On November 25, 2025, the cryptocurrency market shows signs of tentative stabilization after a severe downturn, with investor sentiment stuck in "Extreme Fear" but finding some support from positive traditional market movements and new institutional product launches. Meanwhile, AWS announced Monday it is investing $50 billion to build AI “high-performance computing infrastructure” purposefully built for the U.S. government. The New York Stock Exchange has approved the listing of Grayscale’s XRP and Dogecoin exchange-traded funds, clearing both products to begin trading on Monday. BitMine Immersion Technologies added nearly 70,000 ETH recently, helping to push its total Ethereum holdings to 3% of supply, the company said Monday.

Crypto Market Overview

BTC (+0.55% | Current Price: $87,778.10)

BTC (market cap: $1.75 trillion) exhibited a “range-bound rebound” on November 25, failing to break key resistance but avoiding a deep pullback, reflecting equilibrium between bulls and bears. BTC opened at $88,127, dipped to a low of $85,788 (testing the 85k support zone) in the early morning, then rallied to a high of $88,834 (near the $90k resistance) by noon. It closed at $88,600, up 0.55%, breaking a two-day losing streak.

On November 24th, Bitcoin exchange-traded funds (ETFs) registered an inflow of $9.7 million.

ETH (+2.06% | Current Price: $2,912.64)

Ethereum is at a technical inflection point, attempting a recovery but facing significant overhead resistance. ETH has managed to climb above the $2,850 level and its 100-hour Simple Moving Average, establishing initial support at $2,840. However, the path upward is blocked by a key bearish trend line with resistance at $2,970 and the major psychological barrier at $3,000. Plummeting Gas Fees is a positive development for users. The cost to transact on the Ethereum network has collapsed.

On November 24th, ETH ETFs experienced a total net inflow of $3.3 million.

Altcoins

The Crypto Fear & Greed Index sits at 15, firmly in the "Extreme Fear" territory. While this indicates widespread pessimism, it's often during such periods of peak fear that markets find a bottom. The index slightly improved from 12, hinting at potential stabilization in sentiment. The Altcoin Season Index has plummeted to 23, signaling that Bitcoin is overwhelmingly dominating the market.

Macro Data

This week is crucial due to the release of delayed U.S. economic reports. Data on Retail Sales, the Producer Price Index (PPI), and Initial Jobless Claims will be closely watched for their impact on the Federal Reserve's interest rate decisions. Markets are currently pricing in a high probability of a rate cut in December. In a significant development for altcoins, the NYSE approved Grayscale's Dogecoin (GDOG) and XRP (GXRP) ETFs for trading starting November 24th. This marks a major step in bringing regulated altcoin investment products to the mainstream and reflects a shifting regulatory attitude under the current SEC leadership.

On November 24th, the S&P 500 gained 1.55%, standing at 6,705.12 points; the Dow Jones Industrial Average increased 0.44% to 46,448.27 points, and the Nasdaq Composite gained 2.69% to 22,872.01 points.

Trending Tokens

WAVES Waves (+30.40%, Circulating Market Cap: $99.43 Million)

WAVES is trading at $0.8326, up approximately 30.40% in the past 24 hours. Waves is an open blockchain protocol and development toolset for Web 3.0 applications and decentralized solutions, aiming to raise security, reliability, and speed of IT systems. It enables anyone to build their apps, fostering mass adoption of blockchain.

WAVES broke above its 200-day moving average ($1.03) and the critical $0.723 Fibonacci support-turned-resistance level. The 7-day RSI (68.01) signals bullish momentum without extreme overbought conditions. The breakout suggests short-term traders are capitalizing on bullish chart patterns. With the MACD histogram turning positive (+0.009), buyers see room for further upside toward the next resistance at $0.915 (127.2% Fibonacci extension).

B2 Bsquared Network (+21.59%, Circulating Market Cap: $26.26 Million)

B2 is trading at $0.5601, up approximately 21.59% in the past 24 hours. B² Network is a next-generation Layer2 scaling solution built on top of Bitcoin (BTC), aiming to significantly enhance Bitcoin’s performance and scalability without compromising its foundational security. By integrating zero-knowledge proofs (ZKP) and adopting a modular blockchain architecture, B² Network not only alleviates Bitcoin’s congestion issues but also expands its programmability and utility in the broader crypto ecosystem. B2’s modular architecture connects Bitcoin’s security to EVM-compatible smart contracts, addressing BTC’s scalability limitations. With Bitcoin dominance at 58.13%, projects enhancing BTC utility are attracting capital. B2’s positioning as a Bitcoin Layer-2 aligns with institutional interest in BTC infrastructure. The network’s $453M on-chain TVL and integration with BNB Chain (Cointelegraph) signal growing adoption.

