On December 9, 2025, Hong Kong took a decisive step towards integrating its digital asset market into the global financial regulatory mainstream. The government announced a public consultation on implementing the Organisation for Economic Co-operation and Development's (OECD) Crypto-Asset Reporting Framework (CARF) and revised Common Reporting Standard (CRS) rules. This move targets the automatic exchange of tax-relevant information on crypto-assets with partner jurisdictions starting in 2028, followed by the updated CRS in 2029. While Hong Kong has not yet signed the CARF Multilateral Competent Authority Agreement (MCAA), setting this clear timeline demonstrates a strategic commitment to international cooperation while carefully managing the pace of domestic regulatory change.

This initiative is not an isolated policy shift but a logical progression in Hong Kong's evolving approach to digital assets. It balances the ambitious vision of becoming a "global innovation centre" for digital assets, as outlined in the 2025 Policy Declaration 2.0, with the practical necessities of tax transparency and combating cross-border tax evasion. For market participants, from global exchanges to individual investors—understanding CARF's mechanics and implications is no longer optional; it is fundamental to future-proofing their operations and investments in one of Asia's foremost financial hubs.

CARF Framework: A Global Standard for Crypto Tax Transparency

The Crypto-Asset Reporting Framework (CARF) is an international standard developed by the OECD to facilitate the automatic exchange of information (AEOI) on crypto-assets for tax purposes. Conceived in 2022 and refined through 2024 with technical guidance, its primary goal is to prevent the erosion of global tax transparency caused by the rapid growth of the crypto-asset market. In essence, CARF aims to apply the long-established principles of financial account reporting to the digital asset ecosystem.

The framework's core mechanism is straightforward yet powerful. It imposes due diligence and reporting obligations not on the assets themselves, but on the intermediaries that provide commercial services around them. These entities are classified as Reporting Crypto-Asset Service Providers (RCASPs). The scope of RCASPs is deliberately broad, encompassing:

-

Centralised exchanges and trading platforms.

-

Custodial wallet providers and custodians.

-

Brokers and dealers in crypto-assets, including some over-the-counter (OTC) desks.

-

Entities involved in the exchange of stablecoins for fiat currency or other crypto-assets.

-

Certain decentralised finance (DeFi) platforms that have an identifiable, controlling entity.

Under CARF, these RCASPs must identify their customers' tax residency and meticulously track reportable transactions. This includes exchanges (crypto-to-fiat and crypto-to-crypto), transfers, and disposals. The collected data—detailing gross proceeds, transaction timestamps, and wallet addresses—is then reported annually to the local tax authority, which automatically exchanges it with the tax authorities of the jurisdictions where the customers are tax residents.

