After a deep correction and panic selling at the end of November, the cryptocurrency market saw a strong rebound on December 3. The total global cryptocurrency market capitalization surged in a single day. Leading asset Bitcoin (BTC) successfully reclaimed the $90,000 mark, rising over 7% in 24 hours, and trading around $93,000. Ethereum (ETH) performed even better, surging approximately 9% and returning above $3,000. Meanwhile, BTC mining companies, even large public operators, are struggling to break even as revenue collapses and costs soar. Tether Data today announced the launch of QVAC Fabric LLM, a new comprehensive LLM inference runtime and fine-tuning framework that makes it possible to execute, train and personalize large language models directly on everyday hardware, including consumer GPUs, laptops, and even smartphones. Prediction markets platform Kalshi announced today that it is becoming CNN's official prediction markets partner.

Crypto Market Overview

BTC (+7.85% | Current Price: $93,814.01)

Bitcoin led the charge, with its price action demonstrating the mechanics of a classic short squeeze underpinned by a shifting macro narrative. BTC surged as much as 7.8% to a high of $93,965, decisively recapturing the psychologically crucial $90,000 level. This marked an impressive 11% gain over a three-day rally from a low near $83,000 on December 1st. Beyond technicals, two fundamental drivers were at play. First, the Fed's end to QT alleviated systemic liquidity concerns. Second, and more impactful for crypto, was the "Vanguard Effect." The firm's decision to allow its 8 million brokerage clients to trade spot crypto ETFs like BlackRock's IBIT was a watershed moment. Trading in IBIT alone saw over $1 billion in volume in the first 30 minutes of the U.S. market open, illustrating the immense pent-up demand.

Immediate resistance lies near the local high of $93,000, with the next major test at $95,000. Support has now solidified at the $90,000 breakout level. Analysts suggest BTC may trade in a wide range ($83,000 - $95,000) through year-end as the market digests these flows.

On December 2nd, Bitcoin exchange-traded funds (ETFs) registered an inflow of $58.5 million, with BlackRock's IBIT saw an inflow of $120.1 million.

ETH (+9.73% | Current Price: $3,081.50)

Ethereum outperformed Bitcoin on the day, rebounding by more than 9% to push back above the $3,000 threshold. This strength was supported by its own set of catalysts. The move allowed ETH to break through a significant resistance level near $2,926, with some analysts suggesting a sustained hold above this point could open a path toward $3,700. December 3rd also saw the mainnet deployment of the Fusaka upgrade. This hard fork is designed to significantly enhance Layer 1 scalability by increasing the default block gas limit and improving data availability sampling (PeerDAS), which is critical for the efficiency of Layer 2 solutions and decentralized applications. On-chain data preceding the rally indicated persistent institutional interest, with Ethereum ETFs recording inflows exceeding $60 million daily.

On December 2nd, ETH ETFs experienced a total net outflow of $9.9 million, with BlackRock's ETHA saw an outflow of $88.7 million.

Altcoins

The cryptocurrency Fear & Greed Index rebounded significantly today from 16 (extreme fear) to 22, moving out of the "extreme fear" zone and into the "fear" zone. While market sentiment remains cautious, this jump clearly indicates a rapid easing of panic and an initial recovery in investor confidence. The index's 7-day average is 15, suggesting the market is gradually recovering from its trough. In today's broad-based rally, major altcoins generally outperformed Bitcoin, indicating that risk-averse funds are beginning to refocus on opportunities outside of Bitcoin. However, there are no clear signs of a full-blown "altcoin season" yet, and fund rotation is still in its early stages.

Macro Data

The Fed's pivot from QT, coupled with market expectations for an 87.2% probability of a rate cut on December 10th, provided the essential macro backdrop for risk asset appreciation.

The Vanguard news is arguably the most significant development of the day. It represents the crumbling of one of the last major walls of institutional resistance. As Bloomberg analyst Eric Balchunas termed it, this "Vanguard Effect" demonstrates that even the most conservative investor base is seeking exposure. This follows Bank of America's move to allow its advisors to recommend crypto allocations, systematically opening the floodgates to mainstream capital.

On December 2nd, the S&P 500 gained 0.25%, standing at 6,829.37 points; the Dow Jones Industrial Average increased 0.39% to 47,474.46 points, and the Nasdaq Composite gained 0.59% to 23,413.67 points. The price of gold is $4,207.05, up 0.42%, at 7:00 UTC, December 3rd.