COMMON COMMON (+19.84%, Circulating Market Cap: $48.74 Million)

COMMON is trading at $0.007265, up approximately 19.84% in the past 24 hours. Common is an AI-native workspace where every community, project, and thread is tokenized, so 1.7 million users (across 40 k communities) and their AI agents can do deep research, trade, code on feature requests, and earn on every idea or bounty in one place. COMMON’s RSI 14 (30.48) and 21-day (28.4) were deeply oversold, aligning with its -87% 30d decline. The price crossed above its 7-day SMA ($0.0064), triggering short-term bullish signals. Traders often interpret oversold RSI and SMA crossovers as buy opportunities. However, with no 30-day SMA data (tool output: 0), the rally lacks confirmation for longer-term reversal.

Market News

AWS Is Spending $50B to Build AI Infrastructure for the US Government

Amazon Web Services is making a sizable new investment in infrastructure designed to boost AI capabilities for U.S. government organizations.

AWS announced Monday it is investing $50 billion to build AI “high-performance computing infrastructure” purposefully built for the U.S. government. The buildout is meant to expand federal government agencies’ access to AWS AI services. The project will add 1.3 gigawatts of compute and will expand government access to AWS products, including Amazon SageMaker AI, model customization, Amazon Bedrock, model deployment, and Anthropic’s Claude chatbot, among others, according to the company.

AWS expects to break ground on these data center projects in 2026. “Our investment in purpose-built government AI and cloud infrastructure will fundamentally transform how federal agencies leverage supercomputing,” AWS CEO Matt Garman said in the company’s press release. “We’re giving agencies expanded access to advanced AI capabilities that will enable them to accelerate critical missions from cybersecurity to drug discovery. This investment removes the technology barriers that have held government back and further positions America to lead in the AI era.”

AWS is no stranger to working with the U.S. Government. The entity began building cloud infrastructure for the U.S. government back in 2011. Three years later, it launched AWS Top Secret-East, the first air-gapped commercial cloud to work with classified workloads. AWS introduced AWS Secret Region in 2017, which has accredited access to all levels of security classification.

NYSE Approves Listings for Grayscale’s XRP and Dogecoin ETFs

XRP filings with SEC.

The New York Stock Exchange has approved the listing of Grayscale’s XRP and Dogecoin exchange-traded funds, clearing both products to begin trading on Monday.

NYSE Arca, the exchange’s ETF-focused subsidiary, filed certifications on Friday confirming the listing and registration of the Grayscale XRP Trust ETF Shares and the Grayscale Dogecoin Trust ETF Shares under the Securities Exchange Act of 1934. Notably, both products are conversions of long-running private trusts into fully listed ETFs. “These approvals certify the listing and registration” of the trusts, NYSE Arca wrote, setting the stage for two of the crypto market’s most widely followed assets to gain ETF access.

XRP is the fourth-largest cryptocurrency, while Dogecoin, created as a meme, remains the largest memecoin globally with a deeply loyal retail following.Grayscale’s latest conversions arrive during a surge of new crypto ETFs in the United States. Over the past year, funds tracking Litecoin, HBAR, XRP, and Solana secured listings using guidance the SEC issued early in the government shutdown. That guidance outlined how issuers could go public without waiting for explicit approval, provided listing standards, themselves approved by the SEC in September, were met.

If launched as planned, Grayscale’s Dogecoin ETF will become the second Dogecoin ETF in the US, following the REX-Osprey DOGE product that debuted in September under the Investment Company Act of 1940.

