In today's multi-chain cryptocurrency ecosystem, Ethereum and its Layer 2 networks remain the core layer for value settlement. However, a fundamental contradiction has become increasingly prominent: while demand for decentralized finance (DeFi) and on-chain applications is growing exponentially, the underlying blockchain's performance, particularly transaction processing speed (TPS) and finality latency, remains a persistent bottleneck. Most Ethereum Virtual Machine (EVM)-compatible chains can only achieve triple-digit TPS, with block times measured in seconds or even tens of seconds. This severely limits the development of complex applications that require instant feedback, such as high-performance decentralized exchanges, fully on-chain games, and real-time social platforms.

Against this backdrop, a project aimed at completely shattering the performance ceiling has emerged: MegaETH. It calls itself "the first fully Ethereum-compatible real-time blockchain" and has set an ambitious goal: achieving over

100,000 TPS

and sub-10-millisecond block times. This is not just incremental optimization but a fundamental rethinking of blockchain architecture paradigm. Its vision is to bridge the experience gap between blockchain and high-performance traditional cloud servers, providing a truly "real-time" execution environment for the next generation of Web3 applications.

This article will deeply analyze MegaETH's technical architecture, team background, economic model, and market prospects to explore whether it can become the next milestone in the Ethereum scaling narrative.

MegaETH Project Overview

MegaETH is an Ethereum Layer 2 blockchain focused on extreme performance, built by the development company MegaLabs. Its core mission is straightforward: push blockchain performance to the hardware limit without sacrificing Ethereum's security or EVM compatibility.

Unlike most general-purpose L2s that rely on optimistic rollups or zero-knowledge proofs, MegaETH's design philosophy is "performance first." It believes that current blockchain bottlenecks are not caused by any single component but by limitations in overall architecture. Therefore, MegaETH adopts a "monolithic" design approach that tightly integrates key functions such as sequencing, execution, and data availability to minimize inter-layer communication latency and achieve sub-millisecond transaction confirmation. This level of performance is intended to enable real-time applications previously considered "impossible on-chain," opening up entirely new design spaces for Web3 applications.

Founders and Team

MegaETH's success is inseparable from its prestigious founding team. The core members come from top global universities and have extensive industry experience, providing a solid foundation for its technical ambitions.

-

Yilong Li: Co-founder and CEO, PhD in Computer Science from Stanford University, former senior software engineer at formal verification company Runtime Verification.

-

Lei Yang: Co-founder and CTO, PhD in Computer Science from MIT, member of MIT's Computer Science and Artificial Intelligence Laboratory. His research focuses on efficient consensus and synchronization in distributed systems, which is central to building high-performance blockchains.

-

Shuyao Kong: Co-founder and Chief Business Officer, better known in the Chinese community as "Bing Ge". Before joining MegaLabs, he served as Head of Global Business Development at ConsenSys and had deep understanding and extensive connections in the Ethereum ecosystem.

In addition, the project's early Head of Growth, Namik Muduroglu, also comes from ConsenSys. This combination of "academic elite + Ethereum veterans" ensures the project has both cutting-edge technical vision and mature ecosystem execution capability.

Even more striking is the top-tier capital and industry leader backing the project received. In June 2024, MegaLabs raised a $20 million seed round led by Dragonfly Capital, with participation from Figment Capital, Robot Ventures, Big Brain Holdings, and others. The angel investor list is a true all-star lineup: Ethereum co-founder Vitalik Buterin, ConsenSys founder Joseph Lubin, EigenLayer founder Sreeram Kannan, and more. Such prestigious backing not only provides funding but also grants the project extremely high credibility and industry attention.

Technical Architecture: How to Achieve a "Real-Time" Blockchain?

