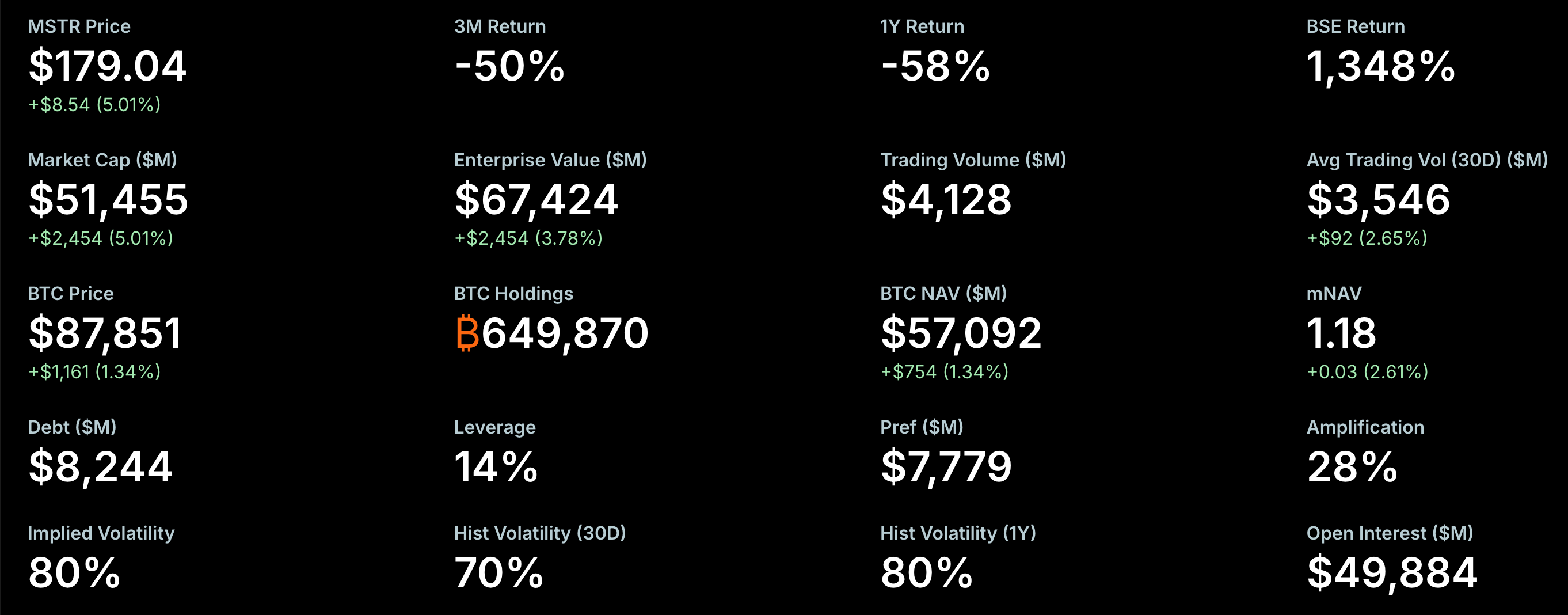

The cryptocurrency market is navigating one of its most turbulent phases in recent years. Bitcoin, the flagship cryptocurrency, has experienced significant volatility, with its price declining approximately 30-35% in November 2025 alone, erasing nearly $800 billion in market value and its gains for the year. This sharp downturn has placed a glaring spotlight on MicroStrategy, the business intelligence company that has transformed into a publicly traded Bitcoin proxy. Under the unwavering leadership of Executive Chairman Michael Saylor, MicroStrategy has amassed a colossal hoard of 649,870 Bitcoins, acquired at an average price of $74,430 per Bitcoin. With Bitcoin's price teetering just above the company's average cost basis, two critical questions dominate investor discourse: How deep can Bitcoin's decline go, and can MicroStrategy's ambitious, highly leveraged strategy withstand a prolonged crypto winter? This article delves into the mechanics of MicroStrategy's bet, analyzes its debt structure, assesses its insolvency threshold, and evaluates the stark risks it faces in a continuing bear market.

MicroStrategy's Bitcoin Strategy and Current Holdings

MicroStrategy's corporate trajectory represents one of the most radical transformations in modern finance. It has evolved from a software development firm into what Saylor terms a "Bitcoin development company," adopting Bitcoin as its primary treasury reserve asset. The company's strategy is deceptively simple: aggressively accumulate Bitcoin using every financial tool at its disposal.

