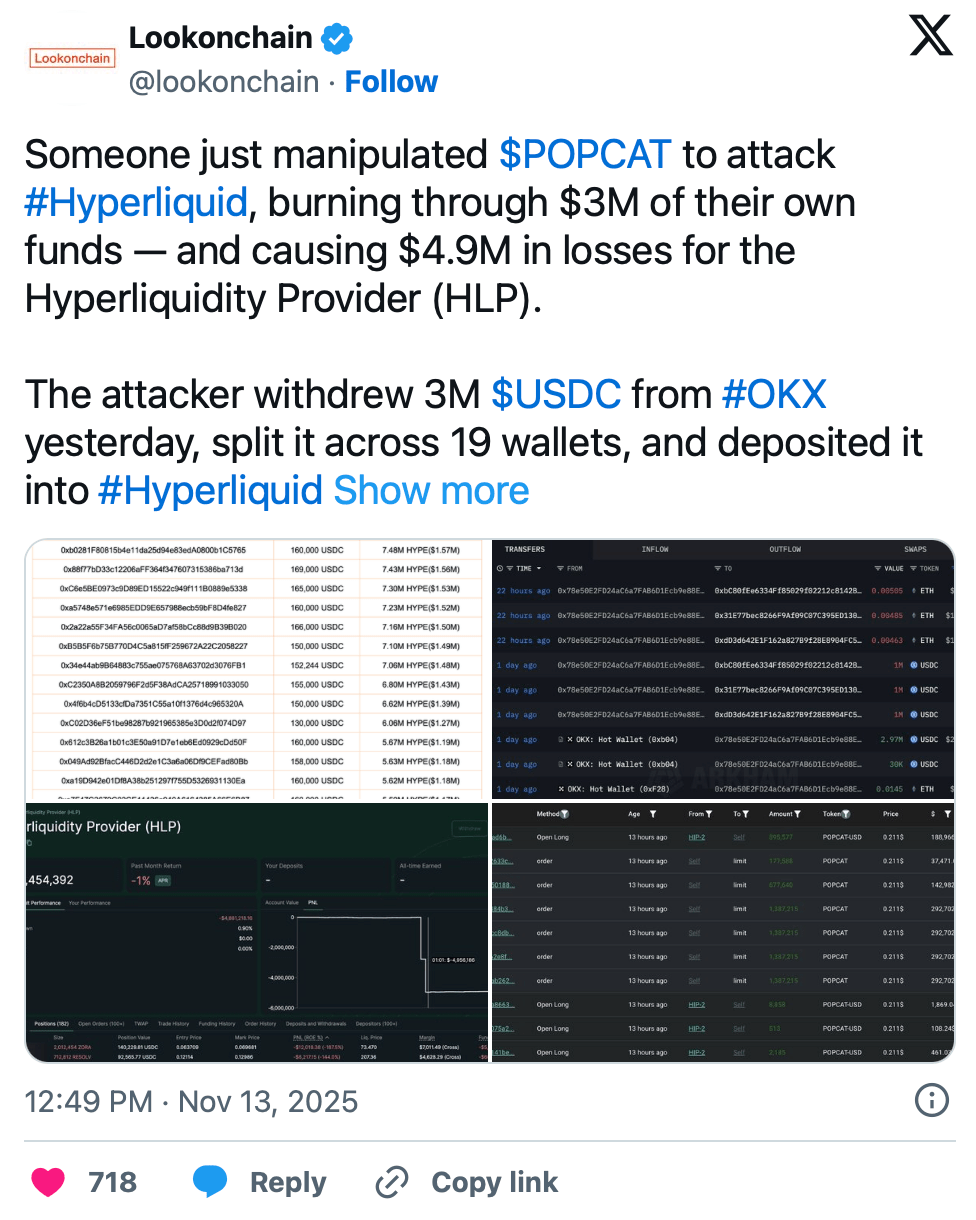

The crypto market experienced a dramatic example of DeFi's fragility on November 13, 2025, when a single trader orchestrated sophisticated manipulation of the POPCAT memecoin, resulting in a cascade of liquidations and a $4.9 million loss for Hyperliquid's liquidity provider vault. The attacker used $3 million in USDC, spread across 19 wallets, to artificially inflate demand before abruptly withdrawing support, causing POPCAT's price to plummet 25% from $0.20 to $0.12 in minutes. This incident highlights persistent vulnerabilities in decentralized finance, where low-liquidity tokens and leveraged trading can be exploited to compromise automated systems, resulting in significant financial damage and eroding investor confidence.

How $3 Million Artificial Demand

Source: Lookonchain

The attack on Hyperliquid began with precise capital preparation. An unidentified trader withdrew $3 million in USDC from the OKX cryptocurrency exchange, then strategically distributed these funds across 19 separate wallets to avoid detection and position limits. This distribution allowed the attacker to establish massive leveraged long positions in POPCAT-denominated perpetual contracts on Hyperliquid without immediately triggering risk alarms.