Largest Ethereum Treasury BitMine Invests Another $200 Million, Addresses Recent ETH Price Decline

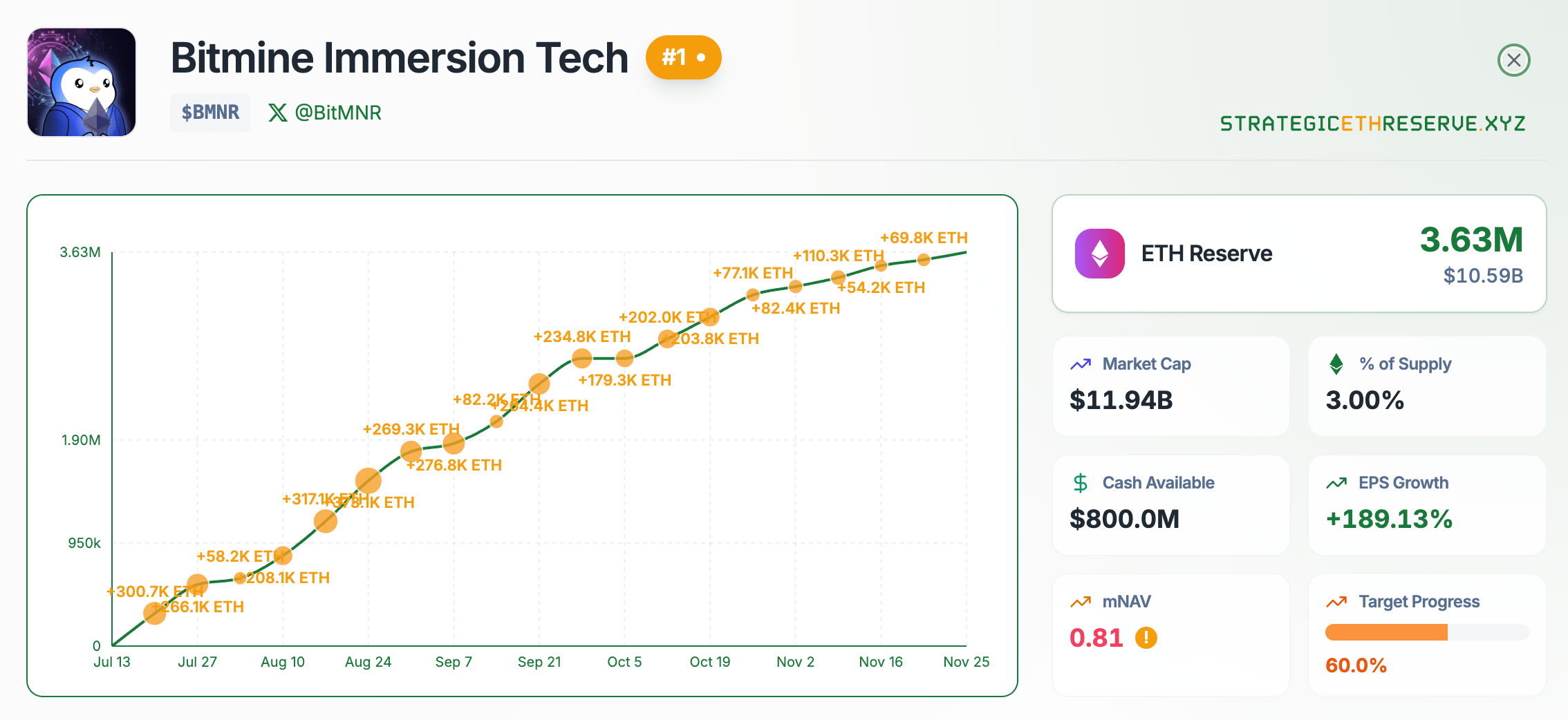

Bitmine ETH holdings chart. Source: StrategicETHReserve.xyz

BitMine Immersion Technologies added nearly 70,000 ETH recently, helping to push its total Ethereum holdings to 3% of supply, the company said Monday.

Although the world's second largest crypto treasury, behind only Bitcoin-focused Strategy, has continued to grow its Ethereum exposure, with a recent decline in prices, the U.S. dollar value of its stockpile has shrank accordingly. BitMine's holdings of 3,629,701 ETH are worth about $10.2 billion as of Monday.

Two weeks ago BitMine's token stockpile was worth over $12 billion. Trading at about $2,800 as of Monday morning, Ethereum is down nearly 30% over the past month.

Last week, as BitMine reported, it had posted a net income of $328 million for its fiscal year ending Aug. 31, it also said the firm will offer shareholders a dividend in an effort to provide investors with a chance to earn a more traditional return. In July, the firm became one of the first DATs to approve a share buyback plan to supplement its continued purchasing of Ethereum.

BitMine also said on Monday it owns 192 bitcoins, a $38 million stake in Eightco Holdings, and $800 million in unencumbered cash. The company is backed by investors including ARK's Cathie Wood, DCG, Founders Fund, Galaxy Digital, Pantera, in addition to individual investors like Bill Miller III and Tom Lee.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.