The cryptocurrency landscape witnessed a significant institutional milestone in December 2025, as Grayscale's Chainlink Trust ETF (GLNK) began trading on NYSE Arca. This event marks the first U.S. exchange-traded product to offer pure exposure to LINK, the native token of the Chainlink network, launched with a temporary 0% fee structure. The ETF's debut, which saw trading volume reach $9.8 million within hours, represents more than just a new financial product; it is a powerful endorsement of Chainlink's foundational role in the blockchain ecosystem. For years, Chainlink has operated as critical but often overlooked "plumbing" within decentralized finance (DeFi). This ETF approval reframes LINK from a utility token for developers into a recognizable asset for traditional investors, validating its premise at the intersection of real-world data and blockchain innovation. This article explores Chainlink's technology, its evolving economic model, the implications of its ETF status, and what the future may hold for its market value.

What Is Chainlink and How Does It Work?

At its core, Chainlink is a decentralized oracle network. To understand its necessity, one must first recognize a fundamental limitation of blockchains like Ethereum: they are sealed, deterministic systems. Smart contracts on these chains cannot natively access external data feeds (like asset prices, weather outcomes, or payment confirmations), which severely limits their potential applications. This is known as the "oracle problem." Early solutions relied on single, centralized oracles, which became vulnerable points of failure and manipulation.

Chainlink solves this by creating a decentralized network of independent node operators. When a smart contract needs data, the Chainlink protocol broadcasts a request. A network of nodes, which have staked LINK tokens as collateral, fetches the data from multiple pre-agreed external sources. Their responses are aggregated, outliers are filtered out, and a validated, consensus-based answer is delivered on-chain to the requesting contract. This process ensures data reliability and tamper-resistance. Nodes are economically incentivized to be honest; providing accurate data earns them LINK fees, while malicious actions lead to the loss ("slashing") of their staked collateral. In essence, Chainlink doesn't just provide data—it provides

trust in a trustless environment, becoming a "committee of sages" that bridges the gap between the secure, isolated blockchain and the dynamic real world.

Key Features and Evolution of the Network

Chainlink's initial product, Price Feeds, became the de facto standard for DeFi, securing tens of billions in value across protocols like Aave and Synthetix. However, its feature set has expanded far beyond simple price data, evolving into a full-stack platform for secure blockchain connectivity.

-

Cross-Chain Interoperability Protocol (CCIP): This is a key infrastructure for the multi-chain future and real-world asset (RWA) tokenization. CCIP enables the secure transfer of not just tokens but also messages and instructions across different blockchains. A landmark example was its use in a delivery-versus-payment (DvP) settlement between J.P. Morgan's blockchain platform and public chains, involving tokenized U.S. Treasuries.

-

Low-Latency Data Streams: To power next-generation, high-frequency DeFi applications, Chainlink developed Data Streams. A pioneering integration with the high-performance blockchain MegaETH embeds Chainlink data directly at the protocol level, delivering market data with sub-millisecond latency. This allows decentralized perpetuals and options to achieve speeds and precision rivaling centralized exchanges.

-

Proof of Reserve (PoR) and Automation: PoR provides on-demand, cryptographically verifiable audits of reserves backing stablecoins or wrapped assets. Furthermore, Chainlink Automation reliably triggers smart contract functions (like limit orders or liquidations) based on time or predefined conditions, serving as a decentralized backend for Web3 applications.

A Brief History of Chainlink

Chainlink was co-founded by Sergey Nazarov and Steve Ellis in 2017, with a vision to solve the oracle problem. Its journey from concept to industry backbone is marked by key milestones:

-

2017: The project raised $32 million in its Initial Coin Offering (ICO).

-

2019: The Chainlink mainnet launched, deploying the first live decentralized oracle network.

-

2020-2021: This period saw massive growth driven by the "DeFi Summer." Major protocols integrated Chainlink's Price Feeds, making LINK synonymous with reliable oracle data. The token price surged, and the passionate "LINK Marine" community became a notable force.

