This week, the cryptocurrency market experienced a dramatic shift from deep anxiety to initial stabilization. At the beginning of the week, the market remained under pressure due to the dual pressures of the Federal Reserve's uncertain policy and rumors of long-term holders selling off. However, as December began, with the influx of bargain hunters and expectations of a shift in macro liquidity, major asset prices rebounded significantly. While market sentiment remains in the "fear" zone, it has shown signs of recovery. This report will provide an in-depth analysis of key data and driving events from the past week, and offer a forecast of future market trends. Meanwhile, Ethereum activated its highly anticipated “Fusaka” upgrade on Wednesday, marking the blockchain’s second major code change of 2025. BitMine Immersion (BMNR) has reported that its combined crypto, cash, and “moonshot” assets now total $12.1 billion, mainly powered by the largest Ethereum treasury in the world. The first exchange-traded fund tracking LINK is set to begin trading on Tuesday on the New York Stock Exchange.

Market Overview

BTC

:

Bitcoin gained 1.99% over the week, now standing at $93,055.20. This week's price action was closely linked to macroeconomic expectations. The market fluctuated at the beginning of the week due to fluctuating expectations of a Fed rate cut, but rebounded in the latter half of the week driven by buying above the key support zone of $80,000 to $82,000. One of the market's focal points was the so-called "OG (Original Group Holder) sell-off." Data shows that over 400,000 Bitcoins dormant for over seven years were moved in the past month. However, analysts point out that this sell-off represents only a very small portion of the total market trading volume, and its motivation is more likely wealth management behavior after achieving returns of over 16 times, rather than a bearish outlook. The fact that over 5 million "dormant" Bitcoins remain unmoved indicates that most long-term holders have strong convictions. The current price has retraced approximately 27% from its October all-time high, but retracements of 25-30% are common in historical bull markets. As long as the $80,000-$82,000 support zone holds, the overall upward structure remains intact. Key resistance lies around $95,000.

ETH

: Ethereum increased 5.22% over the week, now standing at $3,187.15. This week, ETH underperformed Bitcoin, exhibiting higher volatility and beta characteristics. Despite rebounding from its lows, market sentiment is divided on whether it can break through $3,400 in the short term. $2,800 is widely seen as a key support level that must be held; a break below this level could open up further downside potential. On the other hand, its Mayer Multiple Index has entered historical buying territory, suggesting long-term value emerging.

Altcoins: The index rose from 18 to 27 this week, remaining in a state of "fear." This contrasts sharply with the extreme euphoria of the market at the end of October, indicating that investor sentiment has cooled significantly and become more cautious after the price correction. A survey by on-chain prediction platform Myriad shows that only 7.5% of users believe a "crypto winter" is coming, a significant decrease from the previous week. This improved sentiment, synchronized with the price rebound, suggests that confidence within the community is being rebuilt.

Overall, the altcoin market remains in "Bitcoin season." The Altseason Index is only 22, indicating that the vast majority of altcoins have underperformed Bitcoin over the past 90 days. While the broader index fell 7.68%, privacy assets like

Zcash (+28.86%) and

Dash (+20.09%) surged on Grayscale's Zcash Trust launch and regulatory thaw speculation.

Privacy coins captured 5.19% of the volume, up from 3.8%, as Google searches spiked amid EU data-sharing rules. Analysts generally believe that the start of the altcoin season requires two key conditions: 1) Bitcoin prices stabilize at high levels, confirming a bull market; 2) the Federal Reserve begins a rate-cutting cycle, boosting market risk appetite and causing liquidity to spill over from Bitcoin. Furthermore, over 150 altcoin ETFs are awaiting SEC approval, which could be a super catalyst for changing the market landscape.

ETF: Spot Bitcoin ETFs experienced inflows of $240 million on November 28, ending a six-day decline totaling approximately $3.5 billion, which is the first positive movement since October 28. BlackRock's InvestmentBTC recorded modest gains, while Ethereum remained flat. Alternative ETFs performed well, with Solana attracting $128 million and XRP $180 million—totaling $420 million since October—surpassing Bitcoin and Ethereum in inflows.

For November, Bitcoin saw outflows of approximately $3.79 billion, the largest since February, while Ethereum experienced declines of around $1.4 billion. These inflows may indicate institutional buying during dips. Additionally, the upcoming options expiry on December 5, with $15.4 billion in contracts set to expire, is expected to introduce increased volatility, with Bitcoin’s maximum pain point around $100K.

