In the competitive landscape of decentralized finance (DeFi), the Just (JST) token has emerged as a foundational pillar of the Tron blockchain's financial ecosystem. Positioned as more than just a digital asset, JST serves as the governance backbone for a suite of DeFi products, including lending protocols and stablecoin systems. The project gained significant market attention in April 2025 when Tron founder Justin Sun publicly declared that JST had undergone a "fundamental reversal" and could be the "next hundred-fold token". This endorsement, coupled with the protocol's growing utility within one of the world's most active blockchains, positions JST as a noteworthy project for investors and DeFi participants seeking exposure to a high-throughput, cost-effective ecosystem. This article provides a comprehensive analysis of the Just platform, its native JST token, and its evolving role in the broader cryptocurrency market.

What is Just?

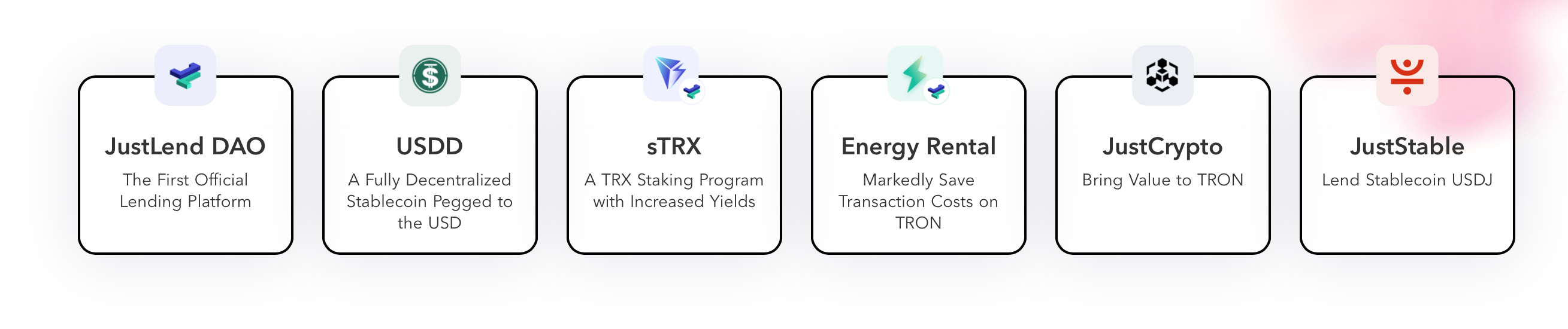

Just is a decentralized financial network built natively on the Tron blockchain. Launched in the third quarter of 2020, its core mission is to expand the Tron ecosystem by providing a unified framework for various crypto financial services. At its heart, the Just ecosystem is powered by JustStable, a decentralized lending platform that facilitates the creation of the USDJ stablecoin. Unlike many projects that operate as independent entities, Just functions as a subsidiary within the Tron network, with development support from a team comprising professionals from leading organizations like Alibaba, Tencent, and IBM.

How Just Works: Lending, Stablecoins, and Governance

The operational model of Just integrates three key financial primitives: decentralized lending, stablecoin minting, and community-led governance.

The primary engine is the JustStable protocol, which allows users to deposit TRX (Tron's native token) as collateral to mint USDJ, a stablecoin soft-pegged to the US Dollar. This mechanism creates a decentralized debt position similar to other CDP (Collateralized Debt Position) models in DeFi. The system is designed to be fully decentralized, operating through self-executing smart contracts that minimize counterparty risk and provide enhanced security through on-chain transaction settlement.

Governance is a critical and distinctive component. JST token holders are granted membership into a dedicated lending DAO (Decentralized Autonomous Organization). Through this DAO, holders can propose modifications to the network, address community concerns, and participate in collaborative decision-making processes that require community consensus. This includes voting on parameters for affiliated platforms like JustLend DAO, Tron's premier lending protocol, where users can earn interest in deposits or borrow assets.