Strategy BTC holdings and stock price. Source: Strategy

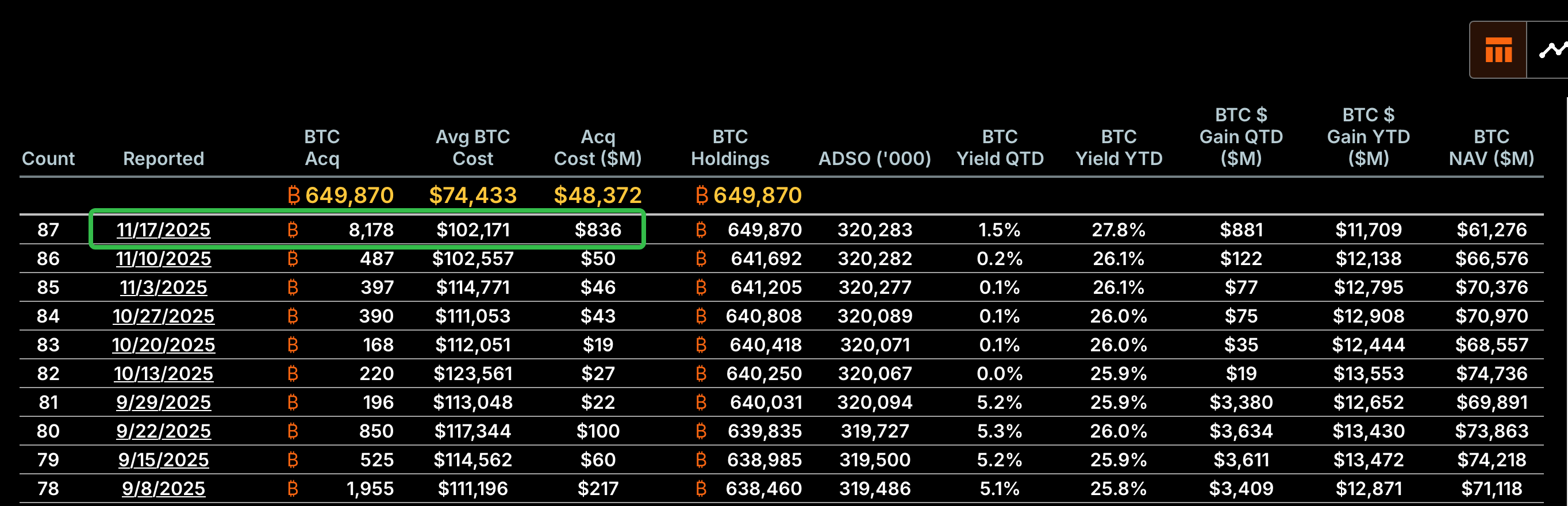

The scale of this accumulation is unprecedented. As of late November 2025, the company holds 649,870 BTC. Despite the recent market downturn, this position remains profitable on paper, with Bitcoin's price around $86,000 representing an unrealized gain of nearly 16% over the company's average purchase price. This aggressive buying has continued even during the sell-off; on November 17, 2025, MicroStrategy announced a massive purchase of 8,178 Bitcoin for $835.6 million, a significant acceleration from its typical weekly purchases of 400 to 500 coins.

