The cryptocurrency market endured a volatile trading period between November 14-20, 2025, characterized by aggressive selling pressure across major assets. The global cryptocurrency market cap stood at approximately $3.26 trillion as of November 20, reflecting a decline of 6.3% from the previous week's $3.63 trillion. Bitcoin's market dominance remained substantial at 55.5%-56.76%, indicating that while altcoins suffered significantly, investors still favored Bitcoin relative to smaller-cap tokens during the turmoil. Meanwhile, Bitwise Asset Management announced the launch of its spot XRP exchange-traded fund on the New York Stock Exchange. Bitcoin extended its decline on Wednesday, falling to roughly $88,600, its lowest level since April and more than 5% below where it opened 2025. The $1 billion Ethereum DAT that leading Asian crypto investors, including Huobi’s Li Lin, proposed will no longer happen, and the committed capital has been returned.

Market Overview

BTC

:

Bitcoin dropped 10.88% over the week, now standing at $92,152.26, facing persistent selling pressure throughout the review period, briefly breaking below the psychologically important $90,000 level to trade as low as $89,368 before recovering to around $91,398-$92,000. This represented a significant technical breakdown, with Bitcoin officially entering bear market territory, defined as a 20% decline from recent highs, and erasing its year-to-date gains, now down approximately 2% by 2025.

Analysts observed that Bitcoin breached its 50-week moving average, a key long-term trend indicator that had provided support throughout the two-year bull market. Some analysts projected potential further declines toward the 200-week moving average if current levels failed to hold.