Why Just (JST) Demands Attention

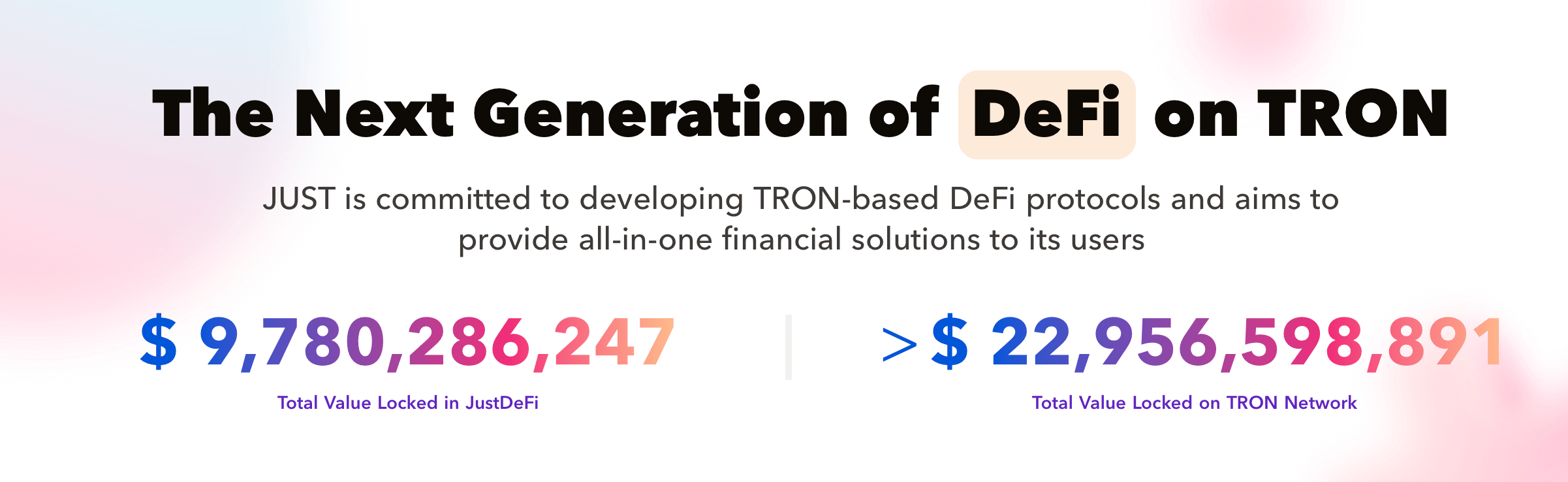

Several factors converge to make JST a token of significant interest within the DeFi sector. First is its privileged position within a top-tier ecosystem. Tron boasts one of the largest and most active DeFi ecosystems, with a Total Value Locked (TVL) that has historically ranked second only to Ethereum. As a core governance asset within this ecosystem, JST's utility and demand are tied to the overall growth and usage of Tron-based DeFi.

Second, the project benefits from strong institutional and foundational backing. The association with Tron founder Justin Sun and his public advocacy provides a high profile. Furthermore, the commitment to use all profits from key ecosystem components like JustLend and the USDD stablecoin to buy back and burn JST tokens introduces a potent deflationary mechanism. This "burn" strategy, akin to that employed by Binance with its BNB token, is designed to reduce the circulating supply over time, potentially increasing scarcity and value.

Finally, the protocol emphasizes cross-chain interoperability. Through Tron's bridging technology, Just connects with other major public blockchains, allowing users to interact with quality digital assets from various networks and enhancing the overall utility of its financial products.

JST Tokenomics: Supply, Distribution, and Utility

A clear understanding of JST's token economics is essential. The token has a fixed maximum and total supply of 9.9 billion, with nearly all (9.9 billion) already in circulation, resulting in a 100% circulating supply. This fully diluted structure provides clarity for investors, as no future inflationary token releases are scheduled.

JST's utility is multi-faceted:

-

Governance: As the governance token for the Just ecosystem, holding JST grants voting rights on protocol upgrades and parameter changes.

-

Fee Payment: JST is used to pay stability fees within the JustStable system when users mint USDJ.

-

Profit Sharing: The protocol is designed to distribute a portion of platform transaction fees and lending interest to JST holders, incentivizing long-term participation.

The token is technically built on the TRC-20 standard, benefiting from Tron's high throughput and low transaction costs. It is widely accessible, being listed on major global exchanges including Binance, Kraken, and Upbit.

