The convergence of artificial intelligence (AI) and blockchain technology is no longer a speculative vision—it is unfolding in real time. On November 11, 2025,

Allora Network

launched its mainnet and native token,

ALLO

, positioning itself as a pioneer in the decentralized AI (DeAI) revolution. Unlike conventional AI systems reliant on centralized entities like OpenAI or Google, Allora introduces a

self-improving network

where machine learning (ML) models collaborate to generate predictive intelligence for decentralized finance (DeFi), governance, and cross-industry applications. With institutional backing from Polychain Capital and a $35 million fundraising round, Allora aims to democratize AI access while addressing critical issues of transparency, data privacy, and model reliability. This article explores Allora’s technology, tokenomics, ecosystem growth, and investment potential as it emerges as a foundational layer for programmable intelligence in Web3.

What Is Allora?

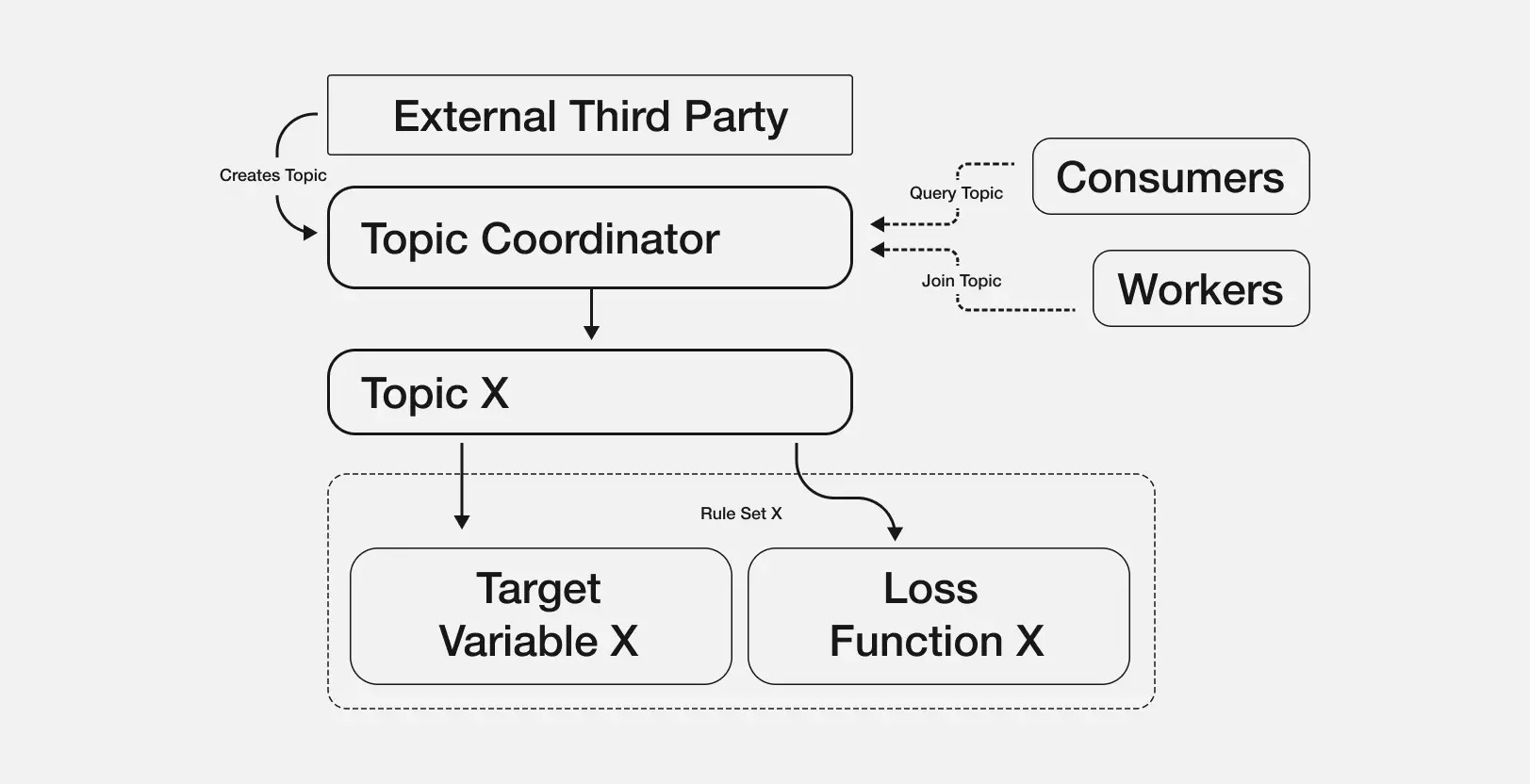

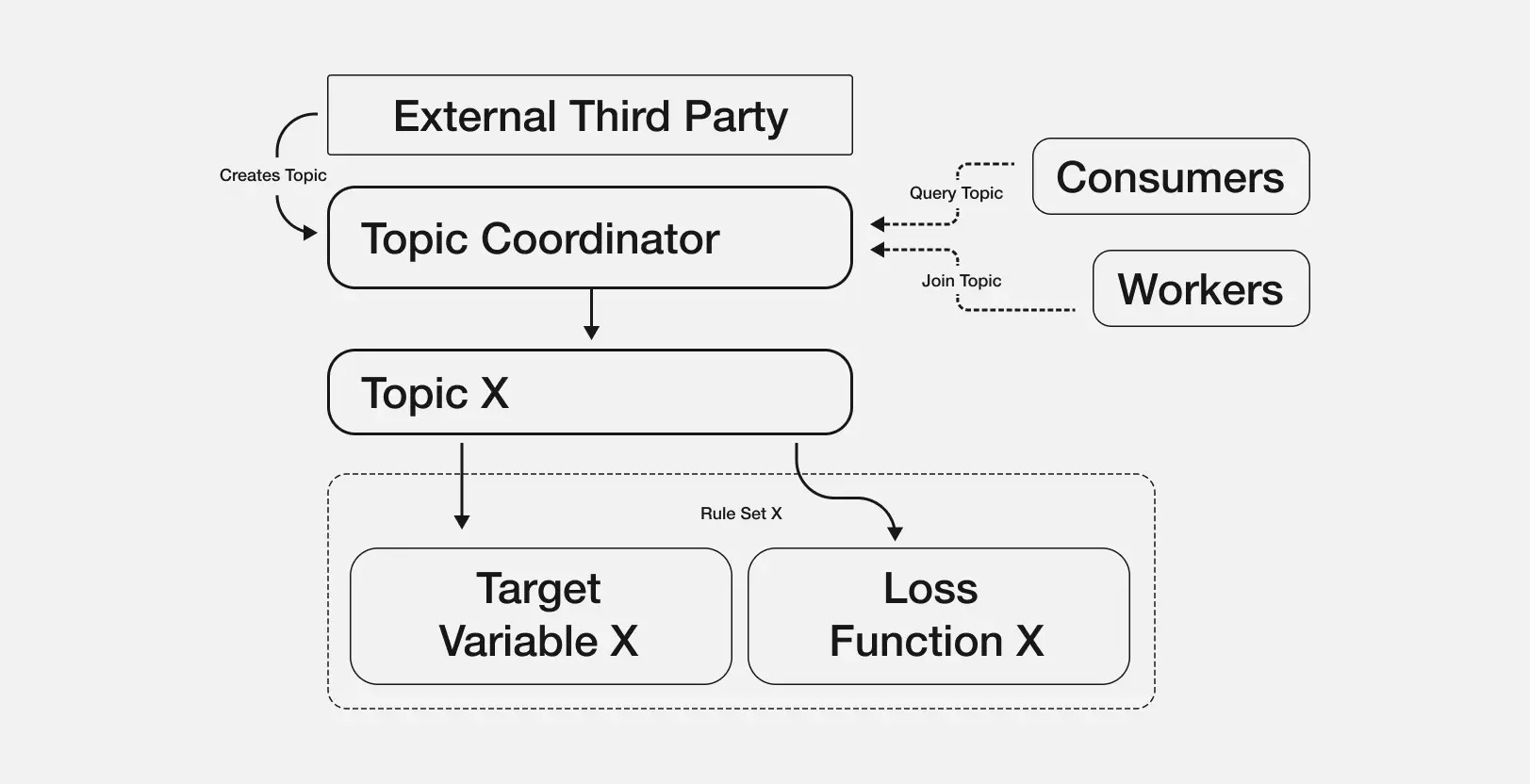

The Allora Network is a state-of-the-art protocol that uses decentralized AI and machine learning (ML) to build and deploy predictions among its participants. It offers actors who wish to use AI predictions a formalized way to obtain the output of state-of-the-art ML models on-chain and to pay the operators of AI/ML nodes who create these predictions. Allora bridges the information gap between data owners, data processors, AI/ML predictors, market analysts, and the end-users or consumers who can execute these insights. The AI/ML agents within the Allora Network use their data and algorithms to broadcast their predictions across a peer-to-peer network, and they ingest these predictions to assess the predictions from all other agents. The network consensus mechanism combines these predictions and assessments and distributes rewards to the agents according to the quality of their predictions and assessments. This carefully designed incentive mechanism enables Allora to continually learn and improve, adjusting to the market as it evolves.

