In a definitive about-face that marks one of the most significant cultural shifts in modern finance, Vanguard Group, the world's second-largest asset manager and a longstanding bastion of traditional investment philosophy, has opened its platform to cryptocurrency Exchange-Traded Funds (ETFs). As of December 2, 2025, the firm's over 50 million brokerage clients, who collectively oversee more than $11 trillion in assets, can now access regulated ETFs and mutual funds holding Bitcoin, Ethereum, XRP, and Solana. This decision dismantles a blockade Vanguard established in January 2024, when it famously refused to offer the newly approved spot Bitcoin ETFs and even removed Bitcoin futures ETFs from its platform. The reversal is not merely a product addition; it is a profound capitulation to relentless client demand and a powerful validation of digital assets' place in the "serious" investment landscape. This article explores the multifaceted drivers behind Vanguard's pivot, its immediate and future implications for capital flows, the deliberate limits of its new policy, and what this seminal moment signals for the future of Bitcoin and the broader crypto market.

Why Vanguard Ultimately Changed Its Position on Crypto

Vanguard has about $11 trillion in assets and more than 50 million customers. The move means that investors of all kinds can now buy and sell crypto ETFs.

The firm has, historically, not been shy about its distaste for crypto. When Bitcoin ETFs launched in the U.S. last year, Vanguard’s CEO said that he didn’t believe they belonged in a long-term portfolio.

But given crypto ETFs’ success in the last couple of years, the brokerage could no longer pass up on the opportunity. In late October, several ETFs from smaller cryptocurrencies, like Solana and Hedera, launched on other brokerages. One of those ETFs, the Bitwise Solana Staking ETF (BSOL), had the best ETF launch of 2025 of any asset class, according to Eric Balchunas of Bloomberg Intelligence.

Crypto ETFs have seen massive amounts of trading volume since the first ones launched in 2024. That year, BlackRock’s iShares Bitcoin Trust ETF (IBIT), and its Ethereum fund (ETHA) set record inflows. Currently, iBit is holding around $66 billion worth of Bitcoin on behalf of its customers.

The crypto industry has fought for ETFs since at least 2013, when Cameron and Tyler Winklevoss sought approval for a spot Bitcoin ETF. After years of rejection from the Securities and Exchange Commission, the doors have now flown open for crypto funds.

What Vanguard Permits and Excludes

Vanguard's new policy is strategically permissive yet carefully bounded, reflecting its conservative risk ethos. The firm is acting strictly as a distributor, not a creator, of crypto products.

The table below summarizes the scope of this new access:

| What's Allowed (Third-Party Products) |

What's Restricted or Excluded |

| Regulated ETFs & Mutual Funds holding Bitcoin (BTC) |

Proprietary Vanguard crypto funds (No plans to launch own products) |

| Regulated ETFs & Mutual Funds holding Ethereum (ETH) |

Funds linked to memecoins (as defined by the SEC) |

| Regulated ETFs & Mutual Funds holding XRP |

Access may vary by region (e.g., not initially on Australia's platform) |

| Regulated ETFs & Mutual Funds holding Solana (SOL) |

/ |

This selective approach allows Vanguard to meet pressing client demand for major digital assets while avoiding the regulatory and reputational risks associated with more speculative corners of the crypto market. It mirrors the firm's treatment of other non-core assets like gold, offering access while maintaining a clear philosophical distance.

Vanguard's Next Wave of ETF Inflows: A Calculated Impact

While the symbolic importance of Vanguard's move is immense, its immediate financial impact is likely to be measured and gradual rather than explosive. The firm's client base is predominantly composed of long-term, buy-and-hold investors with conservative portfolio allocations. Typical allocations to Bitcoin for such investors are expected to range between 1% and 3% of a portfolio.

Analysts at Bloomberg Intelligence have estimated that even a 5% adoption rate among Vanguard's massive client base could translate into $15 to $25 billion in new inflows into crypto ETFs. This would represent a significant infusion of capital, particularly for a market that saw spot Bitcoin ETFs experience net outflows of $3.5 billion in November 2025. However, Vanguard has indicated it will not engage in active marketing of these products, suggesting inflows will be driven organically by existing client interest. Therefore, the true impact may unfold over quarters and years, as crypto assets are progressively normalized within Vanguard's ecosystem and financial advisors begin to consider them for diversified portfolio construction.

What Investors Need to Know About Vanguard's New Crypto Access

For Vanguard's millions of clients, this change simplifies access but does not alter the fundamental nature of the investment. Investors can now buy and sell shares of funds like BlackRock's IBIT or Fidelity's FBTC directly through their existing Vanguard brokerage account, gaining exposure to Bitcoin's price movements without the complexities of direct ownership, such as private key storage. It is crucial for investors to understand that they are purchasing a securities product that holds Bitcoin, not Bitcoin itself.

