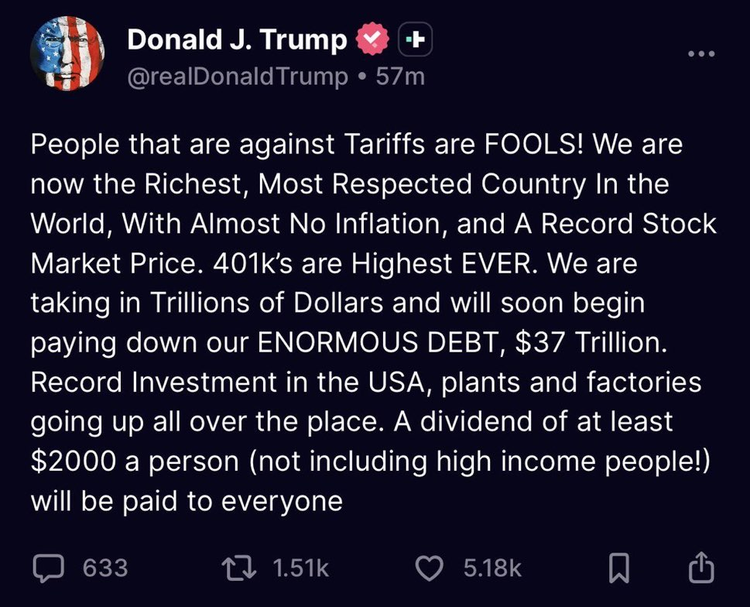

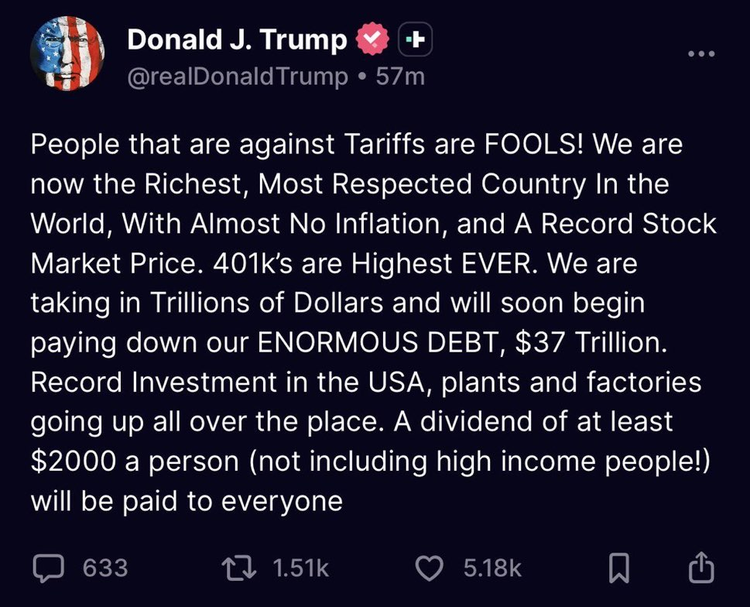

U.S. President Donald Trump’s proposal of a

$2,000 tariff-funded dividend

has ignited discussions about its implications for digital assets. This policy, designed to redistribute tariff revenue to American citizens, echoes the stimulus measures during the COVID-19 pandemic, which previously catalyzed a historic crypto bull run. As Bitcoin, Ethereum, and other major tokens rally in response to the announcement, investors are questioning whether this initiative could inject sustained liquidity into the market, fuel politically linked tokens, and redefine the role of cryptocurrencies in a shifting economic landscape. This article examines the mechanics of Trump’s proposal, its historical parallels, and the opportunities and risks it presents for the crypto ecosystem.

What Is Trump’s Tariff Dividend Proposal?

President Donald Trump on Sunday renewed his call to use tariff revenues to fund direct payments to U.S. households, proposing a $2,000 “dividend” for most Americans.

“A dividend of at least $2000 a person (not including high income people!) will be paid to everyone,” Trump wrote on Truth Social, adding that critics of his trade policies are “FOOLS!”

Trump’s tariff dividend aims to allocate

tariff revenue toward direct payments of

$2,000 to eligible American adults, excluding high-income earners. The policy diverges from traditional fiscal approaches by relying solely on tariffs rather than monetary expansion or debt issuance. According to Trump, the U.S. collected

$195 billion in tariffs in fiscal year 2025, representing a 150% increase from the previous year. However, experts highlight a

funding shortfall: while the dividend would require approximately

$300 billion, net tariff revenue after economic offsets stands at just

$90 billion. Additionally, the proposal faces legal challenges, with the Supreme Court questioning its constitutional validity. Prediction markets currently assign only a

20-23% probability of the policy’s implementation. Despite these hurdles, the mere announcement has already influenced crypto prices, underscoring the market’s reactivity to fiscal policy narratives.