ETH

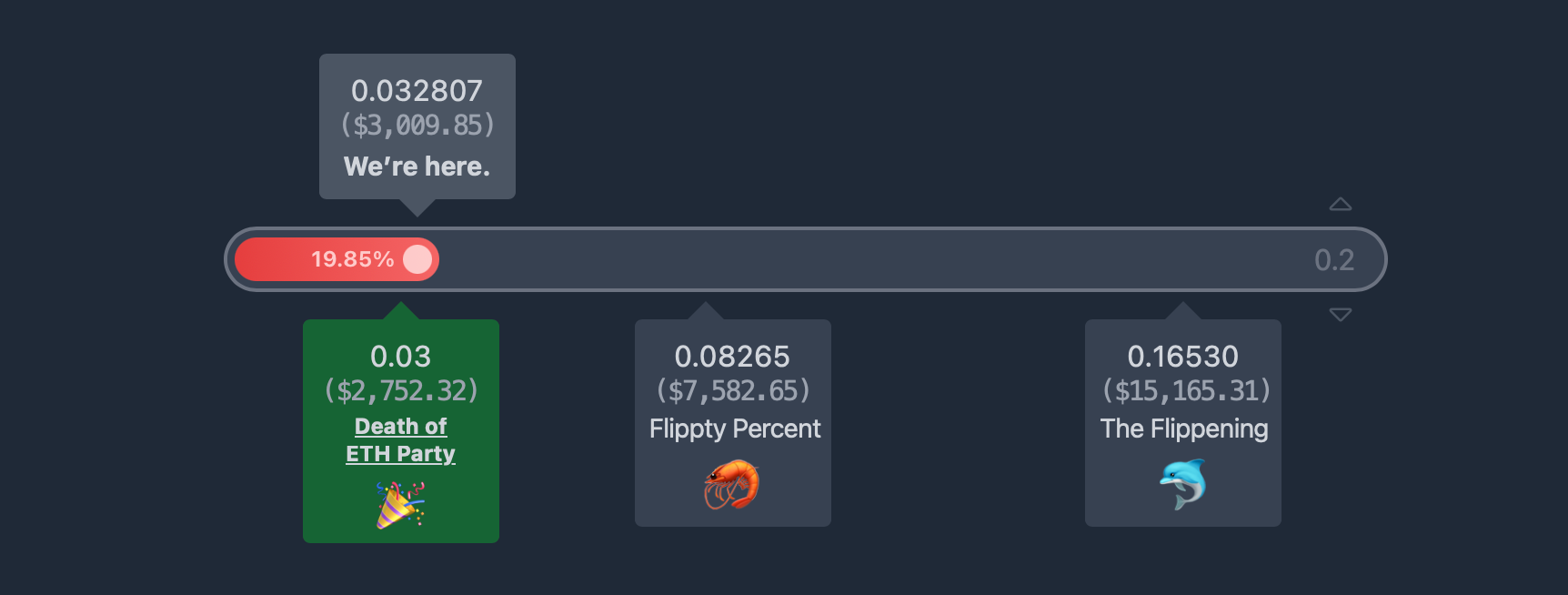

: Ethereum dropped 14.70% over the week, now standing at $3021.75. Ethereum significantly underperformed Bitcoin during the review period, declining more than 8% year-to-date compared to Bitcoin's 2% drop. ETH price fell to five-month lows, breaking below $3,000 and trading around $3,075 at period's end. The ETH/BTC ratio declined to 0.032976, approaching historical lows and significantly below its all-time high of 0.1238, reflecting relative weakness against Bitcoin. Ethereum exhibited similar bearish technical characteristics to Bitcoin, breaking below key moving averages and important psychological support at $3,000. Trading volume declined approximately 30% over 24 hours during the period, indicating potential capitulation or diminished selling pressure at lows.

ETH/BTC ratio. Source: RatioGang

The Ethereum network saw mixed activity indicators, with daily transactions on the Ethereum mainnet declining by 6.92% week-over-week. However, the

Layer-2 ecosystem surrounding Ethereum showed relative resilience, with total value locked (TVL) across Ethereum Layer-2 solutions reaching $369.0 billion, despite a 8.1% weekly decline.

Altcoins: Market sentiment reached extreme fear levels during the review period, with the Crypto Fear and Greed Index plunging to 15-16, marking its lowest reading since February and approaching year-to-date lows. This reading indicated "extreme panic" among market participants, creating potentially contrarian conditions according to historical patterns.

The altcoin market experienced widespread selling pressure during the review period, though with notable divergences between sectors: The Layer-2 sector demonstrated relative strength amidst market turmoil, posting a 0.52% 24-hour gain at one point during the period. Starknet (STRK) led with impressive gains of up to 17.49%, while zkSync (ZK) rose 15.23%. This relative strength in scaling solutions suggested ongoing developer and user commitment to Ethereum's ecosystem despite price weakness.

ETF: U.S. spot Bitcoin ETFs experienced significant outflows during the review period, with total net outflows of $11.1 billion for Bitcoin ETFs and $7.28 billion for Ethereum ETFs. This represented a dramatic shift from earlier in the year when these products saw consistent inflows. The outflows suggested institutional investors were reducing exposure to digital assets amid worsening market technicals and macroeconomic uncertainty.

VanEck's Bitcoin ETF reported a daily net outflow of $17.6 million on November 20th, though the firm continued its practice of directing 5% of profits from the ETF to Bitcoin developers. This outflow, while modest in isolation, contributed to a broader pattern of institutional caution.

