Over the past week, the cryptocurrency market experienced significant bearish pressure throughout this period, with Bitcoin shedding approximately 20% from its early October record highs and confirming entry into bear-market territory. The total cryptocurrency market capitalization has declined by roughly 20% since its October 6 peak near $4.4 trillion, erasing almost all of 2025's gains and leaving the asset class up only about 2.5% for the year. This correction represents one of the steepest reversals since the previous bear cycle, characterized by substantial liquidations, ETF outflows, and a shift to extreme fear sentiment among investors. Market structure suggests a transition between new and old holders is underway, with the path forward heavily dependent on macroeconomic data and institutional flow recovery. Meanwhile, the federal government began reopening Wednesday night after President Trump signed into law a spending package that narrowly passed the House, ending the longest shutdown in the nation’s history. Layer-1 blockchain Monad

confirmed Monday its public mainnet will launch Nov. 24 with 7.5% of total MON supply offered through Coinbase's new token sale platform. Global fintech giant Visa will roll out a new pilot program that allows businesses to make payments to individual stablecoin wallets in fiat currency, while recipients can choose to receive funds in US dollar-backed stablecoins.

Market Overview

BTC

: Bitcoin is currently trading within a core range between $100,000 and $107,000, with the price hovering near crucial technical thresholds around $97,000. As of November 13, BTC is priced at

$102,998.57, representing

a 0.19% decrease over a week. The session high was $107,244, while the low touched $99,324. Bitcoin has now extended its slide for the second consecutive week and its fourth down week in the past five, reflecting the market's struggle to recover from October's "Red October" slump. Bitcoin's RSI reading of 30.81 places it near oversold territory, signaling weak momentum but also suggesting the market may be vulnerable to continued downside or, alternatively, due to a short-term relief bounce if buyers step in. Analysts note that Bitcoin is "holding above the $100,000 level for now," but warn that "until BTC closes a strong daily candle above the $106,000 level," investors must brace for potential new lows. The $97,000 level represents critical technical support that must hold to prevent further deterioration.

ETH

: Ethereum's price has recently broken through important support levels, leading to a test of the critical $3,300 support zone. As of November 13, ETH is trading at approximately $3,532, marking a 4.36% increase over 24 hours. During this period, ETH reached its lowest point at $3,198.86 and its highest at $3,646.55. The second major support resides around $3,300, and if this level fails to hold, Ethereum could potentially hit a new monthly low. Analysts identify several key price zones to monitor, with the $3,700 levelacting as temporary resistance. The MACD indicator shows a downward trend indicating selling pressure, though a histogram value of 4.29 suggests a possible increase in value, though this has not been confirmed. The $3,200 level remains crucial for traders as a support level—any negative movement below this level would indicate that further losses may occur. Conversely, ETH needs to break the $3,500 level to signal a transition to a bullish trend.

Altcoins: Market sentiment has deteriorated significantly, with the Crypto Fear & Greed Index standing at 25, reflecting "Fear" among market participants. This week, the reading establishes a new half-year low for the index, down to 20 on November 5th. Such extreme sentiment readings often serve as contrarian indicators, potentially signaling that the market has become overly pessimistic and may be due to a relief rally if fundamental conditions improve.

The altcoin market exhibited mixed but generally negative performance during the reporting period, with most major altcoins following Bitcoin's downward trajectory but with select outliers showing remarkable strength:

Among the top 200 projects on CoinMarketCap, most have decreased while a few have shown impressive gains, including: ICP with a 7-day increase of 199.52%, FIL with a 7-day increase of 122.46%, DASH with a 7-day increase of 59.5%, AR with a 7-day increase of 132.2%, and ZK with a 7-day increase of 100.94%. These outliers demonstrate that even in bearish market conditions, select tokens with strong fundamental catalysts can achieve substantial returns.

ETF: Spot Ethereum exchange-traded funds have recently experienced a major drop in investor interest, with outflows totaling $107 million. Notably, all nine ETFs in this sector recorded no inflows during the period, affecting market sentiment significantly. The total net assets of the ETF are estimated at $22.48 billion, indicating decreased interest in investing in Ethereum-based financial products.

