In the world of finance, few names command as much attention as

Michael Burry

, the legendary investor who famously predicted and profited from the 2008 subprime mortgage crisis. His story was immortalized in

Michael Lewis's bestselling book "The Big Short"

and its subsequent film adaptation, which documented how he foresaw the housing market collapse when others were blinded by irrational exuberance. Now, Burry has turned his skeptical gaze toward what many consider the most promising technological revolution of our time:

artificial intelligence (AI)

. Through his new Substack newsletter, Burry is articulating a detailed case for why he believes the AI boom represents a dangerous market bubble, drawing

parallels to the early-2000s telecom crash

. For investors navigating crypto space, which is another arena known for spectacular booms and busts—understanding Burry's perspective provides crucial insights into the dynamics of market manias and the psychology of short sellers who bet against popular consensus.

Who's Michael Burry?

Michael Burry's journey to financial fame began in an unlikely way. As

a neurology resident with a passion for investing, he spent late nights reading and blogging about financial markets before transitioning to become a money manager. His unique background gave him an unconventional approach to analysis, focusing on data patterns others overlooked. In 2005, Burry noticed that

"mortgage lenders were extending easy credit" and that the resulting mortgages were being bundled into complex bonds that were far riskier than their ratings suggested. While the financial establishment dismissed his concerns, Burry persisted in his analysis and

placed a massive bet against the housing market through credit default swaps—a form of insurance that would pay out when the mortgage bonds collapsed.

Burry's investment approach combines

deep fundamental research with contrarian thinking. He specializes in identifying widely accepted market assumptions that are built on flawed foundations. In the case of the 2008 crisis, it was the belief that housing prices would never fall simultaneously across the United States. Today, he argues that the AI revolution rests on similarly shaky ground—particularly regarding

the economics of AI infrastructure investments. After deregistering his hedge fund firm, Scion Asset Management, from routine regulatory disclosures, Burry has continued to invest and share his perspectives through his writing. He remains actively involved in markets and is

"doubling down on what he sees as the next major mispricing in markets"—the artificial intelligence boom that has driven stocks like Nvidia to astronomical valuations.