Trending Tokens

TURBO Turbo (+40.41%, Circulating Market Cap: $173.55 Million)

TURBO is trading at $0.002517, up approximately 40.41% in the past 24 hours. This is the first ever memecoin created by AI. Turbo Token began as a bold experiment in cryptocurrency creation. Inspired by the power of artificial intelligence, the project's founder turned to GPT-4 with a simple challenge: create the next great meme coin. TURBO’s 24h volume hit $195M (+426%). The token’s turnover ratio (volume/market cap) hit 1.10, indicating high liquidity and reduced slippage. Retail traders and whales likely fueled the rally, as seen in

social media sentiment celebrating the breakout. High turnover reduces volatility risks short-term but increases susceptibility to profit-taking.

ALCH Alchemist (+39.09%, Circulating Market Cap: $83.57 Million)

ALCH is trading at $0.4957, up approximately 24.5% in the past 24 hours. Alchemist AI is a no-code development platform where users can manifest any idea, dream, or thoughts into a living application. ALCH broke above its 7-day SMA ($0.147) and 30-day EMA ($0.133), with RSI14 at 63.34 – signaling bullish momentum without being overbought. The MACD histogram turned positive, confirming upward pressure. Traders likely interpreted the breakout above $0.15 as a buy signal, especially with volume spiking 76.8% to $57.8M. Fibonacci retracement levels suggest next resistance near $0.192 (23.6% level).

BRETT Brett (+15.55%, Circulating Market Cap: $261.17 Million)

FARTCOIN is trading at $0.3192, up approximately 15.55% in the past 24 hours. BRETT is a fan tribute to Brett, a character from Matt Furie’s

Boys’ Club comics, repurposed as the mascot of the Base blockchain. Unlike Pepe-themed tokens, BRETT focuses on lighthearted community engagement rather than explicit ideological messaging. Its primary role is to foster camaraderie within the Base ecosystem, similar to Dogecoin’s early meme-driven ethos. BRETT reclaimed its 7-day SMA ($0.0178) and EMA ($0.0176), with the MACD histogram turning positive (+0.00078) for the first time in weeks. The RSI-7 (65.29) shows room for upward movement before overbought conditions. The breakout above key moving averages triggered algorithmic buying, while the MACD crossover historically precedes 15-25% rallies in meme coins. With volume up 72% to $61.5M, the move has liquidity confirmation.

