The crypto market is currently experiencing a period of significant turbulence, with major digital assets like Bitcoin facing substantial sell-offs while specific sectors demonstrate remarkable resilience. Over the past weeks, Bitcoin has surrendered key psychological levels, traditional safe-haven assets face skepticism, and yet privacy-focused cryptocurrencies and AI-related projects continue to capture investor attention. This analysis examines the complex interplay of factors driving these developments, from macroeconomic pressures and shifting investor sentiment to technological advancements and regulatory developments that are redefining what constitutes value in the digital asset space.

Market Overview

The cryptocurrency market is presenting a starkly divergent picture in November 2025. While major cryptocurrencies like Bitcoin and Ethereum face persistent selling pressure, specific niches within the digital asset ecosystem are not just weathering the storm but actively thriving. This sectoral rotation suggests that the market is maturing beyond the era where all digital assets moved in lockstep, with investors becoming increasingly discerning about fundamental value propositions and real-world utility.

Bitcoin, the bellwether of the crypto market, continues its downward trajectory, recently touching lows around $92,985 after breaching the critical $100,000 support level. This decline has effectively erased all its year-to-date gains, representing a significant psychological blow to market participants. The downward movement has been accompanied by massive liquidations.

BTC liquidation chart. Source: Coinglass

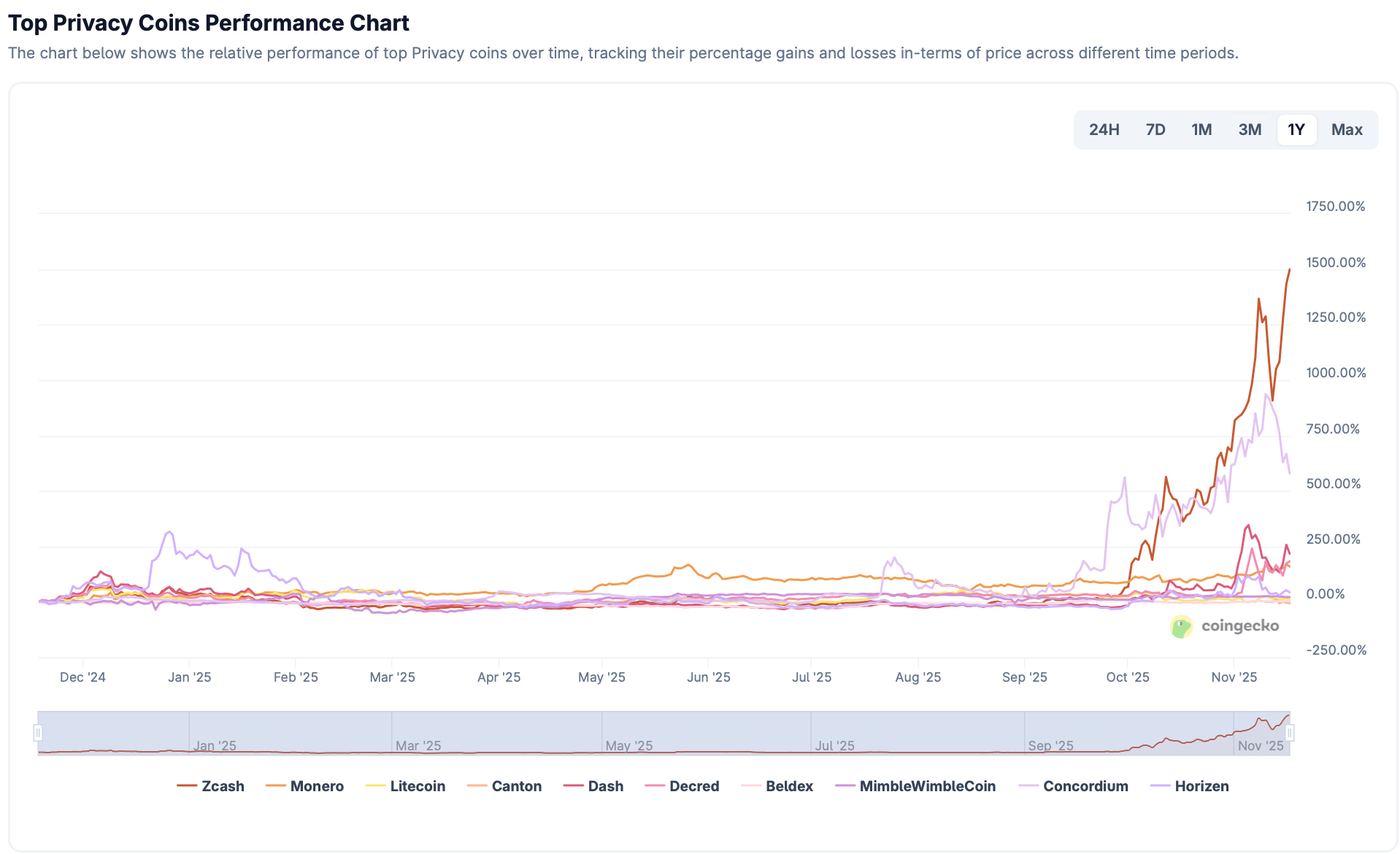

Meanwhile, against this gloomy backdrop, privacy coins and AI-related crypto projects are telling a different story entirely. The privacy coin sector has delivered gains of approximately 120% in 2025, dramatically outperforming Bitcoin's 28.5% increase before its recent retreat. This divergence underscores how specialized narratives and technological advancements are creating new investment opportunities that operate independently of the broader market sentiment.

Privacy coins performance chart. Source: CoinGecko

Bitcoin's Sharp Decline: Unpacking the Drivers

Investor Exodus and Institutional Retreat

Bitcoin's recent weakness stems primarily from a notable retreat by institutional players who had previously been driving its upward momentum. According to market analysis, "major investment funds, exchange-traded fund investors, and corporate treasury departments have retreated from Bitcoin," taking away what Patrick Munnelly of Tickmill Group described as the "key pillars supporting this year's rally" and thereby "opening a new period of market fragility".This institutional pullback has created a vulnerability in Bitcoin's price structure that retail investors alone cannot compensate for.