Use Cases and Ecosystem Features

The Just ecosystem extends beyond a single application, offering a range of use cases:

-

Decentralized Lending and Borrowing: Through JustLend DAO, users can supply crypto assets to liquidity pools to earn interest or use their assets as collateral to borrow from others.

-

Stablecoin Minting (USDJ): Users can generate the decentralized USDJ stablecoin by over-collateralizing their TRX holdings, providing a stable medium of exchange and store of value within the ecosystem.

-

Algorithmic Stablecoin Governance (USDD): JST also plays a role in governing USDD, an algorithmic stablecoin launched by Tron in 2022. The release of USDD 2.0 with attractive yield mechanisms has been a significant growth driver for the associated governance tokens.

-

Cross-Chain Finance: The network's bridging capabilities enable users to leverage assets from multiple blockchains within the Just ecosystem, broadening its appeal and functionality.

Is JST a Good Investment? Weighing the Prospects and Risks

Determining JST's investment merit requires a balanced view of its potential against inherent risks.

The Bull Case rests on several pillars: the continued growth of the Tron DeFi ecosystem; the deflationary pressure from the promised buyback-and-burn mechanism; and increasing real-world adoption, exemplified by the government of Dominica recognizing JST as legal tender in 2025. Proponents see it as a leveraged bet on Tron's overall success.

Significant Risks must be acknowledged. The project's success is closely tied to the stability of its associated stablecoins. USDD, as an algorithmic stablecoin, carries inherent design risks reminiscent of the Terra (UST) collapse, and it has experienced brief de-pegging events in the past. Furthermore, the high yields offered by platforms like JustLend and USDD are partially sustained by subsidies from the Tron DAO, raising questions about their long-term sustainability without such support. As with many blockchain projects linked to a prominent founder, centralization and execution risk are also considerations.

Recent News and Developments (2025)

The year 2025 has been eventful for JST, marked by pivotal announcements:

-

Founder's Endorsement: In April 2025, Justin Sun's declaration of JST's "fundamental reversal" and "hundred-fold" potential catalyzed a 34% price surge within 24 hours, dramatically increasing trading volume and market attention.

-

Major Exchange Listing: The token was listed on the compliant U.S.-based exchange Kraken, accompanied by a $90,000 airdrop campaign, enhancing its legitimacy and accessibility.

-

Legal Tender Status: The aforementioned recognition by Dominica added a unique dimension of sovereign validation to the token's profile.

Price Analysis and Market Performance

As of late 2025, JST's price has shown volatility with an overall positive mid-term trend. Data indicates a price of approximately $0.2679, with a market capitalization of around $2.65 billion. The token has gained over 28% in the past year, though it remains significantly below its all-time high of roughly $1.39.

Long-term price predictions, which are inherently speculative, illustrate a range of market sentiments. The table below summarizes potential price trajectories based on historical data and market pattern analysis.

| Year |

Predicted Average Price |

Potential Low |

Potential High |

Projected Change from Current* |

| 2025 |

$0.27 |

$0.24 |

$0.31 |

-- |

| 2026 |

$0.29 |

$0.19 |

$0.34 |

0.07 |

| 2027 |

$0.32 |

$0.30 |

$0.38 |

0.17 |

| 2030 |

$0.43 |

$0.27 |

$0.56 |

0.6 |

| 2035 |

$0.86 |

$0.64 |

$1.02 |

2.2 |

It is crucial to note that these forecasts are not financial advice but models based on past trends, and actual performance will depend on ecosystem growth, broader crypto market conditions, and successful execution of the project's roadmap.

Conclusion

Just (JST) represents a compelling and complex instrument within the DeFi space. It is more than a mere token; it is the functional governance layer for a rapidly evolving financial ecosystem on one of the world's most utilized blockchains. Its value proposition is tied to tangible utilities—governing lending protocols, stabilizing currency systems, and facilitating cross-chain transactions.

For investors, JST offers a pathway to participate in Tron's DeFi growth, amplified by a promising deflationary token model. However, this opportunity is counterbalanced by genuine risks related to stablecoin stability and the sustainability of high-yield mechanisms. Ultimately, JST's trajectory will depend less on short-term speculation and more on the organic adoption of its underlying platforms, the prudent management of its stablecoin systems, and the continued innovation of the broader Tron network. As with any cryptocurrency investment, thorough personal research and careful consideration of risk tolerance are indispensable.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.