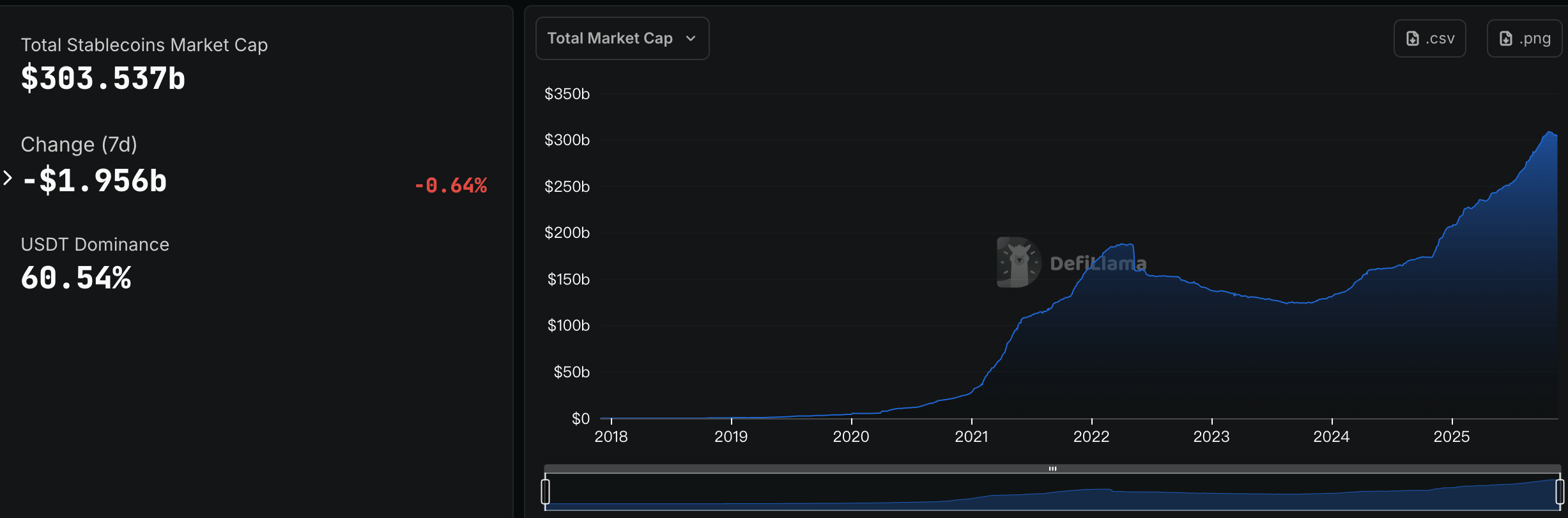

Stablecoins: Stablecoins continued to play a critical role in market structure despite price declines across major cryptocurrencies: Total Stablecoin Market Cap: The stablecoin sector reached $303 billion in market capitalization, with Tether (USDT) maintaining dominance at $183.9 billion (60.35% share) and USDC following at $74.8 billion (24.54%).

Stablecoins marketcap. Source: DefiLlama

Stablecoins experienced rapid supply expansion, with 36.98 billion new tokens minted during the period, representing a 78.05% increase from the previous week. This growth suggested continued capital inflow into the crypto ecosystem, albeit with investors preferring dollar-pegged assets during volatility.

Macro Data:

Cryptocurrencies faced significant headwinds from traditional markets during the review period, with several macro developments influencing digital asset prices:

-

Global Liquidity Concerns: Japan's soaring bond yields created particular concern, with the country's 40-year government bond yield surging to a record high of 3.697%. This development threatened to unwind the massive Yen carry trade, estimated at $20 trillion globally, potentially reducing liquidity available for speculative assets like cryptocurrencies.

-

Federal Reserve Uncertainty: Market participants trimmed bets on Federal Reserve rate cuts for December, with the CME FedWatch Tool showing below 49% odds of a 25 basis point reduction. This represented a significant shift from earlier expectations and created pressure on rate-sensitive assets like technology stocks and cryptocurrencies.

-

Economic Data Disruptions: The absence of key economic data due to the earlier government shutdown created additional uncertainty, with no October CPI or jobs data scheduled for release. This information vacuum forced investors to make decisions with incomplete information, potentially exacerbating market volatility.