-

2022-Present: The focus shifted to expansion beyond Ethereum and into enterprise use cases. The publication of the Chainlink 2.0 whitepaper outlined a vision for scalable, privacy-preserving oracles and hybrid smart contracts. Strategic partnerships with institutions like SWIFT and The Depository Trust & Clearing Corporation (DTCC) showcased its potential for traditional finance. The launch of the staking mechanism in 2022 further cemented its cryptoeconomic security model.

What Is the LINK Token? Understanding Its Tokenomics

LINK is an ERC-20 standard token that functions as the lifeblood of the Chainlink network. Its utility is multifaceted:

-

Payment for Services: Users pay node operators in LINK for data and other oracle services.

-

Security Collateral: Node operators must stake LINK to participate in the network. This stake can be slashed for dishonest behavior, aligning economic incentives with reliable performance.

-

Governance and Staking: LINK holders can stake their tokens in a dedicated pool. As of 2025, staking offers an annual reward rate of approximately 5% and will play a role in future community governance of the network.

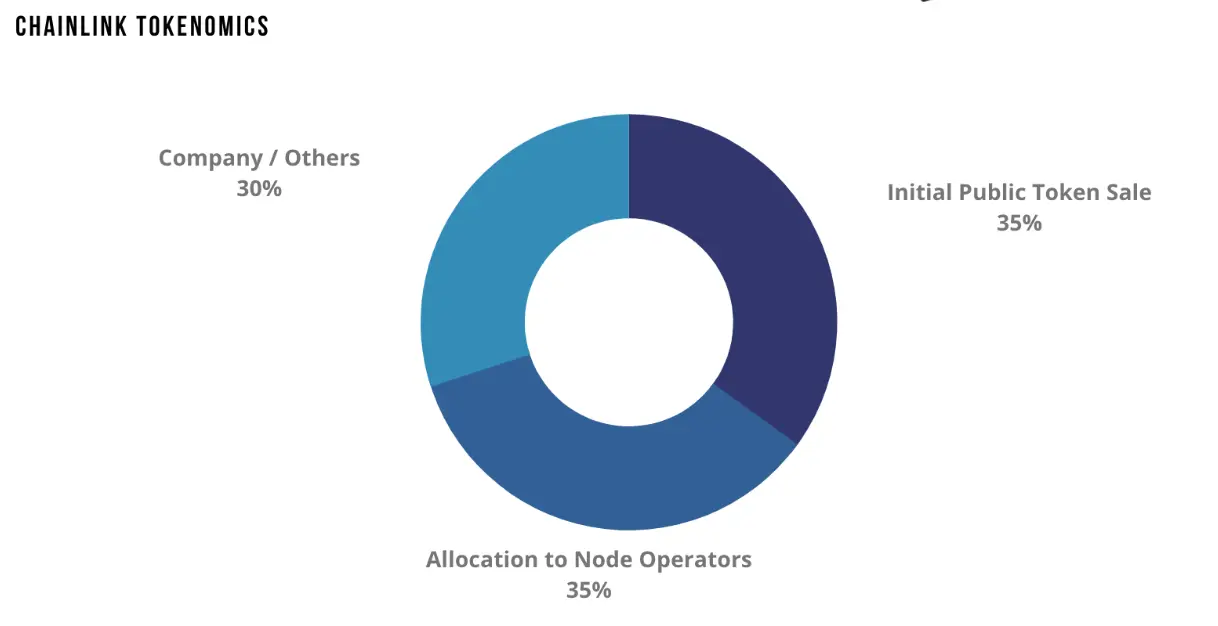

Chainlink's tokenomics are designed for long-term sustainability and value capture. The total supply is capped at 1 billion tokens. The initial distribution allocated 35% to node operators and ecosystem growth, 30% to the core development team, and 35% was sold in the ICO to fund development.

A critical, forward-looking element of its economic design is the concept of a value capture "flywheel." As demand for oracle services grows (especially from RWA tokenization), network fees increase. A portion of these fees is directed to a strategic "LINK Reserve," which is designed to systematically repurchase and retire LINK tokens from the open market. This creates a built-in, demand-driven buy pressure that could positively influence the token's price over time, especially when coupled with the reduction in circulating supply from staking.

The First U.S. Chainlink ETF: A Watershed Moment

The approval of the Grayscale Chainlink Trust ETF by NYSE Arca is a landmark event for several reasons.