Spot Bitcoin ETFs have faced significant challenges, with early November seeing net outflows of $1.207 billion from U.S. Bitcoin spot ETFs. This represents a dramatic reversal from the record inflows witnessed in early October and indicates weakening institutional confidence in the short term. The recovery of Bitcoin ETF fund flows represents a critical metric to monitor for assessing whether institutional confidence is returning to the market.

Stablecoins: The stablecoin market capitalization currently totals $305.4 billion, having decreased by 0.63% over the past week. This marks the second consecutive week of decline for stablecoin totals, suggesting reduced capital formation and potential risk-off behavior among market participants. USDT maintains its dominant position with 60.08% of the stablecoin market share.

Macro Data: The broader market is closely monitoring the vote in the US House of Representatives, which is scheduled to end the longest government shutdown in US history. This resolution would be a timely development likely to restore market confidence, potentially triggering a bullish trend across risk assets, including cryptocurrencies. The reopening allows statistical agencies to resume operations and Treasury auctions to be rescheduled, enabling the resumption of official data releases that underpin interest rate expectations and the dollar's value.

The cryptocurrency market stands at a critical juncture, with several potential paths forward depending on the evolution of key variables: If CPI targets are met and Treasury refunding proceeds smoothly, the real interest rate could fall to 1.6%-1.7%, the dollar would weaken, and ETFs may see small net inflows. This would likely catalyze a relief rally across major cryptocurrencies, with Bitcoin potentially testing the $107,000 resistance level and Ethereum targeting $3,500. If CPI prints higher than expected and the Treasury issues additional Treasury bills, the real interest rate could exceed 1.9%, ETF outflows would resume, and cryptocurrencies would exhibit defensive movement. In this case, Bitcoin could break below $97,000 and test lower supports, while Ethereum might violate the $3,200 level.