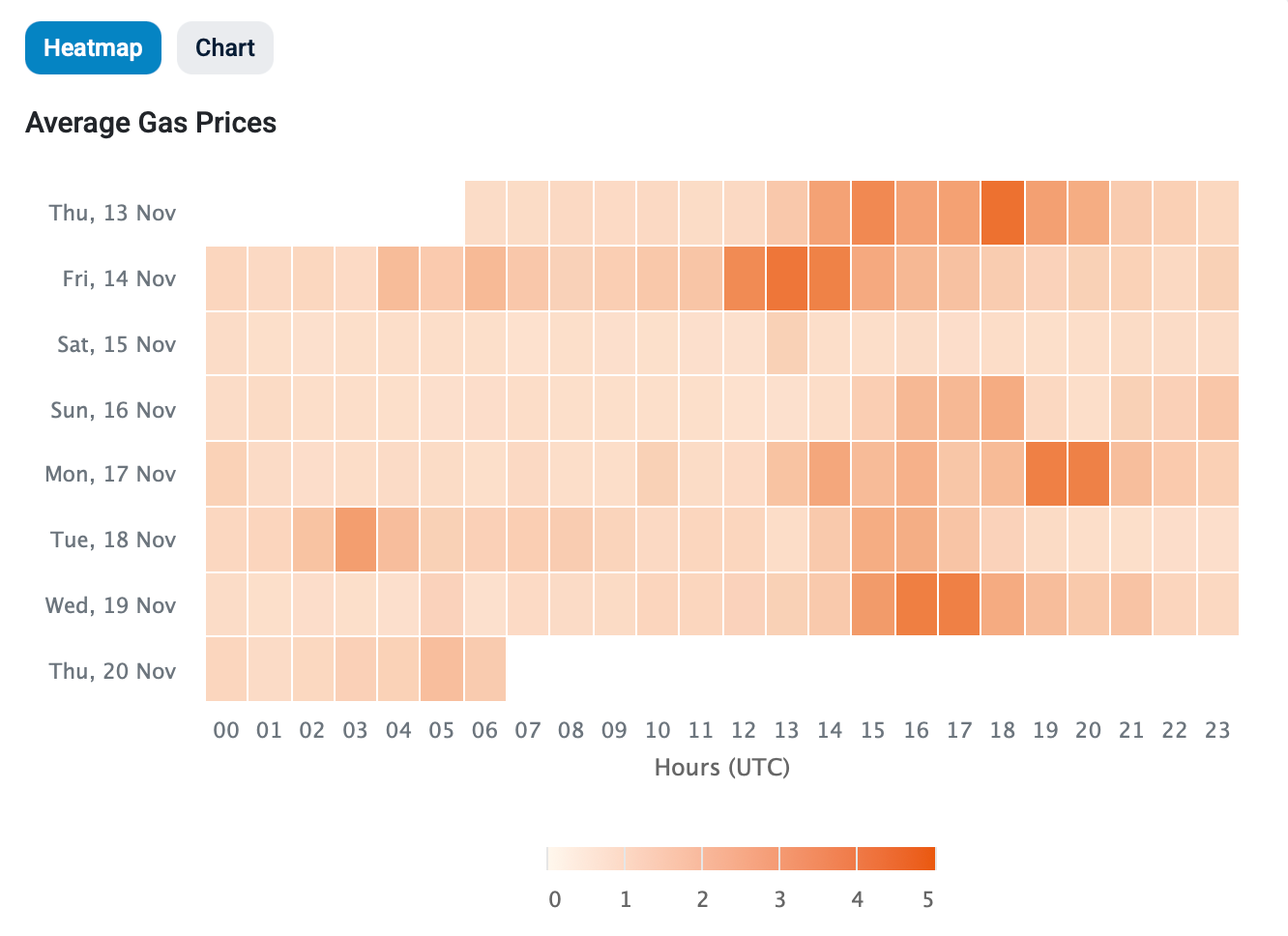

Gas Fees: The current gas fee is 1.387 Gwei. Data from the start of the month and recent trends indicate that fees have dropped to historically low levels, driven by successful scaling solutions and lower market activity.

Gas fee heatmap. Source: Etherscan

Weekly Trending Sectors & Opportunities

The sector performance during this week aligns with several longer-term trends identified in the broader 2025 market, which can help frame opportunities.