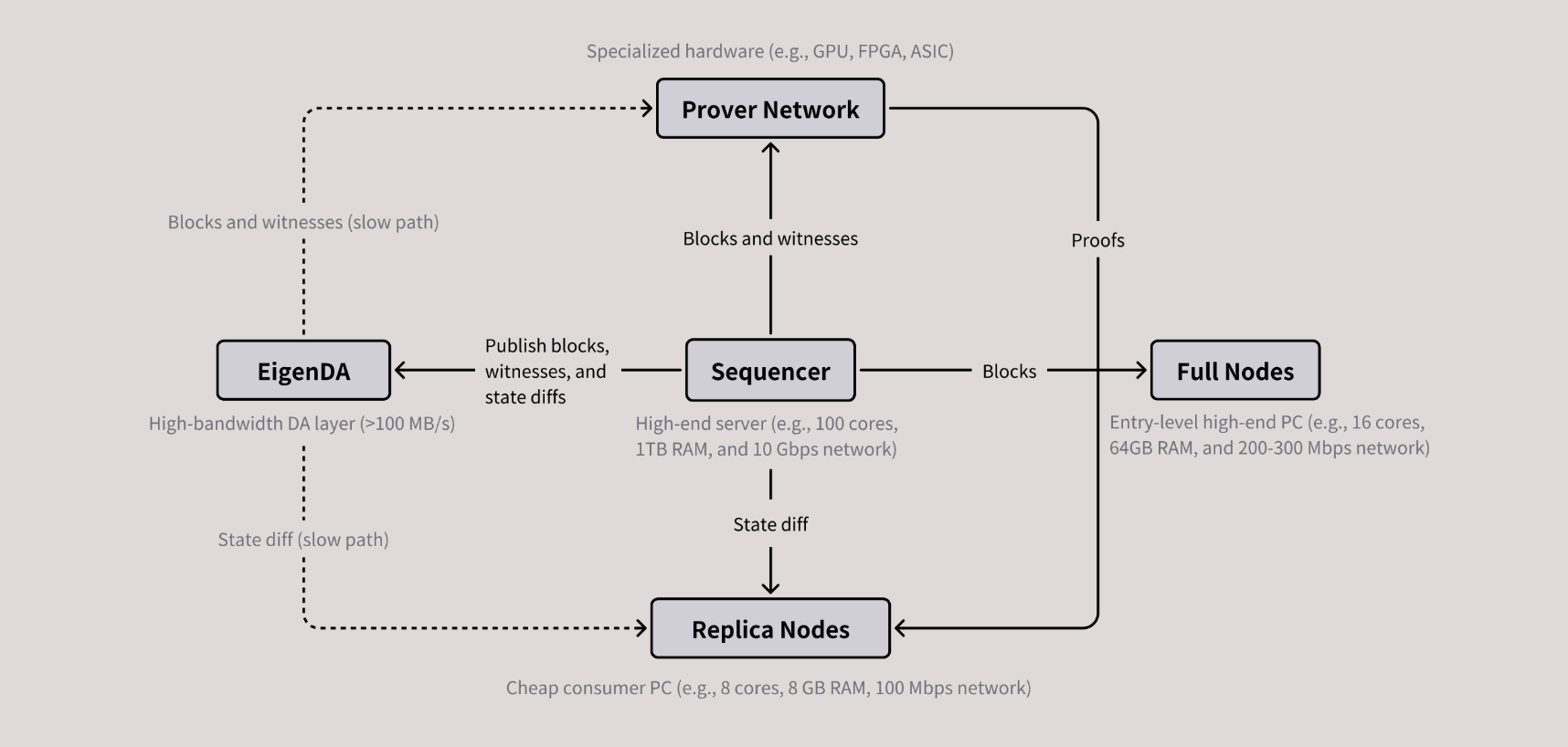

Major components of MegaETH and their interaction. Source: MEGAETH Research

MegaETH's "real-time" performance is not magic but the result of a series of synergistic technical innovations rebuilt from the ground up. Its core architecture can be summarized as: specialized node roles, memory-first computing model, and inheritance of Ethereum security.

1. Heterogeneous Node Architecture and Specialized Division of Labor

Traditional blockchains require every full node to perform all tasks (consensus, execution, storage), leading to inefficiency. MegaETH introduces fine-grained node role specialization, allowing different types of nodes to focus on specific tasks and dramatically improving overall network efficiency.