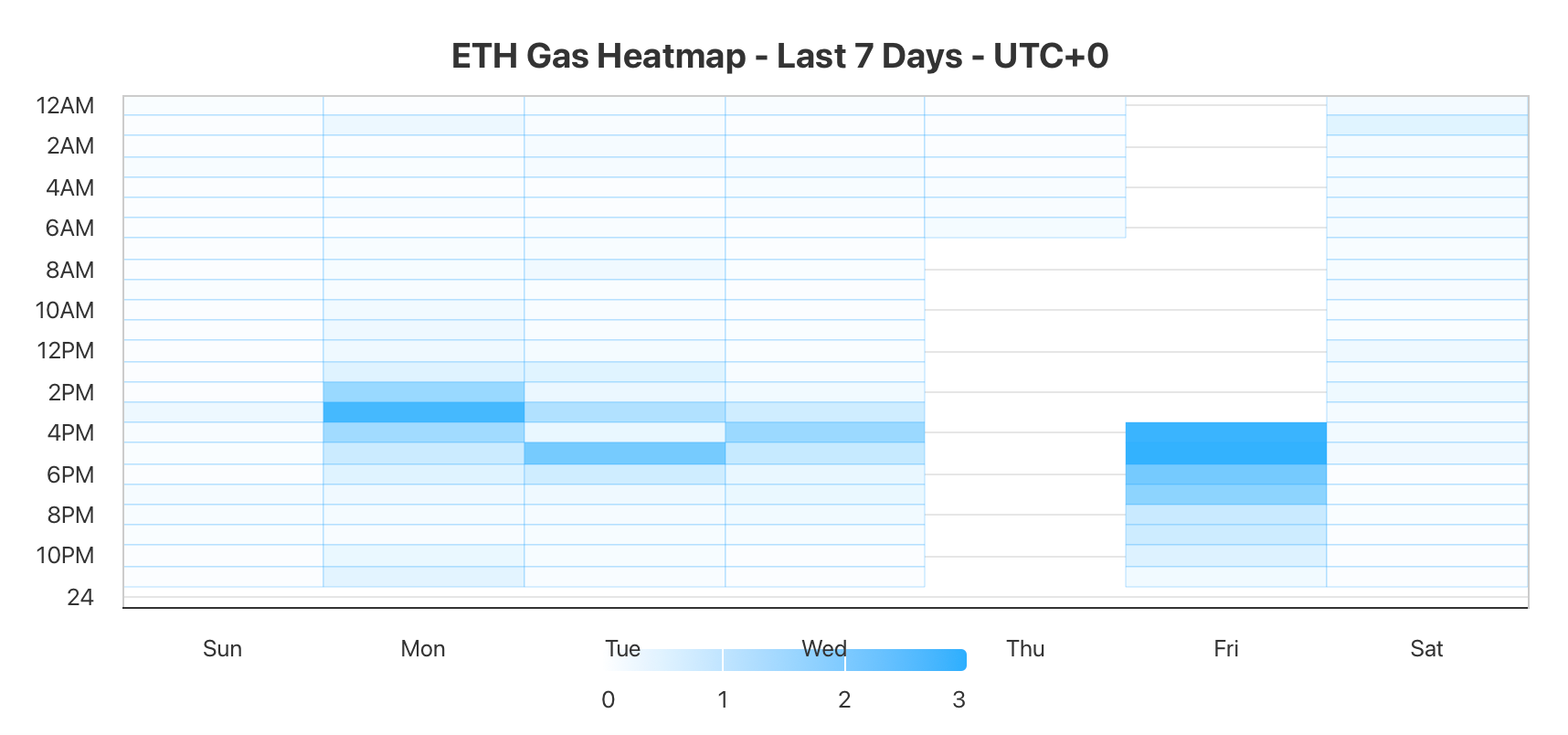

Gas Fees: During the week of November 6 to November 13, 2025, the average Ethereum gas price showed significant volatility, starting at 4.136 Gwei on November 6 and dropping to a low of 0.8529 Gwei on November 9, before fluctuating and closing the period at 1.195 Gwei on November 11. This contrasts sharply with an average gas price of 29.96 Gwei a year prior, marking a 96.01% year-over-year decrease. This drop is largely attributed to the successful implementation and adoption of Layer 2 (L2) scaling solutions following the Dencun upgrade in March 2024, which reduced network congestion on the main Ethereum chain (L1).

Gas fee heatmap. Source: Milk Road

Weekly Trending Sectors & Opportunities

Based on the week's market activity up to November 13, 2025, the crypto landscape is showing clear sector rotations. Privacy coins have experienced explosive growth, while sectors like Real-World Assets (RWA) and NFTs have also demonstrated notable strength amidst a fluctuating market for major assets like Bitcoin and Ethereum.

Privacy Coins Sector

Privacy coins emerged as the best-performing sector this week, with major tokens showing significant gains. DCR (Decred) rose by 16.44%, ZEC (Zcash) recorded a weekly increase of 10.08% with an impressive 200% monthly surge, while XMR (Monero) gained 6.07%. This strong performance is primarily driven by growing concerns over financial surveillance and the rollout of Central Bank Digital Currencies (CBDCs) worldwide, prompting investors to seek enhanced transaction privacy. Regulatory developments, such as the delisting of Tornado Cash, have paradoxically increased demand for compliant privacy solutions. Additionally, ongoing advancements in zero-knowledge proof technology have contributed to the explosive growth of the privacy coin sector.

Real World Assets (RWA) Sector

The RWA sector showed steady growth this week with an overall increase of 2.05%. SKY led the gains with a 9.01% rise, while Keeta's token KTA also posted a solid 5.32% return. This performance reflects growing market interest in the tokenization of physical assets. Investors are increasingly recognizing the value of blockchain-based innovation in transforming traditional assets such as real estate and commodities into tokenized forms, viewing this as a way to enhance portfolio diversification and stability.

NFT and Digital Collectibles Sector

The NFT sector gained 2.01% this week, with infrastructure project Zora's native token ZORAstanding out with a remarkable 19.46% surge. Despite generally cautious market sentiment, the NFT sector demonstrated resilience, indicating that infrastructure and tooling projects are currently receiving more market attention.