The network’s architecture operates through three core roles:

-

Workers: ML models that provide inferences (e.g., price forecasts for assets) and forecasted losses.

-

Reputers: Validators that assess the quality of Workers’ outputs against ground-truth data.

-

Consumers: End-users (e.g., DeFi protocols, AI agents) who pay ALLO tokens to access the network’s intelligence.

This tripartite system creates a closed-loop economy where accuracy is rewarded, low-quality contributions are penalized, and the network continuously self-optimizes a mechanism Allora terms

Proof-of-Alpha.

How Allora Works: Proof-of-Alpha and zkML

Allora’s operational backbone is its

Proof-of-Alpha consensus, which aligns economic incentives with model performance. Instead of relying on a single AI provider, the network aggregates predictions from thousands of models, weighting them based on historical accuracy and contextual relevance. For example, in predicting Tesla’s Q4 earnings, models with a proven track record in equity analysis would have a higher influence than those specializing in unrelated domains, such as commodity trends. This dynamic coordination ensures that the network’s collective intelligence outperforms individual models over time.

To preserve privacy and verifiability, Allora leverages

zkML technology. Models generate cryptographic proofs attesting to the validity of their inferences without revealing underlying data or parameters. This is critical for DeFi applications where sensitive trading strategies or user data must remain confidential. For instance, a hedge fund could use Allora to optimize portfolio allocations without exposing proprietary algorithms to competitors.

The network’s modular architecture, comprising an interface layer (task submission), a compute layer (model inference), and a governance layer (token economics), enables cross-chain compatibility with Ethereum, BNB Chain, and Cosmos-based ecosystems. This interoperability allows Allora to serve as an

AI middleware for diverseblockchain protocols, from DeFi platforms to autonomous agents.