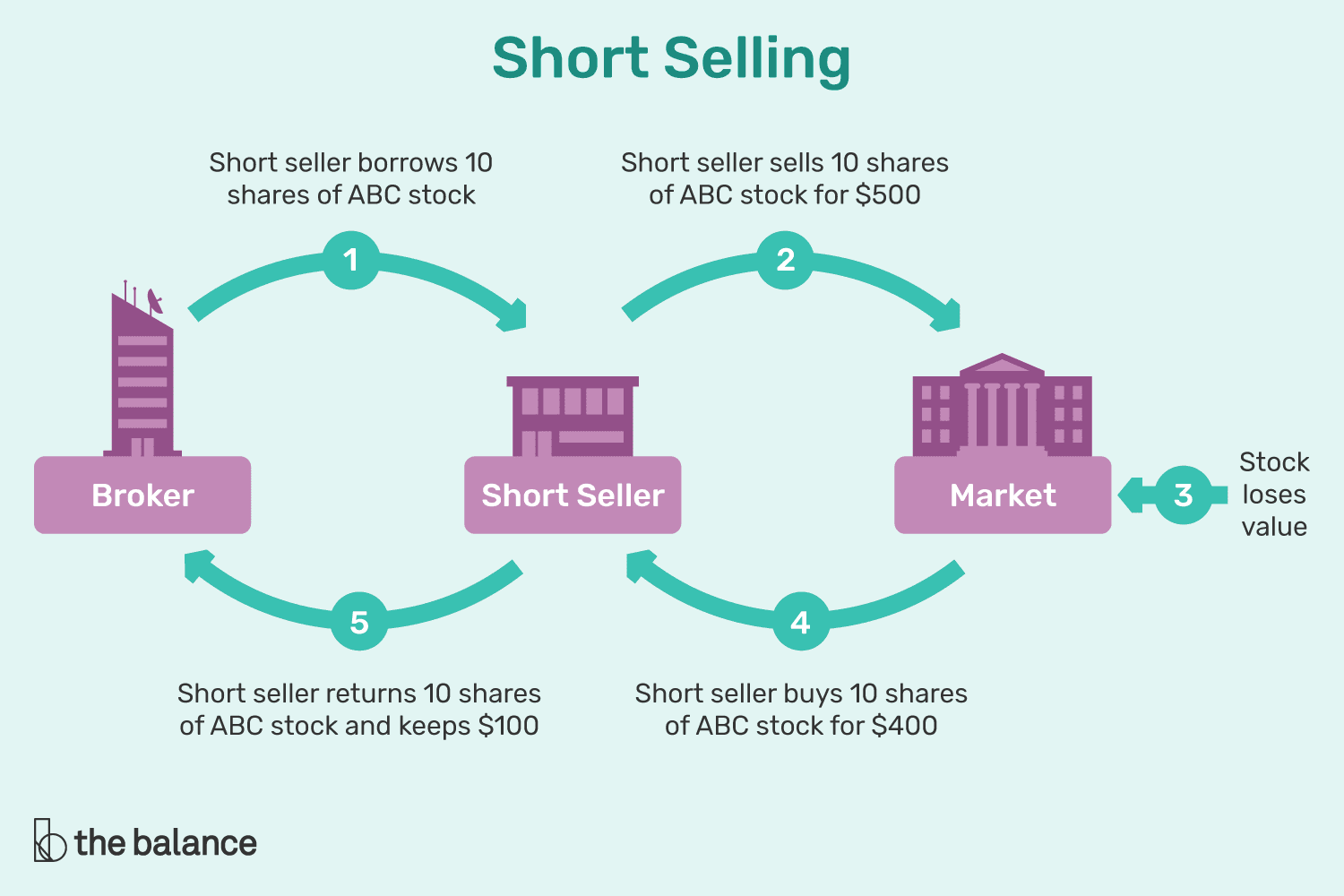

What "Shorting" Really Means?

To understand Michael Burry's perspective on AI, one must first grasp the mechanics and mindset of short selling. At its core,

short selling is a strategy that profits when an asset's price declines. The process involves borrowing shares and selling them with the agreement to repurchase them later at what the short seller hopes will be a lower price. The difference between the selling price and the repurchase price represents the profit (or loss if the price has risen). This "

sell high, buy low" approach in reverse enables investors to profit from overvalued assets.

In traditional markets, short selling involves

borrowing shares from a broker, selling them immediately, and then waiting to buy them back at a lower price. The risks are substantial—if the price increases instead of decreases, losses can be theoretically unlimited since there's no ceiling on how high a stock price can rise. This helps explain why short sellers typically conduct extensive research before placing their bets. For Burry and his contemporaries in "The Big Short," their thorough analysis of mortgage bonds enabled them to withstand significant pressure as they waited for their thesis to play out.

In cryptocurrency markets, shorting has become increasingly sophisticated. Traders can use

futures contracts(agreements to buy or sell assets at predetermined future prices) or

options(which give the right but not the obligation to trade at specific prices) to bet against digital assets. The fundamental principle remains the same: identifying assets where the current market price significantly exceeds their intrinsic value. Short sellers play a controversial role in markets—they're often viewed as profiting from others' misfortune, but they also serve as an important check on irrational exuberance by

exposing overvaluation and corporate malfeasance.

Michael Burry's Case Against AI Hype

Nvidia stock price chart. Source: Nvidia Investors

Central to Michael Burry's skeptical view of AI is an accounting issue that most casual investors overlook:

how companies depreciate their technology investments. Depreciation refers to the process of allocating the cost of a tangible asset over its useful life. When companies purchase servers, GPUs, and networking equipment for AI workloads, they don't expense the entire cost immediately. Instead, they spread it out over what they estimate to be the equipment's useful lifespan. Burry argues that major technology companies, known as "

hyperscalers," are using depreciation periods that are too long, which

artificially inflate their reported earnings in the short term.

The core of Burry's argument is that

rapid technological obsolescence in AI hardware makes longer depreciation schedules unrealistic. Nvidia releases new GPU architectures approximately every year, each offering significant improvements in performance and efficiency. Despite this, many tech giants have been extending the estimated useful lives of their servers and networking equipment:

Table: Recent Changes in Depreciation Policies of Major Tech Companies

| Company |

Last Change Date |

Change in Useful Life Assumption |

| Alphabet |

2023 |

Servers from four years to six years; certain network equipment from five years to six years |

| Amazon |

2025 |

From six years to five years (due to "increased pace of technology development" in AI) |

| Meta Platforms |

2025 |

5.5 years (from four to five years) for certain servers and network assets |

| Microsoft |

2022 |

Server and network equipment from four years to six years |

| Oracle |

2025 |

Servers from five years to six years |

Burry projects that across the industry,

depreciation has been understated by approximately $176 billion between 2026 and 2028. He claims that companies like Oracle and Meta Platforms could be overstating their earnings by nearly 27% and 21%, respectively, due to these accounting practices. The implication is clear: when these "incorrect assumptions unravel," the AI spending bubble may burst as the sector adjusts to reflect more realistic earnings.

Why Michael Burry Might Be Wrong?

While Burry's argument about depreciation practices raises valid questions, many analysts offer

compelling counterarguments against his bearish AI thesis. First, critics point out that

lowering depreciation boosts earnings but reduces cash flow, since companies must pay taxes on the increased earnings. It's questionable why highly cash-generative companies like Alphabet, Microsoft, and Meta Platforms would need to manipulate earnings at the expense of cash flow, especially since debt rating agencies and capital markets focus more on cash flow and EBITDA than net income.