Looking ahead, sustained positive momentum could target a price of $112,000 for Bitcoin. A shift in market dominance toward altcoins may occur if Bitcoin's dominance diminishes.

Stablecoins: Stablecoin market cap hit $307.791 billion by December 4, up 2.60% weekly. USDT dominated at 60.09% ($184.7 billion), followed by USDC (20.75%). Fiat-pegged growth (35.4% since 2023) offset algo dips with a $219.4 trillion volume (8.6 billion txns) since 2019.

Stablecoins marketcap. Source: DefiLlama

Macro Data:

The likelihood of a

Federal Reserve rate cut in December has increased to 87%, up from 33% following the recent data vacuum caused by U.S. government shutdowns delaying employment and inflation reports. Yields spiked following Japan’s interest rate hike, resulting in declines in risk assets; the Nasdaq and S&P 500 dropped approximately 3% on December 1. The weaker-than-expected Non-Farm Payrolls figure indicates a slowing economy and raises recession concerns, while the August Consumer Price Index at 2.3% suggests stabilized inflation expectations. The correlation between the money supply (M2) and cryptocurrency markets has intensified, with rate cuts historically associated with approximately 25% rallies in Bitcoin. In geopolitics, U.S.-China tariff tensions have contributed to increased Bitcoin hedging activity. The Federal Open Market Committee’s (FOMC) December 10 meeting is expected to be dovish, possibly signaling a 25 basis point rate cut; the end of quantitative tightening may help add liquidity. Investors are advised to monitor upcoming employment data on December 16, as softer payroll figures could bolster bullish sentiment.

Gas Fees: Ethereum gas fees averaged 0.034 Gwei for the week ending December 4, nearing historic lows and equating to approximately $0.44 per basic transfer. This represents a 90% decrease from the peak levels observed after the Dencun upgrade in 2024. The rollout of

Fusaka on December 3 further impacted network economics by increasing blob capacity from 6 to 48 per block, resulting in a 40-60% reduction in Layer 2 transaction costs, with daily transaction volumes reaching 1.4 million. Fusaka’s proposed EIPs aim to achieve an additional 70% reduction, thereby enhancing the efficiency of Real-World Assets and decentralized finance applications. Looking ahead, it is anticipated that gas fees may fall below 1 Gwei by 2026. Monitoring blob capacity for spam resilience remains important. The reduction in transaction costs is conducive to increased adoption, particularly for on-chain commerce.

Weekly Trending Sectors & Opportunities

Based on the week's market activity, several crypto sectors have shown significant momentum. AI, Real-World Assets (RWA) and Layer-2 solutions were among the top performers, driven by strong institutional and ecosystem developments.

AI & Blockchain Convergence: This remains one of the most compelling narratives. Projects that leverage decentralized networks for AI model training, data sourcing, or compute power are viewed as high-growth potential bets in the next cycle.

Layer 2 Scaling Solutions: With Ethereum's usage becoming cheaper and more efficient, the ecosystem around its Layer 2 networks (Arbitrum, Optimism, Base, etc.) continues to thrive. They are critical infrastructure for mainstream adoption.

Real-World Assets (RWA): The tokenization of traditional financial assets (bonds, credit, commodities) on blockchain is moving from concept to early adoption. This sector is poised to benefit from both crypto-native growth and institutional experimentation.

Weekly Market Focus

Ethereum Activates Fusaka Upgrade, Aiming to Cut Node Costs, Speed Layer-2 Settlements

Ethereum activated its highly anticipated “Fusaka” upgrade on Wednesday, marking the blockchain’s second major code change of 2025. The update is designed to help Ethereum handle the increasingly large transaction batches coming from the layer-2 networks that settle on top of it.

Fusaka is a blend of the names Fulu + Osaka that bundles two hard forks on Ethereum happening in tandem: one on the consensus layer and one on the execution layer. The former is where transactions and smart contracts run, while the settlement layer is where these transactions are verified, finalized, and secured. At the center of the upgrade is PeerDAS, a system that lets validators check small slices of data rather than entire “blobs,” reducing both costs and computational load for validators and layer-2 networks.

