The past week was a defining period for the cryptocurrency market, characterized by intense volatility, a pivotal macroeconomic shift from the Federal Reserve, and a continued battle to establish a new equilibrium. Bitcoin, after a rollercoaster ride that saw it drop to near $84,000, managed a resilient recovery back above $90,000. This price action underscored a market in transition: moving from a phase dominated by speculative excess and leveraged washouts to one increasingly re-anchored to macroeconomic fundamentals and institutional flows.

The Federal Reserve's decision on December 10th to deliver a widely anticipated 25-basis-point rate cut, while signaling a more cautious path forward, served as the week's central macro theme. Meanwhile, Bitwise has had its crypto index fund uplisted to the New York Stock Exchange Arca, the first crypto index fund to trade on that exchange. Tempo, the payments-focused protocol valued at roughly $5 billion after raising money from VCs like Sequoia Capital, launched its public testnet on Tuesday. Stable, a dedicated stablecoin and payments Layer 1 blockchain project backed by Bitfinex and powered by USDT, announced the mainnet launch of StableChain on Monday.

Market Overview

BTC

:

Bitcoin dropped 2.74% over the week, now standing at $90,335.76. Following the previous week's recovery, BTC entered a phase of narrow-range consolidation between $90,500 and $94,000. Trading sentiment was cautious, with the market in a holding pattern ahead of the key Fed decision. Technically, BTC struggled to break and hold above the key 20-day Moving Average (MA20) near $93,600, reinforcing it as a major resistance. The Fear & Greed Index remained mired in "Fear" territory around 29, reflecting pervasive negative sentiment that, historically, can precede a bounce. Analysts at BCA Research argued that the sharp deleveraging seen in prior weeks had flushed out speculative excess, setting the stage for Bitcoin to refocus on macro drivers. U.S. spot Bitcoin ETFs continued to see volatile daily flows, a pattern reflecting institutional hesitation and year-end portfolio rebalancing. While November recorded significant net outflows ($3.5B), the long-term structural narrative remains intact, with firms like Vanguard enabling crypto allocations and Bank of America endorsing small portfolio exposures.

ETH

: Ethereum increased 1.03% over the week, now standing at $3,214.67. Largely mirrored Bitcoin's macro-driven volatility but with notable sensitivity. Futures data showed ETH swinging between roughly $2,930 and $3,400 during the week, struggling to maintain momentum. A critical positive development for the network is the dramatic reduction in gas fees, which have fallen approximately 95% since the Dencun upgrade. This has fundamentally improved user experience and economic viability for on-chain applications. The broader altcoin market faced a challenging environment.

Altcoins: The index rose from 21 to 30 this week, remaining in a state of "fear." The "Altseason Index" remained subdued, as Bitcoin's dominance held relatively firm. Major tokens like XRP faced intense negative social sentiment, pushing its crowd mood into a "fear zone" according to Santiment data, which is a condition that can sometimes set up a contrarian rebound if buying pressure emerges. Token Unlocks: A significant overhang for the altcoin sector is the scheduled unlocking of over $1.8 billion worth of tokens in December. Major unlocks for projects like

SUI, LayerZero's

ZRO, and

PUMP will increase circulating supply, historically creating selling pressure and volatility, potentially delaying a broad-based altcoin season.

ETF: BTC ETFs experienced a weekly net outflow of $87.8 million (compared to a $195 million outflow the previous week), with a year-to-date inflow of $22.3 billion and a November net outflow of $3.5 billion. Ethereum (ETH) saw a $140 million inflow as of December 4, coinciding with BlackRock's filing related to ETH staking. XRP had an inflow of $89.6 million, bringing its total to $874 million.

Stablecoins: Market capitalization increased by 0.46% week-over-week to $309.03 billion, with USDT accounting for $186.12 billion (60.18% market share). USDC reached $78.22 billion, supported by a recent licensing extension in the UAE; Ethena USDe stands at $6.64 billion through yield strategies. Trading volumes for USDT totaled $72.6 billion. The GENIUS Act is advancing regulatory efforts, while Fitch has highlighted potential risks within banking institutions.

Stablecoins marketcap. Source: DefiLlama

Macro Data:

The December 10th FOMC meeting was the undisputed macro event of the week. The

25 bps cut was expected, but the forward guidance was key. The Fed's updated projections suggest a slower pace of easing ahead, with the "dot plot" indicating only one more cut in 2026.