Payment Finance (PayFi) Sector

The PayFi sector advanced 1.51% this week, highlighted by Telcoin's token TEL soaring 61.69%. This sector activity reflects market optimism about blockchain technology's application prospects in traditional payment and remittance fields, particularly regarding its potential to reduce costs and improve the efficiency of cross-border payments.

Stablecoins and Payment Solutions

The stablecoin sector received significant positive news as Visa announced the pilot launch of USDC payment solutions for U.S. businesses. Meanwhile, the U.S. government projects that the stablecoin market will grow tenfold from its current $300 billion to $3 trillion by 2030. These developments are primarily driven by the demand for faster, more globalized payment solutions, indicating that stablecoins are becoming a crucial bridge connecting traditional finance with the crypto world.

Weekly Market Focus

Revolutionary Aerodrome and Velodrome Merge Creates New DeFi Powerhouse

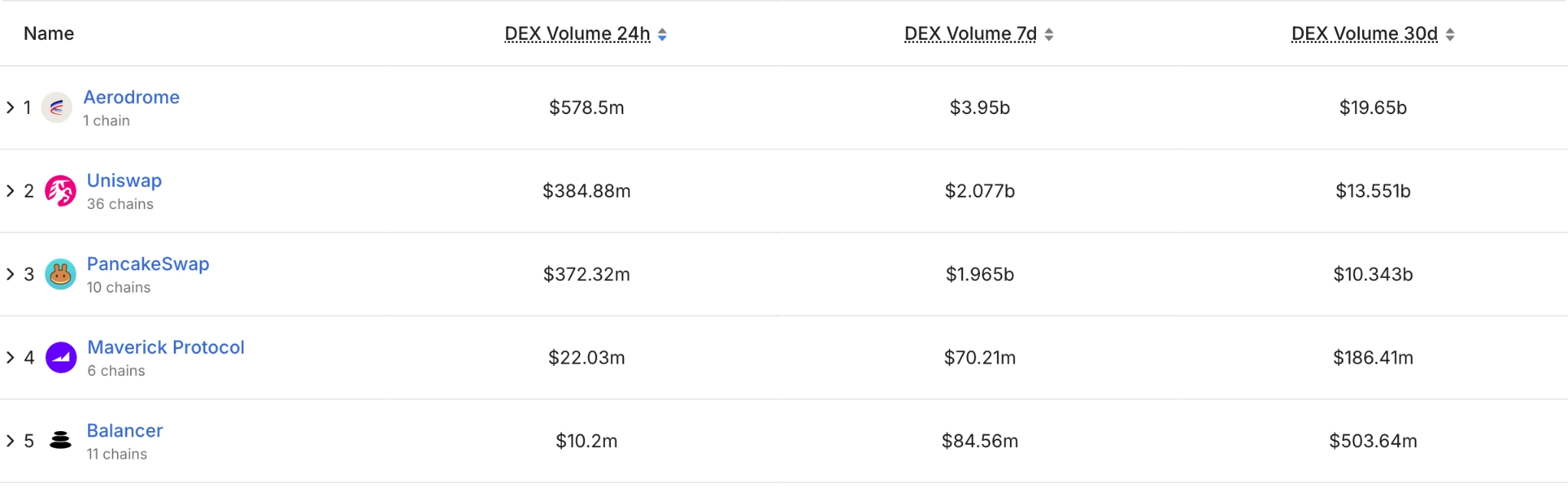

Dromos Labs, the organization behind the Base-based decentralized exchange Aerodrome, has launched a new trading hub dubbed Aero. The new platform will unify Dromos’ Aerodrome network with its sister protocol, Velodrome, live on Optimism, as well as serve as a home base to expand onto additional Ethereum chains.

The “central liquidity hub” Aero will first expand to the Ethereum mainnet and Circle’s stablecoin-optimized Arc blockchain, though it is also built for easy integration across the EVM stack. “The home base for Aero is on Base," Aerodrome Foundation Executive Director Luis de la Cerda said at Dromos' "New Horizon" event on Wednesday.

