In the rapidly evolving landscape of decentralized finance (DeFi), liquidity is the lifeblood that determines the efficiency, stability, and growth of any ecosystem. As layer-2 networks like Base, backed by Coinbase, experience explosive adoption, the need for sophisticated, native liquidity infrastructure becomes paramount. Enter Aerodrome Finance, a next-generation Automated Market Maker (AMM) that has positioned itself not merely as another decentralized exchange, but as the central liquidity hub for the entire Base network. Since its launch in August 2023, Aerodrome has synthesized the best mechanics from leading DeFi pioneers like Curve, Convex, and Uniswap into a cohesive, governance-driven protocol. Its rise to prominence, commanding a dominant share of Base's total value locked (TVL), underscores a critical trend: the future of scalable DeFi is built on dedicated, incentivized liquidity layers. This article delves into the mechanics of AMMs, explores the innovative design of Aerodrome Finance, analyzes its dual-token economy, and examines its market trajectory amidst recent events and strategic developments.

What Is an AMM and How Does a Crypto AMM Work?

To understand Aerodrome's innovation, one must first grasp the foundational technology it builds upon: the Automated Market Maker (AMM). Traditional finance relies on order books, where buyers and sellers place orders to create liquidity. In contrast, an AMM replaces this model with a self-executing, algorithmic protocol.

At its core, an AMM uses liquidity pools. Users, called Liquidity Providers (LPs), deposit pairs of tokens (e.g., ETH/USDC) into a smart contract. This pooled capital forms the reserves against which all trades are executed. When a trader wants to swap one token for another, they do not need a counterparty on the other side; instead, they trade directly with the pool. The price of assets within the pool is determined by a mathematical formula, the most common being the constant product formula (x * y = k), which automatically adjusts prices based on the changing ratio of the two assets in the pool.

The key innovation is that liquidity is always available, facilitated by algorithms rather than human market makers. LPs earn fees from every trade executed in their pool, proportional to their share of the liquidity. This model democratizes market making but introduces challenges like impermanent loss and requires careful incentive design to attract sufficient capital. Aerodrome Finance, as a next-generation AMM, tackles these challenges head-on by integrating advanced incentive structures and governance models to optimize liquidity efficiency.

What Is Aerodrome Finance?

Aerodrome Finance is a decentralized exchange (DEX) and automated market maker protocol launched on the Base network. Its foundational mission is to serve as Base's central liquidity hub, solving the problem of fragmented liquidity by concentrating incentives and trading activity into a single, powerful protocol. Designed by core contributors from Velodrome V2, it inherits a battle-tested model optimized for aligning the long-term interests of voters, liquidity providers, and the broader ecosystem.

Aerodrome distinguishes itself through its "clean launch" philosophy. It was initiated as a public good with zero venture capital funding and no token presale, ensuring a fair and community-oriented start. The protocol is designed to return 100% of its generated fees and trading rewards to its active users/traders, LPs, and governance participants, creating a powerful flywheel where usage directly benefits the community. By late 2024, Aerodrome had cemented its leadership, surpassing $10 billion in Total Value Locked (TVL) and accounting for a significant portion of Base's entire DeFi activity.

Features of Aerodrome Finance

Aerodrome's architecture is built on several core pillars that collectively create a robust and user-aligned liquidity environment.

First, it prioritizes capital-efficient trading. The protocol supports both stable and volatile asset pools, utilizing specialized curves to enable low-slippage swaps, particularly for stablecoin pairs, similar to Curve's model. This efficiency is critical for attracting high-volume traders and minimizing costs for users.

Second, its epoch-based incentive system is the heartbeat of the protocol. Operations are organized into weekly cycles called epochs. During each epoch, emissions of the native AERO token are distributed to liquidity providers who have staked their LP tokens in the protocol's "gauge" system. Crucially, the direction of these emissions is not set by a central team. Instead, it is governed democratically by veAERO holders, who vote to allocate rewards to specific pools, ensuring liquidity is directed where the community deems it most valuable.

Third, Aerodrome is defined by its vote-lock governance model, ve(3,3). This is implemented through a dual-token system. Users can lock their AERO tokens to receive veAERO, a non-fungible governance token (NFT). The longer the lock period (up to four years), the greater the voting weight. veAERO holders wield substantial power: they direct weekly AERO emissions, receive 100% of the protocol's trading fees from the previous epoch, and can earn additional voter incentives. This model aligns long-term protocol health with long-term holder commitment, as those most invested in Aerodrome's future are entrusted with its steering.