Chair Powell's press conference highlighted the central bank's dilemma: walking a tightrope between "somewhat elevated" inflation and a labor market that is "gradually cooling." This officially ushers in a "data-dependent" regime, where every upcoming employment and inflation report will critically sway market expectations for the March 2026 meeting and beyond. For crypto, this means macro liquidity tailwinds are weakening, and asset prices will be more sensitive to traditional economic indicators

Gas Fees: Following the

Fusaka update, transaction fees averaged 0.132 Gwei, representing a 95% reduction from pre-upgrade levels and enabling transactions costing approximately $0.01. Layer 2 solutions, such as Base, now process over 1 million transactions daily at costs below one cent.

Weekly Trending Sectors & Opportunities

This week's narrative shift from post-November correction fatigue to macro-fueled optimism, created fertile ground for opportunities. With the Altcoin Season Index still at 35 (firmly in Bitcoin territory), capital flowed into high-conviction themes like AI interoperability and tokenized real-world assets, where total value locked (TVL) in RWAs climbed 63% year-over-year to $25.7 billion. Memecoins and gaming ecosystems added speculative flair, with Pump.fun's ecosystem posting 0.96% gains amid creator incentives. Emerging catalysts, such as TAO's halving on December 13 and

Solana's Breakpoint conference (December 11–13), may amplify these moves, potentially rotating $50 billion into alts by Q1 2026. Below, we dive deep into the top trending sectors, unpacking performance drivers, key projects, and actionable opportunities for traders and long-term builders eyeing 2026's supercycle.

AI & Machine Learning

Artificial intelligence continues to lead the narrative in the cryptocurrency sector for 2025, with sector indices such as SSI AI achieving over 5% weekly gains despite broader market declines, which outperforming Bitcoin's 2.46% and Ethereum's 3.26% increases. This resilience is driven by strong institutional commitment, evidenced by Pantera Capital's $15 million investment in Surf's funding round, alongside contributions from Coinbase Ventures and Digital Currency Group. These investments highlight a strategic focus on developing AI models tailored for crypto research, including decentralized data oracles and predictive analytics. Additionally, AI-related spending in Asia has increased significantly, with NEAR Protocol and Circle launching hybrid tools that enable on-chain AI agents. Meanwhile, application development remains prominent, with code usage up 40% week-over-week as developers incorporate large language models into decentralized applications.

DeFi & Yield Optimization

Decentralized finance clawed back 3.8% in TVL to $125 billion this week, shrugging off a 2.35% sector dip as Ethereum's Fusaka upgrade (activated December 3) slashed Layer-2 fees by 95%, enabling sub-$0.01 transactions and unlocking $40 billion in L2 liquidity. Aave's V3 deployment on MegaETH and the removal of USDS from its reserves highlighted protocol maturation, while Solana's Kamino (KMNO) suite for lending and vaults drew $500 million in new deposits, underscoring cross-chain interoperability via

Axelar (AXL).

Real-World Assets (RWAs) & Tokenization

Tokenized real-world assets emerged as 2025's stealth bull, with TVL exploding 63% year-over-year to $25.7 billion, driven by fractional ownership of bonds, property, and commodities unlocking $400 billion in projected 2026 flows.

ONDO's probe closure without charges catalyzed a 10% sector lift, while IXS verified $88 million in RWA TVL, blending tokenized treasuries with DeFi yields. BlackRock's staked ETH ETF filing and PNC Bank's BTC trading via Coinbase further legitimized the trend, with stablecoins facilitating $8 trillion in annual Visa-processed transactions.

ONDO led with resilient pricing post-regulatory greenlight, integrating with Polygon’s Rio upgrade for streamlined payments. Centrifuge and RealT tokenized $500 million in real estate this week, offering 8–12% yields on illiquid assets. River (RIVER), a Bitcoin mining infrastructure played by River Financial, climbed on ecosystem expansions.

Privacy & Security Protocols

Privacy coins and zero-knowledge tech surged 2.09% in the Privacy Blockchain category, with

Zcash (ZEC) rebounding 10% intraday before a 10% weekly pullback, buoyed by FOMC discussions on shielded transactions. Brevis (BREVIS_ZK) and Miden (0xMiden) trended on X for privacy-focused scaling, while WHISTLE's Solana ecosystem play positioned it as undervalued tech beyond memes. Quantum-resistant protocols like NIGHT (Midnight) held flat at 0.01%, but on-chain activity spiked 25% as whales accumulated amid CFTC's BTC/ETH/USDC collateral pilot.

