Toncoin

(TON), the native cryptocurrency of The Open Network, has emerged as one of the most promising blockchain projects in 2025, demonstrating remarkable resilience and growth amid market fluctuations. With its unique connection to Telegram's massive user base and ongoing technical developments, TON has captured the attention of traders and investors alike. This comprehensive analysis examines Toncoin's price trajectory, technical indicators, ecosystem developments, and future predictions to provide a thorough trading guide.

What is Toncoin (TON)?

Toncoin is the native cryptocurrency of

The Open Network (TON), a high-performance, layer-1 blockchain that originally began as the Telegram Open Network before transitioning to community development. TON is designed to handle millions of transactions per second with minimal fees, positioning itself as a scalable solution for mass cryptocurrency adoption. Its integration with Telegram, which boasts over 800 million active users worldwide, provides an unprecedented onboarding pathway for users into the crypto ecosystem through built-in wallet services and payment solutions.

The TON blockchain supports

smart contracts, decentralized applications (dApps), and various Web3 services, all accessible directly through the Telegram interface. This unique positioning has accelerated adoption rates, with TON wallet integrations growing rapidly throughout 2024 and 2025. The network utilizes a

proof-of-stake consensus mechanism, where Toncoin serves multiple purposes, including transaction fees, staking for network security, governance participation, and as the primary medium of exchange within the TON ecosystem.