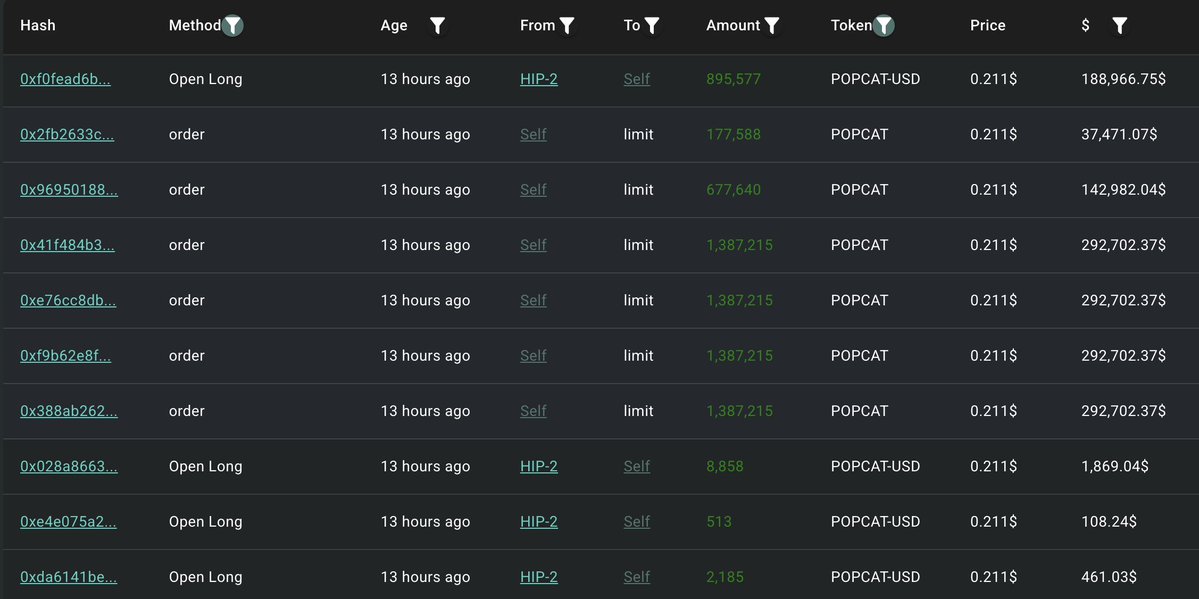

Using these 19 wallets, the attacker established over $26 million in leveraged long positions tied to HYPE, Hyperliquid's POPCAT perpetual contract. The scale of these positions represented a significant concentration in a relatively illiquid market. The manipulation then entered its critical phase: the creation of an artificial buy wall. The attacker placed approximately $20 million in buy orders near the $0.21 price level, creating a powerful illusion of substantial buying interest and underlying demand for POPCAT.

This fabricated signal successfully pushed POPCAT's market price upward, attracting legitimate retail traders who misinterpreted the artificial buy wall as genuine market momentum. Unaware they were chasing manipulated price action, these traders entered long positions based on the false liquidity, further amplifying the upward price movement and setting the stage for the subsequent collapse.

The Domino Effect: Cascading Liquidations

The attack's destructive phase commenced when the attacker abruptly canceled the entire $20 million buy wall, causing immediate liquidity evaporation and eliminating crucial price support. This created a vacuum in which sell orders rapidly overwhelmed the diminished buy-side liquidity, triggering a violent price collapse.

POPCAT price changes. Source: Hyperliquid

POPCAT's price plummeted approximately 25% in minutes, crashing from $0.20 to $0.12. This rapid descent triggered mass liquidations across the platform, particularly impacting the highly leveraged positions that had accumulated during the artificial inflation phase. The Hyperliquidity Provider (HLP) vault, which functions as the platform's backbone for managing risk and providing liquidity, was forced to absorb these distressed positions, resulting in approximately $4.9 million in losses.

Remarkably, the attacker's own $3 million collateral was completely wiped out during the liquidation cascade. This unusual outcome—where the manipulator incurred total capital loss—suggests the primary motive may have been structural damage to the platform rather than direct profit, representing what some analysts termed "the costliest research ever" conducted on a DeFi protocol's vulnerabilities.

Hyperliquid's Emergency Response

In the immediate aftermath of the manipulation, Hyperliquid implemented emergency measures to contain the damage and stabilize its system. The platform temporarily suspended withdrawals and invoked its "vote emergency lock" function to pause contract operations as a precaution against potential further exploitation. This rapid response aimed to prevent additional losses during the period of extreme volatility and market uncertainty.

The platform's developers also manually intervened by closing remaining problematic positions and temporarily halting the Arbitrum bridge to prevent liquidity stress from spreading to other ecosystems. Within approximately 25-60 minutes, Hyperliquid resumed normal operations, including deposits and withdrawals, indicating the immediate crisis had been contained.