Aero, expected to launch in the second quarter of 2026, will unify Aerodrome and Velodrome's existing AERO, VELO tokens under the single AERO. This token will "serve as a claim on the productive capacity" of Aero's suite of DEXs, de la Cerda said. The initial distribution of the new AERO token "mirrors the current split" between Aerodrome and Velodrome's current revenues, meaning approximately 5.5% of the supply will go toward VELO holders and the remaining 94.5% to AERO holders. The upgraded MetaDEX 03 system — reportedly under development for two years — introduces a “dual engine model,” combining new AER and REV engines that look to “internalize” additional revenue streams for the protocol while also decreasing the potential value that leaks out of the ecosystem to rival automated money markets, like Uniswap, Cutler said on stage at the event.

Aerodrome is already the largest DEX on the Coinbase-incubated Layer 2, Base, and top revenue-generating onchain exchange on any blockchain. The protocol has earned approximately $14.79 million over the past 30 days, surpassing Pump’s $8.96 million

Launched in August 2023 on Coinbase’s Layer 2 Base network, Aerodrome has grown to become the largest DEX on the network by trading volume.

Top-5 DEXs on Base. Source: DefiLlama

At press time, the platform holds $475.9 million in total value locked (TVL), making it the fourth-largest protocol on Base by TVL, per

data from DefiLlama.

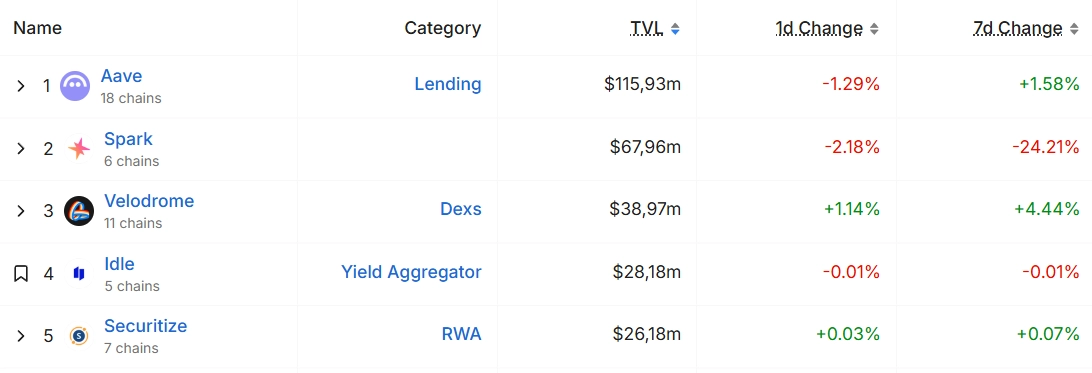

Velodrome, meanwhile, was launched in 2022 for Optimism’s Superchain ecosystem and currently has almost $39 million in TVL, making it the third-largest protocol on OP Mainnet.

Top-5 protocols on OP Mainnet by TVL. Source: DefiLlama

Telcoin Makes U.S. Banking History with Approval to Launch the First Regulated Digital Asset Bank

Charter approval allows Telcoin Digital Asset Bank to establish a bridge between traditional banking and decentralized finance, including the creation of eUSD as the nation’s first bank-issued stablecoin.

Telcoin today announced its final charter approval from the Nebraska Department of Banking and Finance to launch Telcoin Digital Asset Bank, the first Digital Asset Depository Institution in the United States. The charter positions Telcoin to become the first true blockchain bank, directly connecting U.S. bank accounts to regulated “Digital Cash” stablecoins. Its flagship product, eUSD, will be the first bank-issued, on-chain U.S. dollar stablecoin, offering consumers and businesses a secure, compliant way to use Digital Cash for payments, remittances, and savings. Notably, it is also the first bank charter to explicitly authorize connecting U.S. consumers to DeFi.