Market News

Bitcoin Mining Profits Have Shrunk to Historical Lows

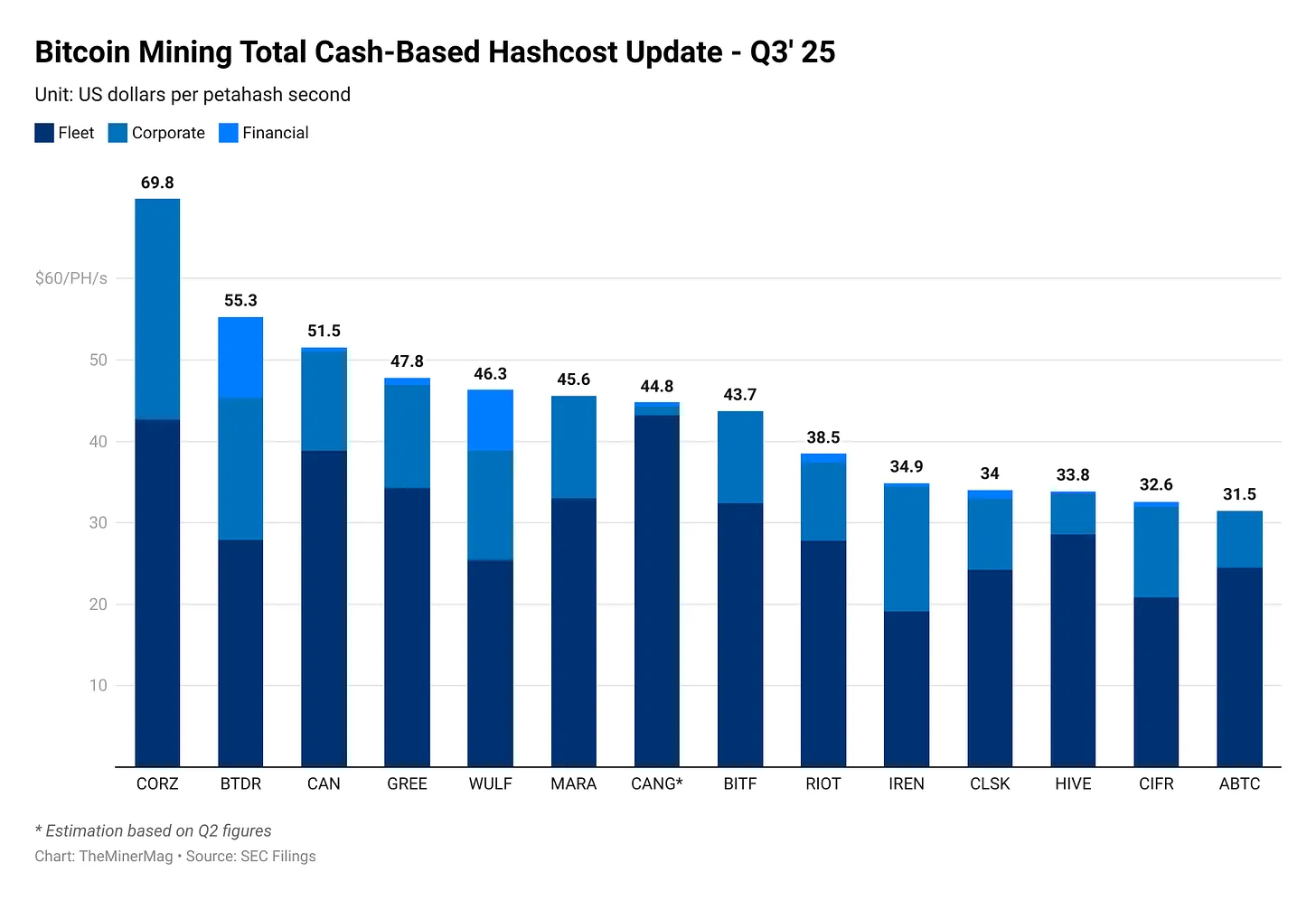

BTC hashcost. Source: Miner Weekly

The Bitcoin mining industry is experiencing what experts call the "harshest margin environment of all time." Mining companies, even large public operators, are struggling to break even as revenue collapses and costs soar.

The crisis stems from a perfect storm of factors: Bitcoin’s price dropped from a record high near $126,000 in October to below $80,000 in November, while mining difficulty reached record highs. This combination has created unprecedented challenges for an industry that secures the world’s largest cryptocurrency network.

Mining profitability has hit structural lows that experts say represent more than just a temporary downturn. Hashprice, which measures how much miners earn per unit of computing power, crashed from $55 per petahash per second (PH/s) in the third quarter to roughly $35 PH/s by late 2025.

TheMinerMag’s recent Q3 look-back report makes this tension clear: the median total hashcost among major public miners sits around $44/PH/s. That number includes cash-based fleet opex, corporate overhead and financing—meaning even operators with efficient machines and competitive power rates are now navigating break-even economics. To account for diversified business models, corporate and financial hashcosts are estimated by allocating company-wide expenses proportionally based on the proprietary mining segment’s share of total revenue.

Tether Data Introduces QVAC Fabric LLM, the Edge-First LLM Inference Runtime and Generalized LLM LoRA Fine-Tuning Framework

Tether Data today announced the launch of QVAC Fabric LLM, a new comprehensive LLM inference runtime and fine-tuning framework that makes it possible to execute, train and personalize large language models directly on everyday hardware, including consumer GPUs, laptops, and even smartphones. What once required high-end cloud servers or specialized NVIDIA systems can now happen locally on devices people already own.

High Performance LLM Inference Runtime and Fine-tuning have traditionally been reserved for companies with access to expensive infrastructure, but QVAC Fabric shifts that model entirely. It is the first unified, portable, cross-platform, highly-scalable system capable of full LLM inference execution, LoRA, and instruction-tuning across mobile operating systems (iOS and Android) as well as all other laptop, desktop, and server environments (Windows, macOS, Linux), allowing developers and organizations to build, deploy, execute, and customize AI privately and independently. No cloud dependency, no vendor lock-in, and no sensitive data leaving the device.

A major breakthrough in this release is the ability to fine-tune models on mobile GPUs such as Qualcomm Adreno and ARM Mali. This is the first time a production-ready framework has enabled modern LLM training on smartphone-class hardware. It opens the door to personalized AI that can learn directly from users on their devices, preserving privacy and functioning even without an internet connection, and powering a new generation of highly resilient, anti-fragile, on-device AI applications.