Today, layer 2s submit their transaction data to Ethereum in the form of blobs, which validators must download and verify in full. That process contributes to congestion and slows down the network. PeerDAS changes this by allowing validators to verify only a small portion of the blob’s data, which speeds up the verification process and thus reduces the gas fees tied to the processing. Beyond layer 2s, the upgrade is expected to lower the barrier for smaller or newer validator operators by cutting down the resources required to run just a few validators. Still, Ethereum developers note that institutions operating large fleets of nodes, such as staking pools, won’t see the same level of savings.

Ethereum developers moved quickly to ship the upgrade this year as the ecosystem grapples with a reputation for slow or delayed rollouts. The goal was to land a series of smaller improvements now while preparing for more ambitious changes ahead.

Traditional financial (TradFi) institutions are taking notice as well. Last month, Fidelity Digital Assets published a report describing Fusaka as a decisive step toward a more strategically aligned and economically coherent roadmap for Ethereum.

First Chainlink ETF Began Trading on Tuesday as Exchange Signs off on Grayscale's LINK Fund

The first exchange-traded fund tracking LINK is set to begin trading on Tuesday on the New York Stock Exchange. NYSE Arca, the subsidiary of the NYSE Group, certified a listing to convert the Grayscale Chainlink Trust ETF, according to a filing posted on Monday.

Chainlink is an oracle network that connects blockchains to external data and has been adopted by national governments, major DeFi protocols and traditional financial institutions, according to its site. Its token, LINK, has a market cap of nearly $8.5 billion, ranking it among the 25 largest cryptocurrencies, according to The Block’s price page.

Over the past few weeks, several crypto ETFs have launched in the U.S., including ones tracking Litecoin, HBAR, XRP and SOL. In particular, Grayscale has converted several of its closed-end trusts to exchange-traded products, including those tracking Dogecoin and Solana.

Under the Biden administration, the Securities and Exchange Commission, which oversees ETFs, took a more cautious approach to digital assets while bringing several enforcement cases against major players.

Now, under SEC Chair Paul Atkins, the SEC has taken steps to provide clarity for digital assets as well as approved listing standards for certain ETFs, allowing them to begin trading more quickly.

UK Passes Law Officially Recognizing Crypto as Third Kind of Property

The UK’s crypto regulation reached a major milestone on Tuesday after the Property (Digital Assets etc.) Act 2025 received Royal Assent from King Charles III, legally recognizing digital assets as a form of property. The short bill, which passed both houses of Parliament without amendment, confirms that digital holdings such as bitcoin and stablecoins can be the subject of property rights distinct from traditional categories of physical objects or contractual rights.

The Law Commission, an independent statutory body in the UK, first recommended the reform in 2023. The bill was introduced to the House of Lords in September 2024.

CryptoUK, the country's first crypto and blockchain industry trade association, said on X that UK courts have already been treating crypto as property through case-by-case judgments. Having that actually written into law will provide clearer legal pathways for crypto-related crimes or litigations, the association said.

Meanwhile, the Bank of England recently launched a consultation on a proposed regulatory regime for sterling-denominated stablecoins, noting that it is "a significant step" in preparing for a future where digital money is widely used for payments. Bank of England Deputy Governor Sarah Breeden said that the country aims to catch up to the U.S. in terms of stablecoin regulation, and said new rules will be operational "just as quickly as the U.S.," Bloomberg reported last month.

Key Market Data Highlights

Crypto Market Rebounds Above $3 Trillion as ‘Vanguard Effect’ Jolts ETF Flows

Crypto market cap. Source: CoinMarketCap

Crypto markets staged a turnaround on Tuesday as traders responded to surging Fed rate-cut expectations and a burst of U.S. ETF activity following Vanguard’s decision to lift its long-standing ban on bitcoin ETF purchases. BTC climbed back above $91,000, up roughly 8% over the past 24 hours, while ether reclaimed $3,000 after a 10% jump, according to The Block's price page. Total crypto market capitalization rose to $3.06 trillion, recovering after slipping below $3 trillion during Sunday night’s sell-off.

Bloomberg Intelligence analyst Eric Balchunas said bitcoin’s intraday surge lined up almost exactly with the U.S. equity market open — the first session after Vanguard clients regained access to spot bitcoin ETFs.

Vanguard’s reversal comes the same day Bank of America reportedly told advisers across Merrill, Private Bank and Merrill Edge that clients can now allocate 1%–4% of portfolios to crypto, an end to a long-standing restriction that prevented more than 15,000 advisers from proactively recommending digital-asset products.