MSTR BTC purchase. Source: Strategy

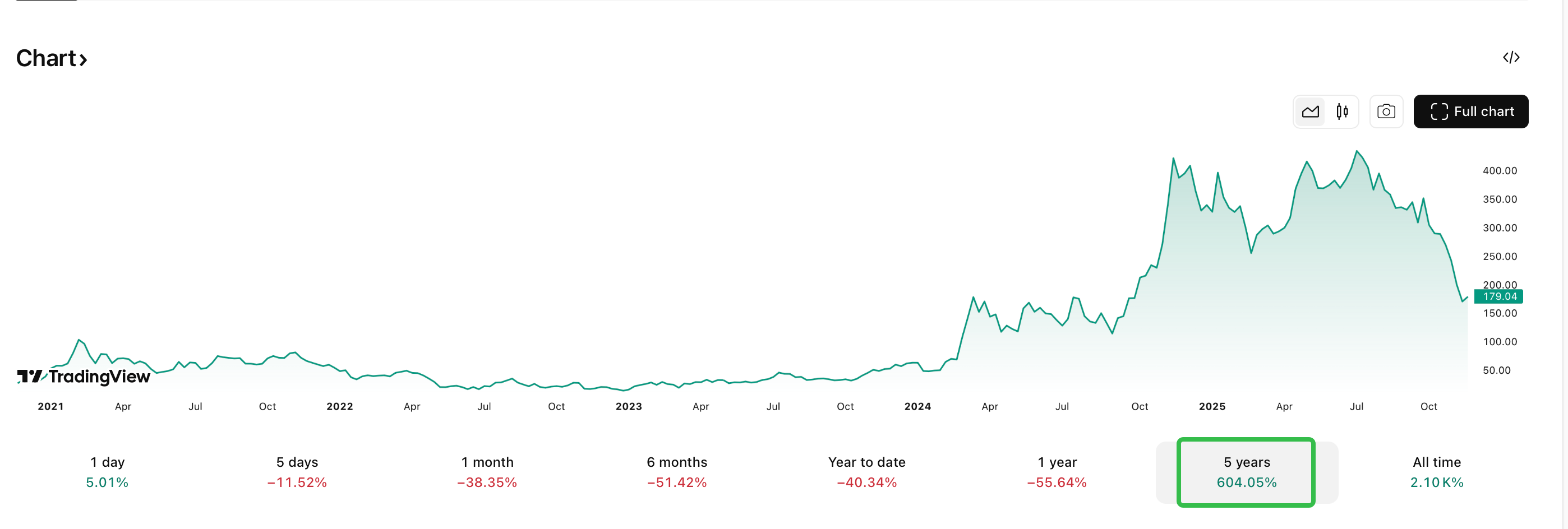

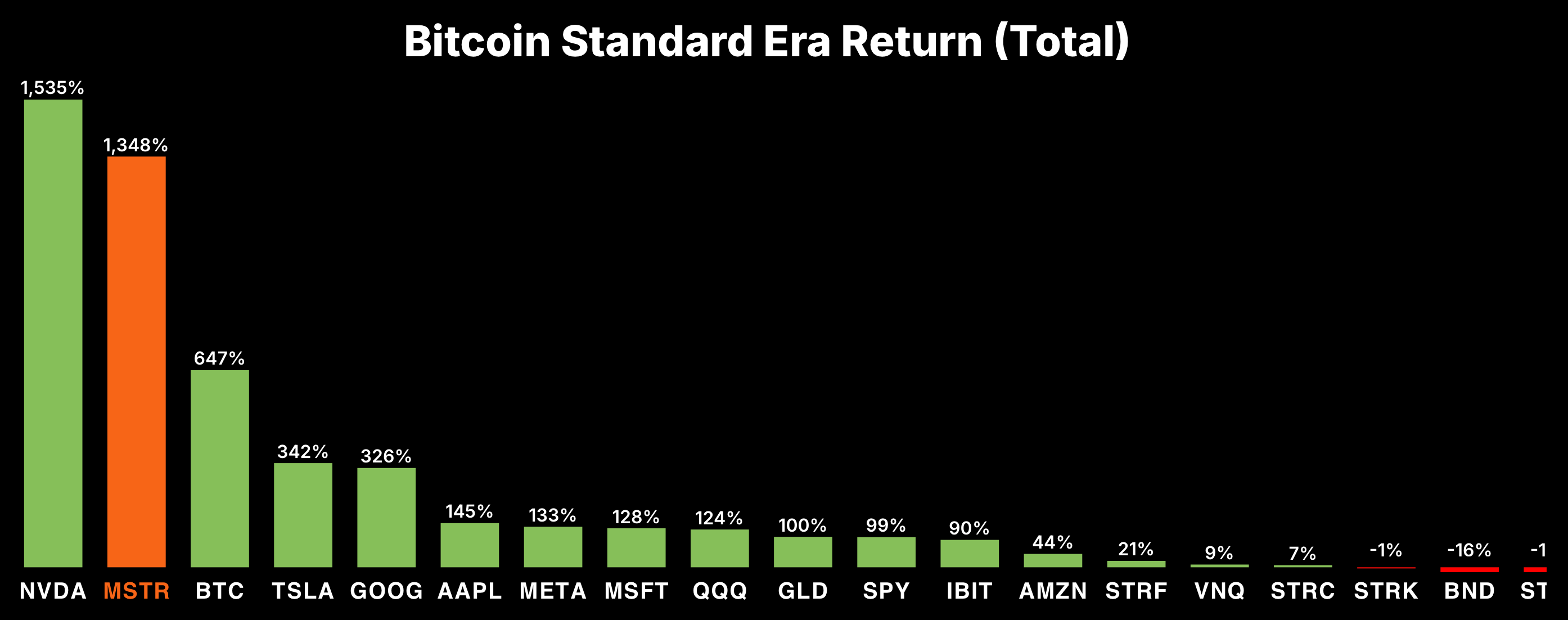

The strategic rationale, as championed by Saylor, is a profound lack of faith in traditional fiat currency and a firm belief in Bitcoin's long-term value proposition as "digital gold." The company's performance over multi-year horizons seems to vindicate this bet. Over a five-year window, MicroStrategy's stock soared over 600%, dramatically outperforming tech giants like Apple and Microsoft. This performance has made its stock a popular proxy for Bitcoin exposure, with investors using its options chain to hedge their broader crypto portfolios. However, this same dynamic turns MicroStrategy into a pressure valve for the crypto market, absorbing hedging pressure and volatility that may not be directly related to the fundamental soundness of its own strategy.

MSTR stock price. Source: TradingView

The Mechanics of MicroStrategy's Debt and Leverage

MicroStrategy's acquisition spree is not funded merely by operational profits from its software business. Instead, the company has engaged in sophisticated financial engineering to leverage its balance sheet, creating a complex and potentially risky debt structure.

The primary instruments for this have been convertible bonds and various equity offerings. The company has been particularly adept at issuing convertible bonds, which Wall Street hedge funds eagerly bought for Bitcoin exposure, allowing MicroStrategy to raise billions at ultra-low interest rates between 0% and 1% annually. More recently, the company has expanded into issuing 'preferred stocks', including series like STRF (

MSTR (MicroStrategy common stock) is a high-risk equity with high growth potential, while

STRF (MicroStrategy Series A Perpetual Strife Preferred Stock) is a lower-risk preferred stock focused on providing income. MSTR's performance is tied to the price of Bitcoin, whereas STRF pays a fixed 10% annual dividend, making it less volatile than the common stock. ), to fund its Bitcoin purchases. From September 15 to 21, 2025, for instance, the company sold 173,834 STRF shares and used the proceeds to acquire 850 Bitcoins.

BTC standard era return. Source: Strategy