Toncoin Updates: Roadmap Progress

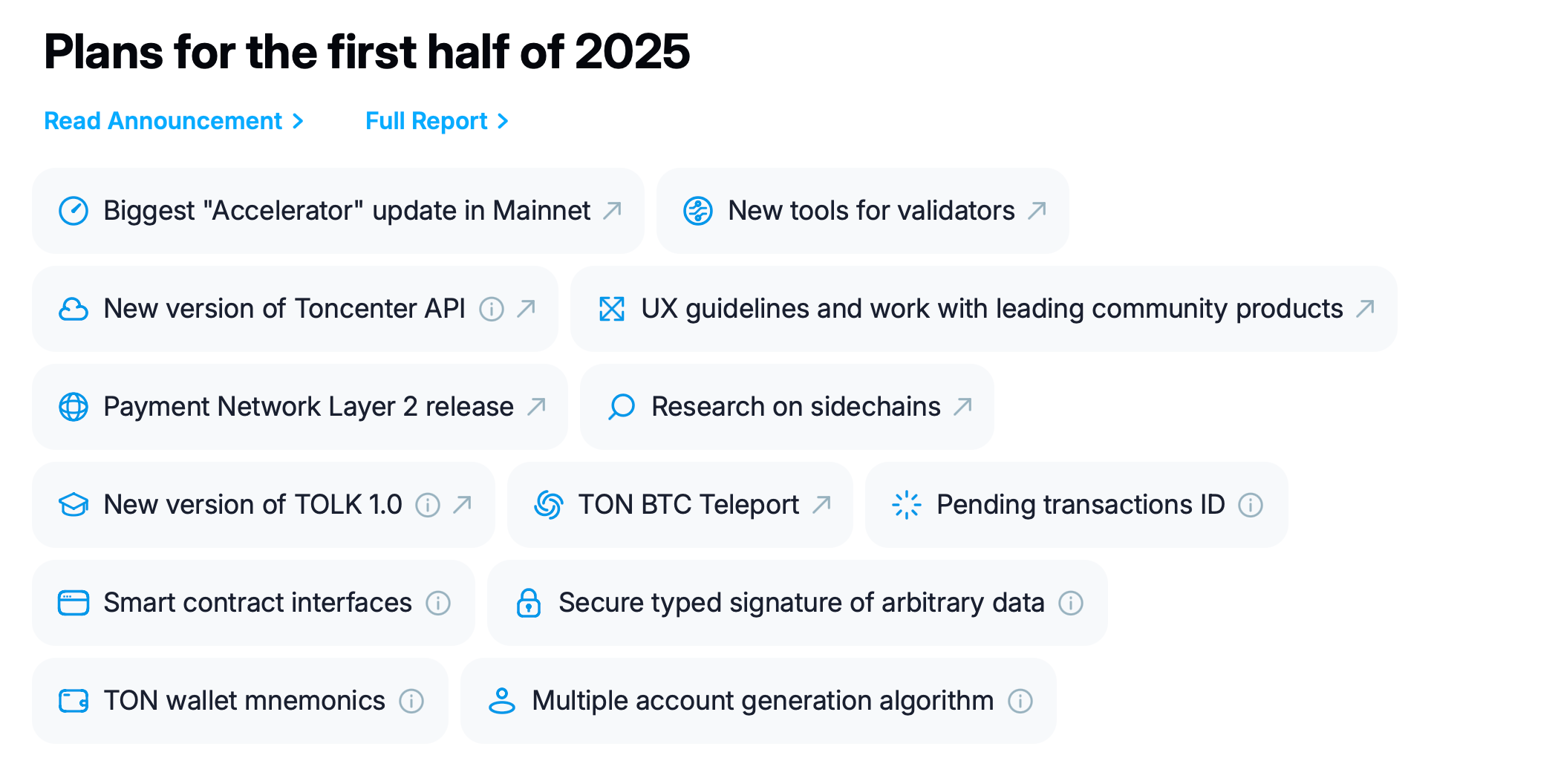

TON roadmap 2025. Source: TON official website

The TON Core development team has maintained an aggressive development schedule throughout 2025, with several key upgrades enhancing the network's capabilities and user experience. The 2025 first-half roadmap included significant milestones such as the "Accelerator" mainnet upgrade, new validator tools, improved Toncenter API with enhanced functionality, and user experience improvements through partnerships with leading community products like DeDust, MyTonWallet, TonScan, TON Diamond, and Stakee.

A particularly notable development has been the release of the

Layer-2 Payment Network, designed to facilitate faster and cheaper transactions while reducing mainnet congestion. Additionally, ongoing sidechain research and the TOLK 1.0 programming language update with new features, including structures, pattern matching, and smart contract interfaces, have strengthened TON's technical foundation. The core team has also been actively supporting the launch of TON BTC Teleport, enhancing interoperability between Bitcoin and the TON ecosystem.

The network's tokenomics have evolved throughout 2025, with strategic adjustments aimed at balancing inflationary and deflationary forces. According to recent analysis, staking rewards and transaction fee burns have created a dynamic supply mechanism that could potentially enhance Toncoin's value proposition for institutional investors. These tokenomic reforms align with TON's broader strategy of building institutional-grade infrastructure while maintaining the network's decentralized principles.

TON Price Movements

TON price chart. Source: CoinMarketCap

TON’s price history is marked by sharp rallies tied to ecosystem updates and institutional milestones, balanced by periods of consolidation during broader market downturns.

-

All-Time High (ATH): TON reached $8.00 on June 15, 2024, pushing its market capitalization above $19 billion for the first time. This peak was driven by Tether’s initial integration with TON and Telegram’s first wave of ad-based TON usage.

-

Key Rallies: In late October 2025, TON surged 31% to $2.64 after Telegram announced ad revenue sharing (CoinGecko, 2025). A month earlier, it rose 26% following rumors that Telegram’s co-founder was considering an IPO, though the IPO has not yet materialized. The launch of Pantera Capital’s fund in early November 2025 also contributed to a 9% price increase (CoinGecko, 2025).

-

2025 YTD Performance: After starting 2025 at ~$5.10, TON declined 70% to its current $1.51 level, which is largely due to broader crypto market correction and regulatory uncertainty. However, the recent Coinbase listing and Jetton 2.0 upgrade have halted this decline, with 7-day gains of 7.73%.

TON Technical Analysis

Technical analysis (TA) helps traders identify trends, support/resistance levels, and potential reversal points. Below is a breakdown of TON’s key technical indicators as of November 25, 2025.

Simple Moving Averages (SMA)

Moving averages smooth price data to reveal trends. For TON, two key SMAs are relevant:

-

50-Day SMA: Currently at $1.95, the 50-day SMA acts as short-term resistance. TON has not closed above this level since November 18 (the Coinbase listing date), indicating that sellers are active at higher prices. A break above $1.95m accompanied by increased volume would signal a shift to bullish momentum.

-

200-Day SMA: At $2.10, the 200-day SMA is a longer-term resistance level. Historically, TON has struggled to sustain gains above the 200-day SMA during bear markets; a close above this level would confirm a longer-term uptrend.

Currently, TON trades below both the 50-day and 200-day SMAs, which is a bearish short-term signal. However, the gap between the price and the 50-day SMA is narrowing—suggesting that a rebound may be imminent (author’s technical analysis).

Relative Strength Index (RSI)

The RSI (14-period) measures overbought (above 70) or oversold (below 30) conditions. As of November 25, TON’s RSI is 24.05, which is deep in oversold territory. This indicates that selling pressure is likely exhausted, and a price bounce is probable in the next 1–3 days. Historical data supports this: when TON’s RSI fell below 25 in September 2025, it rebounded 17% within a week.

Support and Resistance Levels

Support: The primary support level is $1.48, which has been tested three times in the last 72 hours and held each time. A break below $1.48 could trigger a further decline to $1.20, which is the October 2025 low.

Resistance: The first resistance level is $1.71 (the November 20 post-listing high), followed by $1.95 (50-day SMA) and $2.10 (200-day SMA). Breaking $1.95 is critical for TON to regain bullish momentum.

MACD (Moving Average Convergence Divergence)

The MACD (12, 26, 9) measures trend strength and momentum. TON’s MACD line (-0.03) is below the signal line (-0.02), which is a bearish signal. However, the histogram is shrinking (from -0.05 to -0.01 in the last 48 hours), indicating that bearish momentum is fading (author’s technical analysis). A bullish crossover (MACD line crossing above the signal line) would confirm a short-term reversal.