Tom Lee's Ethereum DAT BitMine Now Holds 3% of the Total ETH Supply

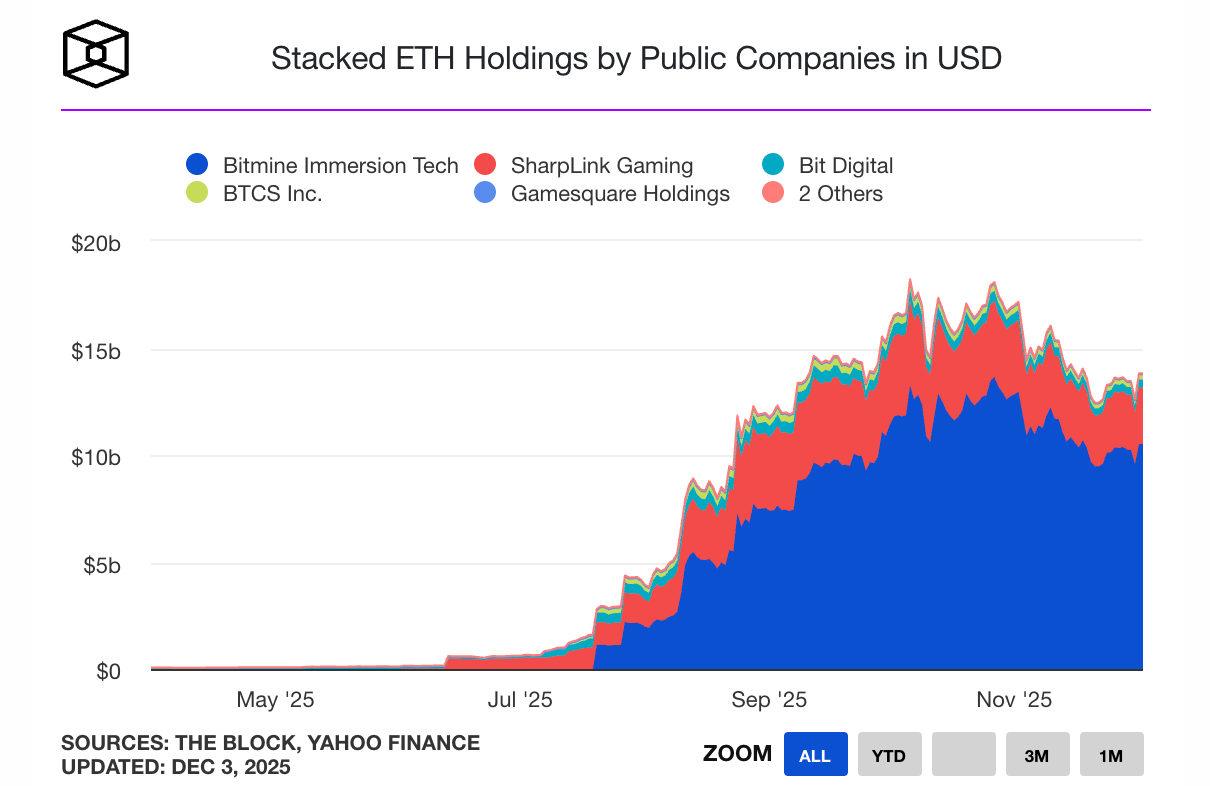

Staked ETH holdings by public companies. Source: The Block

BitMine Immersion (BMNR) has reported that its combined crypto, cash, and “moonshot” assets now total $12.1 billion, mainly powered by the largest Ethereum treasury in the world. Despite sliding crypto prices, BitMine has continued to ramp up ETH purchases. Chairman Tom Lee said the firm acquired 96,798 ETH for roughly $273 million in the past week alone, a 39% increase from its prior weekly pace.

The treasury position gives BitMine control of more than 3% of the Ethereum supply, placing it “two-thirds of the way” to its internal target of owning 5% of the network, according to a Dec. 1 disclosure.

Lee cited several near-term catalysts — including the Fusaka (Fulu-Osaka) upgrade, expected on Dec. 3, and the Federal Reserve’s planned end of quantitative tightening — as reasons for stepping up accumulation. BitMine also reported 192 BTC, a $36 million equity stake in Eightco Holdings, and $882 million in unencumbered cash.