This approach allows MicroStrategy to secure what functions as "permanent capital" without the immediate pressure of repayment, avoiding traditional risks like bank runs or margin calls. However, it introduces other significant risks. The continuous issuance of new shares leads to shareholder dilution. Over the past year, the number of issued shares increased by 35%, effectively diluting the value of existing stakes by the same proportion. This financial engineering has allowed the company to move in near-tandem with Bitcoin's price, but it undermines the direct benefits for long-term stockholders. The company's core software business, while still operational and serving clients like Sony and Visa, has become a secondary concern, with all generated profits and raised capital being funneled into Bitcoin acquisitions.

Leverage Threshold: At What Point Does Insolvency Loom?

The critical question for investors is how far Bitcoin must fall before MicroStrategy faces a genuine insolvency crisis. The relationship between Bitcoin's price and the company's financial health is direct and highly leveraged.

Analysis from digital asset data platform Xangle suggests that the company's financial structure is, for now, surprisingly robust. Their research indicates a mathematically calculated default probability of just 0.00% to 0.11%, deeming it "virtually risk-free" from a solvency perspective. The report concludes that "Bitcoin prices have to plunge more than 80% from the current level to create a possibility of default," which would imply a Bitcoin price of approximately $16,000, which is a scenario far more severe than current market projections.

A key metric for proponents is the 'BTC Breakven ARR', which is the average annual Bitcoin growth rate required for the company to sustain its interest and dividend payments. This figure is reportedly as low as 1.46% annually. At this rate, the "MSTR system will run for 68 years without problems," suggesting the company could survive an extended period of stagnant prices, provided Bitcoin eventually recovers at a modest pace. However, this optimistic view is not universal. JPMorgan analysis presents a more near-term threat, warning that a further 15% decline in Bitcoin prices could push MicroStrategy's holdings underwater and threaten its eligibility for major equity indices. This would bring Bitcoin to around $70,000, a level that is well within the realm of possibility given current market volatility and would represent a significant psychological blow.

Short-Term vs. Long-Term Impacts of Bitcoin Decline

The consequences of a continuing Bitcoin decline would manifest differently in the short term versus the long term.