Finally, the protocol incorporates a sophisticated rebase mechanism to protect long-term stakeholders. As new AERO tokens are emitted each week, the voting power of existing veAERO holders could be diluted. The rebase formula periodically mints additional veAERO to existing lockers, compensating them and making new, longer locks more attractive. This design ingeniously incentivizes sustained capital commitment, reducing sell pressure on AERO and promoting protocol stability.

What Is the AERO Token?

The AERO token is the ERC-20 utility token at the center of the Aerodrome ecosystem. Its primary function is to incentivize and reward the participation that secures the network's liquidity. It is emitted weekly and distributed to users who provide liquidity to staked pools. Beyond its role as a liquidity mining reward, AERO is the gateway to protocol governance. By locking AERO, users transform it into veAERO, the key to influencing Aerodrome's development and earning a share of its revenue. This transforms AERO from a simple reward token into a productive capital asset within the Aerodrome economy.

AERO Tokenomics

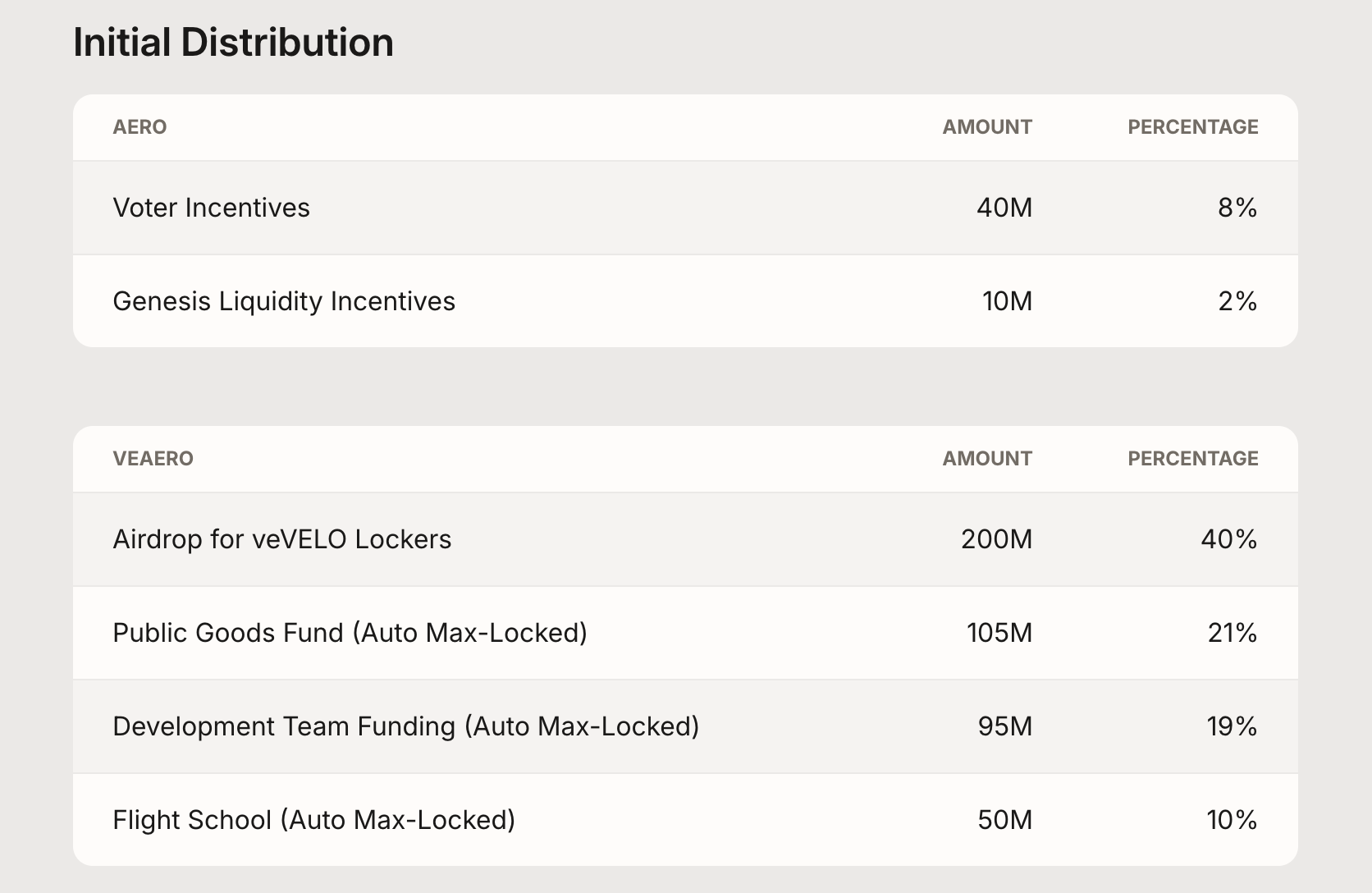

Aerodrome's tokenomics are meticulously crafted for long-term sustainability and community control.

-

Initial and Circulating Supply: The initial total supply was 500 million AERO tokens. A distinctive feature of the launch was that 90% of this supply (450 million AERO) was initially allocated in a vote-locked state as veAERO to the community, public goods fund, foundation, and other ecosystem initiatives, ensuring deep, long-term alignment from day one.

-

Emission Schedule: The protocol employs a dynamic, multi-stage emission policy. It began with a "Take-off" phase where weekly emissions grew to bootstrap liquidity, followed by a "Cruise" phase with weekly reductions. Eventually, control enters the "Aero Fed" phase, where veAERO holders vote weekly to increase, decrease, or maintain the emission rate within set bounds. This places future monetary policy entirely in the hands of the protocol's most committed stakeholders.

-

Value Accrual: Value accrues to AERO and veAERO holders through multiple channels: governance power over lucrative emissions, direct distribution of all trading fees, and rebase rewards for lockers. Strategic initiatives like the protocol's own treasury purchases, such as the acquisition and locking of over 3 million AERO in November 2025—actively reduce circulating supply and demonstrate a commitment to supporting the token's ecosystem value.