ZEC's zk-SNARKs enabled private DeFi, drawing $20 million in new liquidity, while Dash (DASH) integrated masternodes for governance yields.

Memecoins, Gaming & Emerging Narratives

Memecoins and gaming fused for 1.4% gains, with Pump.fun's ecosystem (PUMP) up 6.78% on creator incentives and $PIPPIN's 6.67% meme-AI hybrid. Gaming tokens like MAGIC (TreasureDAO) linked worlds and rewards, while SuperVerse bridged DeFi-AI-gaming. NFTs rebounded with CryptoPunks V1 at 7.33% volume, Doodles at 3.32%, and Pudgy Penguins trending on Beeple collabs.

Influencer Pepe (INPEPE) amassed 25,000 holders via Proof-of-Influence, listed on DEXTools for weeks. LUNC rallied 115% on Do Kwon verdict speculation, while $GAIX hit +270% on airdrops.

Weekly Market Focus

Federal Reserve Cuts Rates 25 Basis Points, With Two Voting for Steady Policy

The U.S. Federal Reserve delivered a widely expected 25 basis point rate cut on Wednesday, lowering the range on its benchmark fed funds rate by 25 basis points to 3.50% to 3.75%. This marks the third straight quarter point reduction and brings short-term borrowing costs to their lowest level since 2022. The Fed in its statement also noted that reserve balances had declined and said it intends to begin purchases of shorter-term Treasury paper as needed to "maintain an ample supply of reserves."

The price of BTC was volatile in the minutes following the news, but remaining around the $92,400 level. U.S. Stocks moved modestly higher and the 10-year Treasury yield dipped two basis points to 4.15%

Today's rate cut is of particular note given the unusually large amount of public dissension among Fed members about the course of monetary policy. Several in recent weeks have loudly voiced their opposition ahead of time to not just today's easing, but also the central bank's 25 basis point reduction at its previous meeting in October.

Alongside the policy decision, this Fed meeting came with an updated set of the central bank's economic projections. Core inflation is now seen at 3% for 2025 and 2.5% for 2026, each down 10 basis points from previous estimates. GDP growth is now expected to be 1.7% this year and 2.3% in 2026, up from previously estimated 1.6% and 1.8%, respectively. The so-called "dot plot" is little-changed, with policymakers still seeing just one rate cut in 2026 even as markets have priced in two rate cuts next year.

Today's news comes at a moment when policymakers are still operating without several key economic data releases that remain delayed or suspended due to the U.S. government shutdown. Also at play is President Trump's continued bashing of current Fed Chair Jerome Powell alongside his search for a replacement when Powell's term as chair ends next year. Attention now turns to Powell's post-meeting press conference at 2:30 pm ET, where listeners will try and further discern his and the Fed's thoughts on the future path of monetary policy. Prior to Powell's appearance, traders have priced at a 24% chance of another rate cut in January, per CME FedWatch.

Bitwise's First-ever Crypto Investment Product Gets Uplisted to the NYSE Arca

Bitwise has had its crypto index fund uplisted to the New York Stock Exchange Arca, the first crypto index fund to trade on that exchange.

The Bitwise 10 Crypto Index ETF (ticker BITW) is the largest crypto index fund in the world, with $1.25 billion in assets under management, the firm said. BITW holds a single basket of 10 leading crypto assets, ranked by market capitalization, screened for risk, and rebalanced monthly with no cap on the largest holding. At this time, bitcoin makes up about 75% of the fund's holdings, with ether at around 15%. As of Tuesday morning, the rest of BITW is made up of XRP, SOL, ADA, LINK, LTC, SUI, AVAX, and DOT. Bitcoin and Ethereum represent the only assets Bitwise has consistently kept in the fund since launch, according to its website.

NYSE Arca (formerly known as the Archipelago Exchange) is a fully electronic stock exchange subsidiary of Intercontinental Exchange that has become a hub for ETF listings and trading. BITW previously traded over-the-counter as a closed-end trust, with its new structure supporting tighter NAV tracking via the ETP redemption process. NovaDius Wealth Management President Nate Geraci said last month he was "highly bullish" on index-based and actively managed crypto ETFs. "No way tradfi investors are ready to navigate all of these single tokens," he said. "They’re going to take a diversified, shotgun approach to an emerging asset class."