-

Mainstream Accessibility: It provides a regulated, familiar investment vehicle for millions of traditional investors and institutions who may be uncomfortable with direct cryptocurrency custody but are convinced of Chainlink's infrastructure thesis.

-

Institutional Validation: Grayscale, the world's largest crypto asset manager, stating that "Chainlink is a foundational blockchain infrastructure" signals deep institutional research and conviction in its long-term role.

-

Market Differentiation: Unlike a Bitcoin ETF, which offers exposure to a "digital gold" store of value, the GLNK ETF offers exposure to the

revenue-generating infrastructure of the digital economy. It is a bet on the growth of smart contracts, DeFi, and RWA tokenization themselves.

-

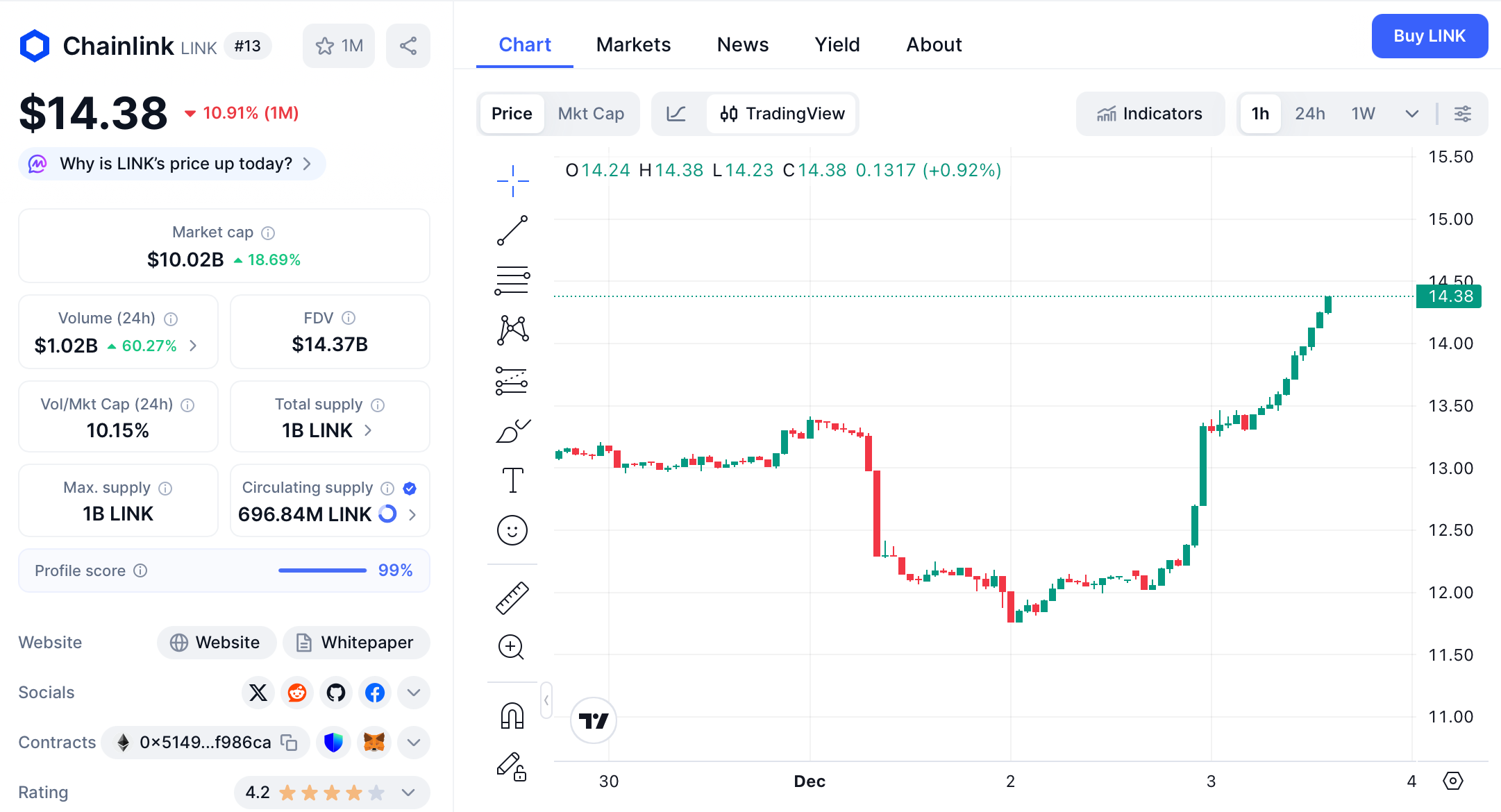

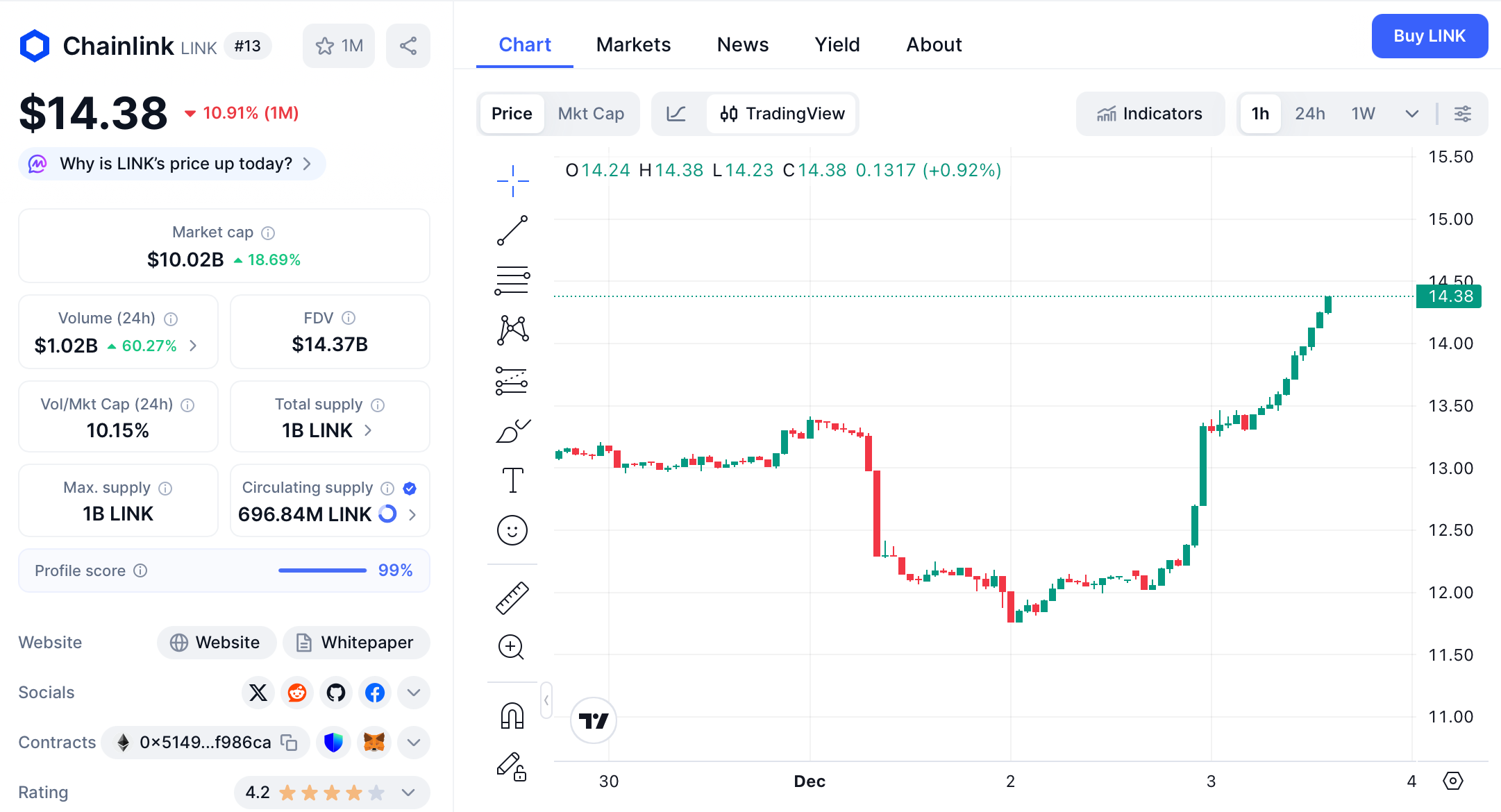

Market Response: Following the announcement, LINK's price reacted positively, rising 12.5% to trade around $13.2, demonstrating immediate market recognition of the event's significance.