Layer 2 Scaling Solutions: The strong relative performance of Layer 2 projects is part of a larger trend focusing on scaling and efficiency. These networks are crucial for enabling faster and cheaper transactions, which is a fundamental need for the entire ecosystem. Their outperformance during a consolidating market suggests strong investor confidence in their long-term value.

Real-World Assets (RWA) & Tokenization: The scope of RWA is expanding beyond tokenized treasuries to include a wider range of products, such as tokenized equity. This trend represents a significant opportunity for asset creation at the intersection of traditional finance and blockchain technology.

Stablecoin Infrastructure: Stablecoins are experiencing record-breaking supply growth and are becoming increasingly "productized". Opportunities are emerging around their use in payments, lending, and as the foundation for more complex financial products like credit systems and "Buy Now, Pay Later" (BNPL) schemes.

Weekly Market Focus

Bitwise Spot XRP ETF Launches Thursday Amid Altcoin Fund Rush

Bitwise Asset Management announced the launch of its spot XRP exchange-traded fund on the New York Stock Exchange. The ETF will start trading on Thursday under ticker XRP, with a management fee of 0.34% that is waived for the first month on the first $500 million in assets.

XRP is currently the world's third-largest non-stablecoin cryptocurrency with a market capitalization of $127.3 billion, according to The Block's price data dashboard. Having facilitated over 4 billion transactions, XRP is challenging the cross-border payments market, the press release said.

In the U.S., Bitwise's fund will be the second spot XRP product following Canary Capital's XRPC. Canary's fund has accumulated $276.8 million in net inflows since launching last week. Bitwise previously launched the Bitwise Physical XRP ETP (GXRP) in Europe that provides investors with direct, physically-backed exposure to the cryptocurrency.

Grayscale is slated to be next, after announcing earlier Wednesday that its GXRP fund is set to launch soon. Bloomberg Analyst James Seyffart wrote on X that Grayscale's spot XRP ETP will likely go live next Monday, alongside its Dogecoin ETF, which would mark a first.

Aztec Launches Privacy-focused L2 Ignition Chain on Mainnet Following Token Sale

Aztec announced to launch the first decentralized L2 on Ethereum. Source: Aztec X account

Aztec Network, a privacy-focused Layer 2 on Ethereum, officially launched its Ignition Chain on Ethereum mainnet on Wednesday, following the start of its AZTEC token sale last week.

The mainnet launch of Ignition Chain, which enables programmable privacy, came after the network's public testnet rollout in May. Ignition Chain saw its validator queue reach 500 on Wednesday, which triggered block production on the Ethereum mainnet, the team said. Ignition Chain powers Aztec's vision of a "private world computer," where developers build DeFi apps with end-to-end confidentiality. It aims to address Ethereum's transparency limitations by using zero-knowledge proofs while maintaining verifiability. In 2022, the Aztec team raised $100 million in its Series B funding round led by a16z.

"2025-2035 will be Privacy's turn of the wheel," said Zac Williamson, co-founder of Aztec Network, in a post on X. "We are going to see the rise of products and services that perform the same information processing role, but using distributed ledgers as their settlement layer and privacy tech as the execution engine," said Williamson. "Data will be sucked out of the Web2 fortresses and given back to the user."

Vitalik Buterin Says Quantum Computers Will Break Crypto Security by 2030

Ethereum creator Vitalik Buterin told developers in Buenos Aires on Tuesday that quantum computers will have the ability to break cryptography holding Bitcoin and others as early as 2028.

Vitalik said “elliptic curves are going to die,” pointing straight at the math that secures wallets, signatures, and every transaction on today’s major blockchains. The concerns grew louder after Google announced a quantum breakthrough last month, following Microsoft’s move in February when it revealed a quantum‑enabling chip. Those jumps pushed quantum danger right into the center of crypto conversation. The fear is that if hardware keeps moving at this speed, encryption that protects every on‑chain wallet and every old signature could be exposed within a few years.