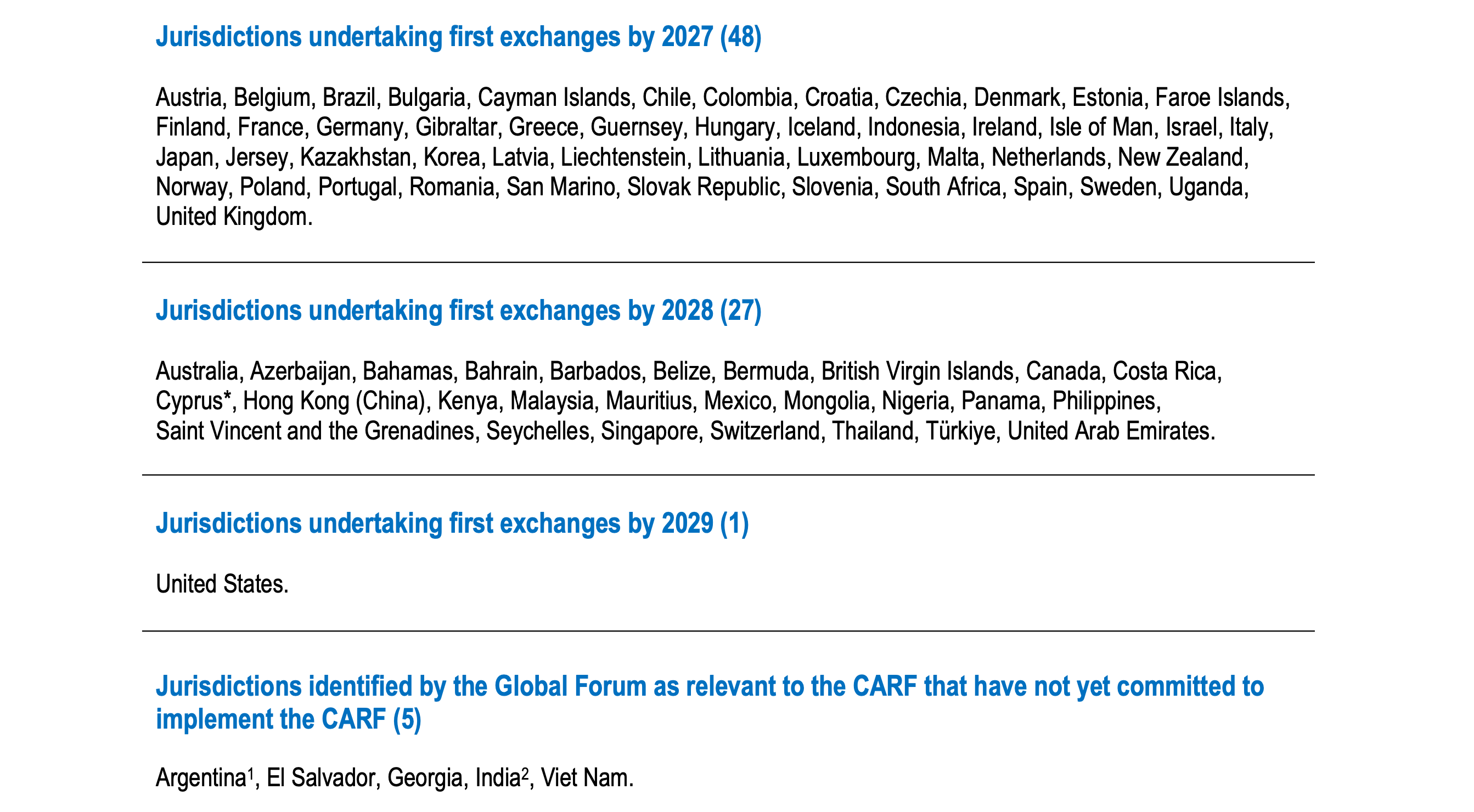

It is crucial to distinguish CARF from its predecessor, the CRS. While CRS governs the AEOI for traditional financial accounts, it has significant gaps in covering novel digital assets. CARF is specifically designed to fill these gaps. Furthermore, CARF operates alongside, not as a replacement for, domestic reporting regimes like the U.S. Form 1099-DA, creating a multi-layered global transparency network. As of late 2025, over 70 jurisdictions have committed to implementing CARF, with major financial centres like Singapore planning to commence exchanges by 2027-2028.

Hong Kong's Existing Foundation: The Common Reporting Standard (CRS)

Hong Kong is not new to the realm of international tax information exchange. It has been an active participant in the CRS since 2018, automatically exchanging financial account information with partner jurisdictions to prevent tax evasion. This existing infrastructure provides a critical foundation for CARF's implementation.

The CRS in Hong Kong requires "financial institutions" to conduct due diligence on their account holders. They must identify accounts held by tax residents of reportable jurisdictions and annually submit details such as account balances, interest, dividends, and sales proceeds from financial assets to the Inland Revenue Department (IRD). The proposed 2029 update to the CRS, mentioned in the same consultation as CARF, aims to further strengthen this system. Expected enhancements include mandatory registration of reporting financial institutions and increased penalties for non-compliance, ensuring Hong Kong maintains a high rating in OECD peer reviews.