Chainlink (LINK) Price Market Dynamics

Following the announcement, LINK's price saw a significant increase within hours. The market reacted positively; for example, reports indicate that after news of related ETF developments in September, LINK's price rose from approximately $11 to nearly $15 in a short period, a substantial increase. This directly reflects the market's perception of ETFs as a major positive, as they provide traditional capital with a regulated and convenient entry point into compliance. In addition to the price increase, market activity and attention also surged dramatically, with on-chain data showing a significant increase in large transactions and the number of active addresses following the news.

The core narrative revolves around the anticipated and actual inflows of institutional funds. The launch of ETFs has opened the floodgates for traditional fund inflows, and the market is closely watching the size of the initial inflows. Some analysts point out that, for example, when Grayscale announced its plans to launch the Chainlink Trust in September 2024, it was seen as a significant signal of institutional adoption. This expectation has supported strong prices. However, if actual inflows fall short of optimistic market expectations, it could trigger a price correction.

In conclusion, the listing of the ETF has brought structural long-term benefits to LINK, fundamentally changing its market landscape. After a period of euphoric gains, the market is now entering a more complex phase of verification and consolidation. It is recommended to closely monitor the ETF's continued inflow data, the movements of large LINK on-chain holders, and the overall market performance of Bitcoin in the coming weeks, as these will be key indicators for determining the short-term direction.

Chainlink Price Prediction: A Framework for Evaluation

Providing precise price predictions is speculative. However, a reasoned forecast can be built by analyzing its fundamentals, market position, and growth vectors.

In terms of price, several key levels are worth noting: the $22-$23 area is a significant near-term support level that needs to be held to maintain the strong structure; on the upside, attention should be paid to the previous high resistance around $25, and the important psychological level of $27-$30 further up.

Short-term price action may follow two paths: First, the price may consolidate within a range at the current high, for example, between $22 and $25, to digest profit-taking and accumulate energy, awaiting further guidance from subsequent fund inflow data. Second, if buying remains strong and the overall market cooperates, the price may attempt to directly break through the previous high and challenge higher resistance levels.

A risk to be wary of is that if the actual inflow of funds through ETFs is significantly lower than market expectations, or if the overall crypto market weakens, the price may retrace or even fall below the stronger support level of $20 to find a new equilibrium.

The long-term thesis for LINK is inextricably linked to the growth of the on-chain economy. As the dominant oracle solution with a 46%+ market share, Chainlink is poised to be the primary beneficiary if RWA tokenization grows into a multi-trillion-dollar market as predicted by firms like M31 Capital. Its expanding product suite (CCIP, Data Streams) opens new revenue streams.

A simple valuation framework considers its potential to capture value as a "toll bridge" for all on-chain data. If the global RWA and DeFi markets grow tenfold, the fees generated by the oracle layer could grow exponentially. Combined with its deflationary reserve mechanism and staking, this creates a powerful fundamental case for sustained value appreciation over the next decade.

Conclusion

The launch of the Grayscale Chainlink ETF is more than a financial product, but it is a recognition of a fundamental shift. Chainlink has successfully transitioned from a single-purpose oracle project into the indispensable "connective tissue" for Web3 and the burgeoning digital economy. Its infrastructure is critical for the next wave of innovation, from high-frequency trading on decentralized exchanges to the settlement of trillions of tokenized real-world assets.

For investors, LINK now presents a dual proposition: it remains a utility token within a vital, revenue-generating cryptoeconomic network, and it has become an accessible asset representing a stake in the blockchain infrastructure layer itself. While subject to market volatility and technological competition, Chainlink's first-mover advantage, extensive integrations, and continuous innovation place it in a unique position. As smart contracts continue to consume the world, the demand for reliable, decentralized data will only intensify, solidifying Chainlink's role as a foundational pillar of the future financial system.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.