Quantum researcher Scott Aaronson said in a blog post that the “staggering rate of hardware progress” makes it a “live possibility” that a fault‑tolerant quantum machine running Shor’s algorithm could exist before the 2028 U.S. election. Scott said Shor’s algorithm would break the encryption behind both Bitcoin and Ethereum. That means old keys, old signatures, and any untouched wallet would be open to attack once the machines reach scale.

Crypto investor Nic Carter reacted on X, saying the “magnitude of the threat that quantum poses to all blockchains” gave him “an urgent sensation like I have to act on it now with as much intensity as I can muster.”

Key Market Data Highlights

Bitcoin Extends Losses Below $89,000 as Fed Minutes Outline Two-sided Risks, No Preset Path for Rate Cuts

Bitcoin extended its decline on Wednesday, falling to roughly $88,600, its lowest level since April and more than 5% below where it opened 2025. The move coincided with the release of the Federal Reserve’s October meeting minutes, which emphasized “two-sided risks” facing the economy and showed officials deeply divided over how quickly to ease policy.

Several policymakers pointed to slower job gains, a rising unemployment rate, and fading labor demand as signs the economy is becoming more vulnerable to a sharper downturn. At the same time, many said inflation has shown little sign of returning sustainably to its 2% target, with tariff-driven goods inflation and sticky service sector prices keeping them cautious about further easing. Against that backdrop, officials stressed that policy is not on a preset course, and December’s decision still remains wide open.

Some participants said another rate cut could be warranted as the Fed inches toward a more neutral stance. Many others argued rates should remain unchanged for the rest of the year, given persistent inflation. One participant favored a larger 50-basis-point reduction, while another preferred no cut at all.

Prediction markets quickly repriced. On Polymarket, the odds of a quarter-point cut at the December meeting fell from about 52% to 30% after the minutes were released, while the probability of no change climbed from 46% to nearly 70%. CME FedWatch, a tool that tracks futures-implied rate expectations, showed virtually the same split.

That added layer of economic uncertainty is only exacerbating bitcoin’s ongoing market troubles.

Nearly $300 Million in Token Unlocks Set to Hit the Market This Week

Data from Tokenomist identifies both single large cliff unlocks exceeding $5 million and daily linear unlocks surpassing $1 million per day. The releases will affect major projects including LayerZero, SOON, Solana, and several meme coins.

LayerZero leads in single large unlocks with 25.71 million tokens valued at $37.28 million. The release represents 7.29% of the project’s unlock supply. ZRO is one of the most-watched releases for the week. The $37.28 million valuation makes it the single largest cliff unlock by dollar value during the seven-day period.

SOON follows with 15.21 million tokens unlocking, now valued at $25.86 million. The release accounts for 4.33% of the project’s unlock supply. Next, YZY will see 37.50 million tokens, worth $14.59 million, enter circulation. The unlock is 12.50% of the project’s unlock supply.

The total value of SOON and YZY unlocks reaches approximately $40 million, making it the second and third largest single release this week.

ZK protocols will unlock 173.08 million tokens valued at $8.71 million. The release represents 3.37% of unlock supply. MBG tokens worth $7.31 million will enter circulation, with 15.84 million tokens unlocking. This accounts for 9.20% of the project’s unlock supply. KAITO comes next with 8.35 million tokens worth $6.30 million and accounts for 2.97% of unlock supply. ApeCoin (APE) rounds out major cliff unlocks at 15.60 million tokens worth $5.47 million. The release represents 1.66% of unlock supply.

Solana (SOL) leads all daily linear unlocks with 491.44K tokens valued at $69.53 million. The release represents just 0.09% of the circulating supply. The $69.53 million Solana unlock exceeds all single cliff releases by a wide margin. TRUMP tokens will see 4.89 million units unlock, valued at $34.48 million. This represents 2.45% of the circulating supply. Worldcoin (WLD) faces 37.23 million tokens entering circulation, worth $25.47 million. The release accounts for 1.60% of the circulating supply.