Telcoin’s eUSD and other global Digital Cash stablecoins represent an evolution of money that is programmable and interoperable, designed to move seamlessly across blockchain and traditional financial rails. Unlike unregulated, offshore, or non-bank stablecoins, eUSD is fully backed by the U.S. dollar deposits and short-term Treasuries held in regulated reserves. Telcoin believes that the trust that comes with being regulated as a bank will drive consumer adoption as well as the institutional adoption needed to scale blockchain-powered finance to the broader market.

The approval coincides with the recent passage of the GENIUS Act, which provides long-awaited federal guidance for stablecoins and digital assets. While blockchain industry peers are seeking to operate as non-depository trust charters, Telcoin is providing a solution to systemic risk concerns around stablecoins expressed by federal regulators.

Visa Launches Fiat-to-Stablecoin Pilot Program for Business Payments

Global fintech giant Visa will roll out a new pilot program that allows businesses to make payments to individual stablecoin wallets in fiat currency, while recipients can choose to receive funds in US dollar-backed stablecoins.

According to Nov. 12 press release from Visa, the new pilot is aimed at international businesses, marketplaces, creator and gig economy platforms, fintechs, and recipients with a compatible stablecoin wallet and who meet KYC/AML checks.

Reaction to the pilot program has seemingly been universally positive with numerous noteworthy figures and organizations within the cryptocurrency community posting bullish comments in response to the launch.

The cryptocurrency sector has seen record-setting growth, as a whole, throughout all of 2025. The explosive surge in global interest was arguably sparked by the Donald Trump administration’s pro-crypto regulatory approach, starting in January.

In the time since, stablecoins have received mainstream treatment. Crypto incumbents such as Circle have seen massive interest in their stablecoin products while mainstream financial service organizations, such as Visa, have steadily increased their exposure.

Key Market Data Highlights

Fed Governor Predicts Multi-Trillion Dollar Stablecoin Boom Will Force Down US Interest Rates

A senior U.S. Federal Reserve officials have warned that the explosive growth of stablecoins, dollar-pegged digital tokens now processing trillions of dollars in payments, could reshape global finance and exert long-term downward pressure on U.S. interest rates.

In a speech titled “A Global Stablecoin Glut: Implications for Monetary Policy” delivered at the BCVC Summit 2025 in New York, Fed Governor Stephen I. Miran said the rising demand for stablecoins is likely to increase purchases of U.S. Treasury securities and other liquid dollar assets.

This, he argued, could mimic the effects of the early-2000s “global savings glut” that depressed rates worldwide. “Stablecoins may become a multitrillion-dollar elephant in the room for central bankers,” Miran said. “Their growth increases the supply of loanable funds in the U.S. economy, placing downward pressure on the neutral interest rate.”

Miran’s comments come as the Federal Reserve maintains a target range of 3.75% to 4.00% for the federal funds rate, following two cuts this year. The effective rate currently sits around 3.87%, marking a decline from 4.33% earlier in 2025. The Fed governor’s analysis suggests that even without further rate cuts, the rapid adoption of stablecoins could naturally exert downward pressure on borrowing costs.