The parallel advancement of both CARF and an enhanced CRS signifies a holistic upgrade of Hong Kong's AEOI regime. It closes the regulatory arbitrage between traditional finance and digital assets, ensuring that an individual's or entity's tax liabilities can be assessed based on a comprehensive view of their entire portfolio, regardless of the asset class.

The Evolution of Crypto-Asset Regulation in Hong Kong

The decision to adopt CARF is the latest step in a clear, multi-year trajectory of regulatory development. Hong Kong's strategy has consistently aimed to foster a "trusted and innovative" digital asset ecosystem that prioritises risk management and investor protection.

A pivotal moment was the introduction of the mandatory licensing regime for Virtual Asset Service Providers (VASPs) in 2023, requiring all centralised trading platforms operating in Hong Kong to be licensed by the Securities and Futures Commission (SFC). This established robust anti-money laundering (AML) and know-your-customer (KYC) standards. The 2025

Policy Declaration 2.0further solidified this path under its "LEAP" framework, with the "L" standing for optimising legal and regulatory streamlining. The declaration announced forthcoming licensing regimes for digital asset trading and custody service providers beyond existing VASPs, and the implementation of a stablecoin issuer licensing regime.

CARF directly complements these existing and planned regulations. While the VASP and future licensing regimes focus on prudential supervision, market conduct, and investor safety, CARF addresses the specific challenge of tax compliance. The stringent KYC and transaction recording requirements already imposed on licensed platforms by the SFC will serve as a ready-made foundation for meeting CARF's due diligence and data collection mandates. Therefore, CARF integration is less a disruptive overhaul and more a strategic extension of Hong Kong's established regulatory philosophy into the tax domain, creating a comprehensive "supervision + transparency" framework.

Potential Impact of CARF on Hong Kong's Crypto Market

The implementation of CARF will have a profound and varied impact across the digital asset value chain in Hong Kong. The following table summarises the primary challenges and shifts for key market participants:

| Market Participant |

Primary Impacts & Challenges |

| Crypto Asset Trading Platforms |

Heightened compliance burden: Must build systems to classify transactions, track tax residency, and generate CARF reports. Increased operational costs for data integration and audit trails. Becomes a competitive differentiator for compliance readiness. |

| Individual Investors |

Loss of perceived anonymity. Mandatory disclosure of trading history to home tax authority. Necessity for accurate personal record-keeping and understanding of taxable events. Potential tax liabilities on previously unreported gains. |

| Crypto Asset Custodians |

Likely classification as RCASPs, imposing direct reporting duties. Need to develop systems to identify and report on customer transactions (transfers, disposals) occurring within custody. |

| Banks & Traditional Intermediaries |

Need to adapt legacy systems to handle crypto-related data from CARF reports received about clients. Potential new reporting obligations if offering crypto-related services (e.g., bank-owned custody). Enhanced scrutiny on fiat on-ramps/off-ramps. |

For Crypto Asset Trading Platforms, the impact is operational and strategic. The core challenge is data. CARF requires transforming raw, often unstructured blockchain and trade log data into standardized, classified, and jurisdictionalized information packages. A simple transfer, a crypto-to-crypto trade on a decentralized exchange, or a complex DeFi yield harvest must be accurately categorized and valued in fiat terms at the time of the transaction. This demands significant investment in data normalization engines, fair market value pricing models (especially for illiquid or long-tail assets), and robust governance controls. Platforms that can demonstrate CARF-ready infrastructure will gain a significant trust advantage.

For Individual Investors, CARF signifies the definitive end of the notion that crypto investments are invisible to tax authorities. Hong Kong-based investors who are tax residents elsewhere will have their transaction summaries automatically sent to their home country's revenue service. This makes meticulous personal record-keeping of acquisition dates, costs, disposal proceeds, and transaction purposes—essential. Investors must proactively understand the tax treatment of crypto events (capital gains, income, etc.) in their home jurisdiction to avoid surprises and penalties.

