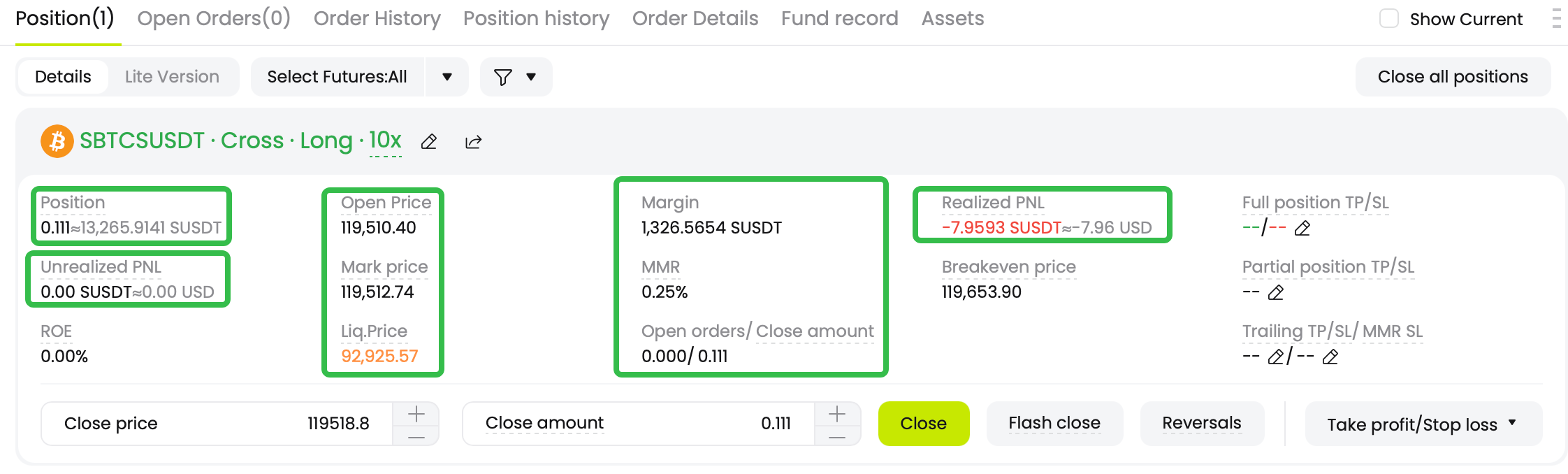

Open Position

Position: Number of contracts in positions that have not yet been closed.

Liq. Price: When your position has hedge positions, or is above the first level, and the margin level is equal to 1. If the price is triggered by mark price, your position will be taken over by the system to deleverage.

Entry Price: Current position, average cost of opening a position.

Mark Price: Improving the stability of the futures market, reducing unnecessary explosions when there are abnormal market fluctuations, using the marked price to calculate user's unrealized profit and loss.

Margin: Margin = Position Value / Leverage

MMR: The value corresponding to the position, when the margin rate of the position is less than the maintenance margin rate, forced decreased or liquidation will be triggered.

ROI: Return on investment (ROI) compares the current value of an asset to its original value (aka the price you paid for it) to determine how it's changed in value since you acquired it. ROI = unrealized PnL ÷ initial margin; initial margin = average entry price × open position size ÷ leverage ÷ margin currency's index price.

Realized PnL: Realized PnL = profit from closing a position + funding fees + transaction fees.

Unrealized PnL: Unrealized Profit and Loss (P&L) in trading refers to the gains or losses in open positions, that is, trades that an investor has not yet closed.

Breakeven Price: The breakeven price refers to the price at which the total profit upon position closure is zero. Breakeven price = (total transaction fee since opening the position − funding fee − realized PnL + opening direction × average entry price × position size) ÷ (position size × (opening direction − taker fee rate)). Note: The opening direction should be assigned a value of 1 for long positions and −1 for short positions.

For beginners, before engaging in futures trading for the first time, you can practice on the CoinCatch

Futures Demo Trading interface to familiarize yourself with various features before entering the live trading platform for trading.