Historical Parallels: COVID-19 Stimulus Checks and Crypto Growth

The COVID-19 stimulus measures between 2020 and 2021 demonstrated how direct payments can accelerate crypto adoption. During this period, the U.S. government distributed

$814 billion in stimulus checks, correlating with a

1,000% surge in Bitcoin’s price and a dramatic expansion of the altcoin market. Research from the Harvard Kennedy School found that nearly

10% of Americans used stimulus funds to purchase cryptocurrencies, a figure that rose to

14% among households earning over $100,000. The influx of retail capital reduced Bitcoin’s dominance from

73% to 39% within six months, highlighting a pivot toward high-risk assets like meme coins and DeFi tokens.For example, an investment of

$3,200 (the total stimulus amount) into Bitcoin at the pandemic’s onset would have grown to

over $50,000 by 2021. This precedent suggests that even partial implementation of Trump’s dividend could mobilize similar risk-on behavior.

The Rise of Politically Linked Tokens

Trump’s policy proposals have concurrently fueled the emergence of

PolitiFi tokens—digital assets tied to political figures or movements. Between January and August 2024, the PolitiFi sector surged by

782%, outpacing traditional meme coins, which grew by only 90.2%. Notable examples include:

-

MAGA (TRUMP): A token inspired by Trump’s brand, which saw a

1,350% price increase in early 2024.

-

World Liberty Financial (WLFI): A Trump-associated governance token that launched with a

$300 billion valuation, leveraging the former president’s political IP .

These assets thrive on speculative demand tied to election cycles, though their volatility remains extreme. For instance, most PolitiFi tokens peaked in June 2024 before shedding over

50% of their value as electoral uncertainties waned. While they represent a niche market, their performance signals growing convergence between political narratives and crypto valuations.

Macroeconomic Factors Shaping the Crypto Market

Beyond political headlines, broader economic forces are critical to understanding the tariff dividend’s potential impact. The Federal Reserve’s pivot toward

monetary easing in 2025, including two rate cuts, has already boosted liquidity for risk assets. Additionally, the U.S. government’s reopening in late 2025 intensified

risk-on sentiment, with prediction markets assigning an

80% probability to policies favoring crypto regulation. These developments coincide with rising institutional adoption; Bitcoin ETFs have absorbed

$64 billion in inflows, stabilizing prices that were once dominated by retail-driven volatility. However, persistent inflation and a

$37 trillion national debt could undermine long-term growth. The dollar index’s

9% decline in 2025 has further enhanced crypto’s appeal as a hedge, though analysts caution that stimulus-driven rallies may be shorter-lived than in 2021.

Let's analyze the relationship between macroeconomic factors and cryptocurrencies.

Inflation and Cryptocurrency: A Hedge or Mere Hype?

One of the most frequently discussed topics in crypto investment is the relationship between inflation and cryptocurrencies. Many investors consider Bitcoin as a potential safeguard against fiat currency devaluation.

Key Points:

-

Crypto as an Inflation Hedge: Assets with limited supply, such as Bitcoin, are viewed as stores of value.

-

Fiat Currency Devaluation: Rising inflation diminishes purchasing power, prompting investors to seek alternative assets.

-

Quantitative Easing: Central banks engaging in money printing can increase demand for decentralized assets.

However, during periods of high inflation, crypto markets have demonstrated varying performance, often influenced by overall market sentiment and liquidity conditions.

Interest Rates and Crypto Volatility

There is generally an inverse relationship between interest rates and cryptocurrencies. When central banks raise rates, risk assets—including cryptocurrencies—tend to decline.

Why It Matters:

-

Federal Reserve and Crypto: Rate hikes can reduce liquidity and increase the opportunity cost of holding non-yielding assets.

-

Risk-On vs. Risk-Off Assets: Cryptocurrencies are considered risk-on assets and tend to perform well in low-interest-rate environments.

-

Capital Flows into Digital Assets: Low rates can encourage speculative investment.

Monitoring central bank decisions is essential for anticipating potential volatility in the crypto markets.

Economic Cycles and Crypto Market Trends

Crypto markets are increasingly affected by traditional economic cycles.

Key Indicators:

-

GDP Growth and Crypto: Strong economic growth can enhance investor confidence.

-

Unemployment Rates and Crypto Sentiment: High unemployment may decrease retail investment activity.

-

Commodity Prices and Crypto: Rising prices for oil and gold can indicate inflationary pressures.

Understanding these global economic indicators enables investors to align their strategies with broader macroeconomic trends.