-

Sequencer: There is only one active sequencer node across the entire network. It receives, orders, and executes transactions in a streaming manner and produces a new block approximately every 10 milliseconds. This centralized block production model completely eliminates latency caused by multi-node consensus and is key to achieving millisecond-level block times. Its hardware requirements are extremely high, targeting 5-10 times the performance of a typical Solana validator node.

-

Provers: Asynchronously generate cryptographic proofs (such as validity proofs) to verify the correctness of the sequencer's execution results without needing access to the full state.

-

Full Nodes: Re-execute all transactions like traditional nodes, providing the highest level of security verification. Usually run by institutions requiring strong security (e.g., cross-chain bridges, market makers).

-

Replica Nodes: A major innovation of MegaETH. Replica nodes do not execute transactions from scratch but directly receive and apply "state diffs" from the sequencer, enabling them to sync to the latest network state quickly with very low hardware costs (comparable to running an Ethereum L1 node). This ensures network decentralization and accessibility.

2. Ultra-Optimized Execution Environment: Memory Computing and JIT Compilation

To break through execution-layer bottlenecks, MegaETH deeply optimized its EVM execution environment.

-

In-Memory Computing: The sequencer keeps the entire EVM world state and state tree completely in RAM instead of disk. This makes state access 1,000 times faster than SSD-based systems, completely solving the problem of disk I/O being the main performance bottleneck.

-

Just-In-Time Compilation: MegaETH uses JIT compilation to dynamically compile smart contract bytecode into native machine code before execution, bypassing the inefficient interpretation process of traditional EVM interpreters. For compute-intensive applications, this can improve performance by up to 100 times.

-

Efficient State Tree and Sync Protocol: The project designed a brand-new state tree structure to replace the traditional Merkle Patricia Trie, minimizing disk I/O. At the same time, an efficient P2P state synchronization protocol ensures all nodes stay in sync even at 100,000 TPS.

Core Advantages of MegaETH

Based on the above architecture, MegaETH exhibits the following distinctive features:

-

Sub-millisecond latency and ultra-high throughput: 10 ms block time and theoretical performance exceeding 100,000 TPS are its biggest selling points.

-

Full EVM compatibility: Developers can seamlessly migrate or deploy applications using familiar Solidity, Hardhat, and other Ethereum tools without learning new paradigms, greatly reducing ecosystem migration costs.

-

Inherits Ethereum security: As a Layer 2, MegaETH anchors settlement and data availability on Ethereum mainnet and plans to integrate decentralized DA layers like EigenDA, achieving security and decentralization by relying on Ethereum while pursuing extreme performance.

-

Differentiated cost structure: By specializing nodes, expensive computing costs are concentrated on a few sequencers, while allowing a large number of replica nodes to run at low cost, achieving a clever balance between performance and decentralization.

Mechanism and Philosophy Behind MegaETH

The mechanism behind MegaETH reflects a pragmatic and clearly targeted design philosophy. The team acknowledges that under current physical and engineering constraints, trying to simultaneously maximize decentralization, security, and performance (the "impossible triangle") on a single layer is unrealistic. Therefore, they made a clear trade-off: prioritizing performance at the execution layer, temporarily accepting sequencer centralization, while delegating security and ultimate decentralization to the time-tested foundation: Ethereum and its ecosystem.

This approach aligns closely with Vitalik Buterin's vision in his 2021 article "Endgame": future blockchain scaling may eventually move toward a model combining centralized block production with decentralized validation. Instead of reinventing the wheel, MegaETH chose to build a high-performance skyscraper on the solid foundation of Ethereum. This modular and division-of-labor thinking is key to its technical breakthrough.