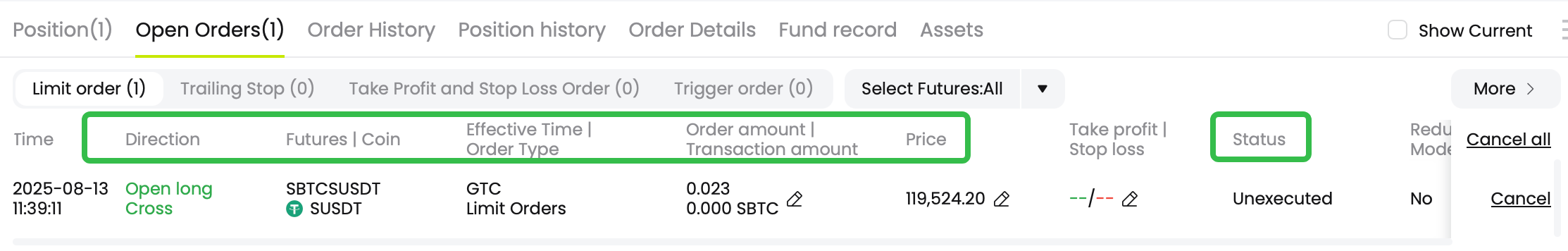

Open Orders

Time: A timestamp for when this order was placed

Coin: Cryptocurrency traded in order.

Direction: Directional trading involves taking a position in the market based on the belief that the price of the asset will move in a specific direction, either up or down.

Order Type

: In trading, an order type specifies how an order to buy or sell a security should be executed. It tells the broker how to handle the order, including when and at what price to attempt the trade. Common order types include market orders, limit orders, and stop orders, each with different implications for price and execution speed.

Satus: Open - When the order is submitted and pending execution. Processing - When the order execution process is almost complete. Filled - When the order is executed. Cancelled - When the order is cancelled.

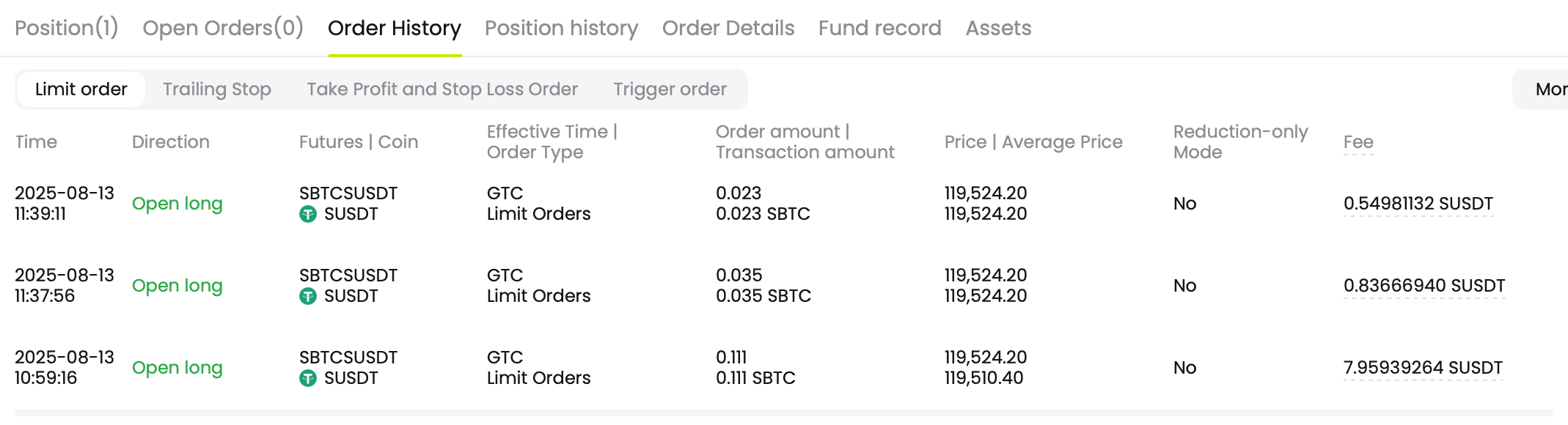

Order History

Fee: All realized profits and losses generated by the position, including trading fees, funding costs, and closing PNL.

Reduction-only Mode: An option for limit and market orders, ensures that an order will only reduce or close an existing position, and will not open a new position or increase the size of an existing one. Essentially, it's a safety mechanism to prevent unintended opposite positions or an increase in exposure.

Understanding the terms related to futures trading is just the first step in learning how to use futures tools. Next, you need to gain practical experience through trading. Before trading futures, you can practice using the futures

Demo Trading platform provided by CoinCatch. Once you are proficient, you can move on to live futures trading.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.