The data reveals a disturbing trend for Bitcoin bulls: blockchain analytics show that over the past 30 days, long-term Bitcoin holders have sold approximately 815,000 Bitcoin, marking the highest level of selling activity since early 2024. Even more concerning is the behavior of so-called "whales"—entities holding at least 1,000 Bitcoin—with wallets holding Bitcoin for more than seven years, selling at a rate exceeding 1,000 Bitcoin per hour. This represents a systematic distribution rather than a panic-driven sell-off, suggesting that early adopters are methodically taking profits at what they perceive as attractive price levels.

Deteriorating Market Sentiment

The psychological dimension of this downturn cannot be overstated. Market sentiment analysis from Santiment reveals that discussions around Bitcoin, Ethereum, and XRP are dominated by negative commentary, with the positive-to-negative sentiment ratio falling well below normal levels. This pessimism has become self-reinforcing, creating a feedback loop that further pressures prices downward.

The emotional attachment to certain price levels has also played a crucial role in the current downturn. As Cory Klippsten, CEO of Swan Bitcoin, noted: "Many early holders I've known since I entered the space in 2017 have been talking about the $100,000 number. For some reason, that's the level people always said they would sell at". This illustrates how long-held profit-taking targets can create concentrated selling pressure at specific psychological thresholds, accelerating downward momentum once those levels are breached.

Traditional Safe Havens: Dollar's Vulnerabilities

The turbulence in cryptocurrency markets coincides with growing questions about traditional safe-haven assets, particularly the U.S. dollar. Historically, the dollar has strengthened during periods of market stress, but recent policy decisions have undermined this status. Following the announcement of "reciprocal tariffs" by the U.S. administration, global markets experienced significant selling pressure, yet contrary to historical patterns, the dollar declined rather than strengthened.

This deviation from established behavior points to deeper structural concerns about U.S. fiscal policy and its potential consequences. According to Anna Cieslak, an economist at Duke University, "fiscal deficits, the government's deliberate reduction of the U.S. capital account and actions to devalue the dollar, uncertainty about Federal Reserve succession, and questioned independence—all these factors are weakening the dollar's status as a safe-haven asset".

The broader implications for digital assets are significant. If traditional havens like the dollar are perceived as increasingly vulnerable, it could ultimately benefit non-traditional stores of value, including cryptocurrencies. However, in the current environment, this theoretical benefit is being outweighed by more immediate concerns about liquidity and leverage across risk assets, including crypto.