TON Price Predictions

TON’s price predictions vary by time horizon, with forecasts heavily influenced by ecosystem growth and institutional adoption. Below are projections from leading analysts and firms:

Short-Term (1–3 Months)

Most analysts expect a rebound from current oversold levels. Gathecha predicts a short-term target of $3.70, assuming TON breaks above the $1.95 resistance level. This projection is supported by Pantera Capital’s fund and Telegram’s planned expansion of mini-apps in December 2025. A more conservative forecast from CoinGecko suggests TON could reach $2.28 by late December, driven by seasonal buying and increased retail participation via Coinbase.

Medium-Term (6–12 Months)

If the Jetton 2.0 upgrade delivers on its promise of faster transactions and Telegram’s ad revenue sharing drives meaningful TON usage, analysts see TON reaching $5.80 by mid-2026. This target assumes Telegram converts 1% of its 1 billion users to TON, adding 10 million new users and increasing daily transaction volume by 50%. CoinMarketCap offers a more cautious medium-term forecast of $4.10, citing regulatory risks as a key headwind.

Long-Term (1–5 Years)

Long-term projections are bullish, with TON’s ties to Telegram being the primary driver. If Telegram fully integrates TON into its payment system, TON could reach $8.00–$10.00 by 2028, surpassing its 2024 ATH. Pantera Capital’s fund manager has even suggested a $15.00 long-term target, though this depends on TON becoming a mainstream payment method for cross-border transactions. However, long-term risks include competition from other Telegram-integrated blockchains and regulatory changes that could limit TON’s utility in key markets.

Is It Worth Trading Toncoin?

Whether TON is worth trading depends on your risk tolerance, time horizon, and trading strategy. Below is a balanced analysis of its pros and cons:

Pros

Real-World Utility: TON’s integration with Telegram provides a unique use case, unlike many cryptocurrencies that lack practical applications. Ad revenue sharing, in-app payments, and mini-apps drive organic demand for TON.

Institutional Momentum: Coinbase’s listing and Pantera Capital’s fund signal growing institutional confidence. This will likely increase liquidity and reduce volatility over time.

Technical Rebound Potential: TON’s oversold RSI (24.05) and shrinking MACD histogram suggest a short-term bounce is likely. Traders can capitalize on this with tight stop-losses.

Cons

Price Volatility: TON’s 70% YTD decline and frequent 10%+ daily swings make it a high-risk asset. Traders should avoid overleveraging.

Regulatory Risk: Telegram’s past run-ins with the SEC create uncertainty. A new regulatory action could limit TON’s availability on U.S. exchanges .

Market Correlation: TON’s price is highly correlated with Bitcoin. A Bitcoin downturn could drag TON lower, even if its fundamentals are strong.

Trading Strategy Recommendations

Short-Term Traders:

Enter a long position at $1.48–$1.50, with a stop-loss at $1.40 (below the primary support level) and a take-profit at $1.95 (50-day SMA). This strategy targets a 30% return with limited downside risk (author’s analysis).

Long-Term Investors: Accumulate TON at $1.20–$1.50, with a 2–3 year horizon. Reinvest staking rewards (TON offers a 0.6% annual inflation rate for validators) for compound gains.

Conclusion

Toncoin (TON) is a high-potential cryptocurrency with a unique value proposition: integration with Telegram’s massive user base. As of November 25, 2025, TON trades at $1.52, which is in the oversold and poised for a short-term rebound with key catalysts on the horizon. Technical analysis suggests a bounce to $1.95 is likely in the next month, while medium-term projections range from $4.10 to $5.80. However, traders must remain cautious of regulatory risks and market correlation. For those willing to tolerate volatility, TON offers a rare combination of utility and growth potential, making it a valuable addition to a diversified crypto portfolio.

Frequently Asked Questions (FAQs)

1. Where can I buy Toncoin (TON)?

TON is available on major exchanges as well as directly in Telegram’s in-app wallet. Always use regulated exchanges to reduce fraud risk.

2. What is the total supply of TON?

TON’s circulating supply is 2.48 billion tokens, with no maximum supply. The network has a 0.6% annual inflation rate to reward validators.

3. How does TON differ from other cryptocurrencies like Ethereum?

TON’s key advantage is speed and integration: it processes 55,000 TPS (vs. Ethereum’s 15 TPS) and is built into Telegram’s ecosystem, enabling mainstream adoption. Ethereum, by contrast, has a larger dApp ecosystem but higher fees and slower transactions.

4. Is TON a good long-term investment?

Long-term, TON’s prospects depend on Telegram’s adoption of its technology. If Telegram expands TON-based payments or mini-apps, TON could see significant growth. However, regulatory risks and competition mean it should only make up 5–10% of a crypto portfolio.

5. What affects TON’s price?

Key drivers include Telegram’s ecosystem updates, institutional moves, and broader crypto market sentiment. Technical factors like RSI levels and SMA crossovers also influence short-term prices.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.