Fundraising and Capital Raising: Community-Driven Frenzy

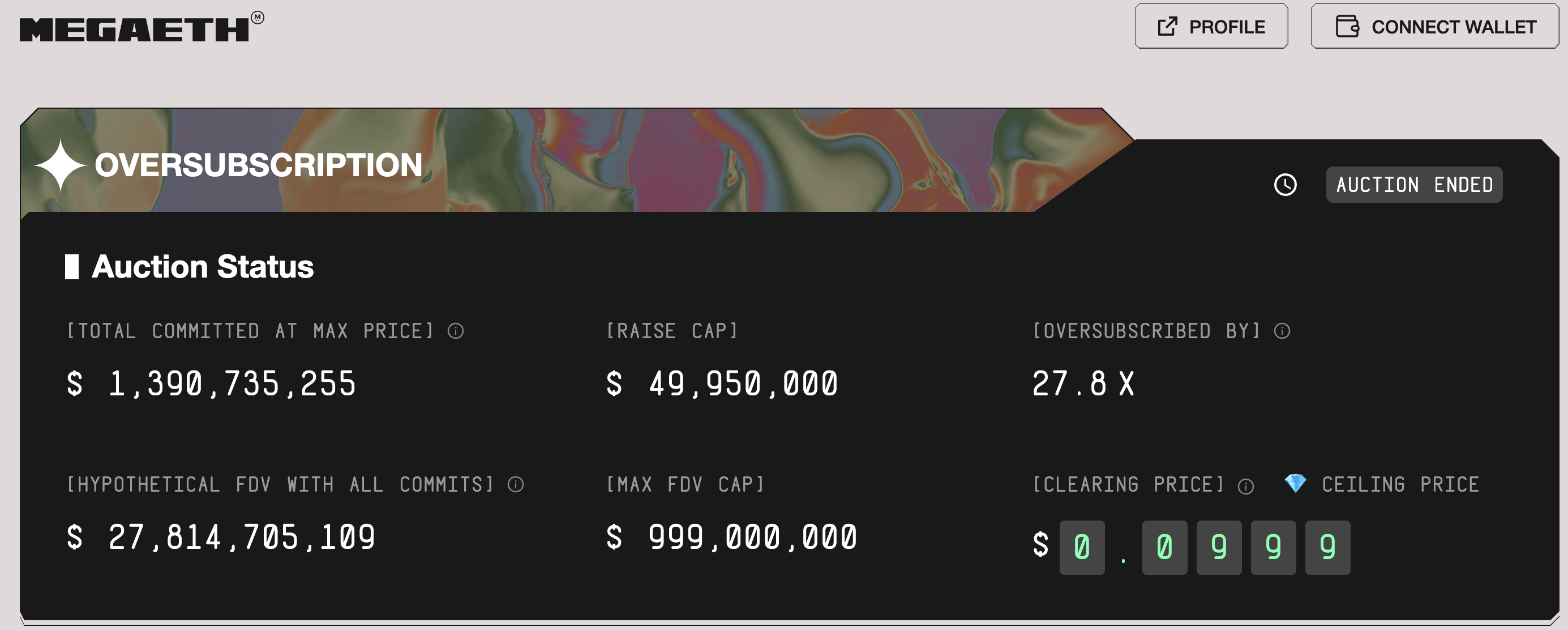

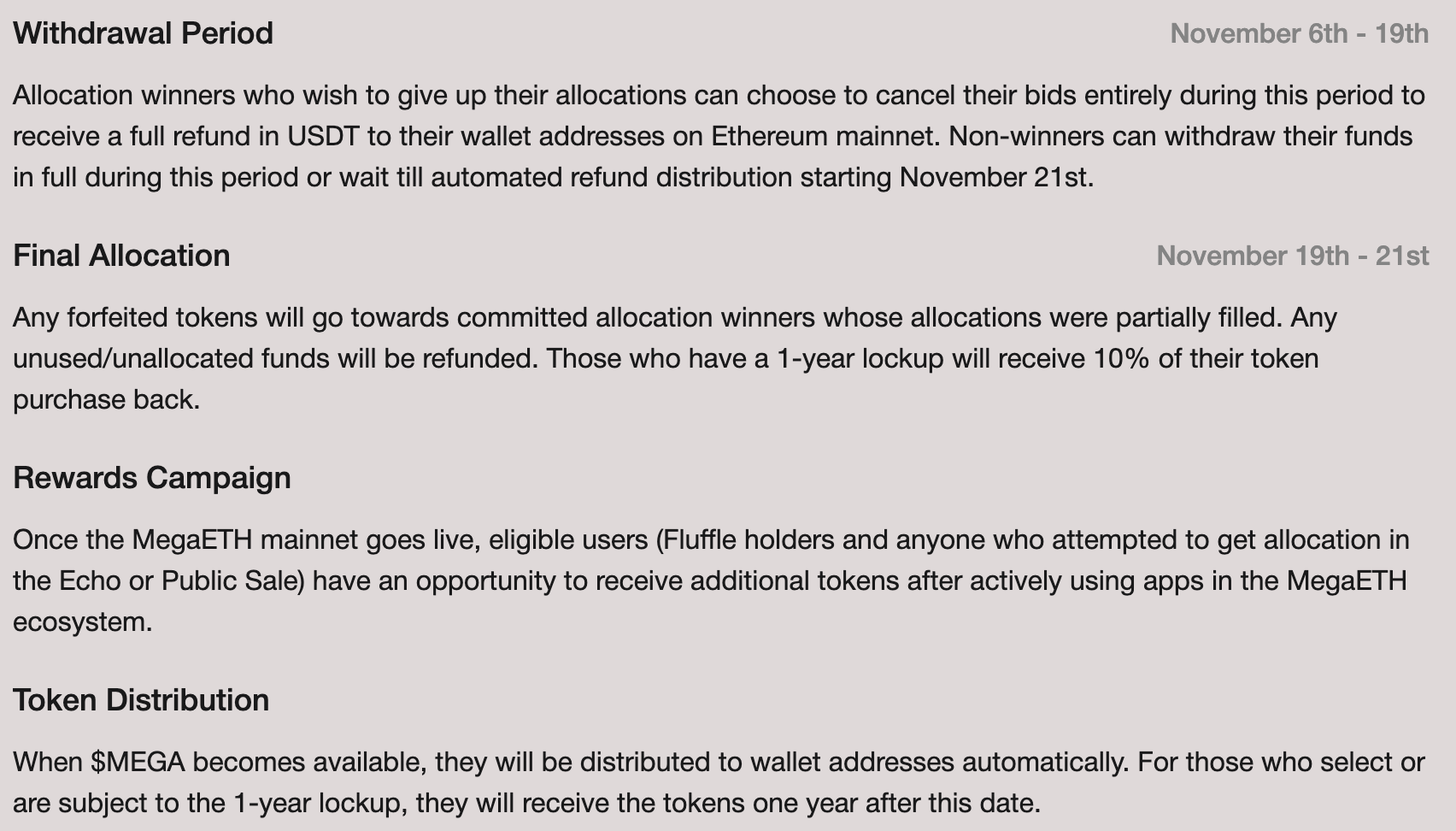

MegaETH auction status. Source: MEGAETH

MegaETH's fundraising journey has been a spectacular evolution from traditional VC to community-driven, with its explosive popularity reflecting the market's strong desire for high-performance narratives.

-

Seed Round (June 2024): $20 million led by Dragonfly, post-money valuation reaching nine figures (at least $100 million).

-

Community Round (December 2024): Raised $10 million in just 3 minutes via the Echo platform created by KOL Cobie, with over 3,200 participants from 94 countries.

-

NFT Round (February 2025): Launched non-transferable soul-bound NFT "The Fluffle." The first phase raised approximately $13.29 million, implying a project valuation of about $540 million.

-

Public Sale (October 2025): Conducted via English auction on Echo's Sonar platform. The sale was unprecedentedly successful but also exposed operational challenges. Total commitments reached $1.39 billion, oversubscribed 27.8 times, with over 50,000 investors participating. However, due to KYC configuration errors and operational mistakes, deposits temporarily went out of control (reaching $500 million), forcing the team to pause the sale and promise refunds for excess funds.