Privacy Coins Defy the Trend

The Zcash Phenomenon

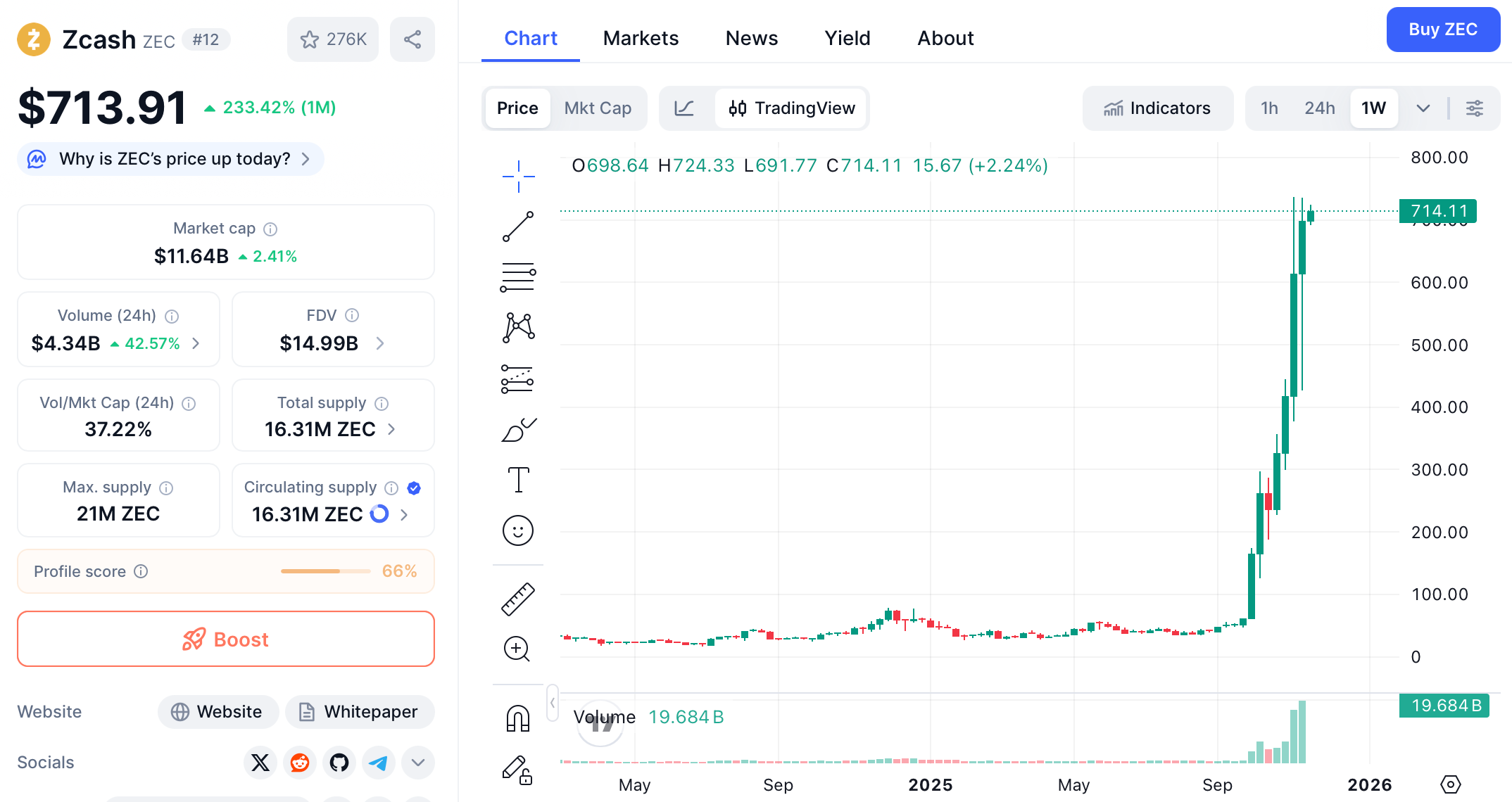

While major cryptocurrencies struggle, privacy coins are experiencing a remarkable resurgence. The standout performer has been

Zcash (ZEC), which saw astronomical gains of over 400% in a single month and more than 600% year-over-year. This impressive rally was catalyzed by a combination of technological developments and influential endorsements, most notably from technology investor Naval Ravikant, who described Zcash as "insurance against Bitcoin".

The fundamental driver behind Zcash's outperformance appears to be substantial organic adoption rather than mere speculation. Blockchain data reveals that Zcash's shielded pool—where private transactions occur—reached a record 4.5 million ZEC, representing approximately 27.5% of the total supply. In just three weeks, over 1 million ZEC were moved into private addresses, with 959 new ZEC transferred to private addresses in a single day. This accelerated adoption of the network's privacy features signals genuine utility rather than speculative trading.

Regulatory Divergence and Technological Evolution

The privacy coin sector faces a complex regulatory landscape that varies significantly across jurisdictions. The European Union's Anti-Money Laundering Regulation (AMLR), set to take effect in 2027, will prohibit "anonymity-enhanced tokens" and anonymous crypto accounts. This has already prompted some European exchanges to delist privacy-focused assets like Monero. However, this regulatory pressure has also catalyzed technological innovation aimed at balancing privacy with compliance.

Projects like Zcash offer "selective disclosure" features through view keys, allowing users to maintain transaction privacy while retaining the ability to share details with auditors or regulators when necessary. This compliance-friendly approach to privacy has positioned certain projects more favorably within the evolving regulatory framework, creating a distinction between privacy technologies that can coexist with regulatory requirements and those that cannot.