Why Allora Matters: Key Innovations and Use Cases

Allora addresses two existential challenges in AI:

centralization risks and

data opacity. By decentralizing model coordination, it reduces reliance on tech giants while fostering transparent, auditable intelligence . Its use cases span multiple sectors:

-

DeFi and Trading: Allora provides predictive signals for illiquid asset pricing, dynamic yield strategies, and risk modeling. In a 2024 case study, the network’s models predicted a 62.5% probability of a Trump election victory, enabling a trading agent (“Pauly”) to generate a 13.79% arbitrage profit. Similarly, the “Big Tony” agent achieved 2.54% average returns per trade by integrating Allora’s forecasts.

-

Enterprise AI: Partnerships with

Alibaba Cloud and Cloudician Tech aim to launch an S&P 500 prediction topic, bridging enterprise-grade AI with on-chain applications.

-

DAO Governance and Gaming: Allora’s inference layer can optimize governance proposals or detect game-theoretic exploits in Web3 games.

The network’s

self-improving design also creates a

data network effect: as more models contribute, the system’s intelligence compounds, attracting further adoption. With over 6.92 billion inferences processed and integrations with 200+ institutions (including Brahma and Seamless Protocol), Allora is positioned as a critical infrastructure for the AI-agent economy.

ALLO Tokenomics: Scarcity and Utility

The Allora Network incorporates a

Pay-What-You-Want (PWYW) model to allow token holders the flexibility to choose the fee they pay for inferences generated by the network. This model fosters inclusivity and accessibility by enabling participants to determine the value they assign to the service.

Token holders have the autonomy to decide the amount of ALLO they wish to pay for a given inference, which encourages token holders to contribute to the network's ecosystem according to their perceived value of the service.

-

Max Supply: 1 billion ALLO.

-

Initial Circulating Supply: 200.05 million (20.005% of max supply), with 15 million allocated to Binance HODLer airdrops.