For Crypto Asset Custodians, the consultation text suggests they will almost certainly fall under the RCASP definition. Their primary duty will shift from passive asset safeguarding to active transaction reporting. They must develop the capability to monitor wallet movements, identify reportable events like transfers to non-custodial wallets, and link these activities to specific, identified customers.

For Banks and Traditional Financial Intermediaries, the influence is twofold. First, they will be critical consumers of CARF data, as the reports will provide unprecedented visibility into their clients' crypto activities, enhancing their own risk profiling. Second, those offering digital asset-related services, such as tokenized asset custody or brokerage, may themselves become RCASPs, requiring them to bridge their legacy compliance systems with the new crypto-data paradigm.

Strategic Responses and the Path to Compliance

Navigating the CARF transition successfully requires proactive and strategic planning from all stakeholders.

For Service Providers (RCASPs): The key is to treat CARF compliance as a strategic capability, not a one-off project. Investment should focus on:

-

Unified Data Architecture: Building or procuring systems that can ingest, normalize, and reconcile data from diverse sources (exchange databases, blockchain ledgers, DeFi protocols).

-

Advanced Transaction Classification: Implementing logic and tools that can intelligently decode smart contract interactions and classify transaction types (disposal, acquisition, income, etc.) accurately.

-

Jurisdictional Mapping: Enhancing KYC systems to reliably determine and document the tax residency of all users.

-

Valuation Engines: Deploying rigorous, auditable methodologies for determining the fair market value of all assets involved in a transaction, particularly in complex crypto-to-crypto trades.

Early engagement with regulators during the consultation period and learning from the experience of early-adopter jurisdictions like Singapore will be invaluable.

For Investors: Proactivity is the best strategy. Investors should:

-

Conduct a Self-Assessment: Review all digital asset holdings across exchanges, wallets, and chains. Assume all this data will be visible to tax authorities.

-

Seek Professional Advice: Consult with tax advisors who specialize in both crypto-assets and international tax law to understand liabilities in all relevant jurisdictions.

-

Implement Robust Tracking: Use dedicated crypto-tax software to automate transaction logging and gain clarity on potential tax obligations ahead of formal CARF reporting.

For Hong Kong Authorities: The successful implementation hinges on clear guidance and phased enforcement. The government should provide detailed technical guidance, similar to Singapore's planned e-Tax Guide, and consider a "soft launch" period to allow RCASPs to test reporting systems. Maintaining dialogue with the industry will be critical to ensuring the rules are practical and effective without stifling the innovation Hong Kong seeks to champion.

Conclusion

Hong Kong's move to implement CARF is a watershed moment that aligns its digital asset market with the irreversible global trend towards tax transparency. It represents a maturation of the sector, replacing ambiguity with clear rules. While introducing new compliance complexities, this alignment ultimately serves to legitimize the asset class, protect the integrity of Hong Kong's financial system, and bolster its reputation as a responsible international financial centre.

The journey to 2028 will require significant adaptation from platforms, custodians, and investors alike. However, those who embrace this change and invest in robust compliance infrastructure will be best positioned to thrive. They will operate with greater certainty, attract institutional capital that demands transparency, and contribute to building the trusted, innovative, and sustainable digital asset ecosystem that Hong Kong's policy declarations envision. In the end, CARF is not merely a regulatory hurdle; it is a foundational pillar for the next chapter of Hong Kong's digital finance future.

Reference:

Inland Revenue Department (IRD) (Hong Kong Special Administrative Region, China). (2025, December 10). PRESS RELEASE: Automatic exchange of tax information on crypto-asset transactions and implementation of amended CRS. Inland Revenue Department (IRD).

https://www.ird.gov.hk/eng/ppr/archives/25120901.htm

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.