Second,

AI investment isn't primarily about near-term earnings for these companies. The hyperscalers are making these investments to generate long-term earnings and cash flow from recurring customers. The remarkable turnaround of Alphabet's Google Cloud illustrates this point—it generated a $700 million loss in the third quarter of 2022 but reported a $3.6 billion profit with 85% year-over-year growth in the most recent quarter. This suggests that AI investments can transition from cash drains to significant profit centers over time.

Third, evidence suggests that

AI hardware may have longer useful lives than Burry assumes. Nvidia's management noted on a recent earnings call that A100 GPUs shipped six years ago "are still running at full utilization today". This supports the assumption of a useful life of five to six years that many companies are using. Additionally, the

economics of current AI investments differ significantly from previous technology bubbles. During the early 2000s telecom crash, fiber-optic networks saw capacity utilization fall to about 5%, whereas today, "every GPU you can find is being lit up and used".

Lessons from the Cryptic World - Connecting AI and Crypto Bubbles

For observers of cryptocurrency markets, the AI investment boom may feel familiar. Both sectors experience

intense hype cycles, dramatic valuations, and narratives about revolutionary technology that will change everything. The parallel becomes especially striking when examining the

DAT (Digital Asset Treasury) companies that emerged during the 2024-2025 crypto bull market. These companies, led by MicroStrategy, employed a "

reflexive flywheel" strategy: their stock traded at a premium to their bitcoin holdings, allowing them to issue new shares at elevated prices to buy more bitcoin, which in turn drove their stock prices higher.

This strategy worked brilliantly in a rising market but contained a

fatal flaw of reflexivity—when the market turned, the flywheel reversed direction. As one analysis noted: "When market转向, premium disappears, mNAV falls below 1.0, the entire logic reverses in an instant". The same reflexive dynamics may be at play in AI stocks, where high valuations enable heavy investment that justifies those valuations—until something breaks in the narrative.

Another parallel between AI and crypto bubbles lies in what might be called "

the infrastructure fallacy"—the assumption that building the tools ensures the outcome. In crypto, this manifested as investing in blockchain infrastructure before meaningful applications emerged; in AI, it appears as massive spending on computing infrastructure before killer apps beyond chatbots have proven economically viable. Burry's colleague Phil Clifton argues that the investment world is "expecting far more economic importance out of this technology than is likely to be provided," noting that "just because a technology is good for society or revolutionizes the world doesn't mean that it's a good business proposition".

How to Invest in the Age of FOMO?

For investors caught between FOMO (Fear Of Missing Out) on AI breakthroughs and concerns about overvalued markets, navigating the current environment requires discipline. Several principles can help guide decision-making:

-

Focus on Cash Flow: Rather than focusing solely on earnings metrics that can be influenced by depreciation assumptions,

analyze cash flow generation. Companies with strong cash flows are better positioned to weather economic downturns and technological shifts.

-

Understand the Technology Lifecycle: New technologies typically follow an S-curve adoption pattern—initial enthusiasm leads to overinvestment, followed by a shakeout period before mature adoption emerges. We may be in the

late enthusiasm phase of AI infrastructure investment.

-

Diversify Beyond the "Mag 6": The so-called "Mag 6" AI-focused tech giants now represent a concentrated portion of the market. Consider

exposure to other sectors that may benefit from AI adoption without the extreme valuations.

-

Manage Risk in Crypto Exposure: For crypto investors, the connection to AI comes through companies like Nvidia, whose GPUs power both AI systems and crypto mining operations. Be aware that

any downturn in AI spending could impact these semiconductor companies and related crypto infrastructure plays.

The great challenge for investors today is balancing the

undeniable potential of AI with

a realistic assessment of its business implications. As with any transformational technology, there will be winners and losers—and the ultimate winners may not be today's darlings. Michael Burry's warnings serve as a valuable reminder that when expectations become unmoored from business fundamentals, painful corrections often follow.

Conclusion

Michael Burry's skepticism toward the AI boom reflects the same contrarian mindset that enabled him to foresee the 2008 financial crisis. His focus on

depreciation accounting practices highlights a subtle but potentially significant discrepancy between reported earnings and economic reality at major technology companies. While valid counterarguments suggest the AI revolution may have more substance than previous bubbles, investors would be wise to consider Burry's perspective—not as a prediction of certain doom, but as a

case study in risk management. In both traditional markets and the crypto space, the principles of careful analysis, understanding of market psychology, and disciplined position sizing remain essential. As Burry himself demonstrated, the most profitable trades often come from going against the crowd when the crowd is wrong—but timing those trades correctly requires both courage and patience. Whether Burry's latest short will prove prescient or premature remains to be seen, but his warning serves as a crucial reminder that in markets, as in physics, what goes up must eventually come down to earth.

References

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.