Dogecoin (DOGE) will unlock 97.45 million tokens valued at $15.76 million. The release represents just 0.06% of the meme coin’s massive circulating supply.

ASTER tokens worth $12.59 million will enter circulation with 10.28 million tokens unlocking. This accounts for 0.51% of the circulating supply. Avalanche (AVAX) will release 700,000 tokens valued at $10.94 million, representing 0.16% of the circulating supply.

Bittensor (TAO) faces a smaller unlock of 25.20K tokens worth $8.34 million, accounting for 0.26% of supply. Zcash (ZEC) will unlock 11.03K tokens valued at $7.51 million, representing 0.07% of the circulating supply. ETHFI rounds out the major daily releases with 8.53 million tokens worth $7.63 million.

$1B ETH DAT Planned by Huobi Founder and Asian Backers Called Off

According to reports, the $1 billion Ethereum DAT that leading Asian crypto investors, including Huobi’s Li Lin, proposed will no longer happen, and the committed capital has been returned. Had the plans gone through, the new trust could have grown into one of the largest dedicated institutional vehicles for Ethereum accumulation, rivaling the holdings of existing funds such as BitMine, SharpLink Gaming, and Grayscale’s Ethereum Trust.

The proposed billion-dollar DAT was expected to be a success because of the entities involved, including Li Lin, who, through Avenir Capital, has been able to build a solid track record in ETFs. Not much is known about why the project was discontinued. However, Wu Blockchain has claimed that sources familiar with the proceedings said the main reason the plan was halted was due to the market downturn that came after the sharp October 11 sell-off. The project was to be a corporate treasury vehicle with the sole purpose of accumulating and holding large amounts of ETH, a strategy similar to the one companies like Strategy, which hold Bitcoin, have employed.

The person who spearheaded the effort was Huobi’s founder, Li Lin, and he had the backing of a number of Asia’s earliest and most influential Ethereum backers, including Shen Bo, co-founder of Fenbushi Capital; Xiao Feng, chairman and CEO of HashKey Group; and Cai Wensheng, founder of Meitu Inc.

CoinCatch New Listings

CoinCatch Weekly Event

Thanksgiving Rescue Plan: $1000 Loss Bonus + 100% Red Packet & 0 Fees!

📅 Event Time: 2025.11.20 (UTC+8) - 2025.11.26 (UTC+8)

🎊 New User Offers: Red Packet Rain + Trade & Get Fee-Free

🛡 Market Counterattack Plan: 100% Loss Subsidy, Up to $1,000 Trading Bonus!

-

Event Rules:

-

Futures trading volume ≥

500,000 USDT:

receive 50% of their net trading losses in position bonus (max $200)

-

Futures trading volume ≥

2,000,000 USDT:

receive 100% of their net trading losses in position bonus (max $1,000)

-

Futures trading volume ≥

10,000,000 USDT:

receive 100% of their net trading losses in trading bonus (max $1,000, limited to 20 users)

📉 Market Bottom-Fishing Plan: Win iPhone 17 Pro Max + $100 Amazon Gift Card

Token Unlocks Next Week

Tokenomist data indicates that from November 17 – November 24, 2025, several major token unlocks are scheduled. Some of them are:

ZRO will unlock approximately $36.25 million worth of tokens over the next seven days, representing 7.29% of the circulating supply.

XPL will unlock approximately $22.12 million worth of tokens over the next seven days, representing 4.74% of the circulating supply.

KAITO will unlock approximately $6.24 million worth of tokens over the next seven days, representing 3.40% of the circulating supply.

ZK will unlock approximately $8.61 million worth of tokens over the next seven days, representing 2.30% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization, presents a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial

advice.