Monday’s update comes during a difficult stretch for crypto treasury firms, many of which saw their net asset values decline sharply during last month’s market drawdown. Moreover, BitMine’s own stock price is down nearly 25% across the same period to around $33.12 on Monday, according to The Block's data. The company will hold its annual shareholder meeting on Jan. 15, 2026, at the Wynn Las Vegas, it said in a filing on Monday. Investor updates on treasury management, staking infrastructure, and BitMine’s broader Ethereum roadmap are expected at the event.

MSTR's $1.44 Billion Dividend Reserve Was Finalized, But Its Stock Price Plummeted 10%.

MSTR stock price in the timeframe of a month. Source: Yahoo Finance

On December 1st, Strategy announced a $1.44 billion dividend reserve, primarily to support preferred stock dividends and debt interest payments. This funding comes from the proceeds of the sale of Class A common stock through an "ATM" (Auction at Market Price) program, and is expected to cover at least 12 months of related expenses, with plans to extend this period to 24 months to enhance financial resilience.

However, the market reaction was not favorable. Following the announcement, Strategy's stock price fell by approximately 5-10%, reflecting growing concerns about its liquidity and long-term sustainability.

Currently, pessimism surrounding Strategy is rapidly spreading across social media and in the media.

Some have likened Strategy to a "Bitcoin central bank," arguing that it is caught in a power struggle between the traditional financial system (the Federal Reserve, Wall Street, JPMorgan Chase) and emerging systems (treasuries, stablecoins, Bitcoin-backed financing). The article points out that JPMorgan Chase has recently intensified its short-selling efforts against Strategy, including delaying stock settlement, suppressing the Bitcoin derivatives market, and creating panic through "dumping" in the options market. This has caused Strategy's stock price to plummet since its July 2025 high, with a cumulative drop of over 60%, and it faces the risk of being removed from the MSCI index.

CoinCatch Weekly Event

🦃 Thanksgiving Treat: Download App, Trade 1U & Win $3,000 in Real Cash!

📅 Event Time: 2025.11.27 (UTC+8) - 2025.12.7 (UTC+8)

🚀 How to Unlock Draw Entries

-

Spot Trade ≥ 1 USDT → 1 Draw Entry

-

Futures Trade ≥ 10 USDT → 1 Draw Entry

-

First Deposit ≥ 10 USDT → 1 Draw Entry

-

Share the Event & Invite Friends → 1 Draw Entry

🎯 Mandatory Steps to Claim Your Prize (Must Complete All 3):

-

-

Stay active in the App for at least

3 minutes

-

🎁 The Ultimate Prize Pool

Physical Prizes

-

iPhone 17 Pro Max

-

PlayStation Plus Premium 12-Month Subscription

-

Xbox Game Pass Ultimate 12-Month Subscription

-

NBA League Pass Premium Annual Subscription

Platform Bonuses

-

$20 Trading Bonus

-

$100 Position Bonus

-

$200 Position Bonus

Exclusive Crypto Airdrops (First 500 participants only)

-

1 ETH

-

100,000 PEPE

-

66,666 SHIB

-

888 BOME

-

888 MEW

December Bonus: Register for 500 USDT, Check-in Daily to Earn $2,050!

📅 Event Time: December 4, 2025 (UTC+8) - December 10, 2025 (UTC+8)

💎 Event 1: Sign Up & Get 500 USDT

-

Event Rules: Earn up to 500 USDT in position bonus as a new user by completing these tasks:

-

All newly-registered users during the event will receive a

50

USDTposition bonus.

-

Make a net deposit of 100 USDT (must be transferred to your futures balance) during the event to receive a

100 USDT position bonus.

-

Achieve a 1,000 USDT futures trading volume during the event to receive

an

additional 100 USDTposition bonus.

-

Double Up: Users who achieve a

10,000 USDT futures trading volume during the event will see their rewards doubled, making the maximum reward

500 USDT in position bonus!

-

Total Prize Pool: 1,000,000 USDT

✔ Event 2: Check-in to Receive Maximum $2,050

🎁 Event 3: Top Traders Win Surprise Gifts!

Token Unlocks Next Week

Tokenomist data indicates that from December 4 – December 10, 2025, several major token unlocks are scheduled. Some of them are:

ENA will unlock approximately $50.77 million worth of tokens over the next seven days, representing 2.30% of the circulating supply.

LINEA will unlock approximately $12.64 million worth of tokens over the next seven days, representing 8.3% of the circulating supply.

MOVE will unlock approximately $2.45 million worth of tokens over the next seven days, representing 1.8% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization, presents a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial

advice.