Stripe and Paradigm's Payments-focused Blockchain Tempo Launches Public Testnet

Tempo, the payments-focused protocol valued at roughly $5 billion after raising money from VCs like Sequoia Capital, launched its public testnet on Tuesday. The blockchain "is built to deliver instant, deterministic settlement, predictably low fees, and a stablecoin-native experience, which are qualities that most general-purpose blockchains still struggle to provide for financial applications," according to a statement. "The testnet brings together the core features that make payments viable onchain."

Prediction platform Kalshi, Mastercard and UBS are all considered "design" partners of Tempo's, the company also said Tuesday.

Tempo's private testnet has been operational. In October, the firm reportedly raised $500 million in a Series A round led by Thrive Capital and Greenoaks. Sequoia Capital, Ribbit Capital, and SV Angel, also participated in the round. Stripe and Paradigm, which incubated Tempo, did not invest in the round.

The protocol has been designed as an Ethereum-compatible Layer 1 optimized for high-throughput payments and settlement. The blockchain said it is working with firms including OpenAI, Shopify, Visa, Anthropic, and Deutsche Bank. Last month, the "buy now, pay later" company Klarna launched KlarnaUSD, a USD-backed stablecoin issued on Tempo. KlarnaUSD is slated to launch on Tempo's mainnet in 2026.