The Fundamental Case for Privacy

Beyond short-term price movements, the resurgence of privacy coins reflects deeper structural shifts in the digital asset space. As chain surveillance capabilities have advanced dramatically, the need for financial privacy has evolved from a niche concern to a mainstream consideration. The growing recognition that transparent blockchains like Bitcoin and Ethereum expose users to unprecedented financial surveillance has driven renewed interest in privacy-preserving technologies.

This sentiment is echoed in a comprehensive report from Huobi Growth Academy, which notes: "Privacy is no longer a temporary topic but has gradually become a rigid demand for 'financial infrastructure' in the context of regulatory technology, CBDC, on-chain monitoring, and data abuse". The report further emphasizes that enterprises require commercial confidentiality, individuals need protection against comprehensive asset and behavior profiling, and nations are engaging in data sovereignty competitions—all factors supporting the long-term case for privacy-enhancing technologies in digital assets.

AI Narrative Maintains Momentum

AI's Creative Disruption

Parallel to the privacy coin resurgence, artificial intelligence continues to be a compelling narrative within and beyond the crypto space. The integration of AI tools into creative industries illustrates how rapidly these technologies are being adopted. At the recent Busan International Film Festival, AI-generated films showcased how the technology is "breaking down professional barriers and making the dream of 'everyone can create' a reality".

The fundamental transformation enabled by AI tools is making creative production more accessible while simultaneously reducing costs and timelines. As one producer noted: "In the past, using traditional CG to create a set of cultural relic close-ups was prohibitively expensive. Now, the details of Sanxingdui artifacts generated by AI, after minor adjustments, can meet big screen requirements". This democratization of creation through AI has profound implications for content production across industries, including the media and entertainment sectors that increasingly intersect with blockchain-based rights management and distribution platforms.

Micro-Storytelling and Personalized Content

The rise of what's being called "micro-storytelling" demonstrates how AI tools are creating new forms of creative expression perfectly suited to contemporary attention spans and consumption patterns. These short, personalized fiction pieces that range from 100-word snapshots to two-minute narratives, have exploded in popularity across social media platforms and dedicated AI creativity tools.

This trend highlights how AI has evolved from a specialized tool to what amounts to a "creative co-pilot" that enables anyone to transform basic ideas into polished content. As analysis of this trend notes: "The biggest reason micro-storytelling is booming? You no longer need to be a writer". The frictionless creation enabled by these platforms represents a broader shift toward democratized content production that parallels similar trends in decentralized content creation and distribution within the crypto space.

Recent Developments and Market Infrastructure

Several recent developments across the crypto ecosystem highlight how market infrastructure continues to evolve despite price volatility:

Coinbase has launched an end-to-end token sales platform, with Monad being the first project to utilize this new infrastructure. The platform aims to ensure fairer token distribution by prioritizing smaller investors and reducing concentration among large holders.

A crucial hearing in the UK will determine the fate of 60,000 Bitcoins seized in a money laundering case, with potential implications for how governments manage seized digital assets.

Ethereum's Devconnect conference brought together developers in Buenos Aires to discuss the latest advancements, underscoring how technical progress continues regardless of market conditions.

Federal Reserve meeting minutes are being closely scrutinized for insights into interest rate policy, reminding market participants that macroeconomic factors remain significant drivers of digital asset valuations.

Token unlocks for ZKsync, ApeCoin, LayerZero, and KAITO are scheduled, which could create additional selling pressure on these assets as previously locked tokens become liquid.

Conclusion

The current crypto market presents a complex tapestry of competing narratives and divergent performances. Bitcoin's decline below key support levels reflects a combination of institutional retreat, long-term holder distribution, and deteriorating market sentiment. Simultaneously, traditional safe-haven assets like the U.S. dollar face their own challenges due to policy uncertainty and concerns about fiscal sustainability.

Against this backdrop, the remarkable resilience of privacy coins and the persistent momentum of AI-related narratives highlight how the digital asset ecosystem is maturing beyond single-asset dominance toward a more nuanced landscape where specific use cases and technological value propositions drive investment decisions.

The underlying drivers of privacy coin adoption—including growing surveillance capabilities, regulatory developments, and genuine technological innovation—suggest their current outperformance may represent more than short-term speculation. Similarly, AI's transformative impact across creative industries and beyond points to an enduring narrative that will likely continue to influence adjacent technologies, including blockchain and digital assets.

As market participants navigate this fragmented landscape, the historical correlation between different crypto assets appears to be weakening, requiring more sophisticated analysis that accounts for technological fundamentals, regulatory developments, and real-world utility rather than relying solely on broad market trends. In this evolving environment, understanding the specific drivers of each sector—from privacy technologies to AI integration—will be essential for identifying opportunities amid the ongoing market turbulence.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.