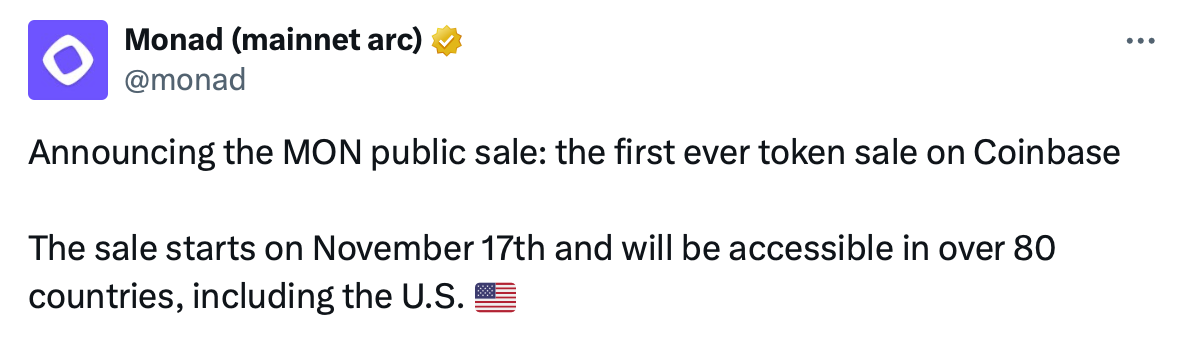

Monad Sets Nov. 24 Launch With 50.6% Tokens Locked

Layer-1 blockchain Monad

confirmed Monday its public mainnet will launch Nov. 24 with 7.5% of total MON supply offered through Coinbase's new token sale platform. The offering runs Nov. 17 at 9 a.m. ET through Nov. 22 at 9 p.m. ET, accessible in over 80 countries, including the U.S., at $0.025 per token.

Exactly 50.6% of the 100 billion token supply will be locked at launch and cannot be staked. All investor and team tokens, plus the Category Labs Treasury allocation, remain locked on day one, subject to vesting schedules designed to ensure long-term alignment with project success.

Participants can bid between $100 minimum and $100,000 maximum. If fully subscribed, the sale raises $187.5 million at an assumed $2.5 billion fully diluted valuation, making this Coinbase's first offering through its newly launched initial coin offering platform.

The token distribution allocates 38.5% for ecosystem development, 27% for the team, and 19.7% for investors. Category Labs Treasury, formerly Monad Labs, receives 4%. Beyond public sale, 3.3% is reserved for a MON airdrop for early users, with both allocations unlocked at launch.

Coinbase

announced its end-to-end token sales platform Monday following its $400 million acquisition of Echo and Sonar crowdfunding platforms built by crypto trader Jordan Fish. The exchange plans roughly one token sale monthly, with Monad serving as the inaugural offering.

The Monad Foundation will steward the 38.5 billion ecosystem tokens over multiple years, issuing grants strategically and delegating through its Validator Delegation Program. This measured approach aims to build sustainable network growth rather than flooding markets with tokens.

Trump Signs A bill Ending 46 Day Long Government Shutdown in US History

The federal government began reopening Wednesday night after President Trump signed into law a spending package that narrowly passed the House, ending the longest shutdown in the nation’s history.

“With my signature, the federal government will now resume normal operations,” Mr. Trump said as he signed the legislation alongside Republican House leadership and business executives.

Earlier, the House voted 222 to 209 on Day 43 of the shutdown and days after eight senators in the Democratic caucus broke their own party’s blockade and joined Republicans in allowing the spending measure to move forward, prompting a bitter backlash in their ranks. It was the first time the House had held a vote in nearly two months, after an extended recess during the shutdown.

Some programs like food stamps, or the Supplemental Nutrition Assistance Program, could be restored within hours, while other effects could take longer to unravel.

CoinCatch New Listings

CoinCatch Weekly Event

Volatility = Opportunity! Trade Major Pairs to share $1M + $1,500 BTC

📅 Event Period: November 13, 2025 (UTC+8) – November 27, 2025 (UTC+8)

Join our futures trading campaign and get a chance to share a massive $1,000,000 prize pool 🏆, with up to $10,000 in rewards per user! Compete on the leaderboard and win an extra $1,500 in BTC! 💰

🎁 Event 1: Make Your First Futures Trade – Share $300,000!

Make your first-ever futures trade on any of these pairs:

BTCUSDT,

BNBUSDT,

ETHUSDT,

XRPUSDT,

SOLUSDT,

DOGEUSDT,

TRXUSDT,

PEPEUSDT,

ADAUSDT,

WIFUSDT,

AVAXUSDT,

BCHUSDT,

ZECUSDT or

HYPEUSDT

And receive a random reward between

$50 – $500!

🔹 Higher trade amount = higher reward

🔹 Total Prize Pool: $300,000 USDT

⚡ Event 2: Trade More, Earn More – Up to $1,000 + $1,500 in BTC!

Trade any of the listed major pairs during the event and accumulate futures trading volume to reach different reward tiers!