Key Market Data Highlights

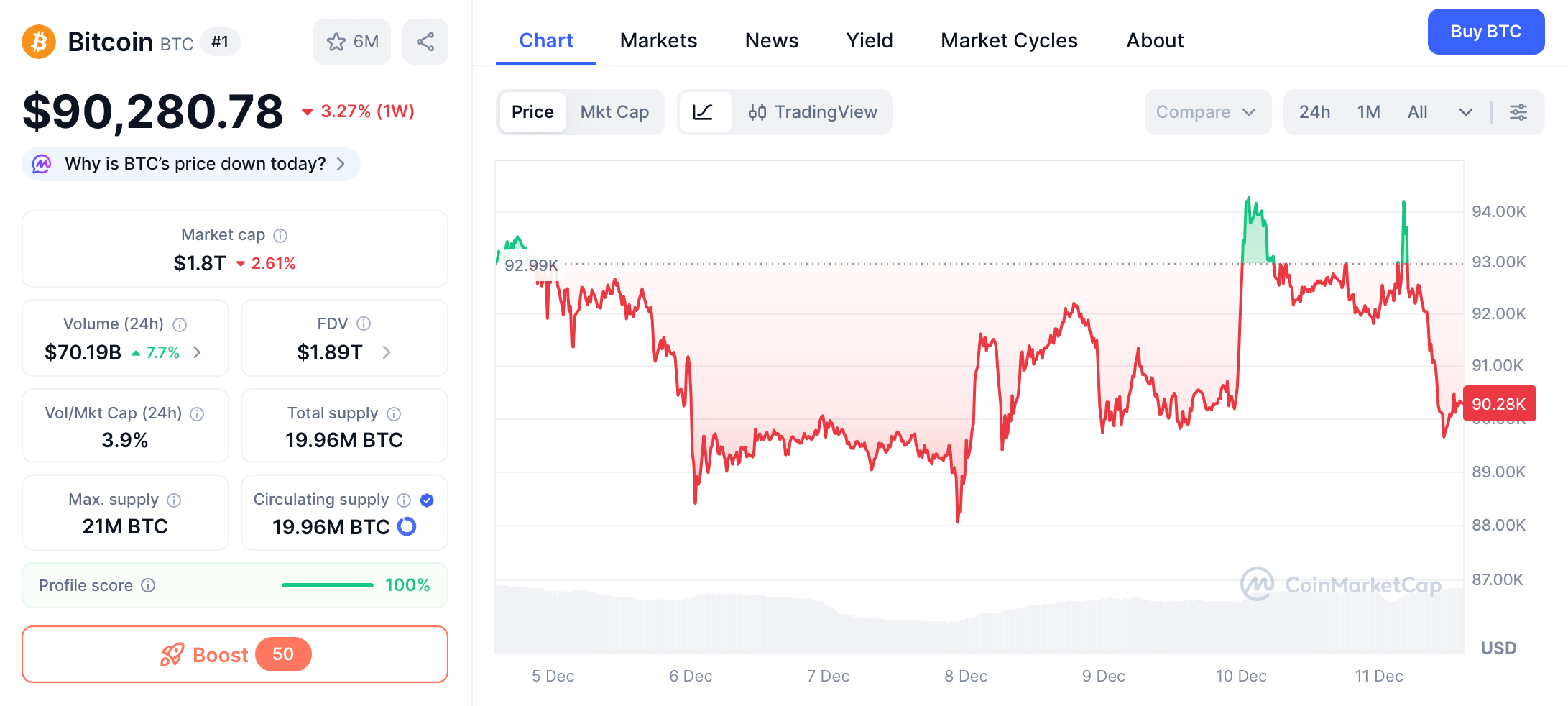

Bitcoin's Rollercoaster: From $88,000 Low to Fed-Fueled Rebound

BTC price over the week. Source: CoinMarketCap

BTC's weekly performance reflected a reversal similar to that of Q4: a 4.8% increase from the $88,135 low recorded on December 5, despite experiencing a 4.4% intraday decline amid $195 million in ETF outflows. The price then recovered to a high of $94,600 following Federal Reserve announcements before settling at $90,500, representing a daily decline of 2.65%. Year-to-date, Bitcoin has appreciated approximately 105% from January's $45,000, although its 17% decline in November has introduced caution and skepticism regarding its "digital gold" narrative. Additionally, BTC's 0.5 correlation with the S&P 500 has underscored its potential to behave as a risk-on asset during equity market downturns.

Technical indicators have stabilized: a weekly close above $92,000 confirms a higher-low pattern between $86,300 and $90,400, with the RSI at a neutral 50 and MACD showing bullish divergence. On-chain metrics are also positive, with exchange reserves at a multi-year low of 2.1 million BTC, long-term holders accumulating an additional 48,000 BTC, and the network hashrate reaching a record 650 EH/s. However, the presence of approximately $787 billion in perpetual leverage (compared to $135 billion in ETFs) has heightened liquidation risks, leading to $19 billion in position liquidations.

Market sentiment was also influenced by social media activity: Ash Crypto's post offering a "$10,000 BTC giveaway if all-time highs are achieved by 2025" gained significant engagement with 6,598 likes, reflecting optimistic sentiment amid dips. Similarly, a giveaway from Mr. Crypto of 1 BTC (approximately $92,000) received 528 likes, demonstrating retail investor resilience. The outlook suggests a target of $98,000 by December 15 supported by M2 money supply growth, though there remains a risk of decline to $85,000 if large unlocks create downward pressure.

GameStop Posted $9.4M Loss on Bitcoin Holdings in Q3

GameStop's (GME) bitcoin stack was worth $519.4 million at the end of the third quarter (Nov. 1), with the company recording a $9.2 million loss digital asset holdings during the period. Bitcoin fell from roughly $115,000 to about $110,000 during the three months ended Nov. 1.

The video game retailer likely continued to hold 4,710 BTC at the end of the third quarter, the same amount it purchased between early May and mid-June using proceeds from a $1.3 billion debt offering announced in March.

Shares of the company were lower by 5.8% on Wednesday as sales results were shy of investor expectations.

GameStop’s move to adopt bitcoin as part of its treasury strategy marked a major shift for the company in March, which has struggled to regain momentum since its pandemic-era meme stock surge. The firm hasn’t added to or sold any of its BTC since the initial buy, opting to sit tight through market swings.

Shares have fallen more than 22% since GameStop announced the bitcoin initiative in March, as investors weigh the risks of holding crypto alongside weak core business performance.

Stable, a Layer 1 using Tether's USDT for Gas, Launches Mainnet and Native Token with FDV Exceeded 2 Billion

Stable, a dedicated stablecoin and payments Layer 1 blockchain project backed by Bitfinex and powered by USDT, announced the mainnet launch of StableChain on Monday, hoping to drive both institutional and retail integrations of stablecoin assets. Alongside the mainnet, the project launched its native STABLE token, as well as the Stable Foundation, which is a new independent organization set up to shepherd the Stable blockchain.