Overall, MegaETH's token presale and fundraising attracted enormous attention. Total supply of the token is 10 billion, with 5% (500 million tokens) allocated to public auction. The October 2025 community sale on Sonar used an English auction format: starting price $0.0001 per token (FDV $1 million), capped at $0.0999 (FDV $999 million), with bid range $2,650 to $186,282 per submission. Final clearing price applied uniformly. Early fundraising totaled over $30 million, including the $20 million seed round and $10 million Echo community round.

From a valuation perspective, the market has high expectations for MegaETH. Based on NFT sales and early rounds, FDV estimates ranged from several hundred million to $540 million after the first NFT phase. Before the public sale, prediction markets like Polymarket showed an 86% probability of first-day FDV reaching $2 billion at one point. Compared to other major Layer 2s (Arbitrum ~$3.2B, OP ~$2B, StarkNet ~$1.2B, zkSync ~$800M), breaking $2 billion remains uncertain but demonstrates strong market interest in the "high-performance Ethereum execution layer" narrative.

MegaETH Token Economics: KPI-Driven Innovative Model

According to public information, the native token $MEGA has a total supply of 10 billion. Its allocation model is innovative, emphasizing linkage with actual network growth:

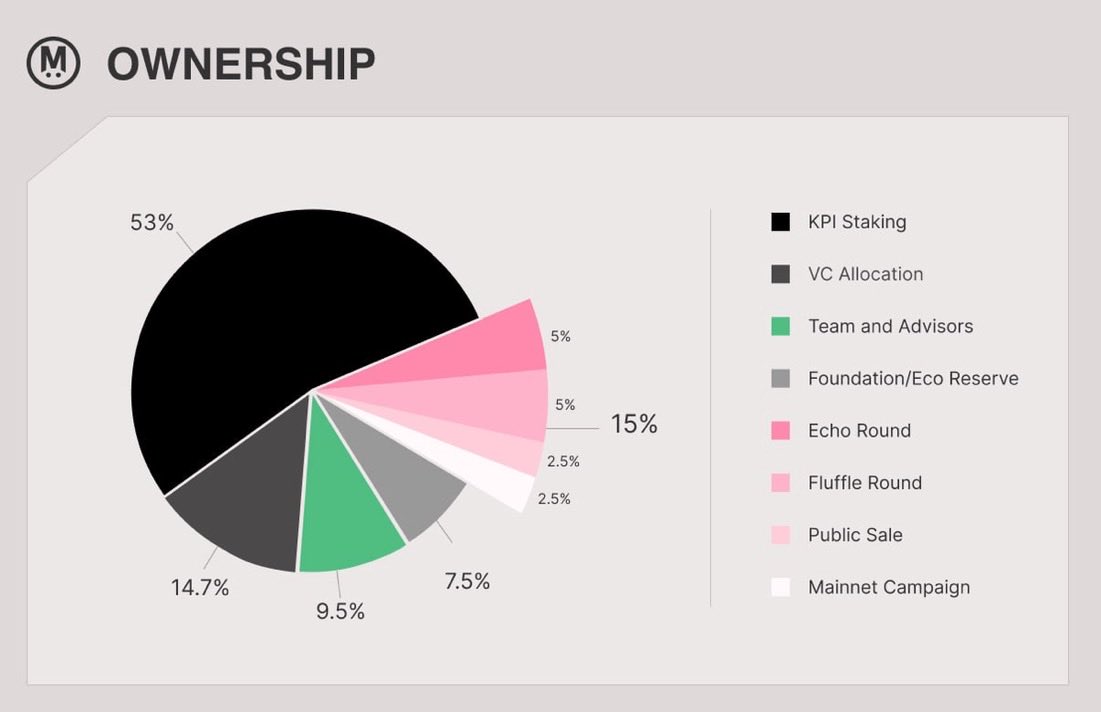

MEGAETH ownership. Source: MEGAETH

-

KPI Reward Pool: ~53%, the core of the model. These tokens will be gradually released based on achieving specific key performance indicators (TVL, transaction volume, active addresses, etc.), deeply tying token emission to ecosystem success.

-

Investors and Early Rounds: ~24.7% total, including institutional investors, Echo round, Fluffle NFT buyers, and Sonar reward pool.