-

Emission Schedule: 21.45% of total supply is reserved for network emissions, distributed to Workers, Reputers, and validators via an exponential-moving-average (EMA) curve that reduces issuance as activity grows.

ALLO Token Utility

Purchasing Inferences

ALLO tokens can be used to buy inferences generated by the network.

Uses a PWYW model where consumers choose the ALLO fee for an inference.

Creating or Participating in Topics

ALLO tokens are paid for creating topics or participating in the network as a worker.

ALLO tokens can be used to pay the registration fee for workers and reputers to register to a topic.

Staking and Delegating Stake

Reputers and network validators use ALLO tokens to stake.

Staking reputers, network validators, and delegating token holders receive rewards in ALLO.

Reward Distribution

The network uses ALLO tokens to pay out rewards to participants. Participant rewards are explained in-depth in the

Consensus Layer.

ALLO Token Allocation

Allocations include 31.05% for early supporters, 17.5% for core contributors, 21.45% for network emissions, and 9.3% for community initiatives. The “Pay-What-You-Want” (PWYW) model lets consumers set custom fees for inferences, linking token demand directly to network usage.

Investment Potential: Opportunities and Risks

Bullish Catalysts

Institutional Traction: Backing by Polychain, Framework, and Delphi Ventures underscores institutional confidence. Exchange listings on Binance, MEXC, and Bitget within days of mainnet launch have enhanced liquidity.

Airdrop-Driven Demand: Binance’s HODLer airdrop program and MEXC’s zero-fee trading campaign are driving short-term demand.

AI Market Tailwinds: The global AI sector is projected to grow 25% annually, with decentralized AI capturing niche demand for privacy-focused solutions.

Key Risks

Regulatory Uncertainty: The U.S. SEC’s stance on AI-crypto hybrids remains ambiguous, potentially impactingALLO’s cross-border accessibility.

Technical Hurdles: zkML technology is nascent, and scalability issues could delay adoption.

Competition: Rivals like Bittensor (decentralized ML training) and Ora (AI data markets) threaten Allora’s market share.

Recent Developments and Price Drivers

Allora’s mainnet launch on November 11, 2025, triggered a wave of ecosystem activity :

Enterprise Partnership: The collaboration with Alibaba Cloud aims to launch decentralized S&P 500 predictions, bridging traditional finance with on-chain intelligence.

Exchange Listings: Listings on Binance Alpha, MEXC, and Bitget have facilitated broader access, with MEXC offering zero-fee ALLO/USDT trading and a $60,000 Airdrop+ reward pool.

Community Growth: The Allora Forge Builder Kit enables ML engineers to deploy models in minutes, accelerating network expansion.

While ALLO’s price remains volatile post-listing, its multichain utility and disinflationary emissions could support long-term valuation. The token’s integration with DeFi protocols like Aave—where it serves as collateral—adds utility beyond speculative trading.

Price Analysis and Future Outlook

As of November 2025, ALLO’s price is influenced by three factors:

Network Adoption: Total value locked (TVL) in Allora-powered dApps and inference request volume are key metrics to monitor.

Market Sentiment: AI-themed crypto assets outperformed the broader market in 2025, though they remain prone to hype cycles.

Macro Trends: Regulatory clarity for staking (e.g., the U.S. Treasury’s framework) could bolster institutional participation.

Technically, ALLO’s EMA-based emission schedule may create supply-side scarcity as network usage grows. If Allora captures even 1% of the projected $300 billion AI infrastructure market, its valuation could be appreciated significantly.

Conclusion

Allora represents a paradigm shift in AI development from closed, centralized systems to open, collaborative intelligence. Its unique combination of Proof-of-Alpha consensus, zkML privacy, and tokenized incentives positions it as a foundational project in the DeAI landscape. For investors, ALLO offers exposure to two high-growth sectors: AI infrastructure and decentralized finance.

However, the project faces significant challenges, including regulatory scrutiny, technical complexity, and intense competition. Investors should prioritize due diligence, monitor mainnet adoption metrics, and allocate only risk-capital portions of their portfolio. As Nick Emmons, Founder of Allora Labs, stated,

“Allora makes intelligence programmable, adaptive, and openly accessible”. If the network delivers on this vision, it could become the standard for trustworthy AI on Web3.

References

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.