The Stable Foundation will support the growth of the Stable blockchain by providing grants, community and ecosystem programs, and participating in protocol governance, the team said. The STABLE token will serve as the network's primary utility token for governance and security, with holders expected to take part in protocol decisions and help secure the chain, it added. Tether's USDT stablecoin is used as the network's gas token for fee payments. Stable's EVM-compatible mainnet launch follows its pre-deposit campaign, which drew more than $2 billion in deposits from over 24,000 wallets across two phases, the project claimed.

Also, Stable previously raised $28 million in a seed round led by Bitfinex and Hack VC, as well as advisors including Tether CEO and Bitfinex CTO Paolo Ardoino, Anchorage CEO Nathan Macauley, and other crypto angel investors. Bitfinex also led a $3.5 million funding round in October 2024 for Plasma, a stablecoin-focused EVM-compatible sidechain aiming to eliminate USDT transaction fees.

CoinCatch Weekly Event

👑 Claim the Crown: Join King of Long & Short Challenge, Share $1M

📅Event Period: December 9, 2025 (UTC+8) - December 23, 2025 (UTC+8)

🥇 Event 1: Trading Competition – King of Long & Short Ranking

All profitable closed trades completed by users during the event will be recorded to calculate their

"Long & Short Points" — the core metric for rankings and rewards.

📊 Point Calculation Rules:

Single Trade Points = Single Trade Net Profit (USDT) × Direction Coefficient

Profitable Long Position: Direction Coefficient = +1

Profitable Short Position: Direction Coefficient = –1

Total Points = Sum of points from all profitable trades during the event

Long Position Net Profiter =

Positive total points

Short Position Net Profiter =

Negative total points

🏆 Reward Structure:

The "

King of Long & Short" Leaderboard, ranked by total positive points in descending order, is displayed below. Users must achieve a minimum trading volume of

50,000 USDT in futures trading to be eligible for ranking.

🎁 "Position Star" Special Leaderboards

✅

Long Position Star Leaderboard (Ranked by positive points):

1st Place: 1,000 USDT

2nd–5th Place: 200 USDT each

❌

Short Position Star Leaderboard (Ranked by negative points):

1st Place: 1,000 USDT

2nd–5th Place: 200 USDT each

🍀 Lucky Participation Award

Users who complete

at least 3 profitable trades during the event will automatically enter the random drawing pool. 200 lucky users will be selected randomly, with each winning 100 USDT!

🤝 Event 2: Invite Friends – Team Up for Bonus Rewards

Grab your

exclusive invitation link and invite friends to join! A friend counts as a "Valid Invitation" if they sign up via your link and complete

at least 1 profitable trade.

📈 Invitation Leaderboard

The top 10 users with the most valid invitations will each receive an additional

50 USDT reward!

Don’t Miss Out: Share $60,000 Trading Bonus + $1,000 XRP!

📅 Event Time: 2025.12.11(UTC+8) - 2025.12.17(UTC+8)

🚀 For New Users: Share $10,000 Trading Bonus

-

Event Rules: Register during the event and complete the tasks below to share the prize pool.

-

Reward Per User: 10 USDT trading bonus. Limited to the first 1,000 eligible users.

💰 For All Users: Trade to Share $50,000 Trading Bonus + $50,000 Deduction Coupon

-

Event Rules: Reach at least

50,000 USDT in futures trading volume during the event to claim rewards.

-

Base reward: (Total futures trading volume

× 0.8) ÷ 10,000. Max reward: $200 reward package.

-

New users get 50% extra: (Total futures trading volume

× 1.2) ÷ 10,000. Max reward: $500 reward package.

-

Total Prize Pool: 100,000 USDT in trading bonus & deduction coupon.

✨ Lucky Star Draw: Trade $5,000 to Win $1,000 XRP or iPhone 17 (512GB)

-

Among all users who achieve

5,000 USDT in futures trading volume, we’ll randomly select

5 winners to receive:

$1,000 XRP or an

iPhone 17(512GB, $999 value)!

Token Unlocks Next Week

Tokenomist data indicates that from December 11 – December 17, 2025, several major token unlocks are scheduled. Some of them are:

APT will unlock approximately $19.45 million worth of tokens over the next seven days, representing 1.5% of the circulating supply.

ARB will unlock approximately $19.16 million worth of tokens over the next seven days, representing 1.6% of the circulating supply.

STRK will unlock approximately $13.47 million worth of tokens over the next seven days, representing 2.7% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization, presents a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial

advice.