-

Team and Advisors: 9.5%, with 1-year cliff and 3-year linear vesting thereafter.

-

Foundation and Ecosystem Reserve: 7.5%, for ecosystem development.

-

Public Sale: 5%.

This KPI-oriented model aims to prevent disorderly token dumping and encourage long-term construction. Initial circulating supply is low, mainly from public sale, with most other portions locked, helping reduce early selling pressure but potentially increasing short-term volatility.

Token utilities:

Allocation plan. Source: MEGA PUBLIC SALE USER MANUAL

Vesting schedules for team and investors are standard multi-year linear releases similar to OP and ARB. Overall, MegaETH's tokenomics are relatively traditional and conservative, focusing on long-term ecosystem building rather than short-term financing or high inflation.

Comparison with Other High-Performance L2s

Layer 2 competition is fierce. Instead of directly competing with Arbitrum, Optimism, or Base on general ecosystem scale, MegaETH has chosen a differentiated path focused on extreme performance and vertical use cases.

Key competitors include:

-

Monad: An independent EVM-compatible Layer 1 focused on parallel execution and software optimization. Targets ~10,000 TPS and ~400 ms block time. Monad emphasizes decentralized improvements via superscalar pipelining and parallel processing, while MegaETH relies on massive hardware scale and heterogeneous architecture.

-

zkSync Era: zk-rollup with strong security and decentralization advantages but higher latency. Focuses on low cost and usability.

-

Base: Coinbase's OP Stack-based L2, prioritizing user experience and regulatory friendliness rather than extreme TPS.

-

Blast: Optimistic rollup with native yield mechanics, more focused on passive income than raw performance.

-

Zircuit: AI-assisted zk-rollup emphasizing security through on-chain transaction monitoring.

In summary, MegaETH stands out by pursuing hardware-driven extreme parallelism and sub-millisecond latency, while most competitors balance performance with decentralization, cost, or security in different ways.

Market Adoption and Narrative: Early Ecosystem Growth

Although mainnet has not yet launched, over 100 protocols are already built on MegaETH testnet, with total funding raised by these projects exceeding that of MegaETH itself, showing strong capital confidence. Ecosystem projects clearly leverage high concurrency and low latency, mainly in:

-

Advanced DeFi (perpetual DEXs like Valhalla, CLOB lending like Avon)

-

SocialFi and prediction markets (NOISE, Sweep)

-

Fully on-chain games and interactive applications (Euphoria, Pump Party)

Official programs like the "Mega Mafia" accelerator and "MegaForge" builder hub further support development. A healthy and distinctive early ecosystem is crucial for sustaining high valuation and differentiation from general-purpose L2s.

Future Outlook: Opportunities and Challenges

If MegaETH delivers on its technical promises, it could unlock entirely new categories of on-chain applications and lead the "real-time Web3" infrastructure narrative. Its deep community involvement from the fundraising stage has built a loyal early user base.

However, significant challenges remain:

-

Technical execution risk under long-term real-world conditions

-

Ecosystem cold-start and need for killer applications

-

Centralization and trust risks from single sequencer

-

Intense competition from both L2s and high-performance L1s like Solana

-

Operational and governance maturity (as exposed by public sale issues)

Conclusion

MegaETH marks a new phase in the Ethereum scaling story: moving from "good enough" general-purpose scaling to exploring the limits of vertical performance breakthroughs. With near-obsessive engineering focus, it has turned "real-time blockchain" from marketing hype into a tangible technical target.

By making explicit trade-offs (accepting execution-layer centralization while firmly anchoring Ethereum's security foundation), combining a world-class team, star-studded backers, innovative tokenomics, and passionate community support, MegaETH has become one of the most watched projects in crypto.

Ultimately, all glamorous narratives will face the ultimate test of mainnet launch. MegaETH's true value lies not in how much money it raised or how high its valuation climbed, but in whether it can become fertile soil for the next generation of real-time on-chain applications, truly ushering in a new "real-time" paradigm for Ethereum and the broader blockchain world.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.