NovaDius Wealth President Nate Geraci wrote on X Sunday that Grayscale is set to launch the country's first spot Chainlink ETF this week, adding on to the growing list of crypto products.

Kalshi Becomes CNN's Official Partner, Integrating Prediction Market Data into Programming

Prediction markets platform Kalshi announced today that it is becoming CNN's official prediction markets partner.

In an announcement, Kalshi said its prediction market data will be used as a "powerful complement" to CNN's reporting, where its newsroom, data and production team will be given access to Kalshi's information about real-time probabilities of future cultural and political events. Led by CNN Chief Data Analyst Harry Enten, Kalshi data will be integrated across CNN programming, the announcement said. A new Kalshi-powered real-time news ticker will also run during segments featuring the platform's data.

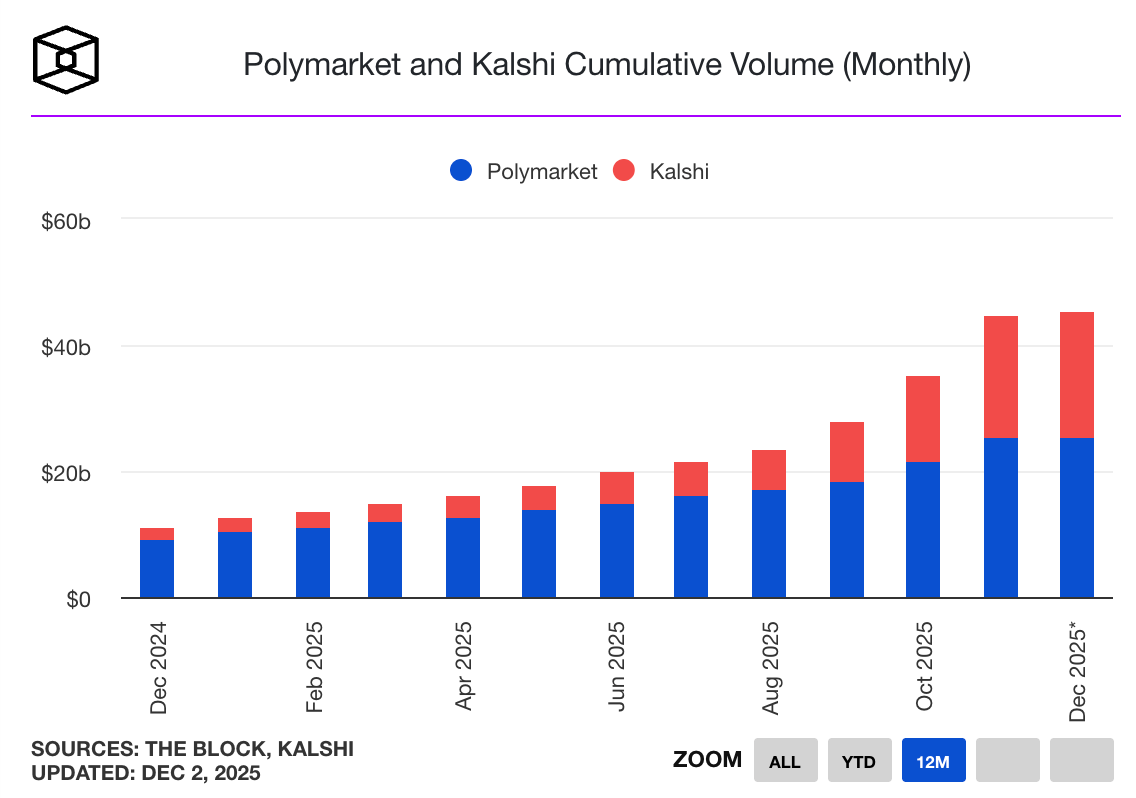

Polymarket and Kalshi cumulative volume. Source: The Block

The two leading prediction market platforms have gained significant amounts of traction this year, with their combined cumulative volume exceeding $45 billion. Google Finance, Yahoo Finance, Robinhood, Intercontinental Exchange and other major players have partnered with these platforms, signifying their growing mainstream acceptance.

However, the prediction market sector still faces criticism that it is closer to sports betting. Kalshi was recently hit with a nationwide class action lawsuit, which accuses the platform of operating an unlicensed sports betting service while falsely advertising better odds than traditional sportsbooks.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.