Market News and Price Analysis

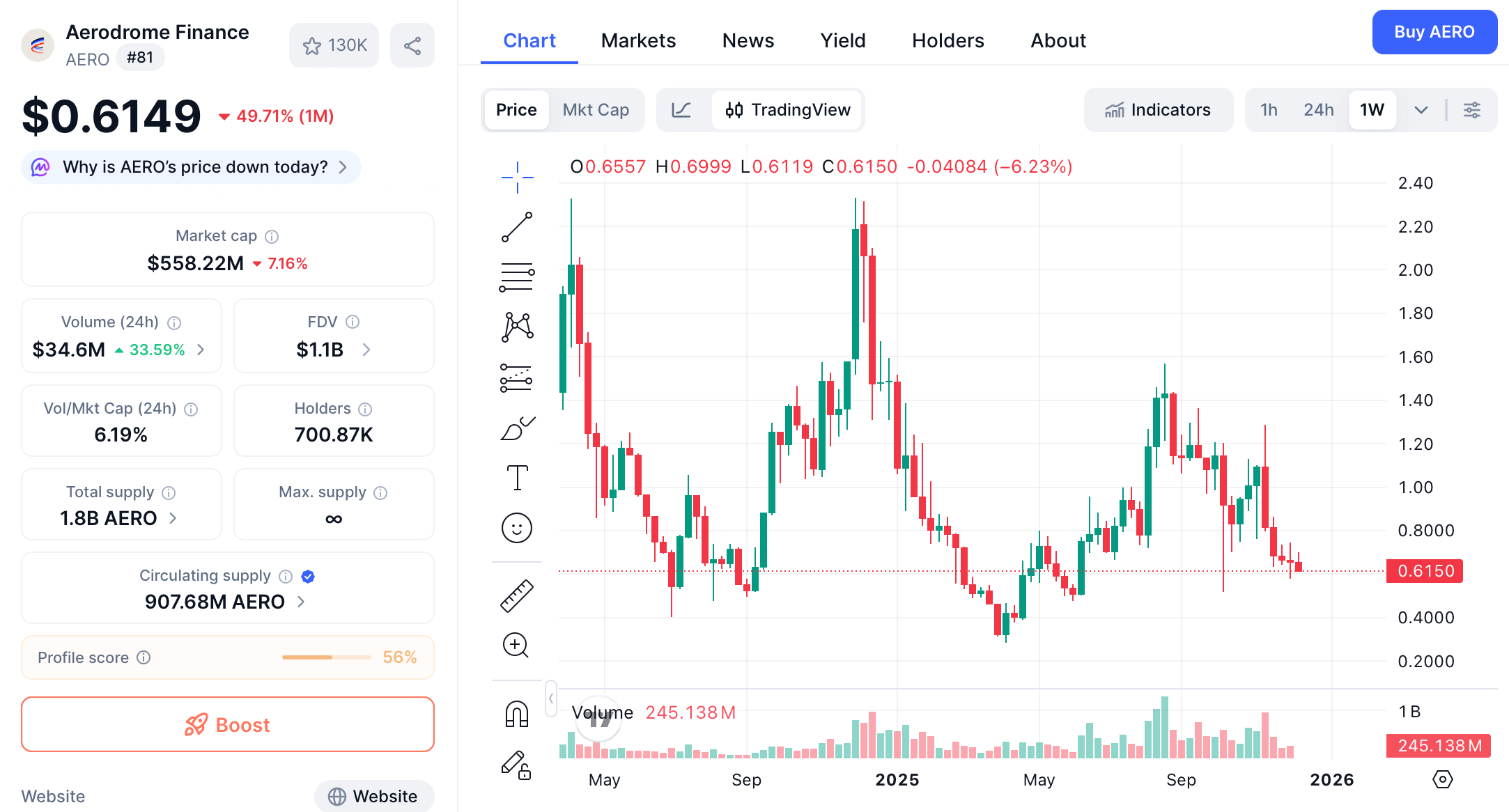

As of December 11, 2025, AERO is trading at approximately $0.6572, representing a modest 0.88% increase intraday but a 10.2% decline over the past week. The 24-hour trading volume has increased by 16.6% to $9.32 million. The company's market capitalization stands at $605.3 million, ranking it #83 globally, down from its August peak above $1.60 billion but up over 3,563,172% from its all-time low of $0.00001861 in December 2023. The circulating supply consists of 900 million tokens out of a total of 1.3 billion, with a fully diluted valuation (FDV) of approximately $1.2 billion, indicating potential dilution risks from ongoing token emissions.

This week's overview reflects a combination of resilience and challenges: Aerodrome's merger with Velodrome, announced on November 12, results in the formation of the unified "Aero" cross-chain decentralized exchange (DEX), operating across Base, Optimism, Ethereum, and Circle's Arc. This strategic move aims to establish multi-chain dominance, with no new token issuance and AERO holders allocated 94.5% of the tokens. Despite a revenue decrease in November to $11.2 million from $17.9 million, affected by Base’s meme coin activity—the launch of the Base-Solana bridge provides an opportunity for seamless Solana token trading, which could enhance trading volumes.

On-chain metrics are positive: over 150 million AERO tokens have been bought back and locked via the Public Goods Fund (PGF), Flight School, and Relay programs. Additionally, a recent purchase of approximately 801,000 AERO (valued at $528,000) occurred on December 3.