Short-Term Pressures: The most immediate threat is not direct bankruptcy, but a potential exclusion from major stock indices. MSCI, a leading index provider, is reportedly considering excluding companies whose cryptocurrency holdings exceed 50% of their balance sheets. With Bitcoin constituting approximately 77-81% of MicroStrategy's total assets, the company far exceeds this threshold. If MicroStrategy is dropped from the MSCI USA index, it would trigger forced selling by passive funds tracking the benchmark, with estimates suggesting outflows of $8.8 billion to $11.6 billion. For a company reliant on issuing stock to fund its operations and Bitcoin purchases, this mechanical selling could critically impair its business model. This fear is already materializing; institutional investors, including giants like BlackRock and Fidelity, sold nearly $5.4 billion of MSTR stock in the third quarter of 2025 alone.

Long-Term Viability: If a bear market persists for months or years, the pressure on MicroStrategy will intensify. The company's ability to raise new capital through equity or debt would diminish significantly as investor appetite wanes. The low cost of its existing debt is an advantage. Still, if Bitcoin's price remains below its average cost basis for an extended period, the strategic narrative would be severely damaged, undermining market confidence. The company would be forced to rely solely on the cash flows from its software business, which, while stable, are insufficient to service its ambitious acquisition strategy on their own. The long-term investment case hinges entirely on the broader macroeconomic narrative that Bitcoin is a viable hedge against inflation and currency devaluation. This thesis remains unproven in the eyes of traditional finance.

Could MicroStrategy Actually Go Bankrupt? A Multi-Faceted Risk Analysis

While a catastrophic 80% crash in Bitcoin is currently considered unlikely, the path to potential insolvency is not a single cliff but a slope of escalating risks.

Liquidity and Refinancing Risk: MicroStrategy's strategy is predicated on perpetual access to cheap capital. A severe downturn could shut off this tap. If the company cannot issue new equity or debt on favorable terms, it may struggle to meet its financial obligations. While its debt may be low-interest, it is not zero-interest. A scenario of rising borrowing costs globally would exacerbate this risk, making refinancing existing debt or raising new capital prohibitively expensive.

Regulatory and Governance Risk: The regulatory landscape for cryptocurrencies remains uncertain. Evolving rules from bodies like the SEC could directly impact how MicroStrategy's Bitcoin holdings are treated from an accounting and regulatory capital perspective. Furthermore, potential index exclusions represent a form of regulatory-adjacent risk, as they are often based on governance and asset-type clarity. Being removed from major indices would reduce liquidity and increase volatility, creating a negative feedback loop for the stock.

Concentration and Market Sentiment Risk: MicroStrategy has placed a bet of existential proportions on a single, highly volatile asset. This extreme concentration is its greatest strength in a bull market and its greatest weakness in a bear market. A loss of confidence in Saylor's vision or in Bitcoin itself could cause the stock to decouple negatively from Bitcoin's price, trading at a persistent discount to its theoretical NAV. The recent institutional sell-off is a clear warning sign that this sentiment shift may already be underway.

Despite these formidable risks, it is crucial to recognize that direct bankruptcy remains a tail-risk scenario. The company has no debt covenants that require it to maintain a specific Bitcoin price level, and its preferred stock offerings do not have maturity dates that could trigger a "bank run." Saylor's unwavering commitment is also a factor; he has publicly stated he "will not retreat," and the company continues to buy the dip, demonstrating a conviction that may steady some investor nerves. The software division, though overshadowed, provides a steady, if relatively small, stream of cash flow that can help cover operational costs.

Conclusion

MicroStrategy stands at a precarious crossroads, its fate inextricably linked to the volatile tides of Bitcoin. Its bold strategy has delivered phenomenal returns during the bull market, but it has also accumulated monumental risk. While the company's financial engineering has thus far insulated it from immediate insolvency threats—with a calculated default probability near zero—this does not mean it is immune to severe financial distress.

A continued decline in Bitcoin's price would not likely bankrupt MicroStrategy overnight, but it would trigger a cascade of damaging consequences: forced selling from index fund exclusions, a flight of institutional capital, and a crippling inability to fund further purchases. The company's long-term survival would then depend on the endurance of its core software business and the eventual recovery of Bitcoin, a gamble of historic proportions. Michael Saylor's bet is not merely on Bitcoin's price, but on its fundamental thesis as a corporate treasury asset. In a world where traditional finance is being challenged by digital assets, MicroStrategy's journey may yet redefine corporate strategy. However, for now, it serves as a high-stakes case study in the perils and potentials of leverage, conviction, and the volatile world of cryptocurrency.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.