This incident marks Hyperliquid's third major market manipulation event in 2025, following a similar exploit targeting the JELLYJELLY memecoin in March that resulted in $12 million in unrealized losses. The repetition of such events has intensified scrutiny of Hyperliquid's risk management frameworks and their ability to protect against coordinated attacks in low-liquidity markets.

Market Impact and Community Reaction

The POPCAT manipulation triggered extensive fallout across cryptocurrency markets and community platforms. Beyond the direct financial damage to Hyperliquid's HLP vault, the attack exacerbated POPCAT's already steep decline, with the token plummeting 19% in 24 hours to $0.1262 and recording a year-to-date loss exceeding 91%. The broader memecoin sector experienced heightened volatility as investors reassessed the vulnerabilities associated with low-liquidity, speculative assets.

The crypto community responded with a mixture of alarm and dark humor. Some observers described the event as "peak degen warfare," highlighting the aggressive tactics sometimes employed in decentralized finance to exploit protocol weaknesses. Others speculated the attack constituted a "$3 million performance art piece" satirizing the extreme behaviors occasionally witnessed in cryptocurrency markets.

The incident sparked renewed debate about the security and maturity of DeFi platforms, particularly their ability to withstand determined manipulation attempts in markets with limited liquidity. Critics emphasized that perpetual markets lacking robust liquidity buffers remain vulnerable to actors willing to sacrifice capital for strategic purposes, whether to demonstrate vulnerabilities, damage platforms, or make ideological statements about DeFi's structural weaknesses.

Broader Implications for DeFi

The Hyperliquid manipulation exposes systemic vulnerabilities that extend far beyond a single platform or token. The incident demonstrates how automated liquidity provision mechanisms in decentralized finance can be weaponized by actors with sufficient capital and coordination, particularly in markets for low-capacity or memecoins where liquidity is naturally thin.

This event underscores the persistent tension between decentralization and security in DeFi ecosystems. While decentralized exchanges offer permissionless access and censorship resistance, their openness can make them susceptible to sophisticated manipulation schemes that might be more easily prevented in traditional centralized venues with manual oversight. The attack highlights the critical need for enhanced risk management protocols, including more sophisticated oracle mechanisms, dynamic position limits, and circuit breakers that can respond to abnormal market conditions.

The fact that this represents Hyperliquid's third such incident in a single year suggests that current safeguards remain inadequate against determined attackers. As DeFi continues evolving, protocols must develop more robust defenses against liquidity-based attacks, potentially including improved market surveillance, collateral requirements for large positions, and mechanisms to detect coordinated activity across multiple wallets.

Trading Outlook and Future Vulnerabilities

In the wake of the manipulation, analysts noted mixed signals in POPCAT's market structure. Despite the spot price collapse, derivative metrics showed open interest for POPCAT futures actually increased 11.41% to $64.04 million, while the long-to-short ratio dropped to 0.89, indicating bearish dominance in the short term despite the elevated trading activity.

Technical analysis suggests POPCAT's price stability now depends heavily on maintaining the $0.15 support level. If this level fails, analysts warn the token could experience further declines, potentially below $0.10. Conversely, some traders identified potential rebound opportunities if buying pressure emerges near current levels, with $0.23 mentioned as a longer-term target should market sentiment improve and sustained accumulation occur.

The concentration of POPCAT holdings among a limited number of exchanges and large holders—with Bybit and Robinhood collectively controlling 10% of supply and the top 10 holders owning 38.1%—creates ongoing vulnerability to large-scale movements that could amplify volatility. This ownership structure means future price swings could be exacerbated by decisions from a relatively small group of influential market participants.

Conclusion

The POPCAT manipulation event on Hyperliquid serves as a stark case study in DeFi's evolving security challenges.The attack demonstrated how determined actors can exploit low-liquidity markets and automated systems to cause substantial damage, even at personal financial loss. While Hyperliquid's emergency response contained the immediate fallout, the repeated nature of such incidents throughout 2025 suggests fundamental vulnerabilities remain unaddressed in many decentralized trading venues.

For the broader cryptocurrency ecosystem, the POPCAT crash underscores the inherent risks in memecoin trading and leveraged derivatives, particularly on platforms where liquidity may be insufficient to absorb coordinated attacks. As DeFi continues to mature, developing more sophisticated risk management frameworks and manipulation-resistant mechanisms will be crucial for building resilient platforms capable of supporting mainstream adoption.

The incident ultimately highlights the ongoing evolution of "degen warfare" in cryptocurrency markets, where participants continuously probe for weaknesses in automated systems. For traders and liquidity providers, it reinforcesthe importance of understanding platform-specific risks, especially when engaging with volatile assets in permissionless financial environments where traditional protections may be absent.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.