Technical sentiment remains cautious, with the Fear & Greed Index at 28, indicating Fear. Currently, AERO is trading approximately 70% below its all-time high of $2.32, but the Relative Strength Index (RSI) at 40 suggests oversold conditions that may present an opportunity for a rebound. Social media activity on X highlights Coinbase integration: "If it's on Aerodrome, it's on Coinbase", as a potential driver for the platform's exposure to over 120 million users, alongside today’s "Routing on Rift" event aimed at improving trade execution.

The outlook remains bullish if the price breaks through the $0.736 resistance level, with a target range of $0.90 to $1.00, supported by expectations of Federal Reserve easing and growth within the Base ecosystem. Conversely, if the price drops below the $0.664 support level (near recent lows of $0.57), a bearish trend may ensue. Strategic accumulation on dips is advisable, given the projected high of $2.18 for 2026, representing an estimated 137% upside.

Conclusion

Aerodrome Finance has emerged as a paradigmatic example of a next-generation DeFi primitive. It transcends the basic swap functionality of early AMMs by weaving together efficient trading, calibrated token emissions, and deeply participatory governance into a single system. Its success is intrinsically linked to the ascent of the Base network, positioning it as a critical piece of infrastructure in the layer-2 scaling narrative. While challenges such as market volatility and competitive pressures persist, Aerodrome's community-driven design, clean launch ethos, and growing institutional recognition provide a compelling framework for sustainable growth. It stands as a testament to the evolving sophistication of DeFi, where liquidity is not just a service but a carefully governed public good, engineered and owned by its users.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.