Geopolitical Events and Regulatory Announcements

Geopolitical developments and regulatory changes can lead to significant price fluctuations in cryptocurrencies.

Examples:

-

Conflicts and Wars: Such events introduce uncertainty, often resulting in market sell-offs.

-

Regulatory Risks: Bans or restrictions can impact adoption rates and liquidity.

-

Adoption During Economic Uncertainty: In some regions, economic instability may drive increased crypto usage.

Staying informed about global political and regulatory developments is crucial for effective risk management.

Central Bank Policies and Global Liquidity Conditions

Central bank policies have a direct influence on global liquidity, which in turn affects crypto markets.

Key Concepts:

-

Monetary Policy Impact: Tightening measures reduce liquidity, negatively affecting speculative assets.

-

Global Liquidity Conditions: Markets tend to favor cryptocurrencies when capital is cheap and abundant.

-

Regulatory Compliance: Authorities may implement stricter controls on crypto platforms.

Tracking policy developments helps investors anticipate shifts in cryptocurrency market dynamics.

Risks and Challenges to the Bull Run

While the tariff dividend could inject short-term optimism, several risks threaten its sustainability:

Legal and Fiscal Viability: The Supreme Court’s skepticism toward Trump’s use of emergency powers for tariffs jeopardizes the proposal’s implementation. A ruling against the policy could force the government to refund

$90 billion in collected tariffs, eliminating the dividend’s funding source.

Economic Headwinds: Interest rates now exceed

4%, compared to near-zero levels during the pandemic, raising borrowing costs and potentially dampening speculative investments.

Market Manipulation: Low liquidity in PolitiFi tokens makes them susceptible to pump-and-dump schemes. As observed with WLFI,

minimal initial circulation can artificially inflate prices before abrupt corrections.

Inflation Concerns: Stimulus programs often precede inflationary cycles. The 2020–2022 period saw inflation peak at

9%, contributing to a

70% crypto market crash in 2022.

These factors underscore the need for cautious portfolio management amid potential volatility.

A New Era for Altcoins

As the cryptocurrency market matures, analysts anticipate a shift toward a more selective altcoin season. This evolution reflects a growing emphasis on projects with real-world utility, innovative use cases, and strong development teams.

Investors are encouraged to conduct thorough research and prioritize tokens with long-term potential. Projects addressing real-world problems and offering tangible value are likely to thrive in this environment, while speculative assets may struggle to gain traction.

The tariff dividend could extend the crypto bull run beyond Bitcoin, mirroring the altcoin explosion of 2021. Ethereum, Solana, and tokens like

DOGE and SHIB already rallied following Trump’s announcement, with ETH gaining

4.8%and SOL rising

2.5%. The CoinDesk 20 Index, which tracks major cryptocurrencies, climbed

1.5% in 24 hours. This trend may accelerate if retail investors deploy dividend funds into smaller-cap assets.

Moreover, the approval of

XRP ETFs in November 2025, a byproduct of post-reopening regulatory clarity—could further legitimize altcoins and diversify institutional exposure. As observed during the COVID-19 stimulus era, altcoins often outperform Bitcoin when liquidity is abundant, though their reliance on speculative demand heightens volatility.

Investor Strategies for a Policy-Driven Market

In this evolving landscape, investors should prioritize:

-

Liquidity Analysis: Tools like liquidation heatmaps can identify critical support and resistance levels for assets like BTCUSDT, helping traders avoid volatility traps.

-

Narrative Diversification: Allocating capital to sectors like PolitiFi tokens, AI-driven DeFi projects, or ETF-backed assets (e.g., XRP) may capture short-term trends while hedging against Bitcoin-specific risks.

-

Macroeconomic Monitoring: Tracking CPI reports, Fed rate decisions, and tariff revenue data can provide early signals for market shifts. For example, a

0.2% change in CPI correlated with an

8% Bitcoin price fluctuation in 2025.

While Kook Capital projects a

multi-month “melt-up” for crypto assets, it advises combining momentum trading with risk management tools like stop-loss orders.

Conclusion

Trump’s tariff dividend proposal represents more than a fiscal experiment—it is a potential catalyst for the next crypto revolution. By channeling liquidity into digital assets, reinforcing political narratives in token valuations, and intersecting with macroeconomic shifts, the policy could ignite a broad-based bull run. However, legal hurdles, inflationary pressures, and market manipulation risks necessitate vigilance. For investors, the key lies in balancing optimism with discipline, leveraging historical insights while adapting to unprecedented regulatory and economic conditions. As the lines between politics, policy, and crypto blur, one truth remains: in volatile markets, opportunity and risk are two sides of the same coin.

References:

Brave New Coin. (2025).

Trump announces a $2,000 tariff 'dividend' — here's how it could affect crypto.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.