BTCUSDT,

BNBUSDT,

ETHUSDT,

XRPUSDT,

SOLUSDT,

DOGEUSDT,

TRXUSDT,

PEPEUSDT,

ADAUSDT,

WIFUSDT,

AVAXUSDT,

BCHUSDT,

ZECUSDT or

HYPEUSDT

| Futures Trading Volume Requirement (USDT) |

Reward Unlocked (Position Bonus) |

| 10,000 |

200 USDT |

| 100,000 |

500 USDT |

| 500,000 |

1,000 USDT |

| 1,000,000 |

5,000 USDT |

| 10,000,000 |

10,000 USDT |

🔹 Total Prize Pool: $700,000 USDT

🔹 First-come, first-served based on registration!

🏅 Leaderboard Rewards (Bonus BTC!)

Users with accumulated futures trading volume ≥

10,000,000 USDT can enter the ranking competition.

Top 3 users will win extra BTC rewards:

🥇 1st Place: $1,500 BTC

🥈 2nd Place: $1,000 BTC

🥉 3rd Place: $500 BTC

Winter Escape: Trade $100, Win Travel Gear & 10 Million Bonuses

📅 Event Time: 2025.11.13(UTC+8) - 2025.11.19(UTC+8)

✨ Limited-Time Offer:

💎Complete more tasks below to earn up to

20 chances to open mystery boxes! Win your exclusive

Travel Gear and bonuses worth 10,000,000 USDT!

Mission 1: Complete Deposits to Open Mystery Box

-

Net deposit ≥

500 USDT held for 3+ days →

1 mystery box unlock

-

Net deposit ≥

5,000 USDT held for 3+ days →

+1 mystery box unlock

-

Net deposit ≥

20,000 USDT held for 3+ days →

+1 mystery box unlock

Mission 2: Futures Trading Volume Challenge

-

Futures Trading Volume ≥

10,000 USDT →

1 mystery box unlock

-

Futures Trading Volume ≥

50,000 USDT →

+1

mystery box unlock

-

Futures Trading Volume ≥

100,000 USDT →

+1

mystery box unlock

-

Futures Trading Volume ≥

200,000 USDT →

+1 mystery box unlock

-

Futures Trading Volume ≥

500,000 USDT →

+1 mystery box unlock

-

Futures Trading Volume ≥

1,000,000 USDT →

+1 mystery box unlock

-

Futures Trading Volume ≥

5,000,000 USDT →

+2

mystery boxes unlock

-

Futures Trading Volume ≥

10,000,000 USDT →

+3 mystery boxes unlock

-

Futures Trading Volume ≥

50,000,000 USDT →

+6 mystery boxes unlock

🎁 Rewards Explained

Prize pool includes:

-

SONY Alpha 9 III (worth $6,800)

-

LV Horizon 55 (worth $4,000)

-

Moncler Grenoble Angren Hooded Down Ski Jacket (worth $3,030)

-

DJI Mini 4 Pro Fly More Combo (RC 2) (worth $1,100)

-

Global Airbnb Gift Card (worth $1,000)

-

REDSTER X5 GREY + M 10 GW (worth $725)

-

More winter travel rewards

-

Hot coins with a maximum value of $100

-

Up to 500 USDT trading bonus

-

Up to 10,000 USDT in position bonus

Each completed task earns you a chance to win a prize; the more tasks you complete, the more chances you have!

Token Unlocks Next Week

Tokenomist data indicates that from October 31 – November 6, 2025, several major token unlocks are scheduled. Some of them are:

ARB will unlock approximately $24.83 million worth of tokens over the next seven days, representing 1.94% of the circulating supply.

STRK will unlock approximately $18.35 million worth of tokens over the next seven days, representing 5.34% of the circulating supply.

SEI will unlock approximately $9.89 million worth of tokens over the next seven days, representing 1.12% of the circulating supply.

ZK will unlock approximately $8.63 million worth of tokens over the next seven days, representing 3.37% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization—presented a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial

advice.