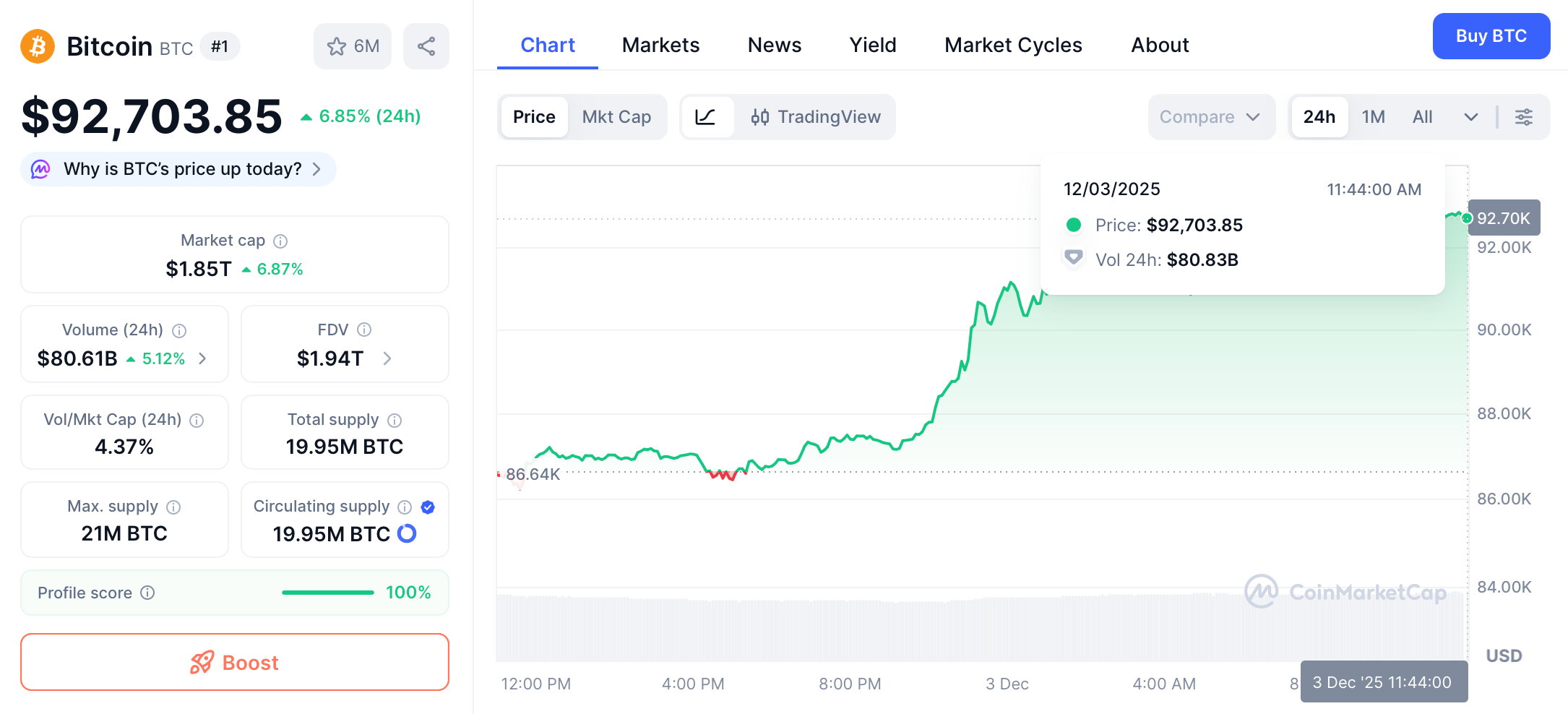

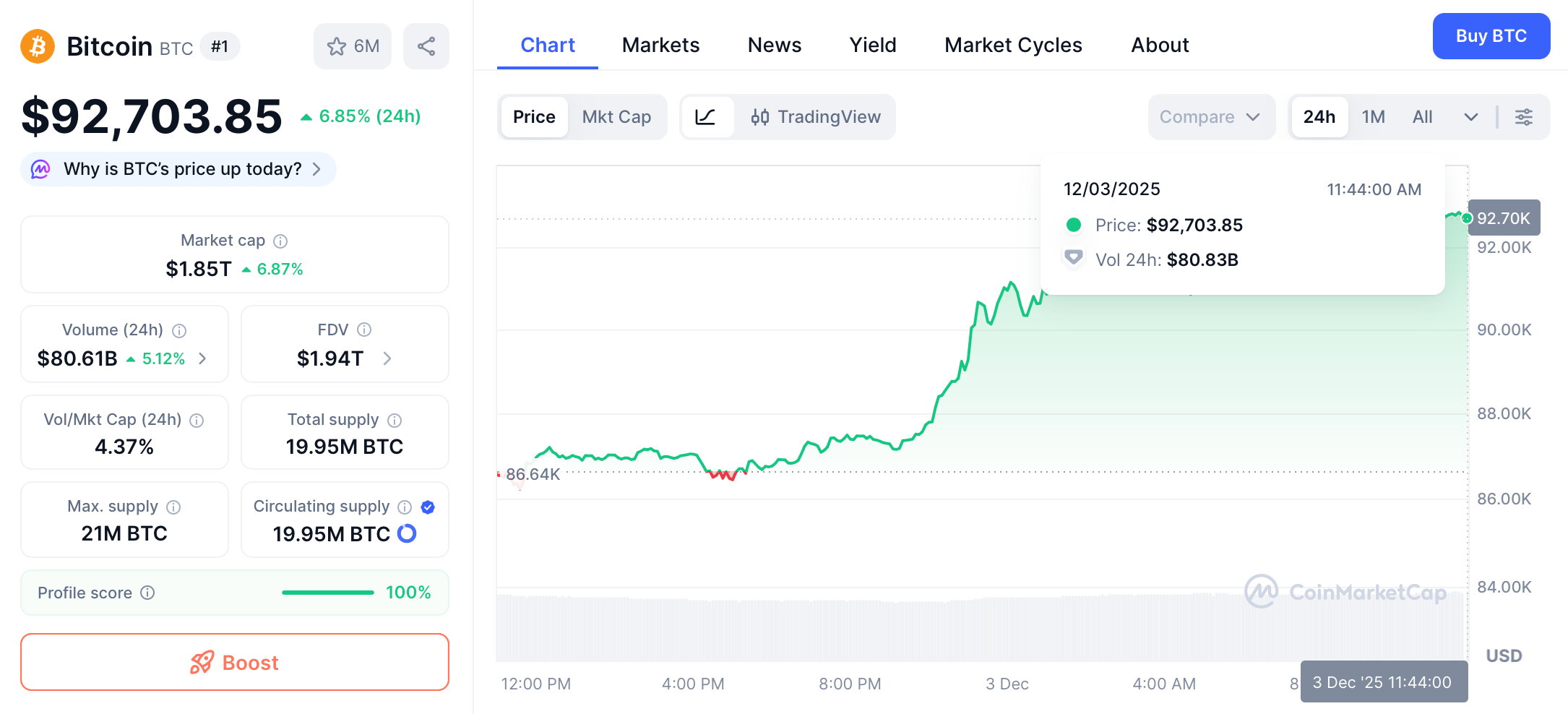

This access arrives during a period of notable market volatility. Bitcoin's price, at approximately $86,000 at the time of the announcement, is down about 32% from its all-time high of $126,000 in early October 2025. Vanguard's move, therefore, can be seen as providing access at a potentially discounted price point, embodying a classic "when there's blood in the streets" investment opportunity for believers in the long-term thesis. Investors should approach this as they would any new asset class: with clear risk assessment, an understanding of the asset's high volatility, and as part of a deliberate and diversified portfolio strategy.

BTC Price Reaction and Future Forecast: Validating the Bottom?

Bloomberg ETF analyst Eric Balchunas wrote on the X platform that on the first trading day after Vanguard lifted its ban on Bitcoin ETFs, Bitcoin rose 6% at the opening of the US stock market. Furthermore, IBIT saw $1 billion in trading volume within the first 30 minutes of trading.

Vanguard's endorsement acts as a powerful counter-narrative to recent bearish sentiment. It signals that the largest traditional finance players are not frightened away by a 30% correction but are instead systematically integrating crypto into their offerings. Analysts from Standard Chartered have predicted a major rebound, suggesting this could be the last time Bitcoin trades below $100,000, with long-term price targets as high as $500,000 by the end of the decade. While such forecasts are speculative, Vanguard's move provides a concrete institutional foundation that makes these bullish scenarios more plausible. It establishes a vast new pipeline of potential demand that can provide a price floor and fuel future rallies.

Conclusion

Vanguard's decision to open its gates to crypto ETFs is more than a policy update; it is the falling of the final major wall of institutional resistance. The firm that once declared Bitcoin unsuitable for long-term portfolios has now legitimized it as an accessible asset for 50 million mainstream investors. This pivot, driven by client demand, matured infrastructure, and new leadership, closes a contentious chapter in the relationship between traditional finance and digital assets.

The immediate future will see controlled, organic inflows from a conservative investor base, providing steady rather than explosive demand. The strategic choice to distribute but not create products allows Vanguard to participate in the trend while managing its risk profile. For the market, this event serves as a profound confidence signal, potentially validating the current price level as a strategic entry point for institutions. It confirms that the trajectory toward crypto's financial normalization is now irreversible. As the world's largest asset managers compete to serve client demand for digital assets, the fusion of traditional and decentralized finance advances to its next, inevitable stage.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.